US MACRO

IMMIGRATION

THE TAX PAYER COST FOR UNCONTROLLED IMMIGRATION

OBSERVATIONS: WHAT KIND OF ECONOMY HAVE WE WROUGHT?

A PART TME WORK ECONOMY: The hard fact is virtually all the jobs added YTD are part-time jobs. Full-time jobs have actually been disappearing since December of last year. In fact considering that the year-over-year measure of full-time jobs has fallen it would normally be recognized as a pillar of being in recession territory.

IMMIGRANT HIRING: Most of the new part-time jobs are going to immigrants, many of whom are in the country illegally. There has been zero job creation for native-born Americans since mid-2018. While immigrants are not harming the economy by working, the scale of new foreign-born workers has papered over the employment struggles of the native-born population (those who legally pay taxes).

GOVERNMENT JOBS: Being completely obscured is the fact that government jobs accounted for almost a quarter of those added—way above the standard ten to twelve percent. Just like with government spending and economic growth, government hiring boosts the official jobs number while draining the actual, value-producing economy.

PRIVATE SECTOR RECESSION: As we have pointed out with the difference between GDP and GDI, the U.S. economy is already experiencing a private-sector recession. However, government spending and hiring are propping up the official data enough to hide it.

A recession is inevitable, thanks to the last decade of interest rate manipulation by the Federal Reserve—and especially to its dramatic actions during the pandemic. The recession-like condition in full-time jobs is further evidence that we are right.

LOST PURCHASING POWER: The US dollars is worth about 20 percent less than they were four years ago on a purchasing power basis, with no prospect of that trend reversing.

STUDENT DEBT FORGIVENESS: President Biden is scrambling to put the brakes on energy production and to transfer money from the working class to his base of left leaning and indoctrinated college graduates, all before he’s up for re-election in November!

WHAT YOU NEED TO KNOW!

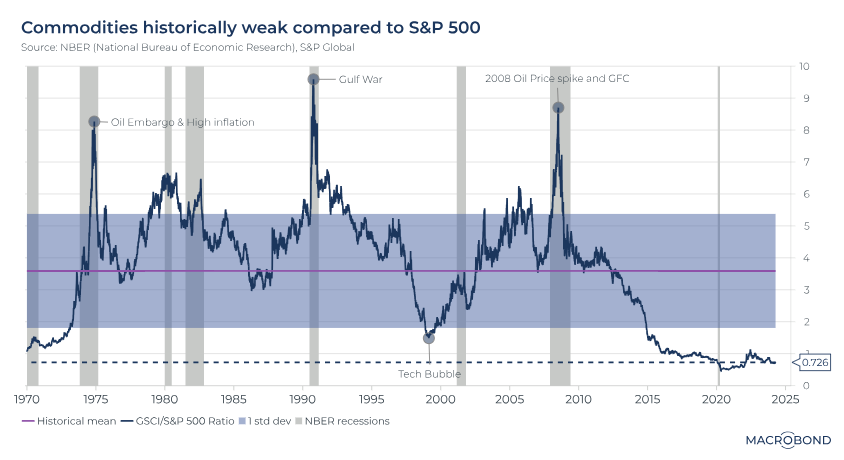

ARE COMMODITIES UNDERPRICED??

It isn’t so much that commodities are underpriced to an unprecedented level, but rather both the S&P 500 and US$ together are excessively over-valued!

It isn’t so much that commodities are underpriced to an unprecedented level, but rather both the S&P 500 and US$ together are excessively over-valued!

When the dollar starts weakening along with the Equity markets it will be time to buy Commodities aggressively. The first wave of this occurring is already signaling with Gold, Silver, Copper, Cocoa and a few others. All indicate where we are headed.

RESEARCH

THE TAX PAYER COST FOR UNCONTROLLED IMMIGRATON

-

- As of March 2024, border security is routinely experiencing daily encounters of over 7,000 with a cumulative total of that during an April 10 press conference. House Speaker Mike Johnson (R-La.) said he estimates that nearly 16 million illegal immigrants entered the United States under the Biden administration.

- Adjusted for inflation, the lifetime cost to taxpayers of each illegal immigrant is over $80,000 according to reporting by the Center for Immigration Studies.

- Using Speaker Mike Johnson’s April 10th update of 16M Illegal Immigrants, the Tax Payer cost of Illegal Immigration is $1.28 TRILLION.

2024 Q1 EARNINGS

-

- Bank stocks, though initially weak on earnings release, have been trending up while the overall market weakened.

- The Financials appear to be trying to follow the Banking stocks higher against the overall trend of the market.

- Earnings are at or near all-time highs in Europe and US. Historically when Earnings surge a Recession follows. The surge this time is parabolic! Does this fit with the current “No-Landing” – “No Recession” narrative?

- Small Business hiring plans are plunging – does this correlate with a strong earnings outlook? Maybe for the major global corporations, but not for America that historically has been built on small business.

DEVELOPMENTS TO WATCH

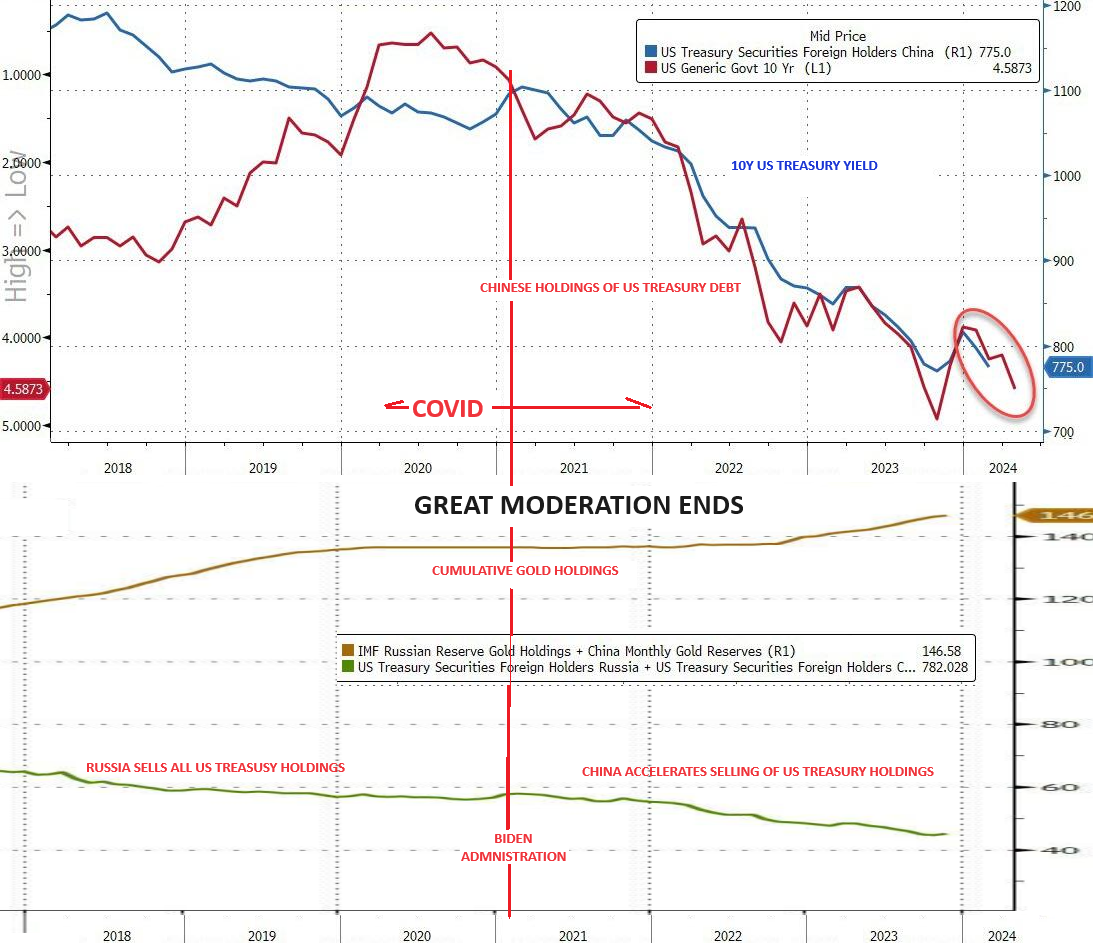

CHINA: IS CHINA CONTRIBUTING TO RISING US TREASURY YIELDS?

CHINA: IS CHINA CONTRIBUTING TO RISING US TREASURY YIELDS?

-

- In 2013 China held around $1.3T of US Treasury Debt. When China’s holdings fell to ~0.9T, it was an obvious problem. The latest TICs report was a real eye opener with China plummeting to $0.775T.

- The correlation with rising US Treasury Yields is readily apparent (chart right – Top pane).

- It is also clear (chart right – bottom pane) that China is using the sales to buy Gold.

SERVICE INFLATION: EXPLODING CHILD CARE INFLATION

-

- Parents are drowning in childcare costs, and high inflation is adding to their laundry list of daily expenses.

- According to a recent survey from childcare platform Care.com:

- The average cost to enroll a child in a licensed day care can set you back $16,692 annually in 2024, or $321 a week for just one child. Infant care in a home day care costs $230 a week, or $11,960 a year.

- The price of a full-time nanny stood at an average of $766 per week, tallying up to $39,832 annually.

- A typical family with an income of $69,651 in New York could spend 22.1% of their annual income on childcare, while minimum-wage earners, making about $24,544, would spend 62.7% of their annual income on infant care.

GLOBAL ECONOMIC REPORTING

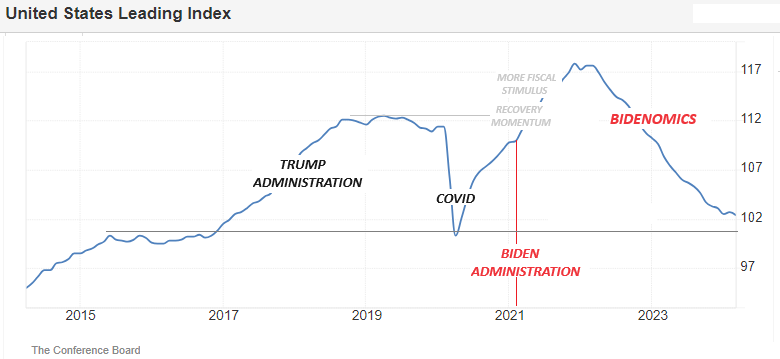

LEADING ECONOMIC INDICATOR (LEI)

LEADING ECONOMIC INDICATOR (LEI)-

- The LEI’s six-month and annual growth rates remain negative, but the pace of contraction has slowed.

- Overall, the Index points to a fragile—even if not recessionary—outlook for the U.S. economy.

- According to the Conference Board: “rising consumer debt, elevated interest rates, and persistent inflation pressures continue to pose risks to economic activity in 2024.”

- HOUSING STARTS/BUILDING PERMITS

- “The drop in permits and the spike in mortgage rates following the release of the March CPI report lend some downside risk to our forecast for a modest rise in housing starts over the rest of 2024.”

- RETAIL SALES

- “that the retail sales number is a nominal dollar growth rate and with inflation running so hot this is accounting for much of the growth. Real retail sales, i.e. retail sales adjusted for inflation, are much weaker and essentially have been flat for the past three years”.

- EMPIRE SURVEY

- The report summarizes that business activity continued to decline in New York.

- The headline general business conditions index rose but remained below zero.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.