TIPPING POINTS

INFLATION

THE US HAS SLOWLY BEGUN IMPORTING INFLATION!

OBSERVATIONS: THE REDISTRIBUTION OF WEALTH

I remember visually and tentatively walking into the eastern University amphitheater of my first year Political Science class. It was 1968 and though Canada was far away from the Vietnam War, I was confronted by at least 60% of the students having long hair, bandanas around their heads with flowered braids and paisley adornments. They were fleeing US draft dodgers.

The clear smell of “pot” floating in the air was something this country boy from western Canada was not used to. With the US Presidential election campaigns of Hubert Humphrey and Richard Nixon fully underway, there was a charged feeling within the hall as the professor mounted the podium. His first words out of his mouth brought out a thunderous and knowing approval from the students when he bellowed:

“Politics is about the redistribution of wealth, from one group to another!”

I never forgot how that statement loudly resonated throughout the theater that morning. The arbitrary taking of wealth from some to give to others seemed somehow unfair to me coming from a region of extremely independent famers and ranchers. In that first semester I came to grips with the immense power we give to our elected officials. I naively assumed (and hoped) these older and wiser adults would exercise the entrusted power with knowledge, wisdom and a strong moral compass. My newly introduced “tainted” American friends however quickly tried dispelling that notion in the highly ruckus tutorial sessions.

Now that my hair is grey, I have witnessed enormous change in the field of political economics. Nothing being larger than exploding public debt and the implicit power it commands. This is the modern version of Redistribution of Wealth, where increasing nation debt and its financing obligations are transferred to “We the People” by political operatives and politicians from those with the financial acumen and leveraged liquidity access to turn it into unfathomable wealth!

Secondly, increasing Crony Capitalism has emerged over the years living off Regulatory Arbitrage and the flow of deficit financing, which has created government dependent industries controlled by private enterprises.

I also additionally recall learning in my first semester of Political Economics that:

“Power Corrupts, But Absolute Power Absolutely Corrupts!”

This is precisely one reason why the Canadian national anthem has the phrase “We Stand On Guard For Thee” enshrined in it.

WHAT YOU NEED TO KNOW!

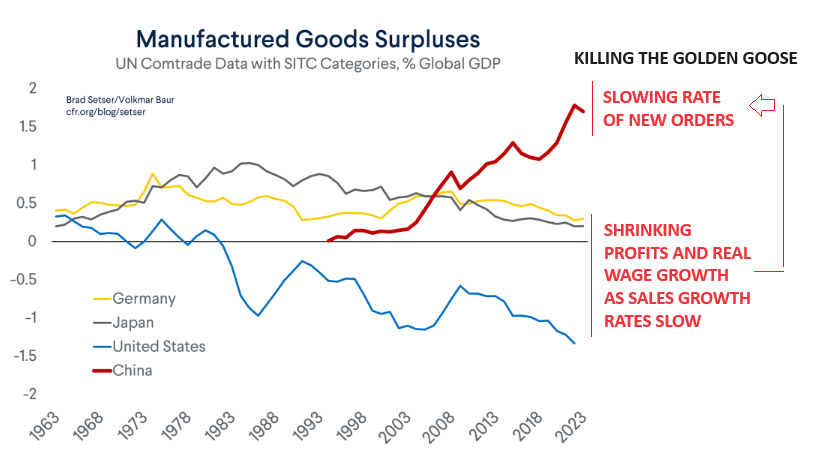

THE KILLING OF THE GLOBAL GOLDEN GOOSE

The US as a nearly 70% consumption economy and the Euro Zone as ~ 55% consumption economy are critical demand drivers of the Chinese manufacturing juggernaut. However, when that Juggernaut reaches a point where it begins slowing the rate of growth of those buying its products something happens. Job growth and wage growth slows in the consuming countries and with it Consumer demand growth slows. This becomes a slow starvation of the Golden Goose. Has China potentially now reached such a point? Is this at the core root of China’s current dilemma?

The US as a nearly 70% consumption economy and the Euro Zone as ~ 55% consumption economy are critical demand drivers of the Chinese manufacturing juggernaut. However, when that Juggernaut reaches a point where it begins slowing the rate of growth of those buying its products something happens. Job growth and wage growth slows in the consuming countries and with it Consumer demand growth slows. This becomes a slow starvation of the Golden Goose. Has China potentially now reached such a point? Is this at the core root of China’s current dilemma?

RESEARCH

THE US HAS SLOWLY BEGUN IMPORTING INFLATION – Will only get worse when Commodities resume their rise.

-

- People get fooled by currency conversions. It is actually about PPP (purchase price parity).

- Distortions from the ~600-$750T unregulated, OTC Swaps markets creates a false illusion.

- Major Fiat currencies and currency pegs continue heading lower together. However, you can’t tell because they are always measured against each other.

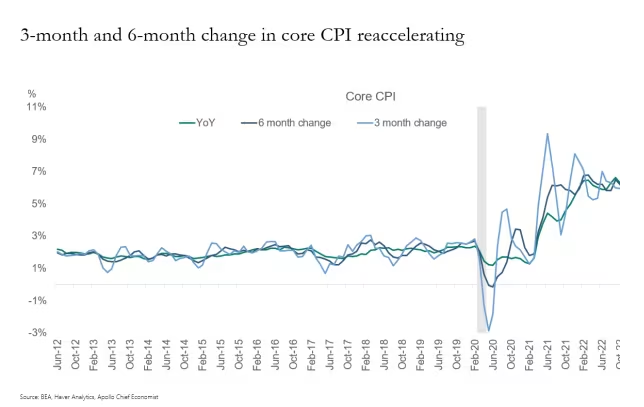

CORE SERVICE INFLATION IS WHAT REALLY MATTERS IN A SERVICE ECONOMY – Goods Inflation Pressures now Succumbing to Services Inflation

-

- Core Service inflation has accelerated over the past six months, and it is a major problem for the Fed.

- The Fed acutely knows it, but can’t directly or expediently control it!

- Core prices have actually accelerated on an annualized basis and is particularly evident on 3 and 6 month time horizons.

- Time Strapped US Consumers have become highly dependent on the increasing use of consumer services which is fostering workers to demand wage increases as their real disposable incomes come under pressure.

DEVELOPMENTS TO WATCH

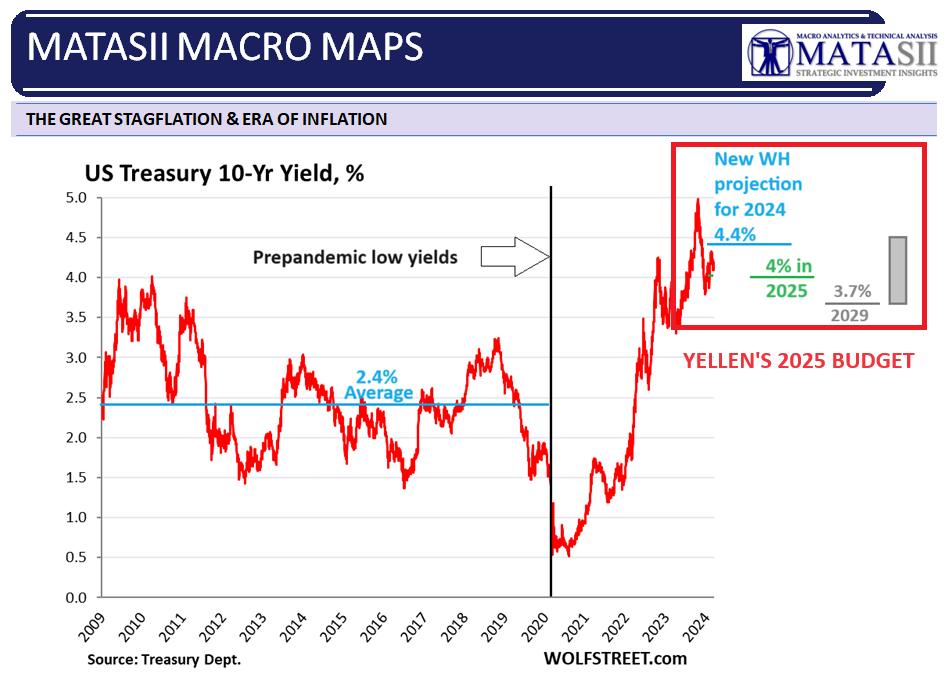

BIDEN BUDGET – $7.3T and the End of Fiscal Responsibility

BIDEN BUDGET – $7.3T and the End of Fiscal Responsibility

-

- The Biden administration has released a proposed budget that would boost federal spending to $7.3 trillion next fiscal year. To pay for it, they intend to raise taxes by $5.5T over 10 years.

- To make Biden’s Budget seem plausible the planned increase in Individual Income Tax is going to be taken from $2510B in the current tax year to $4486B in 10 years or 78.7%.

- If this tax is to supposedly to come from primarily those earnings over $400K/annum, do you really believe the rich are going to stay or worse – invest in America?

- The Budget is simply preposterous since, even with these Revenue expectations, the budget deficit growth is $16.3T over the same 10 years.

140,000 FARMS LOST – A Food Inflation Set-Up??

-

- Between 2017 and 2022, the number of farms in the U.S. declined by 141,733 or 7%,

- Acres operated by farm operations during the same timeframe declined by 20.1 million (2.2%), a loss equivalent to an area about the size of Maine.

- Only 1.88% of acres operated and 1% of farm operations were classified under a non-family corporate farm structure.

GLOBAL ECONOMIC REPORTING

FEBRUARY CPI: Core CPI continued to decline on a year-over-year basis in February. But things look different over a three-month and six-month time horizon. For both, core prices have actually accelerated on an annualized basis.

FEBRUARY CPI: Core CPI continued to decline on a year-over-year basis in February. But things look different over a three-month and six-month time horizon. For both, core prices have actually accelerated on an annualized basis.

- The February CPI report suggests that Wall Street bankers’ hopes for the last mile of disinflation may remain elusive, as the economy could face the resurgence of inflation in the coming quarters.

- Additionally, geopolitical and social unrest both domestically and abroad may contribute to a stagflation environment by the end of the second quarter.

- Similar to the 1970s and previous periods marked by wars and social unrest, holding equities and hard assets, rather than long-dated bonds, appears to be the most effective strategy for safeguarding investors’ purchasing power.

- FEBRUARY PPI: February Producer Prices were expected to slow their surge from January, but they did not.

- Headline Final Demand PPI rose 0.6% MoM (double the 0.3% rise expected) – the hottest print since June 2022.

- This lifted the YoY PPI to +1.6%, its highest since September.

- RETAIL SALES: Adjusted (crudely) for inflation, this was a huge drop in ‘real’ retail sales.

- REAL retail sales have declined for 12 of the last 16 months – in other words, on a crude basis (Ret Sales – CPI), Americans aren’t buying more “stuff”!

- Is the “Soft-landing” morphing into a stagflationary crash-landing?

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.