TIPPING POINTS

FUNDAMENTALS

A RISING EQUITY MARKET BUT SHRINKING STOCK TRADING VOLUMES?

OBSERVATIONS: THE FED NEEDS TO STOP ELECTION YEAR CHEER LEADING & COACH!

The Fed is making yet another big policy mistake similar to assessing AFTER COVID-19 that “inflation was only transitory”!

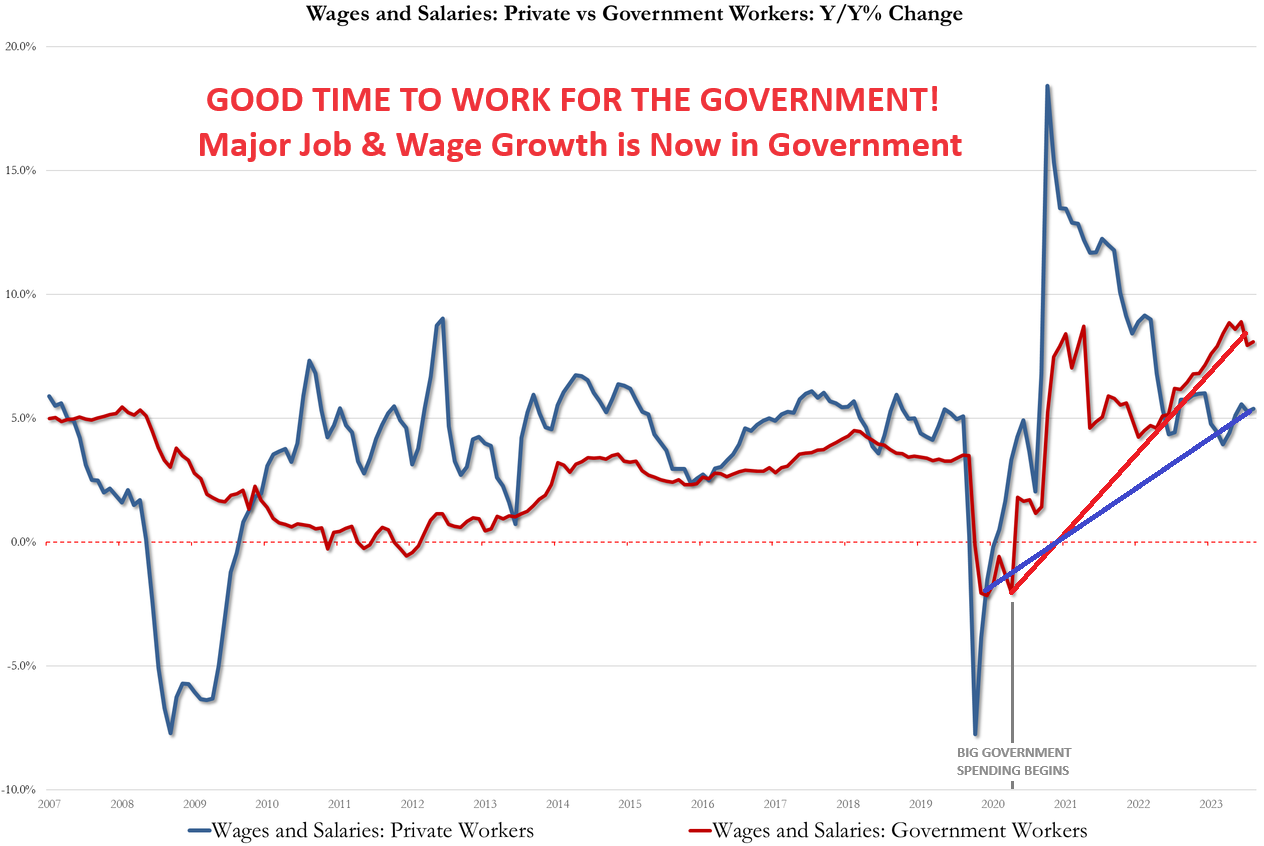

The mistake this time is cheering the headline economic figures that come from disguising a private sector recession with a massive increase in public debt and weakening employment figures.

It is only being embellished by:

-

- Growing temporary and multi-job workers needing to take low earning jobs

- Unprecedented public sector hiring

- Giving dovish signals that make market participants take more risk

There has been no relevant reduction in the money supply if we include the different layers of liquidity injections. Announcing forthcoming rate cuts will certainly make speculative debt rise, but will hardly change the credit demand from the backbone of the economy, small businesses and families.

Since the US government has rejected any calls for normalization and instead added more deficits and debt, as if rising bond yields were not a problem, citizens and businesses have already suffered greatly from ongoing inflation and rate increases.

As such, the rate cuts will help an already bloated government spending and the zombie corporations that require uninterrupted access to capital markets.

Everyone else will be hurt both ways, with inflation and lower access to credit.

WHAT YOU NEED TO KNOW!

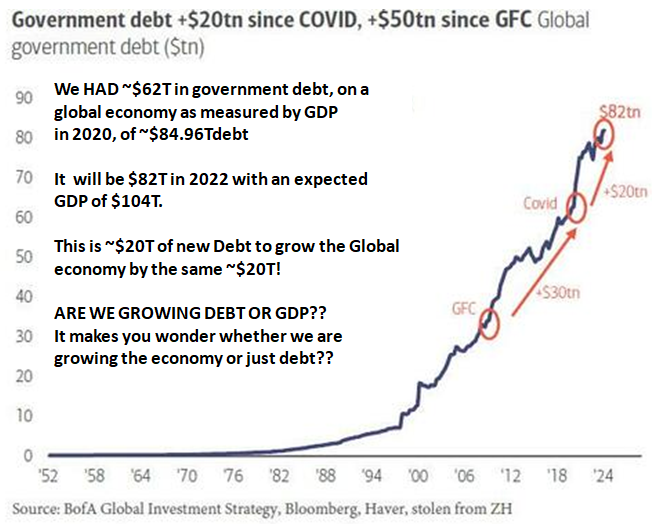

GROWTH OF GLOBAL GOVERNMENT DEBT

GROWTH OF GLOBAL GOVERNMENT DEBT

-

- In 2020 Global Government Debt was ~$62T. Global GDP was ~ $84.96T.

- In 2022 Global Government Debt had grown to ~$82T with Global GDP approximating ~$104T.

This means debt grew by ~$20T while GDP growth grew by a corresponding ~$20T. $1 of debt growth equaling a $1 of economic GDP Growth.

Are we really growing GDP or just Debt?? Or has GDP become become nothing more than a measure of Debt Growth?

RESEARCH

RISING MARKETS BUT SHRINKING STOCK VOLUME?

-

- From Currencies, Bonds, Commodities; to economic indicators like inflation Swaps; to market measures like volatility – almost nothing doesn’t have a leveraged derivative that can now be traded.

- There are some startling & secretive consequences of this that fortunes are being made from.

- The message is that economies and financial markets are not what they appear when you have quadrillions of derivative structures taking place behind the “veil”.

YET ANOTHER 800,000 JOBS REPORTING MISTAKE?

-

- The labor market is far weaker than conventionally believed. In fact, no less than 800,000 payrolls are “missing” when one uses the far more accurate Quarterly Census of Employment and Wages data rather than the BLS’ woefully inaccurate and politically mandated monthly payrolls “data”.

- If one looks back the monthly gains across most of 2023, one gets not 230K jobs added on average every month but rather 130K!

- When the issuance of $1 trillion in debt every 100 days only adds 800,000 less jobs it makes you wonder what the money is being used for???

- What is additionally alarming is that the Philly Fed found that the BLS had also overstated payrolls in 2022 by 1.1 million!

- This identifies where a significant part of the mysterious 5M job difference is between the BEA’s Establishment Survey and Household jobs.

DEVELOPMENTS TO WATCH

AN INCREASINGLY DESPERATE XI JINPING SUMMONS US EXECUTIVES TO CHINA

AN INCREASINGLY DESPERATE XI JINPING SUMMONS US EXECUTIVES TO CHINA

-

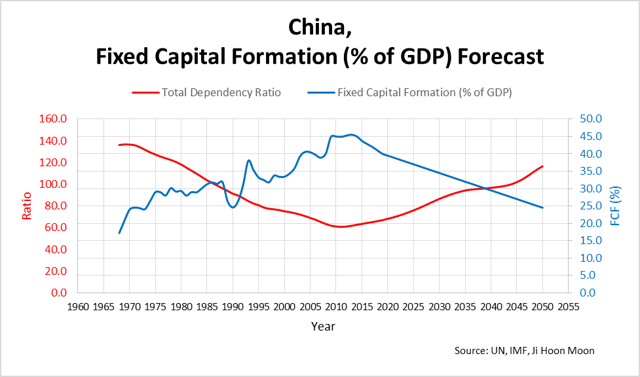

- As Chinese Fixed Capital Formation and Foreign Direct Investment (FDI) continues to erode, President Xi Jinping is taking urgent measures to shore up foreign business and investment confidence.

XI JINPING ORDERS PBOC TO INJECT LIQUIDITY

-

- According to the the South China Morning Post, Xi Jinping has instructed the Chinese central bank to restart treasury-bond trades after a 2-decade hiatus.

- President Xi has told China’s financial cadres that an active monetary policy tool kit must include a controversial means of injecting liquidity into the economy.

- Economist says PBOC has not bought treasury bonds for years because monetary authorities did not want to fuel market speculation of a major stimulus.

GLOBAL ECONOMIC REPORTING

-

PERSONAL CONSUMPTION EXPENDITURE (PCE)

PERSONAL CONSUMPTION EXPENDITURE (PCE)

- One of The Fed’s favorite inflation indicators – Core PCE Deflator – was flat at +2.8% YoY in February (as expected) – the lowest since March 2021.

- The headline PCE Deflator stalled its disinflationary path, rising to +2.5% YoY (from +2.4%).

- Government Wage growth significantly stands out (chart right).

-

- DURABLE GOODS

- US Durable Goods (which in the US is primarily about Transportation and sporadically about Defense) have begun trending up.

- DURABLE GOODS

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.