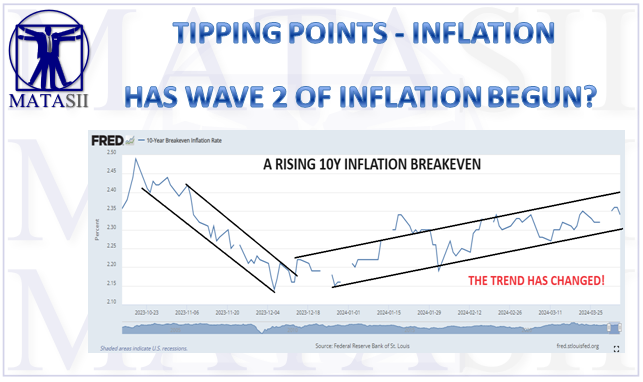

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS INFLATION HAS WAVE 2 OF INFLATION BEGUN? OBSERVATIONS: THE “COMMON MAN” CPI Since January 2021, the consumer price index, or CPI, has risen a cumulative 18%. Yet that measure obscures more than it reveals! Jason Trennert, founder of the brokerage and financial advisory […]

TP Highest Risk

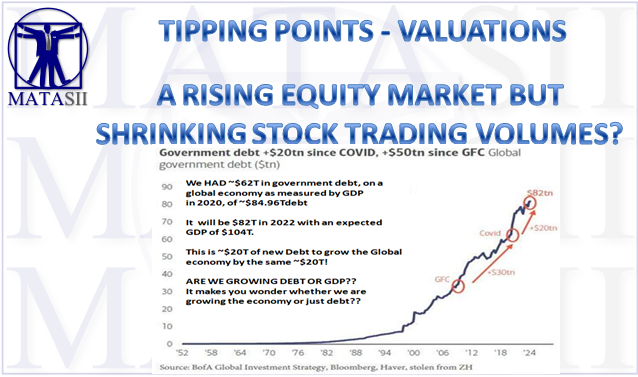

A RISING EQUITY MARKET BUT SHRINKING STOCK TRADING VOLUMES?

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS FUNDAMENTALS A RISING EQUITY MARKET BUT SHRINKING STOCK TRADING VOLUMES? OBSERVATIONS: THE FED NEEDS TO STOP ELECTION YEAR CHEER LEADING & COACH! The Fed is making yet another big policy mistake similar to assessing AFTER COVID-19 that “inflation was only transitory”! The mistake […]

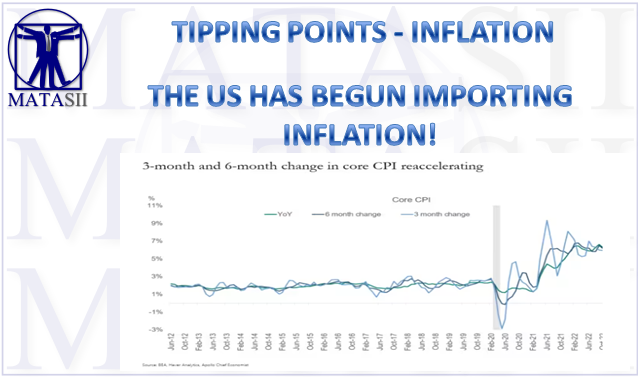

THE US HAS BEGUN IMPORTING INFLATION!

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS INFLATION THE US HAS SLOWLY BEGUN IMPORTING INFLATION! OBSERVATIONS: THE REDISTRIBUTION OF WEALTH I remember visually and tentatively walking into the eastern University amphitheater of my first year Political Science class. It was 1968 and though Canada was far away from the Vietnam […]

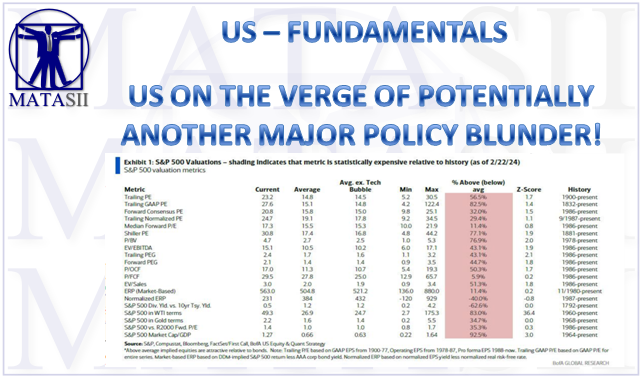

US ON THE VERGE OF POTENTIALLY ANOTHER MAJOR POLICY BLUNDER!

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS FUNDAMENTALS THE US IS ON THE VERGE OF POTENTIALLY ANOTHER MAJOR POLICY BLUNDER! OBSERVATIONS: US Asset Seizure of Russian Funds is Illegal – But Giving them To Another Country Is Financial Suicide! The US’s unprecedented freezing of U.S. dollars owned by a foreign […]

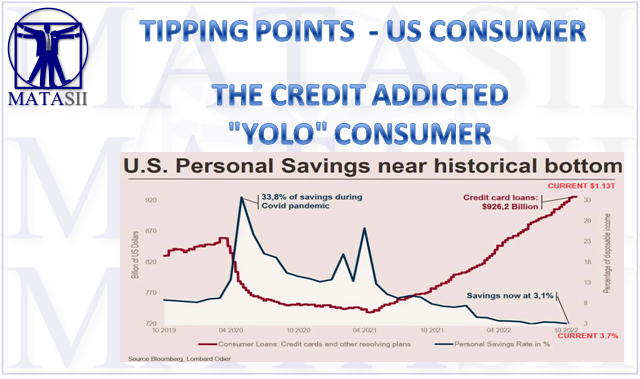

THE CREDIT ADDICTED “YOLO” CONSUMER

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS THE US CONSUMER THE CREDIT ADDICTED “YOLO” CONSUMER OBSERVATIONS: THE POLITICAL CLASS HAS SIMPLY LOST THEIR WAY Our US political leaders, (I like to call them the “Political Class” because they have become divorced from “Mainstreet”), have been very busy since the Biden Regime took […]

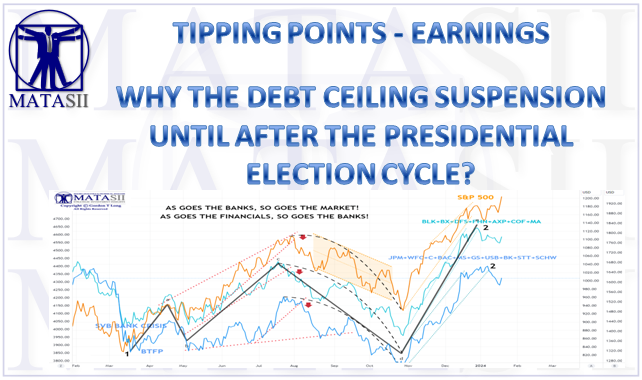

WHY THE DEBT CEILING SUSPENSION UNTIL AFTER THE PRESIDENTIAL ELECTION CYCLE?

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS EARNINGS WHY THE DEBT CEILING SUSPENSION UNTIL AFTER THE PRESIDENTIAL ELECTION CYCLE? OBSERVATIONS: THE SUSPENSION OF DEBT CEILING WAS WELL PLANNED! Last June, Biden signed into law the suspension of the debt ceiling until 1 January 2025. Since then, the Federal Government’s debt has […]

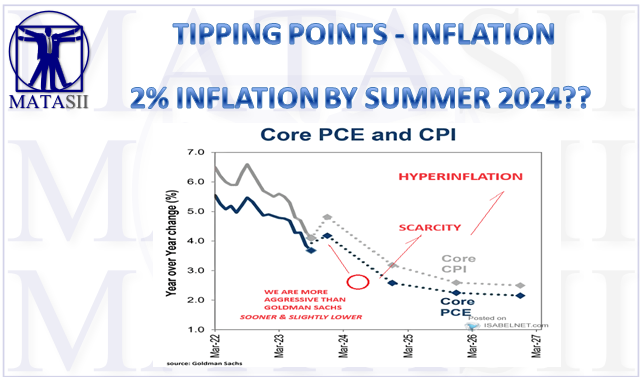

2% INFLATION BY SUMMER 2024??

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS DISINFLATION – DEFLATION PRESSURES 2% INFLATION BY SUMMER 2024?? OBSERVATIONS: AS GOES SMALL BUSINESS, SO GOES AMERICA! In this month’s LONGWave video (link right), I mentioned the serious concerns I was witnessing within small business in America. Covid-19 placed huge financial strain on […]

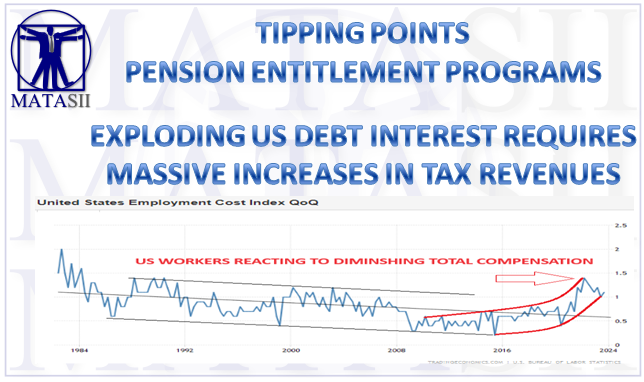

EXPLODING US DEBT INTEREST WILL REQUIRE MASSIVE INCREASES IN TAX REVENUES

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS PENSION ENTITLEMENT PROGRAMS EXPLODING US DEBT INTEREST WILL REQUIRE MASSIVE INCREASES IN TAX REVENUES OBSERVATIONS: YELLEN IS NOT SIMPLY A MISPLACED ACADEMIC, IT IS WORSE THAN THAT! I recently wrote that I witnessed first hand how well retirees in Austria were so well […]

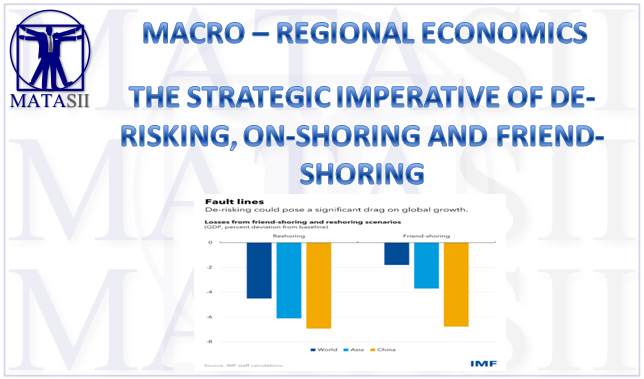

THE STRATEGIC IMPERATIVE OF DE-RISKING, ON-SHORING AND FRIEND-SHORING

Gordon T Long Global Macro Research | Macro-Technical Analysis GLOBAL MACRO REGIONAL THE STRATEGIC IMPERATIVE OF DE-RISKING, ON-SHORING AND FRIEND-SHORING OBSERVATIONS: We Have Become A Lazy, Obsolete Industrial Nation Manufacturing is an area I spent many years involved in. I started my career as an IBM Manufacturing specialist in pioneering new computer processes across […]

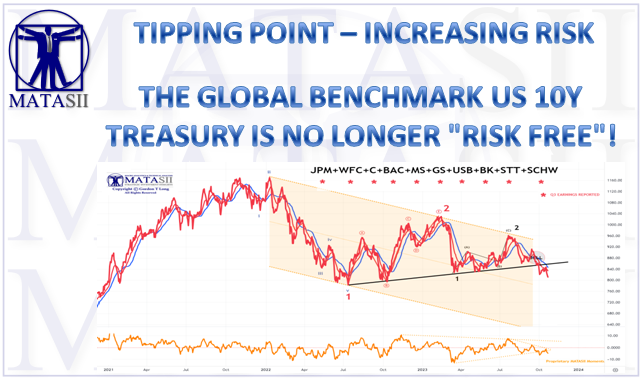

THE GLOBAL BENCHMARK US 10Y TREASURY IS NO LONGER “RISK FREE”!

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS INCREASING RISK THE GLOBAL BENCHMARK US 10Y TREASURY IS NO LONGER “RISK FREE”! OBSERVATIONS: The Importance and Problem With A Social Safety Net Having just returned from Europe and prior to that having researched an UnderTheLens Video on China’s problems, something struck me […]