TIPPING POINTS

FUNDAMENTALS

THE US IS ON THE VERGE OF POTENTIALLY ANOTHER MAJOR POLICY BLUNDER!

OBSERVATIONS: US Asset Seizure of Russian Funds is Illegal – But Giving them To Another Country Is Financial Suicide!

The US’s unprecedented freezing of U.S. dollars owned by a foreign central bank has fundamentally jeopardized the US’s hard-won reserve status. It’s an important factor now driving dozens of countries away from what they see as a dangerous and unpredictable United States—countries now including France and Saudi Arabia. Of course, China is eager to exploit these fears and welcome countries into its rapidly growing BRICS anti-dollar bloc.

After the Biden administration spent months scoffing at the mere hint of de-dollarization, Janet Yellen dropped a bombshell last year, casually admitting that not only is de-dollarization happening, but Americans should expect more—in her words, it’s “only natural” for countries to flee the dollar since the world is big.

However, countries are fleeing because Biden made them question the U.S. dollar by using it as a political football where countries must grovel and obey Washington or risk having their national patrimony frozen. Nations who disagree with Biden on abortion, homosexuality, fossil fuel use, etc. also run the risk of seeing their dollar reserves taken away. As if on cue, the Biden administration has threatened sanctions against countries with anti-sodomy laws such as Uganda.

This asset seizure bill would dramatically up the ante. If the U.S. is willing to not just freeze, but actually hand over a nation’s (Russian) entire dollar reserves to another country (Ukraine), it confirms the worst fears of any country questioning whether they can count on the dollar or the U.S. at all.

As more nations lose confidence in the dollar, they will sell their dollars. If enough countries do this, those trillions will come flooding home to America—essentially 70 years of deficits pouring in almost all at once.

This tsunami could set off an inflation the likes of which we haven’t seen in a century. Imagine the last three years of price increases put on steroids, amphetamines and covered in nicotine patches.

At a minimum, it would be multiple years of double-digit inflation like we’re used to seeing in third world countries. At worst, it would be a full-blown Weimar Republic replacing wallets with wheelbarrows for carrying around currency.

Such an economic catastrophe would, of course, take America off the world stage, not by choice but by necessity. The Uniparty would have made their virtue-signaling gift to the Ukraine at the expense of America’s very standing as a world power.

The naïve calls for currency manipulation are a defiling of the dollar’s sanctity and an assault on people’s property rights. If the Uniparty in Congress and the Biden administration push the issue much further, it will mean a long walk off a short pier into an ocean of misery for the American people.

WHAT YOU NEED TO KNOW!

INFLATION PATTERN UNFOLDING AS WE PREDICTED

INFLATION PATTERN UNFOLDING AS WE PREDICTED

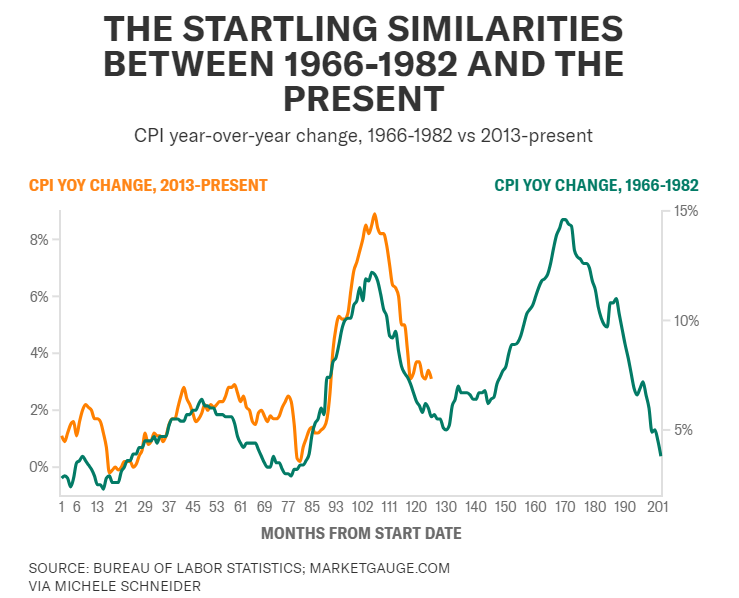

In our 2023 Thesis paper “The Great Stagflation” we warned that we should expect Inflation to unfold in a similar fashion to the three wave patterns of the 1930-1940s and the 1970s. That is exactly what we are currently seeing (chart right).

In the upcoming latest LONGWave video we revisit and delve into the unfolding Inflation pattern and what it means in the current market environment. FALSE BELIEFS & MARKET SHOCKS will be released to video subscribers on Wednesday.

RESEARCH

EVENTUALLY FUNDAMENTALS MATTER!

-

- Historical patterns indicate that gradual earnings decline, coupled with the Fed’s interest rate cuts, can lead to rising market valuations, enabling the stock market to continue climbing despite a recession.

- However, unexpected dynamics, such as rising earnings accompanied by a stock market decline, can occur when the Fed raises interest rates.

- While current valuations are high, the direction of future interest rate changes remains uncertain.

THE LATEST CONGRESSIONAL “PORK” SPENDING PACKAGE

-

- Have you actually ever read any Congressional Bills? You need to, in understanding how totally corrupt and wasteful Washington has become in spending our money. It is literally a feeding trough for legal robbery.

- We took the time to outline the latest spending package in Congress which will make the already outrageous $34.4 trillion federal debt (with $1.7T in interest) much. much worse via hidden waste!

DEVELOPMENTS TO WATCH

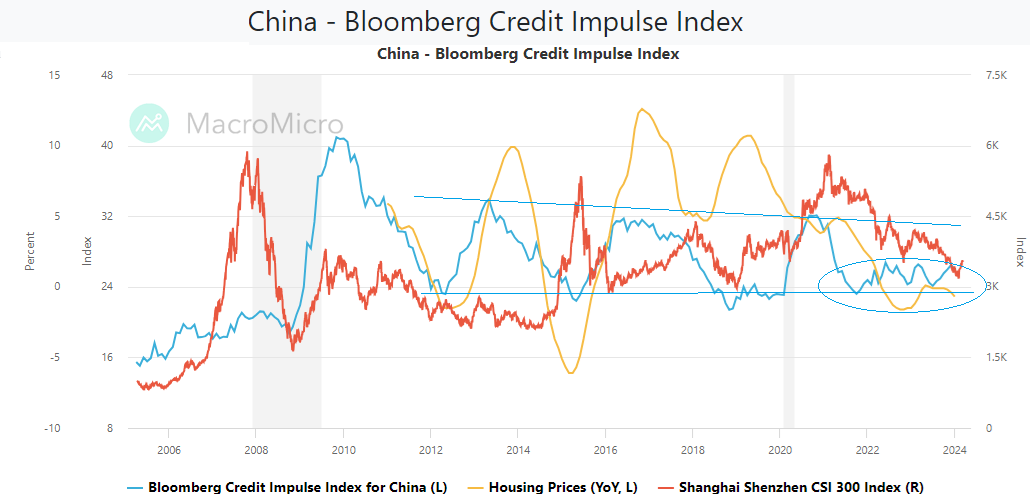

CHINESE DEVELOPMENTS & CREDIT IMPUSLE

CHINESE DEVELOPMENTS & CREDIT IMPUSLE

-

- As expected, China revealed a new growth target of ‘around 5%’ in the Work Report at the National People’s Congress.

- However, the report disappointed markets as there were no clear sign of stronger stimulus signals. In some respects the wording and planned measures were stronger, but it was buried in the details.

- Lifting consumer spending is becoming a high priority and the issuance of ultralong bonds for several years also suggests stimulus measures are set to continue.

- Other takeaways were stronger language on Taiwan, vowing support for the private sector, stronger efforts to attract FDI and a strong tech focus.

UNFUNDED SOCIAL SECURITY & MEDICARE $175.3 TRILLION

-

- Medicare is forecasted to start cutting benefits in just seven years.

- Social Security’s trust funds start running out of money in ten years.

- The funds are projected for depletion by 2041.

Here are how the unfunded liabilities break out by program:

-

- Medicare Part A, which covers hospital visits, is projected to have $15.1 trillion more than it needs.

- Medicare Part B is the largest liability with an unfunded $99.5 trillion.

- Medicare Part D, for prescription drugs, will be missing $22.1 trillion.

- Social Security needs an additional $68.8 trillion.

GLOBAL ECONOMIC REPORTING

- NON-FARM PAYROLLS (NFP) – FEBRUARY LABOR REPORT

- PART-TIME JOB GROWTH: All the job growth has been in part-time jobs, which have increased by 921K since February 2023 (from 27.020 million to 27.941 million).

- FOREIGN BORN WORKER GROWTH: A near-record 2.4 million plunge in native-born workers in just the past 3 months (only the covid crash was worse)!

- A record 1.2 million foreign-born (read immigrants, both legal and illegal but mostly illegal) workers added in February!

- All job creation in the past 6 years has not only been been exclusively for foreign-born workers.

- There has been zero job-creation for native born workers since June 2018!

- ADP EMPLOYMENT REPORT – ADP has reported substantially less job growth than BLS’s version of the truth for the last six months…and it’s getting worse.

- We saw Wage-Growth Re-Accelerating In February.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.