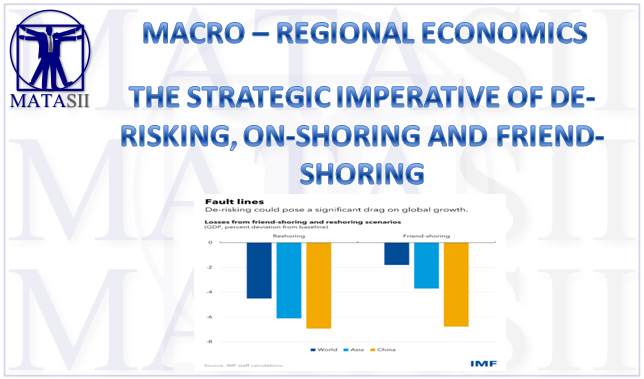

Gordon T Long Global Macro Research | Macro-Technical Analysis GLOBAL MACRO REGIONAL THE STRATEGIC IMPERATIVE OF DE-RISKING, ON-SHORING AND FRIEND-SHORING OBSERVATIONS: We Have Become A Lazy, Obsolete Industrial Nation Manufacturing is an area I spent many years involved in. I started my career as an IBM Manufacturing specialist in pioneering new computer processes across […]

TP Credit Contraction II

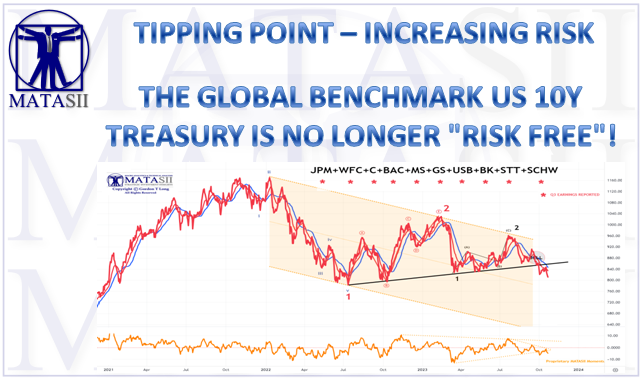

THE GLOBAL BENCHMARK US 10Y TREASURY IS NO LONGER “RISK FREE”!

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS INCREASING RISK THE GLOBAL BENCHMARK US 10Y TREASURY IS NO LONGER “RISK FREE”! OBSERVATIONS: The Importance and Problem With A Social Safety Net Having just returned from Europe and prior to that having researched an UnderTheLens Video on China’s problems, something struck me […]

IS THE US BEGINNING TO SPIN OUT OF FINANCIAL CONTROL?

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS CREDIT CONTRACTION IS THE US BEGINNING TO SPIN OUT OF FINANCIAL CONTROL? OBSERVATIONS: I thought I would share another set of observations I had during my recent trip to Europe. It is about housing and supporting contract services. Having replaced my home roof […]

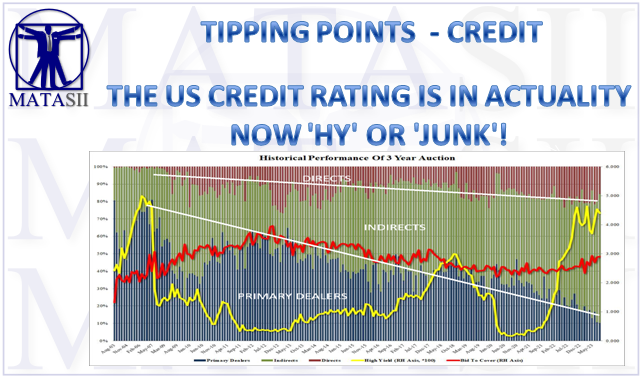

THE US CREDIT RATING IS IN ACTUALITY NOW ‘HY’ OR ‘JUNK’!

The content has been lost from the site. To read this post please see the full newsletter: THE US CREDIT RATING IS IN ACTUALITY NOW ‘HY’ OR ‘JUNK’! If the above direct link fails, try this: https://myemail.constantcontact.com/The-US-Credit-Rating-Is-In-Actuality-Now–HY–or–JUNK–.html?soid=1110877245158&aid=T0WJfMtuVs8

US CREDIT DOWNGRADED: Bidenomics Breaks The US ‘Credit Credibility’ Dam!

US CREDIT DOWNGRADED: Bidenomics Breaks The US ‘Credit Credibility’ Dam! Key Rating Drivers Ratings Downgrade: The rating downgrade of the United States reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to ‘AA’ and ‘AAA’ rated peers over the last two decades that […]

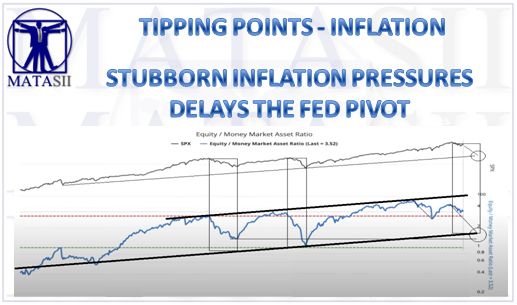

STUBBORN INFLATION PRESSURES DELAYING FED PIVOT

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS INFLATION PRESSURES STUBBORN INFLATION PRESSURES DELAYING FED PIVOT Weakening Inflation is not sticking to the script by coming down relatively quickly. Instead it is universally stubbornly coming in higher than expectations and actually increasing on a M-o-M basis. This isn’t just a US […]

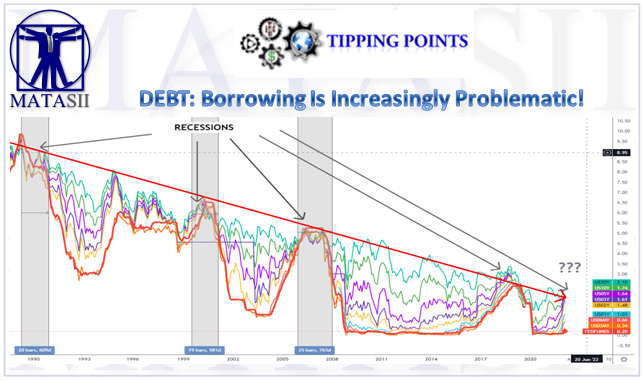

DEBT: Borrowing Is Increasingly Problematic!

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS CREDIT CONTRACTION DEBT: Borrowing Is Increasingly Problematic! SIMPLY AN INADEQUATE RESPONSE! ==== THE FEDERAL RESERVE’S POOR RESPONSE TO HISTORIC US INFLATION IS NOW SERIOUSLY COMPOUNDING A NATIONAL PROBLEM! Real average hourly earnings to offset exploding inflation fell for the 12th straight month. […]

CREDIT LEADS: The Lending Spigot Is Quickly Constricting

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS CREDIT CONTRACTION CREDIT LEADS: The Lending Spigot Is Quickly Constricting! COMPOUNDING UNINTENDED CONSEQUENCES OF RUSSIAN SANCTIONS Sustained central bank QT programs are likely (if carried out) to result in another major mortgage / housing debacle similar to 2008, European Banks (specifically large Italian and […]

SOVEREIGN CREDIT SHAKEN FURTHER BY UKRAINE CONFLICT

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS CREDIT CONTRACTION SOVEREIGN CREDIT SHAKEN FURTHER BY UKRAINE CONFLICT The issues within both Sovereign and Corporate Credit have been mounting. Ukraine was just another shock to an already increasingly Fragile sector becoming more “Brittle” by the day, versus the “Resiliency” that is required […]

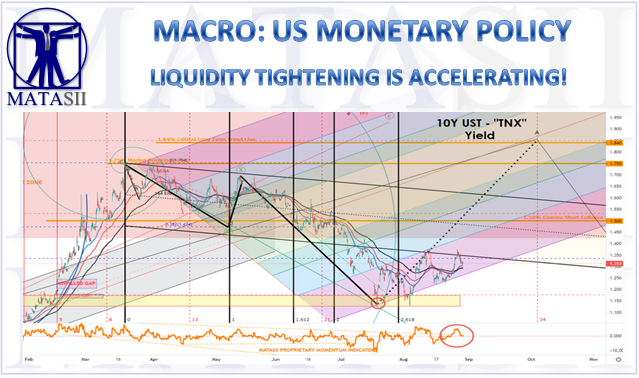

LIQUIDITY TIGHTENING IS ACCELERATING!

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS CREDIT TIGHTENING FOLLOWING DETAILED ANALYSIS IS SUBSCRIBER CONTENT ONLY Subscribe to view full post content with supporting live charts SUBSCRIBE LIQUIDITY TIGHTENING IS ACCELERATING! We have long advocated that problems in the equity markets are foreshadowed by warnings in the Credit Markets. This […]