SII

LENDERS

EERIE SIMILARITIES IN AUTO LENDERS TO 2008 MORTGAGE DEBACLE

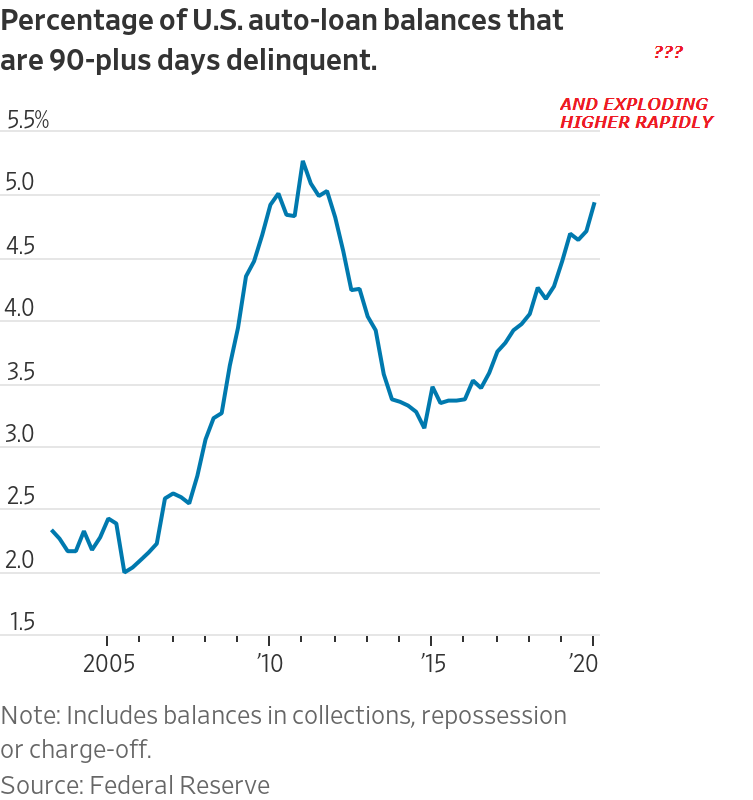

- Missed payments are expected, Delinquencies over 30 days are exploding and Defaults are on the rise,

- Lenders cash flows are being imperiled with little site or financial relief insight,

- Dividends and Buybacks supporting stock prices are likely to be slashed in this and coming quarters to match the historic loan loss reserves major banks took in the most recent quarter,

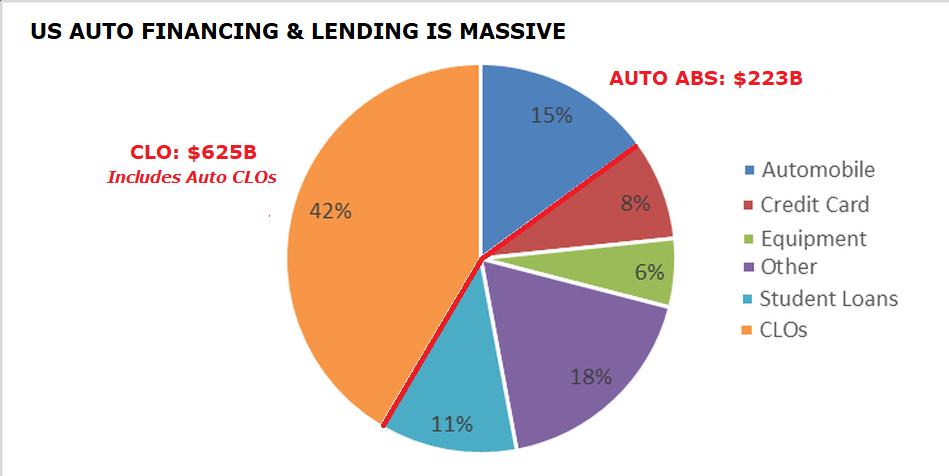

- This is having a profound impact on the entire ~$2T structured auto credit, ABS, Leveraged Loans, CDO industry which supports the auto loan lending process,

- Buyers of high yield structured auto loans products such as Insurance companies, Pensions, Hedge Funds, Fund Managers are now facing credit downgrades on their holdings which can position the holding below minimum portfolio requirements,

- As a major holder of major Airline stocks this will have a significant impact on the perception of the industries abilities to recover,

- All eyes are however now on Hertz negotiations where their bankruptcy creditors may decide to liquidate fleet collateral holdings because of future pressures in the travel sector and the linkage to airports where typical auto rentals occur.

- The damage of placing this amount of supply on an already over supplied investor can only be likened to what has recently occurred in the oil sector.

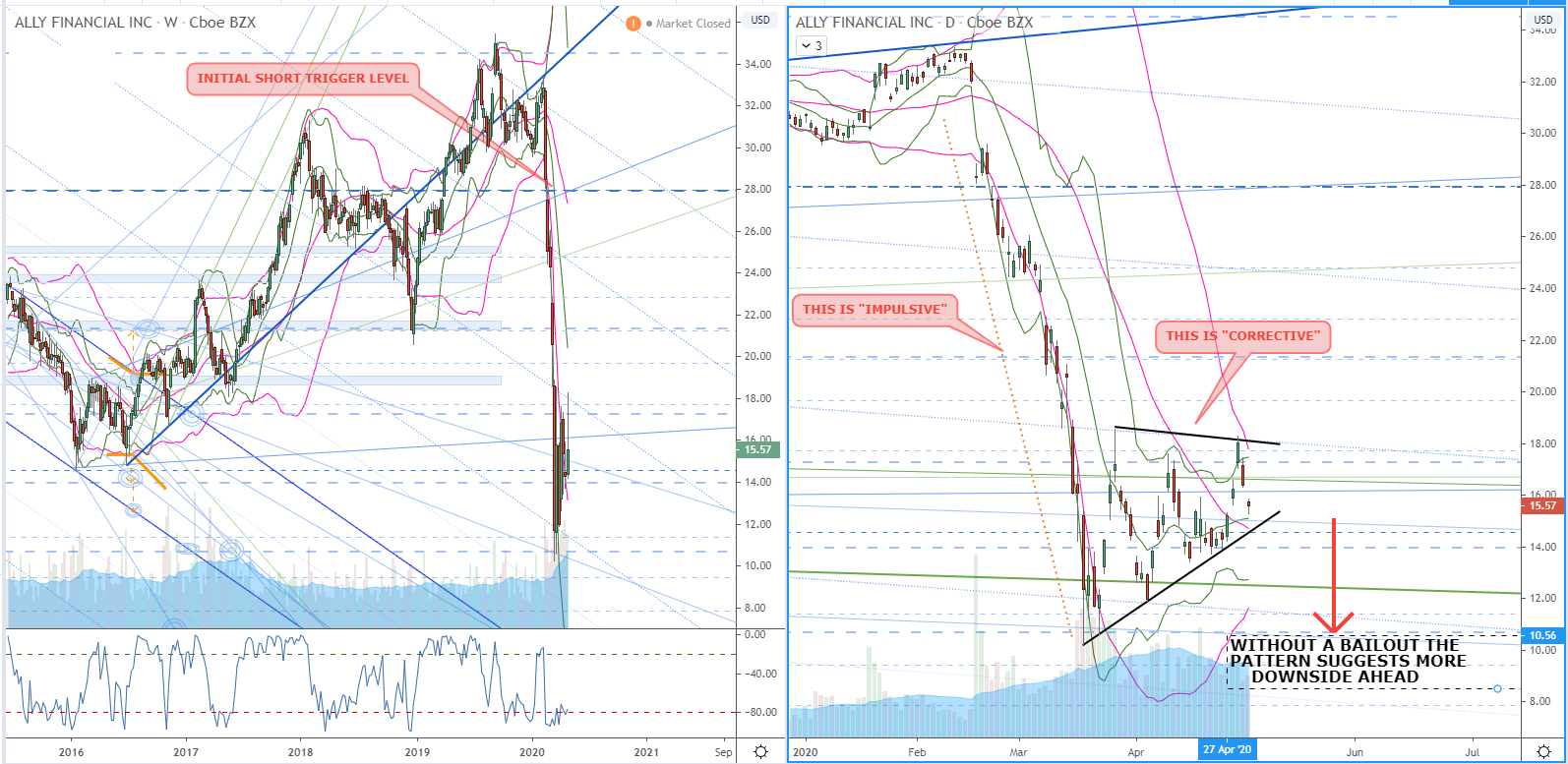

- AUTO LENDERS like Ally Financial are a reflection of the Auto Lending sector. Ally is a dominate player in the $223 Billion Auto ABS (Asset Backed Securities) market. The Auto ABS market pales in comparison to the $625B Collateralized Loan Obligations (CLO) securitization market which also handles Auto financing. In case this all sounds familiar it is because the 2008 Mortgage Crisis stemmed from credit erosion problems in the CDO market (Collateralized Debt Obligations).

- The Financing arms of General Motors and Ford are likely to incur multibillion dollar losses associated with the drastic drop in used-vehicle prices, per JP Morgan Chase. (Reported by Zacks Research).

- American used car value index, Manheim, fell 11.8% in the first half of April owing to halting used car wholesale auctions as a result of coronavirus-induced economic lock-down, thereby dashing any hopes of recovery for firms’ captive-finance subsidiaries. The last time the index witnessed declines of such magnitude was during the 2008-09 financial crisis.

- This drop in used-car prices is likely to create pressure in several areas of automotive chain, resulting in myriad challenges.Used car prices impact new car prices, rental car firms, and dealership earnings and lease residual values. The residual value is the estimated wholesale value that the vehicle will retain at the end of the lease period. While the firms are expecting the used car prices to fall, any larger-than-expected price drop will lead to massive losses from leasing impairments. =

- The record-breaking $1.3 trillion worth of auto loan debt Americans are collectively shouldering is starting to show some serious cracks. As of late last year, auto loan delinquencies were at an eight-year high, and suspiciously, that was right around the same time the number of rejected auto loan applications jumped. That’s despite one of the best — and best-paying — job markets on record.

- It’s anecdotal evidence of a brewing problem likely to be worsened by the coronavirus pandemic. With millions of people newly out of work and countless more adversely affected by the economic slowdown, even more car payments could start to be skipped as incomes and credit scores sink hand in hand.

- That puts all lenders on notice, but could prove particularly problematic for Credit Acceptance (NASDAQ:CACC), Santander Consumer USA Holdings (NYSE:SC), and Ally Financial (NYSE:ALLY), each of which relies heavily on auto lending.

A superficial look at the global economy as of last year was encouraging. In retrospect, though, things may not have been as strong as they seemed. The American Bankers Association reported in January that, as of the end of the fourth quarter of last year, 2.43% of auto loan recipients were at least 30 days late on their payments.

- That’s the highest rate since 2011 when most consumers were digging their way out of 2008’s economic implosion.Lenders responded by tightening their purse strings. The New York Federal Reserve noted by the middle of last year that rejection rates for car loan applications had soared, up from 4.5% in October of 2018 to 8.1% as of October of 2019.

- Consumers haven’t exactly been helping themselves. Automobile market data outfit Edmunds noted that as of March — for the first time ever — the average term of a car loan exceeded 70 months. That’s 5.8 years, and it makes it likely most loans will be “upside-down” for much of that 70-month stretch, meaning the owner will owe more than the then-used vehicle is worth. They’re paying a fortune for those vehicles too, with more than $34,000 typically being financed to buy a new vehicle last month. That’s another record that has led to record-breaking average monthly payments.

Most Vulnerable Companies

Most banks and credit unions offer car loans, but a trio of dedicated consumer lenders are exceedingly exposed to the industry.

- ALLY FINANCIAL is one of those names. To its credit, Ally is providing relief for customers affected by the coronavirus outbreak. Borrowers can defer payments for up to 120 days, and it’s waving some banking and stock-trading fees. Still, about 85% of Ally’s operating income last year came from car loans, leaving it highly vulnerable to the prospect of a job-taking recession. Bolstering that risk is Ally’s recent news that it essentially doubled its loan purchase partnership with automobile sales chain Carvana (NYSE:CVNA). All told, Ally has committed up to $2 billion to help Carvana sell cars by letting the lender take care of those underlying loans. ALLY Financial is hardly the only name that may suddenly be on the hook, however. Santander Consumer USA Holdings is one of the nation’s biggest auto lenders as well, and caters to subprime customers (borrowers with less-than-great credit).

- SANTANDER CONSUMER USA: Like many lenders did back in 2008, Santander will sometimes package a bundle of auto loans into a single bond-like instrument. When one series of that debt failed to pay its new owners as expected last year, however, the lender was forced to buy back that bundle of poorly performing debt just shortly after it was sold. Debt-rating agency Moody’s believes Santander only verified the income for about 3% of the borrowers lumped into that bundled product, which leaves other asset-backed securities based on car loans a bit suspect.

- CREDIT ACCEPTANCE is another subprime auto lender, but one with a twist. It’s also a collection agency on loans it makes that go unpaid. As of the last quarter of last year, its forecasted collection rate of all money due — principal, interest, and any associated fees — was at a 10-year low of 64.8%, after steadily declining from 77.7% in 2010. Total loan volume per dealer as well as partnered-dealer growth were all down during the third fiscal quarter, jibing with CEO Brett Roberts’ comment during the Q&A portion of the Q4 conference call: “We’ve been in a very, very competitive period for a long time, really since late 2011, 2012. It appears that the competitive environment has gotten more intense recently.”

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.