MACRO

US FISCAL & MONETARY POLICY

FISCAL & MONETARY STOPS BEING PULLED OUT FOR THE ELECTION

OBSERVATIONS: FALSE EXPECTATIONS??

I find myself wondering if our global expectations can continue to be funded? I see massive global financing needs where credit creation must be taken to another level.

My colleague Richard Duncan just issued a superb report on the issues with deteriorating US credit growth. (I forwarded a link to all MATASII subscribers). Weak credit growth in the US is a global problem. Total Credit in the United States first exceeded $1 trillion in 1964. This quarter it will top $100 trillion. This 100-fold increase in Credit over the last 60 years, as Richard highlights, has been the most important driver of global economic growth. Credit Growth now drives Economic Growth as Capitalism has evolved into Creditism.

EXPECTATIONS THAT EVERYTHING CAN BE FINANCED

We have huge fiscal spending requirements which are increasingly “trillions” more needed each year:

-

- The interest on the US debt is quickly approaching $2T/year and is more than the tax revenues taken in.

- Unfunded Entitlement Liabilities are now more than $80T with the contributions held in US Treasury Bonds increasingly being redeemed for payouts. The US Treasury will be forced to issue more debt to pay the principle owed when they mature.

- The Green economy is costing Trillions and growing.

- Climate Change is costing Trillions and growing.

- Global Conflict is forcing the Remilitarization of the world.

- The Restructuring of global trade (De-Risking / Onshoring / Friendly shoring)

- The Houthis’ sustained disruption of the Asia-Europe shipping route is repricing global shipping and insurance costs.

- Rare earth metals and global commodity costs continue to reprice.

- Between now and 2030, demand for power from global data centers will easily more than double … within that comes $50bn of capital investment in US power generation alone.

- FX De-Dollarization

…. all must be financed and are INFLATIONARY!

Is our financial system ready for this? It is already experiencing serious secular and unprecedented issues…

INCREASINGLY ABOUT SOLVENCY v LIQUIDITY!

- BANKS:

- The FDIC’s published reports show more than $500 billion in unrealized losses in the US banking sector.

- There was $620b in unrealized Treasury losses last year with Silicon Valley Bank, Signature, First Republic, and now Republic First.

- CENTRAL BANK:

- The Federal Reserve, which in theory would bail out the banking sector, is itself insolvent by $900 billion.

- Total Federal Reserve capital is just $51 billion… versus $948 billion in losses. This means the Fed is insolvent 19 times over.

- GOVERNMENT:

- The US government, which would bail out the Fed, is insolvent by more than $50 trillion.

Oh well, maybe I just worry too much – or too few who are actually responsible even worry about it at all??

Maybe we need to make it more personal! How about this:

-

- From 2012 to 2016, things became 5% more expensive (“things” = gasoline, food, consumer goods).

- From 2016 to 2020, things became 8% more expensive.

- From 2020 to today, things have become 21% more expensive.

TO REVIEW

+5% … to +8% … to +21% = 34%

OR 1/3 more expensive to live (even exist)!

WHAT YOU NEED TO KNOW!

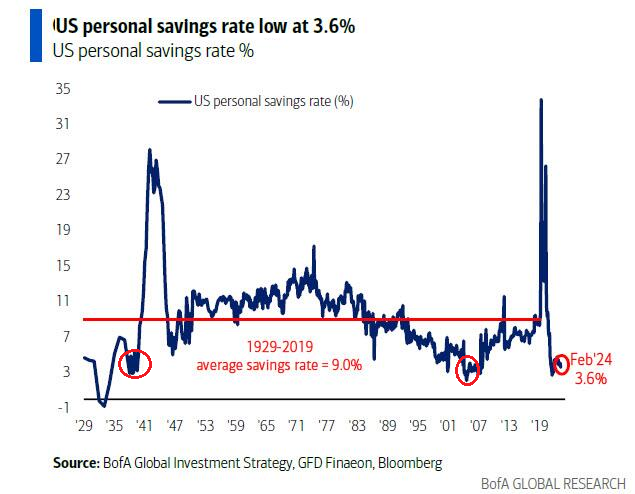

US PERSONAL SAVINGS RATE FALLS TO 3.2%

US PERSONAL SAVINGS RATE FALLS TO 3.2%

The savings rate plunged to 3.2% from 3.6% and down from 5.2% a year ago. The US savings rate is now at levels not seen since the Great Depression and the 2008 Financial Crisis (see red circles). This is about 60% below the long-term average US savings rate of 9.0%, which cannot be a healthy economy!!

Meanwhile credit card balances are at all time highs with credit card rates at record highs. It would appear the recent spending spree is almost over.

RESEARCH

ALL STOPS NOW OUT FOR THE ELECTION!

-

- Powell and Yellen have every incentive in the world to facilitate Monetary and Fiscal Policy to get Biden re-elected, but maybe more importantly to protect their personal legacies? Better to leave on your terms than subject to disgrace!

- In that regard, we have never seen Fiscal and Monetary Policy recently become more closely aligned and supportive! This had not been the case before Biden ran into troubles in the polls.

- Throughout most of Biden’s first term he has saddled the Fed with ~$6.7T in fiscal deficits that sparked an Inflation surge not seen since the 1970’s. The Fed initially espousing the Covid Supply Chain Inflation shock as “Only Transitory” was suddenly made to look inept as it scrambled to fight Biden’s fiscal driven Inflation.

A Classic case of “too many dollars chasing the same amount of goods & services”.

-

- So what are they up to? What is their plan? Of course I can’t be certain, but some things are very clear.

WE LAY OUT THE DETAILS IN THE RESEARCH SECTION

HEDGE FUNDS SHIFT TO “INDIRECT EXCHANGE”

-

- Over 10 years ago, my colleague and former Global Insights partner, Ty Andros and myself produced two videos outlining the “Indirect Exchange”. This followed extensive work Ty, a true Austrian Economist, had done on “Commodity Based Money”.

- As we watch major Hedge Funds and Private Equity Firms capture the US Rental Housing market it is important to understand the umbrella strategy under which they work.

- I asked Ty Andros to distill it as simply as only he can. I lay it out in the Research Section what he said.

DEVELOPMENTS TO WATCH

BLINKEN REBUFFED BY CHINA

BLINKEN REBUFFED BY CHINA

-

- After Yellen’s futile trip to China, Blinken’s visit was even more pointed in highlighting the deterioration of Sino-US relations.

- China has clearly lost respect for America, its global leadership, competitiveness and influence.

- Blinken could best resort to the weak “dialogue-is-progress” narrative.

FAMILY SUPPORTING JOBS IN PERIL IN AMERICA (Unless You Work for the Government)

-

- The US is creating temporary jobs, (being held by non American born workers), and losing full time jobs.

- Full time job growth is dominantly found in Government and Government funded / subsidized organizations.

- Salary and benefit increases are primarily the purview of government and union workers.

- Small Business which has been the bedrock of American employment is in freefall by almost any measure.

GLOBAL ECONOMIC REPORTING

APRIL LABOR REPORT (NFP)

APRIL LABOR REPORT (NFP)

-

- Not a Good Week for Key US Economic Indicators:

-

-

- Rising Unemployment Rate

- Falling new Job Creation

- Rising Employment Cost Index and Unit Labor Costs

- Falling Consumer Confidence

- ISM Manufacturing ISM in contraction

- Falling Construction Spending

- Falling Productivity

-

EMPLOYMENT COST INDEX (ECI)

-

- US labor costs accelerated in the first quarter, led by the government sector, while hikes to state minimum wage levels contributed to higher private sector labor costs.

- Labor costs reaccelerate more than expected. We have seen a big jump in the US 1Q employment cost index of 1.2% quarter-on-quarter versus 0.9% in 4Q23, well above the 1% expected and above every single individual forecast in the Bloomberg survey.

UNIT LABOR COSTS SOAR

-

- Echoing the market-worrying ECI data earlier in the week – Unit Labor Costs soared 4.7% in Q1, (well above the 4.0% expected and the 0.4% rise in Q4).

- So wage inflation is confirmed – rising at the fastest pace in a year – as all the gains we have been told to expect from AI just aren’t there in the data.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.