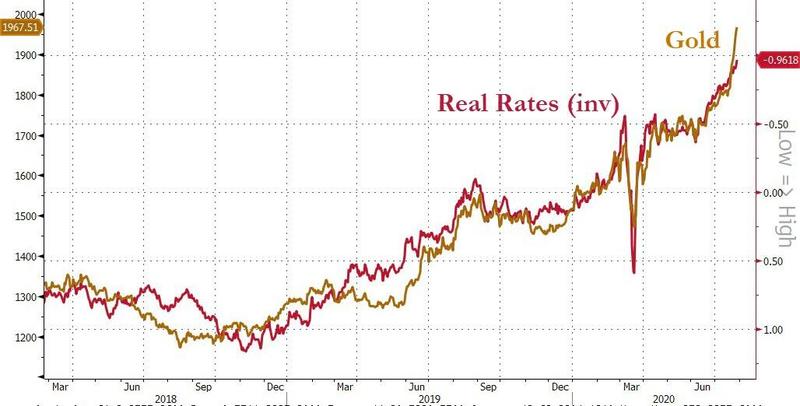

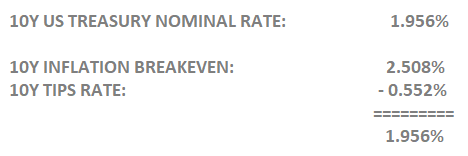

The answer in our view lies in understanding why Gold has diverged from Real Rates and what is the direction of real rates?

WHY HAVE REAL RATES HAVE RISEN SO FAST?

The US government has issued its largest amount of TIPS in history since November. To be precise, $76B just in the last 3-months ending in December. To put this into perspective: that’s almost 5% of the total outstanding amount of TIPs. This doesn’t include January not shown in the chart to the right.

Why is the US Government issuing such unprecedented amounts of US TIP securities?

The Federal Reserve’s current “TAPER” program, which is reducing its rate of increasing holdings of Treasuries, is now forcing the US Treasury department to sell more debt to the public. Increases in Treasury supply normally pushes yields higher and prices lower. Which is exactly what we are seeing. The sales of recently created Treasury i-Shares yielding over 7% has drawn significant sales, though the actual issuances are not yet readily available.

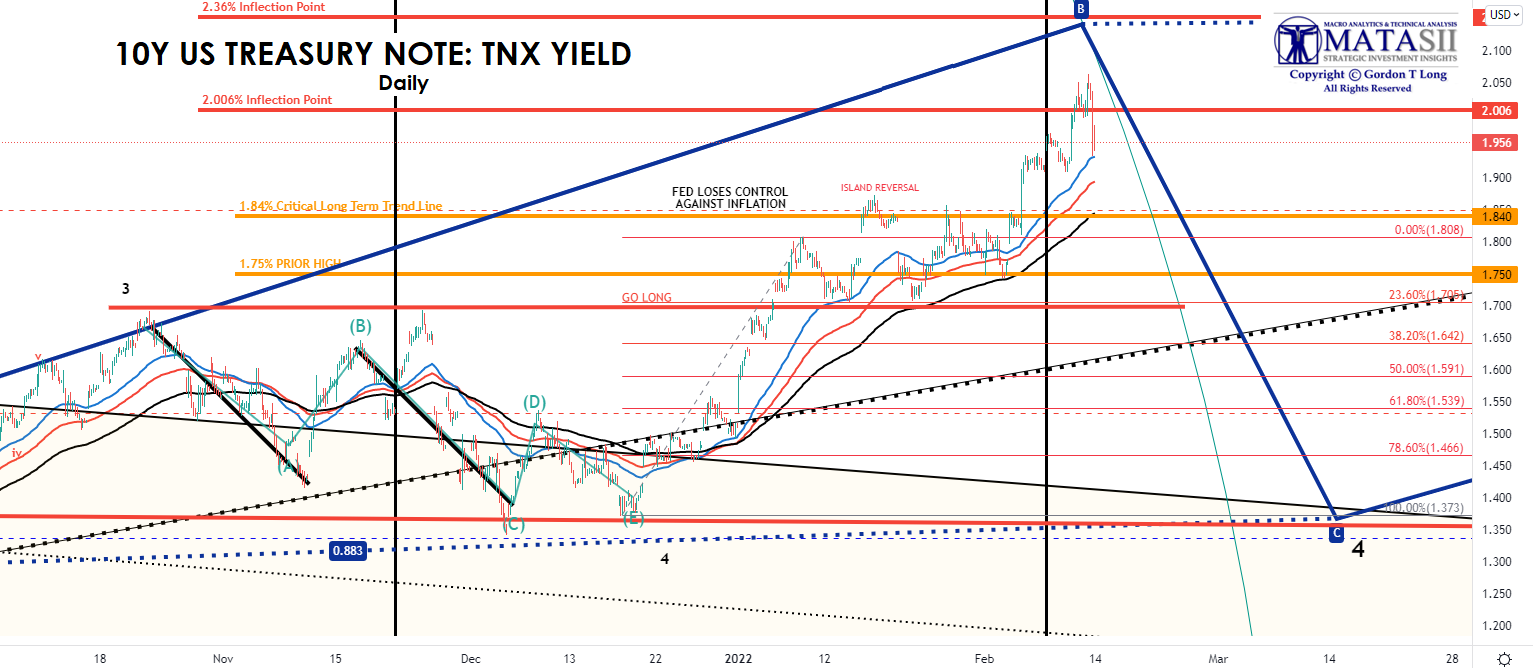

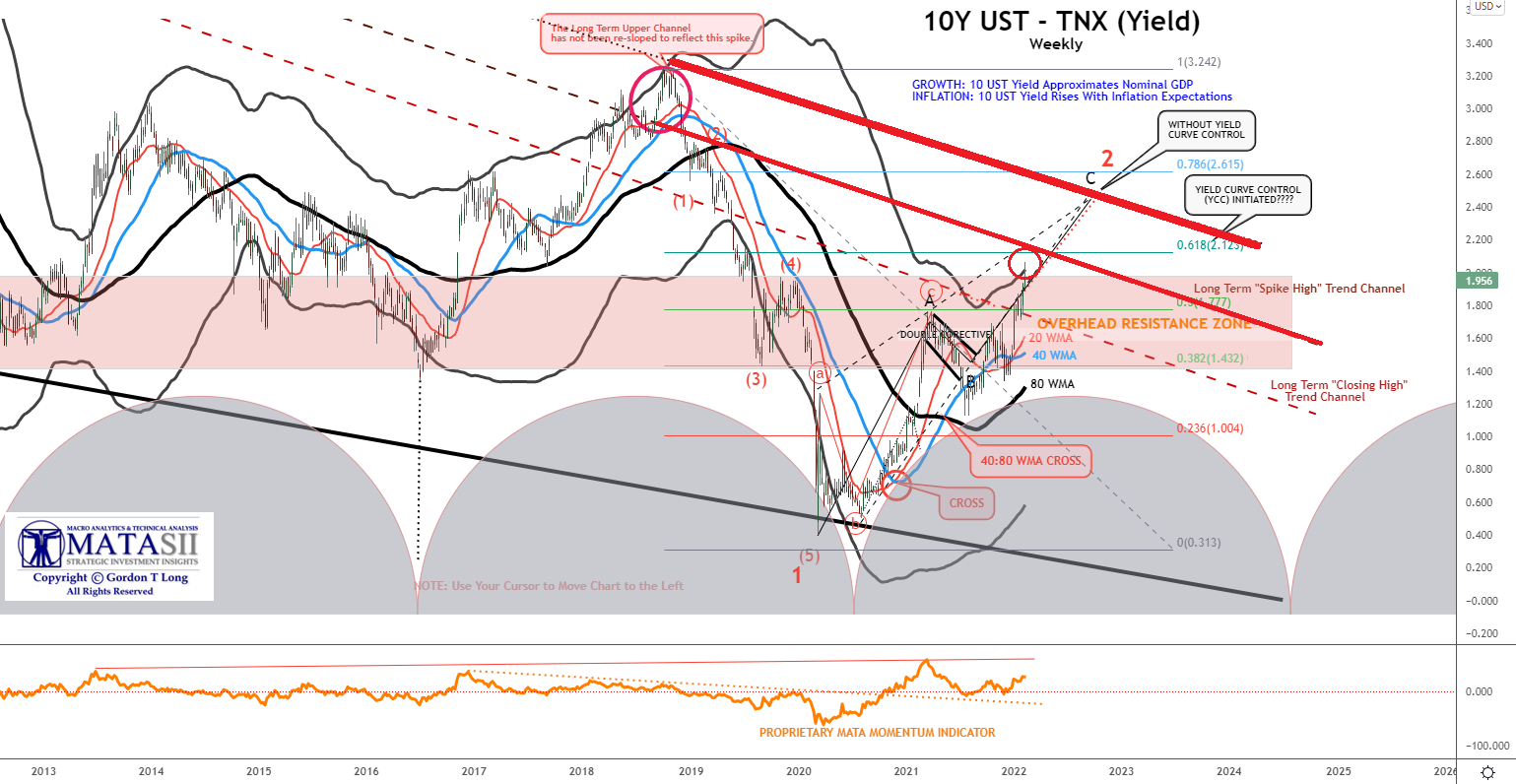

We have seen an unprecedented move in US 10Y Treasury Notes during this period of time. When we put the following projection together in the fall (labelled by the upward blue “B”) we thought it shocking, but our analysis confirmed this was what we should expect! It has been a “moon shot” since.