IN-DEPTH: TRANSCRIPTION - UnderTheLens - 11-22-23 - DECEMBER - The Road to Instability

SLIDE DECK

TRANSCRIPTION

SLIDE 2

Thank you for joining me. I'm Gord Long.

A REMINDER BEFORE WE BEGIN: DO NO NOT TRADE FROM ANY OF THESE SLIDES - they are COMMENTARY for educational and discussions purposes ONLY.

Always consult a professional financial advisor before making any investment decisions.

This is the last UnderTheLens video for 2023 before we prepare our 2024 Thesis paper. As usual this is in liew of the next UnderTheLens video in January. The February UnderTheLens as we traditionally do will focus on the expected Macro Themes for 2024.

I thought it timely to discuss how we have placed ourselves on an economic path of Instability. It is a global path which has emerged as a result of poor political policy choices, emerging structural imbalances and longer term social cycles.

I hope to touch on each of these in the context of how the previous MATASII Annual Thesis papers have been able to flush out this cancerous emergence.

SLIDE 4

As such I want to discuss the subjects as outlined and shown here.

SLIDE 5

Let’s start by recapping the message I hope this video leaves with you.

First, we are currently experiencing the intersection of many long term financial, and social cycles. Whether we are looking at social cycles like the Fourth Turning by luminaries such as Strauss & Howe, Demographic cycles from Harry Dent or Financial cycles by Martin Armstrong they are all pointing to the era we are presently in. I have never seen this in my lifetime. My research finds this era only comparable to 1849 when global nation states were forced by the same cycles into the shift from the domination by monarchies to various forms of representative government.

Secondly, the political discord and social fracturing of common beliefs, priorities and values which binds nations and societies is shifting. We are banding as tribes on the hard right or hard left versus around common hopes and aspirations.

Thirdly, Covid-19 has yet to be fully appreciated as the shock it was to the global world order. It was has acted as a catalyst to i) destabilize existing global imbalances, ii) tipped unfundable debt pyramids and iii) broke and hidden financial ponzi structures.

Fourth, it has become clear that we as individuals are increasingly surrendering our freedoms to authoritarian regulatory states for the apparent sake of personal security, resulting in increasing dependency to these entities with the critical loss of human self-reliance.

SLIDE 6

Let’s begin this line of thinking with where it starts, and that is with the breakdown of trust and the resulting crisis of confidence in political leadership, justice and equality.

SLIDE 7

In 2016 the mechanics of our annual thesis process lead us to focus of what we saw as a “Crisis of Trust”. In a 200 page paper we laid bare the core issues that were causing this. The paper is available with the others I will mention on the MATASII.com web site or by having the pdf links and updates for all our thesis papers automatically mailed by simply selecting that free mailing option on our site.

SLIDE 8

We argued that this crisis of trust and growth in uncertainty and cynicism should be expected to result in increasing economic and investment stagnation and eventually an era of stagflation. In fact our 2023 Thesis paper was entitled “A Great Stagflation”.

SLIDE 9

My colleague Charles Hugh Smith last week published a paper entitled Can We Reverse America's Distemper? which featured this study on decaying US Social Trust.

SLIDE 10

The decay is clear and suggests the decay is such that the surveyed individuals feel only 30% of the people they know or come into contact with can be trusted.

SLIDE 11

Our research suggests this chart also shows something else - we may not be at a low!

SLIDE 12

In fact our research suggests things are about to get much worse!

SLIDE 13

We are entering a new era of major distrust. Lost confidence …. and

SLIDE 14

… overall Global Turmoil!

In 2020 our Thesis paper mechanics led us to publishing our Thesis paper entitled “Global Conflict”. Here we discussed the elements that would bring a shift from a Uni-Polar world to a Multi-Polar world into increasing conflict.

Previously in 2008 we identified that coming shift in the Thesis paper entitled “A New World Order”.

SLIDE 15

“A New World Oder” like all the thesis papers shown here over the last decade, has proven themselves over time because the process of abstraction beginning with the identification of Tipping Points (the colored boxes on the left) has proven to an excellent research methodology in the increasingly complex global economic and financial matrix.

SLIDE 16

The world’s complex network of institutions and governance has evolved as our society and world has evolved. It was never designed but rather evolved based on the needs of the time and era.

It has become increasingly exposed to the vagrancies of instability because of its almost unknowable level of complexity. It is only effectively stressed tested by accident or during a crisis.

The 2000 Dotcom and 2008 Financial Crisis are examples of the system coming under stress stemming from the hidden complexities in the financial derivatives market. An opaque market now measured in size by an unimaginable quadrillion of notional value.

SLIDE 17

What could possibly go wrong here when it is almost completely unregulated, unreported and left to global banks to mysteriously navigate and transact?

That is just one of the reasons why interest rates are going up as associated risk premiums are going up to account somewhat for this unknowable risk.

The de-stabilization and increase of risk premiums elevated substantially with the shock wave of Covid-19.

SLIDE 18

It is easy on a day-to-day basis not to see the big changes that are occurring and the turmoil that is emerging.

Though the US GDP is reported to be up $1.6T, the US budget deficit is up 9% forcing the US to attempt to pull almost the same amount from the global financial markets without blowing the top off global financing rates.

The Peak-to-Trough US 10Y Treasury loss has hit 50% with unrealized bank losses creating a banking crisis currently being papered over by the Fed’s emergency and exploding Bank Term Funding Program (or BTFP).

Japan’s Yen is at a 32 year low crippling the all important global Japanese Carry Trade.

The global manufacturer for the world China has its Renminbi currency trading at a 15 year low.

Despite a recent global energy crisis stemming from the EU and the Ukraine, oil markets are suddenly in a bear market with WTIC touching $72/bl from over $100/bl

Today, only 7 stocks currently account for more than 30% of the S&P 500 market cap with technology stocks at 100 year relative highs.

Meanwhile banks are at 80 year lows and Emerging Markets are at 50 year relative lows.

None of this adds up or makes complete sense?

SLIDE 19

It only makes sense when we start to realize the amount of money that has been pumped into the global economy since Covid-19. In the US alone we are now spending at a greater level than was required to finance WWII. We have War Time spending in a Peace Time Economy. How long can that last?

SLIDE 20

And this came after a decade of Quantitative Easing and Zero bound interest rates which exploded financial asset values. We thought the Dotcom Bubble was a lesson we should have learned from but in fact it appears we have a mirror of it but at an order of magnitude larger.

SLIDE 21

Total global debt shown here has grown at such a rate that the Financial Times in London last week calculated that global government interest payments alone would surpass $3T in 2024. This would place many countries in a position of being forced to cut entitlements and critical subsidies while poorer countries left unable to possibly feed its people.

SLIDE 22

Something should be expected to break somewhere – soon.

The black channel since the 2008 Financial Crisis appears to be indicating that the pressures are beginning to take their toll.

SLIDE 23

Stability in markets comes from finding solid financial support levels.

Instability comes from overhead resistance levels being unable to be broached.

SLIDE 24

Support levels because of the degree of run-up we have experienced since the 2008 Financial Crisis are minimally much lower.

Unfortunately, finding these support levels is going to cause a lot of collateral damage and unintended consequences.

SLIDE 25

We have already entered a period of stagnation which is quickly moving towards Stagflation that will eventually lead to a debt crisis.

SLIDE 26

This is clear to see when we examine the long term DJI to Gold Ratio. These are two old measures that allow us a glimpse of a larger perspective.

We are at a critical pivot that we believe leads, due to:

- De-Globalization in the form a De-Risking and Reshoring,

- Along with De-Financialization and

- Reduced Mercantilism in the form of FX Reserves not flooding into US Treasuries,

….. to having a profound impact on a world in turmoil.

SLIDE 27

We can of course expect the world to respond. That response will take the necessary form of a return to Sound Money.

SLIDE 28

The central issue is that Fiat Currencies are ALWAYS politically abused and always lead to currency debasement and a debt crisis.

That roadmap is well trodden!

SLIDE 29

We are in the upper left part of this established roadmap.

SLIDE 30

The US began coming off sound money in August 1972 when the US came off the Gold standard for repaying its debt. As the world’s reserve currency this had global consequences.

However, it wasn’t however until 1980 and the massive issues with US inflation and taking the world’s risk free benchmark in the form of the US 10Y bond to unprecedented levels that the damage was really done and the world was changed forever.

At that point the Bank of International Settlements began settling annual accounts in credit and not in Gold transfers.

SLIDE 31

This allowed what we call the Great Moderation to come into existence.

Falling rates brought Globalization, Financialization and Consumption to destabilizing levels.

Slide 32

Unfortunately it also created a structurally flawed system of global financial accountability.

There was no “governor” to control the speed of the machine and amount of credit and debt that could be created.

Politicians were effectively unconstrained in the schemes they could contrive for political patronage.

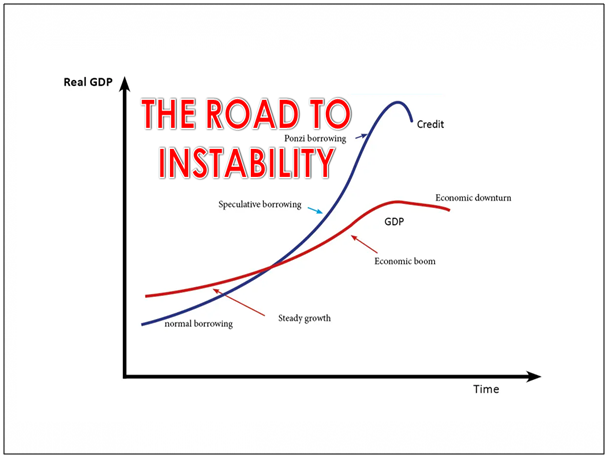

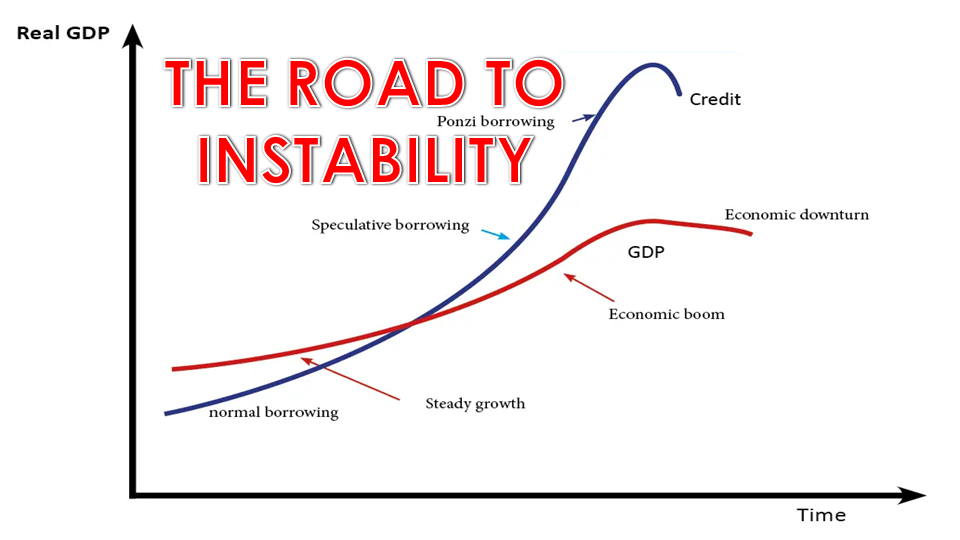

SLIDE 33

The day has arrived!

The hypothesis of financial instability developed by the economist Hyman Minsky has arrived. Minsky argued that financial crisis are endemic in capitalism because periods of economic prosperity encouraged borrowers and lender to be progressively reckless. This excess optimism creates financial bubbles and the later busts. Therefore, capitalism is prone to move from periods of financial stability to instability.

SLIDE 34

This is a type of market failure that requires government regulation over crony capitalism and anti monopoly enforcement. It has been decades since the Sherman act has broken up a corporate monopoly. When the 10 richest people in America ALL founded and own a dominate corporation with almost total control over their particular facet of the new economy we know we have arrived.

SLIDE 35

What can we conclude?

SLIDE 36

Hopefully, some of messages I laid out earlier are a little clearer or you know where to begin your own research and verification.

In many ways there is little you can do in changing what lies ahead – the die has been cast.

SLIDE 37

As individuals however we need to recognize we are increasingly surrendering our freedoms to authoritarian regulatory states for the apparent sake of personal security. This is resulting in increasing dependency to these entities with the critical loss of human self-reliance.

The answer to this is to begin a serious focus on our own self- reliance.

- That starts with stopping being a slave to debt entrapment. Get out of debt or immediately start reducing it. It is going to increasingly cost more to fund debt.

- Establish your own circle of dependencies at a local, community level and do not continue your dependency on large entities and centralized governments where your vote is meaningless and fosters little to no change.

- You must reassess your values system particularly relating to “materialism” and “consumption”. It is another trap the new era will continue to punish ruthlessly.

SLIDE 38

As I always remind you in these videos, remember politicians and Central Banks will print the money to solve any and all problems, until such time as no one will take the money or it is of no value.

That day is still in the future so take advantage of the opportunities as they currently exist.

Investing is always easier when you know with relative certainty how the powers to be will react. Your chances of success go up dramatically.

The powers to be are now effectively trapped by policies of fiat currencies, unsound money, political polarization and global policy paralysis.

SLIDE 39

I would like take a moment as a reminder

DO NO NOT TRADE FROM ANY OF THESE SLIDES - they are for educational and discussions purposes ONLY.

As negative as these comments often are, there has seldom been a better time for investing. However, it requires careful analysis and not following what have traditionally been the true and tried approaches.

Do your reading and make sure you have a knowledgeable and well informed financial advisor.

So until we talk again, may 2023 turn out to be an outstanding investment year for you and your family?

I sincerely thank you for listening!