VIDEO: 36 Minutes with 34 Supporting Slides

KEY MESSAGES

- Covid-19 has shown itself to be a triggering event which has destabilized a fragile global financial system.

- Decades of unsound money, deficit fiscal spending and foreign financing of an economy built on “consuming more than it produced” left the US exposed to the ramifications of Covid-19.

- The ramifications of the lock-downs of the work forces of the US & Developed economies has meant lost national income and trillions of dollars of government relief spending and a global shutdown of supply chains. The decaying shock waves continue to ripple across the globe.

- Suddenly “Too many dollars chasing too few goods” launched monetary inflation pressures around the world.

COST-OF-LIVING” CRISIS

- Current global risks ranked by over 1200 of the top global experts surveyed by the World Economic Forum overwhelming by 4 out of 5 surveyed, stated that “Cost-of-Living” was the largest risk facing their country and the world. They felt it was in fact a “crisis”!

- The other factors in their top issues were an Energy Supply Crisis, a Rising Inflation and a Food Supply Crisis. The magnitude of the 2022 rates of increase of all these factors may diminish on a percentage basis, but if history is any indicator their impact and continuation is likely to be felt for much of this decade.

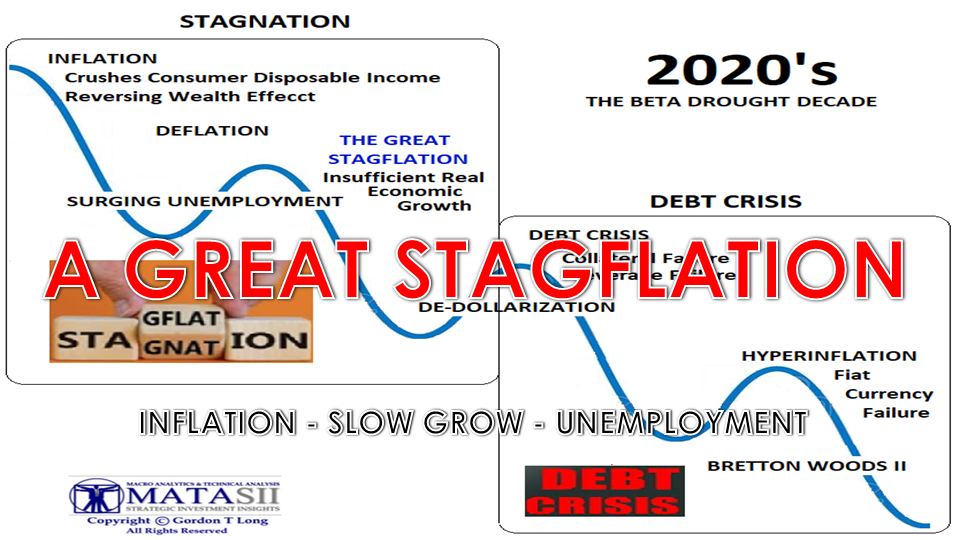

- Coupled with resulting slowing economic growth and surging unemployment will inevitably mean unprecedented stagflation. We have likely already entered the era of what may be someday called “The Great Stagflation”.

THE GREAT STAGFLATION

- Falling financial market valuations will continue throughout this, resulting Beta Drought Decade.

- Historic valuations, excess leverage and unfundable debt in all facets of the global economy, whether consumer, corporate or government, will need to be brought under control and normalized.

- Standards of Living in the developed economies and especially the US can be expected to fall as productivity growth fails to deliver and support current standards-of-living and expectations.

- We have been experiencing “blow-off” bubbles ever since the US as the holder of the world reserve currency came off the gold standard and allowed the US dollar to become a fiat currency.

- We can expect a Debt Crisis in this decade along with elements of hyperinflation which will force the resetting of fiat currencies. This will result in the transition back to some form of sounder money.

- The roadmap ahead will be highly volatile, risky, and fraught with growing geo-political conflicts as the world shifts from a Uni-polar to Multi-polar world.

- The world will be confronted with both Inflation and Deflation in different economic sectors and regions.

- Too many events have yet to occur and resulting policy decisions taken to know with any real certainty how this will all evolve or turn out.

- Our best guess based on the data, charts and analysis in this paper are summarized through both roadmap schematics and market investment charts.