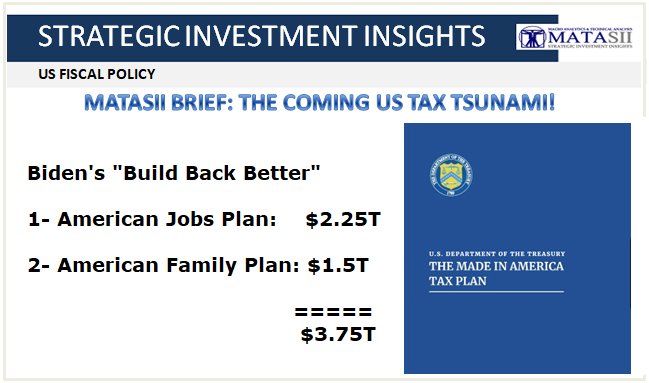

MATASII BRIEF: THE COMING US TAX TSUNAMI!

SOURCES:

- Preparing for President Biden's Tax Increases - 03-29-21 - Berdon LLP Accountants & Advisors,

- Biden expands corporate tax increase proposals - 04-01-21 - Grant Thorton

- President Biden's Tax Plans for the Next Few Years - 02-01-21 - Kiplinger

- Made In America Tax Plan Report - April 2021 - US Treasury Department

- Details and Analysis of President Joe Biden’s Tax Plan - 10-22-20 - Tax Foundation .ORG

- An Analysis of Former Vice President Biden’s Tax Proposals - 03-05-20 - Tax Policy Center - Brookings Institution

CORPORATE TAX

Biden’s Tax Plan Aims to Raise $2.5 Trillion and End Profit-Shifting - 04-07-21 - NY Times

- Aims to raise as much as $2.5 trillion over 15 years to help finance the infrastructure proposal.

- Includes bumping the corporate tax rate to 28 percent from 21 percent,

- Imposing a strict new minimum tax on global profits,

- Cracking down on companies that try to move profits offshore.

- Aims to stop big companies that are profitable but have no federal income tax liability from paying no taxes to the Treasury Department by imposing a 15 percent tax on the profits they report to investors. Such a change would affect about 45 corporations because it would be limited to companies earning $2 billion or more per year.

- Eliminates all subsidies specifically for oil and gas embedded in the tax code, including deductions for drilling costs.

Big Tech $100 Billion Foreign-Profit Hoard Targeted by Tax Plan - 04-22-21 - Bloomberg

- Biden plan takes aim at popular tech tax-code maneuvers

- Book income tax would have cost Apple alone $3.8 bln in 2020

- Apple, Microsoft, Amazon.com Inc., Facebook Inc., Intel Corp. and Alphabet Inc disclosed more than $100 billion in overseas pretax income in their most-recent financial years.

CAPITAL GAINS

Biden Eyeing Tax Rate as High as 43.4% in Next Economic Package - 04-22-21 - Bloomberg

- People earning $1 million would pay 39.6% plus Obamacare levy

- Total tax rates for New Yorkers, Californians could top 50%

- Rationale: "To help pay for a raft of social spending that addresses long-standing inequality"

YELLEN'S GLOBAL MINIMUM TAX

Yellen Unveils $2.5 Trillion Tax Reclamation Plan - 04-07-21 - Zero Hedge (Detailed pdf Document)

- Would increase the rate of what is essentially a minimum tax on money American companies earn abroad.

- It would apply that tax to a much broader selection of income.

- It would also eliminate lucrative tax deductions for foreign-owned companies that are based in low-tax countries — like Bermuda or Ireland — but have operations in the United States.

- Biden wants to increase the global intangible low tax income (GILTI) rate on foreign profits from 10.5% to 21%.

- He also supports a "claw-back" provision to force companies to return public investments and tax benefits when they eliminate jobs in the U.S. and send them overseas.

- He has also called for a 10% surtax on businesses that avoid U.S. taxes by sending jobs and manufacturing overseas and then sell goods back to Americans.

PREPARING FOR PRESIDENT BIDEN’S TAX INCREASES

03.29.21 | BERDON VISION

In all likelihood, the next phase of President Biden’s economic agenda will involve tax legislation. With a divided 50-50 Senate and Vice President Harris as the tie-breaker, tax legislation will probably be achieved through the budget reconciliation process, which includes Federal funding measures to pass in the Senate with a simple majority of 51 votes. Although there are discussions of changing the filibuster rules, currently 60 Senate votes are required to close debate and advance legislation for a bill that is not specified in the budget resolution. Therefore, this procedural hurdle makes it more likely for the next tax legislation to pass under a budget reconciliation bill not subject to the filibuster.

While there is still uncertainty as to whether there will be bipartisan or even unanimous Democratic support for Biden’s tax plans, tax hikes are likely to be on the horizon for certain businesses and higher-income taxpayers. Among other things, Biden’s income tax plans include raising the corporate income tax rate from 21% to 28%, eliminating certain tax benefits for pass-through business owners, introducing a higher income tax rate and additional payroll taxes for individuals earning more than $400,000, and imposing a higher capital gains tax rate for individuals making $1 million or more.

On the estate tax side, Biden’s tax plan would increase the federal estate and gift tax rate from 40% to 45% and lower existing tax exemptions. The federal estate and generation-skipping (GST) tax exemptions would revert to 2009 levels of $3,500,000 per U.S. individual and $7,000,000 for U.S. married couples, and federal gift tax exemptions would potentially be lowered to $1,000,000 per U.S. individual and $2,000,000 for each U.S. married couple (without inflation indexing). These exemption changes coupled with the proposal to eliminate the step-up in basis of inherited assets on death may require review and updating of estate planning strategies.

To prepare for these proposed tax changes and more, we have compiled the accompanying chart highlighting the proposed changes. We have also provided links at the end of this article for further analysis of the impact of Biden’s tax plans on high net worth individuals and their families, businesses and their principals, and intergenerational family wealth transmission.

| TOPIC | CURRENT TAX LAW | PRESIDENT BIDEN TAX PROPOSAL |

|---|---|---|

| Individual Tax Rate |

The 2017 Tax Cuts & Jobs Act (TCJA) reduced the top rate from 39.6% to 37%. | Reverts the top rate to 39.6% for households with taxable income over $400,000. |

| Long Term Capital Gain (LTCG) and Qualified Dividend Tax Rate | LTCG and qualified dividends are taxed at the top rate of 20%, plus a 3.8% net investment income tax (NIIT) imposed under the Affordable Care Act (ACA). Currently there are legal challenges to the ACA in the Supreme Court that would remove the 3.8% NIIT. | Raises the top LTCG and qualified dividend tax rate to match the top ordinary income rate of 39.6% for taxpayers with income over $1 million. |

| Payroll Tax | Social Security (SS) tax is split evenly between employers and employees. Currently a 12.4% SS tax is imposed on wages up to $142,800. No SS tax is imposed on wages above $142,800. | 1. 12.4% SS tax for wages up to $142,800; 2. No SS tax for wages between $142,801 - $400,000; 3. 12.4% SS tax for wages above $400,000. Note: The above parameters apply to the SS tax component of self-employment tax as well. |

| Estate Taxes | The 2017 TCJA increased the exemption amount to $11.7 million for 2021. It will revert back to $5 million (to be adjusted for inflation) after 2025. The current estate tax rate is 40%. Assets passed to heirs at death get a basis step-up to fair market value. | Reduces the estate tax exemption amount to $3.5 million, increases estate tax to 45%, and eliminates basis step-up at death. Alternatively, death may become a taxable event by subjecting unrealized capital gains to income tax at death. |

| Itemized Deductions | The 2017 TCJA capped the State and Local Tax (SALT) and real estate tax deduction to $10,000. It also suspends (through 2025) the 3% limitation on total itemized deductions for high-income taxpayers. | Ends the $10,000 SALT and real estate tax cap, restores the 3% itemized deduction limitation for high-income taxpayers with income above $400,000, caps the tax benefits of itemized deductions to 28% of value (taxpayers in the tax brackets with a tax rate higher than 28% will face limited itemized deductions). |

| Section 199A Qualified Business Income (QBI) Deduction | The 2017 TCJA allowed a 20% QBI deduction. For higher income taxpayers, the deduction is subject to limitations based on wages and unadjusted basis in depreciable assets. | No change to the QBI deduction for taxpayers with taxable income under $400,000, while phasing the deduction out completely for those with income over $400,000. |

| Real Estate | A qualified “like-kind” exchange of real property allows the tax deferral of gains. | Eliminates Section 1031 like-kind exchanges for investors with annual income greater than $400,000. |

| Corporate Income Tax Rate |

The 2017 TCJA reduced the corporate tax rate from 35% to 21%. | Raises the corporate tax rate from 21% to 28%. |

| Corporate Alternative Minimum Tax (AMT) | The 2017 TCJA eliminated the federal AMT for corporations. | Reinstates the corporate AMT in a different form. A 15% minimum tax is imposed on “book” profits of $100 million or higher, still allowing for net operating loss (NOL) and foreign tax credits. Corporations will pay the greater of their regular income tax or the 15% minimum tax. |

| Global Intangible Low Tax Income (GILTI) | 10.5% minimum tax is imposed for qualified foreign affiliates of U.S. companies on income earned from intangible assets. | Doubles the minimum tax rate on GILTI from 10.5% to 21%. |

Although the potential effective dates of President Biden’s proposed tax changes are still unknown, as a general proposition, the U.S. Constitution is not a bar to retroactive tax legislation, and the dictates of fairness and good faith suggest that tax changes affecting transactions (e.g., repeal of section 1031) will be effective prospectively, while general changes like tax rates may be made effective as early as January 1, 2022.

An important caveat: The materials included here, including the additional analyses linked below, are based on interpretations of the general information and concepts made publicly available. Once reduced to actual legislative language, these interpretations could prove inaccurate. For example, things as basic as whether provisions designed to apply based on income levels look to gross income, adjusted gross income, or taxable income are unclear. Or, whether the repeal of the basis step-up of assets held by a decedent at death would be effectuated by a tax on unrealized appreciation at death or a carryover basis regime.

Click here learn how the President’s proposed tax plan will impact income taxes for high net worth individuals and their families.

Click here to learn how the President’s proposed tax plan will impact income taxes for businesses and their principals.

Click here to learn how the President’s proposed tax plan will impact estate and gift taxes for business owners and high net worth families.