MACRO – US

MONETARY POLICY

POWELL GREEN LIGHTS SEPTEMBER RATE CUTS

OBSERVATIONS: “PRICE CONTROLS! – WHAT IS A HIGHLY POLITICAL KAMALA POSSIBLY THINKING??

I lived and worked in Canada in the ’70s and can tell you unequivocally that Price Controls don’t work and have never worked anywhere they have been tried. So what is Presidential hopeful Kamala Harris possibly thinking by announcing such a core policy in her first Economic Policy Platform speech??

I had a very negative perception of her performance as “Border Czar”, but her Price Controls Platform made me suddenly realize she (or her advisors) are extremely shrewd political operatives!!

Clearly Kamala Harris wants Price Controls because she knowingly plans to inflate with even greater voracity than Bidenomics did. Her first speech spilled over $1.7T in new money printing alone.

All the usual tricks which got us this far – money printing, interest rate suppression and ballooning debt have finally run out of runway, because they are now resulting in consumer price inflation.

This is 100% the fault of bad political leadership and central bank policy, but that will never be admitted. Instead, politicians can be counted on to resort to attacks on the productive class and absurd accusations, that it is the fault of investors and entrepreneurs, who must navigate the risks of monetary debasement for causing it. Hence, we have Kamala seemingly anchoring her political campaign on “ending price gouging” once she’s in office.

After one looks at the historical record – 4,000 years of endless failures in price controls, communism and every permutation of centrally planned economies, there has to be a reason politicians are still reaching for it as a solution to problems they have caused and why a small – but vocal and influential segment of the public cheerleads this as a net benefit for society.

The secret sauce of “it’s different this time” is technology – particularly Big Tech, big platforms, Total Information Awareness and surveillance. Central planners think it is now technically feasible to run all the calculations and tracking in real time that would enable unrestrained monetary stimulus while keeping a lid on negative externalities like inflation.

Politicians like Kamala Harris is just farming public sentiment created by their own policy failures. But there are very serious people – mostly unelected technocrats of a particular globalist mindset, who think we have the means, motive and opportunity to create a kind of “fully automated luxury communism”.

J Michael Evans at a WEF meeting is talking about coming personal carbon trackers:

“We are developing, through technology, an ability for consumers to measure their own carbon footprint. What does that mean? That’s where are they travelling, how are they traveling?

What are they eating? What are they consuming on the platform? So, individual – carbon – footprint – tracker. Stay tuned, we don’t have it operational yet, but it’s something we’re working on”.

The stage is set, when politicians tell you they want to be able to control prices, believe them – but what you must understand is that price controls means spending controls ON YOU.

The politicians will tell you that it’s all about putting “greedy CEOs” in their place. What they won’t tell you is that price controls also means telling you what you can or cannot eat, how you use energy – whether you’ll be permitted to travel, or make any other kind of economic decision or make any kind of value exchange that you used to take for granted.

Throughout history, price controls have always brought about serfdom and tyranny, because that is the only way to override individual incentives. In today’s highly wired world that would mean total technocratic feudalism.

The most vivid example we have today is Venezuela – where price controls were so effective, the rabble had to break into public zoos to eat the animals.

WHAT YOU NEED TO KNOW!

NEVER FORGET THIS IS AN ELECTION YEAR!!

NEVER FORGET THIS IS AN ELECTION YEAR!!

Market-driven financial conditions have eased dramatically in the last few months. The market believes the Fed is 100 bps behind the curve and is demanding 200bps of cuts by year end …or else.

SINCE THE PANDEMIC debt has surged by 21%, adding $54.1 trillion to the global total. Today, the largest share of debt is held by non-financial corporations, at $94.1 trillion, while government borrowings follow closely behind at $91.4 trillion. Meanwhile, the financial sector holds $70.4 trillion in debt and households carry $59.1 trillion.

While stimulus measures fueled an influx of borrowing, it is leaving many economies in a more precarious state. Even more concerning is about a third of emerging markets have not recovered from the pandemic, with per capita income standing beneath levels seen in 2019. Over the quarter, debt held by emerging markets hit a record $105 trillion, climbing by $55 trillion over the last 10 years.

RESEARCH

1- S&P 500 v M2 – A Reliable Indicator of What is Ahead

-

- One of the most accurate Recession / Stock Market Plunge Indicators is the Ratio of the price of the stock market per the S&P 500 to the Money Supply (M-2).

- Since 1999 there have been 5 signals and all five resulted in Crashes. Now we see a 6th Signal.

- Historically, when this ratio rises to or above 0.22, an Economic Recession and Stock Market plunge (or even a crash) is imminent.

- This Ratio is currently at 0.25, an Indicator on Red Alert for the start of a major economic Recession and Stock Market Decline.

- A similarly accurate Recession / Stock Market Plunge Indicator is the Ratio of the price of the stock market per the Dow Industrial Average to the Money Supply (M-2).

- Since 1999 there have been 5 signals and all five resulted in Crashes. Now we see a 6th Signal.

- Historically, when this ratio rises to or above 1.80, an Economic Recession and Stock Market plunge (or even a crash) is similarly imminent.

- This Ratio is currently at 1.84, an Indicator on Red Alert for the start of a major economic Recession and Stock Market Decline.

- One of the most accurate Recession / Stock Market Plunge Indicators is the Ratio of the price of the stock market per the S&P 500 to the Money Supply (M-2).

2- AMERICAN PERONISM – KAMALA HARRIS’ RADICAL LEFT PLAN

-

- .An economy that generates an annual deficit of 6 percent of GDP to achieve a mere 2 percent annual growth is already on a dangerous path, and Kamala Harris’ plan is highly likely to make it even worse.

- Kamala Harris promises to cut inflation by spending and printing more money, reducing competition, and attacking businesses. It has never worked and never will because it is upside-down economics. Welcome to the U.S. “Peronism.”.

- Following the Harris plan, the United States public debt will likely increase by $24 trillion in a decade. There is no set of revenue measures that can bring $2 trillion per year in additional tax receipts while tax hikes will harm both investment and growth.

DEVELOPMENTS TO WATCH

MASSIVE DOWNWARD LABOR REVISON

MASSIVE DOWNWARD LABOR REVISON

-

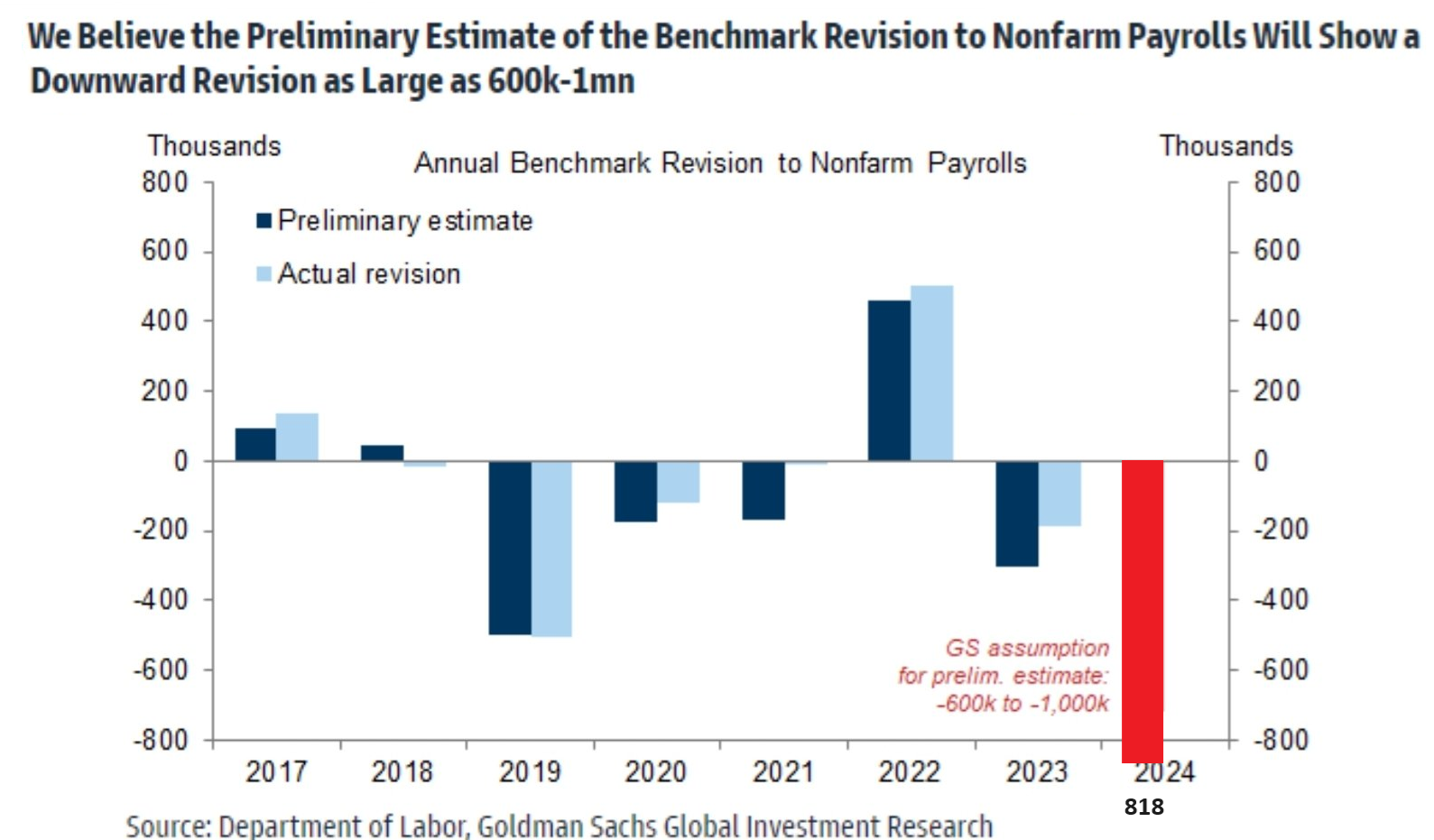

- Markets were caught off guard by a drastic revision of non-farm payrolls, the worst miss since the Lehman crisis. We at MATASII can justifiably say “We told you so!”

- We have been warning all year about the flawed & politicized BLS reporting and that the headline figures are not catching the early signs of trouble in the US jobs market.

“The Fed is late, and is now going to have to scramble, in an undignified manner.”

One has to sympathize with Fed chairman Jay Powell as he descended on Jackson Hole. The institution has been misled once again by unreliable data. The gain in non-farm payrolls in the twelve months to March was 818K less than previously stated.

DEMOCRATIC ELECTION PLATFORM – What the Right v Left is Actually Hearing

-

- What the Right Hears (TAXES): 1-Price Controls, 2-Reversal of Trump Tax Cuts, 3- 28% Corporate Tax Increase, 4- 25% Unrealized Capital Gains Tax, 5- 44.6% Capital Gains Tax.

- What the Left Hears (HANDOUTS): 1-Tax breaks for homebuilders with the goal of building 3 million new housing units in four years, 2-Up to $25,000 in down-payment aid for first-time homebuyers, 3-Up to $6,000 for low- and middle-income families with new babies, 4-Up to $3,600 per child per year in an expanded child tax credit, 5-A ban on price gouging in the food sector, singling out meat prices in particular, 6- Work with states to ban the use of medical debt in credit scores.

GLOBAL ECONOMIC REPORTING

JACKSON HOLE ECONOMIC ENCLAVE

-

- The “Powell Payrolls Pivot” is now complete, because as the Fed chair said:

“… the cooling in labor market conditions is unmistakable.”

“The time has come for policy to adjust.”

-

- “It seems unlikely that the labor market will be a source of elevated inflationary pressures anytime soon.”

- “We do not seek or welcome further cooling in labor market conditions.”

- “The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

- “We will do everything we can to support a strong labor market as we make further progress toward price stability.”

US LEADING ECONOMIC INDICATOR (LEI)

-

- US Leading Economic Indicators down for their 29th straight month – at a level worse than the trough of COVID lockdowns.

- Outside of the great financial crisis, this is the worst decline in LEI since the mid ’70s!!!

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.