THE FEDERAL RESERVE ANNOUNCEMENT

-

- At the end of its FOMC Meeting on Wednesday (September 22nd) the Fed let it be known that it’s likely to begin Tapering Quantitative Easing in either November or December.

- It also indicated that it’s likely to bring QE to an end by the middle of next year.

That would be a more aggressive Taper scenario than when the Fed Tapered in 2014 and a more aggressive scenario than the markets had expected until very recently.

SCENARIO 1: If the Fed begins Tapering in November, and Tapers by $15 billion per month, it would create $540 billion between now and the time QE ends in May.

SCENARIO 2: If the Fed begins Tapering in December, and Tapers by $15 billion per month, it would create $660 billion between now and the time QE ends in June

Total Liquidity in the financial markets would increase by either $540 billion or by $660 billion between now and mid-2022. That would be quite a lot of new Liquidity and would probably by itself continue to support asset price appreciation.

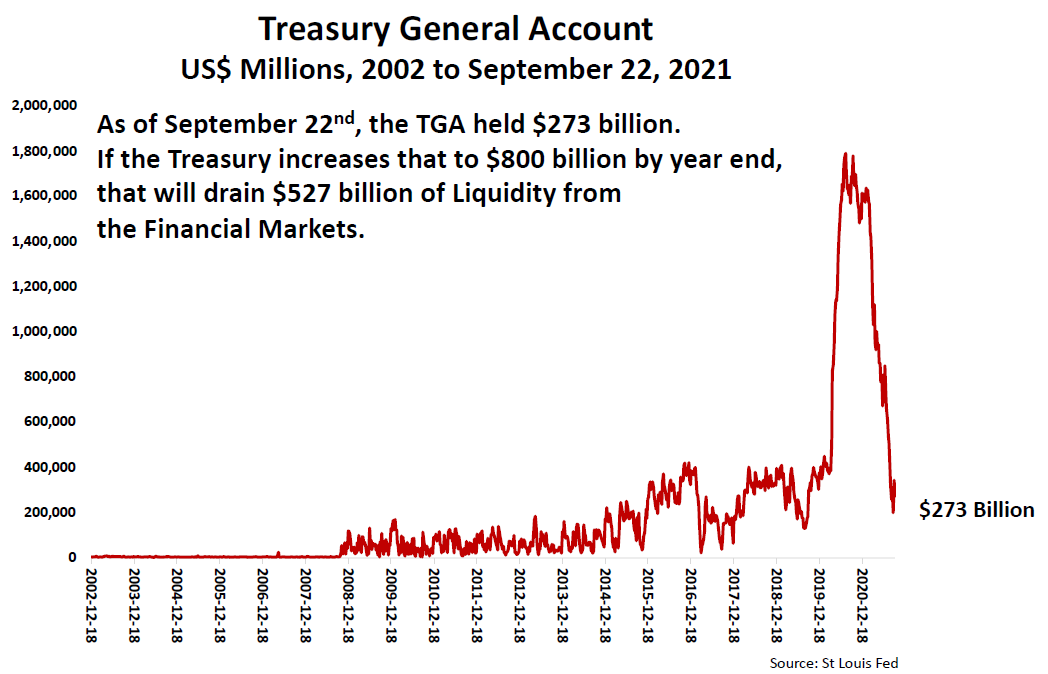

THE LIQUIDITY KILLER: The Treasury General Account (TGA)

The Treasury Department has announced that it plans to have $800 billion in its account at the Fed (the Treasury General Account or TGA) at the end of this year.

“During the October – December 2021 quarter, Treasury expects to borrow $703 billion in privately-held net marketable debt, assuming an end-of-December cash balance of $800 billion.”