THE LIQUIDITY KILLER: The Treasury General Account (TGA)

My colleague Richard Duncan has just released his latest Macro Watch video where he gives us his perspective on what the Federal Reserve and US Treasury are signaling.

I strongly recommend you subscribe the Richard's Macro Watch service. You can do this at LINK. Enter the special Promo Code "FLOWS" to receive a 55% discount.

Richard reports:

- At the end of its FOMC Meeting on Wednesday (September 22nd) the Fed let it be known that it's likely to begin Tapering Quantitative Easing in either November or December.

- It also indicated that it’s likely to bring QE to an end by the middle of next year.

That would be a more aggressive Taper scenario than when the Fed Tapered in 2014 and a more aggressive scenario than the markets had expected until very recently.

SCENARIO 1: If the Fed begins Tapering in November, and Tapers by $15 billion per month, it would create $540 billion between now and the time QE ends in May.

SCENARIO 2: If the Fed begins Tapering in December, and Tapers by $15 billion per month, it would create $660 billion between now and the time QE ends in June

Total Liquidity in the financial markets would increase by either $540 billion or by $660 billion between now and mid-2022. That would be quite a lot of new Liquidity and would probably by itself continue to support asset price appreciation.

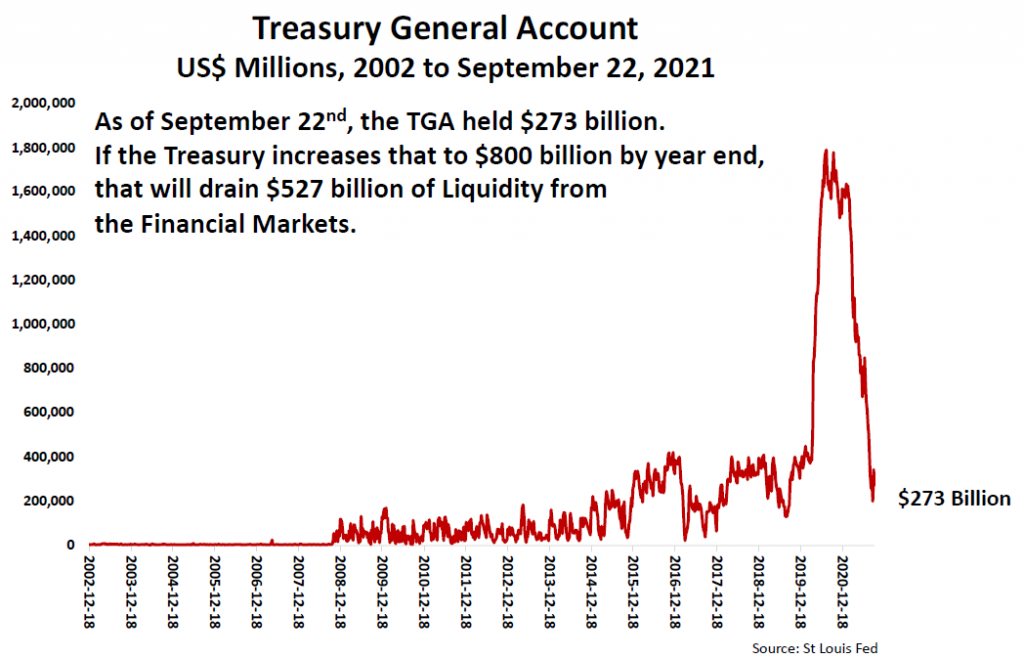

THE LIQUIDITY KILLER

The Treasury General Account (TGA)

The Treasury Department has announced that it plans to have $800 billion in its account at the Fed (the Treasury General Account or TGA) at the end of this year.

“During the October – December 2021 quarter, Treasury expects to borrow $703 billion in privately-held net marketable debt, assuming an end-of-December cash balance of $800 billion.”

The TGA May Absorb More Than The Fed Create

Richard Duncan concludes:

- That would be equivalent to 98% of the Liquidity created by the Fed in Scenario 1, and 87% of the Liquidity created by the Fed in Scenario 2.

- Not only that, but during the fourth quarter of this year, the $527 billion build-up in the TGA would drain even more Liquidity than the Fed creates (which would be $315 billion over the next three months in Scenario 1 or $345 billion in Scenario 2).

- Therefore, Bank Reserves and Liquidity could actually contract during the next quarter.

CONCLUSION

The combination of an aggressive Taper, which now appears to be in the cards, and the build-up in the Treasury’s cash balance at the Fed (in the TGA), strongly suggests that the Liquidity Tsunami that has driven asset prices so much higher over the last 18 months is about to come to an abrupt end.