CONCLUSION

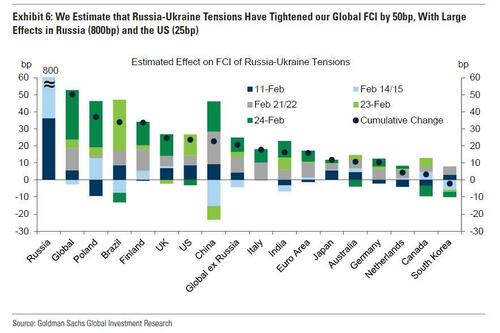

RUSSIAN SANCTIONS MAY BACKFIRE & MATERIALLY IMPACT GLOBAL CREDIT

The

News York Times is warning that US Sanctions against Russia could have far-reaching and indirect consequences, because Russia is a major exporter of staples like natural gas and wheat. It conducts business with companies and countries around the world. As middlemen, banks typically handle those transactions. Severe economic penalties could disrupt global trade flows if banks are forced to stop processing payments for goods and services going in and out of Russia, according to the Institute of International Finance, a trade association that represents global banks.

“The issue here is not just the immediate impact on the financial markets, but the fact that it’s almost impossible in the near term to disentangle Russia from global trade.

There is room for contagion.”

Elina Ribakova, Deputy Chief Economist, Institute of International Finance

Sanctions could also spread economic instability worldwide by raising prices for key commodities that Russia produces — including oil, gas, fertilizer and palladium — and spur inflation in countries that import those products, landing a fresh blow just as the world emerges from the pandemic. Russia’s own economy could be relatively protected from the full impact of sanctions. Its external debt and ties to other advanced economies have waned since the 2014 Crimea crisis, insulating its economy from efforts to cut it off from the global financial system, as economists at Capital Economics noted. They predicted that the most likely sanctions measures could shave around 1 percent from Russia’s gross domestic product. The country’s economy has long been dominated by domestic lenders, which only grew in prominence after the 2014 sanctions. European banks, including Raiffeisen Bank and UniCredit Bank, account for most of the 6.3 percent of assets held by foreign lenders in Russia’s banking sector, while U.S. banks hold less than 1 percent, according to the Institute of International Finance.

“Russia has a more insulated and isolated economy today than it did a decade ago. This makes it less vulnerable to certain types of sanctions, but its increasing economic isolationism is hurting the country’s growth prospects in the long term.”

Clay Lowery, Executive Vice President, Institute of International Finance

Global banks are now bracing for the ripple effects of these harsh new financial and economic sanctions against Russia intended to hobble its economy and restrict its access to foreign capital.

Global banks are now bracing for the ripple effects of these harsh new financial and economic sanctions against Russia intended to hobble its economy and restrict its access to foreign capital.

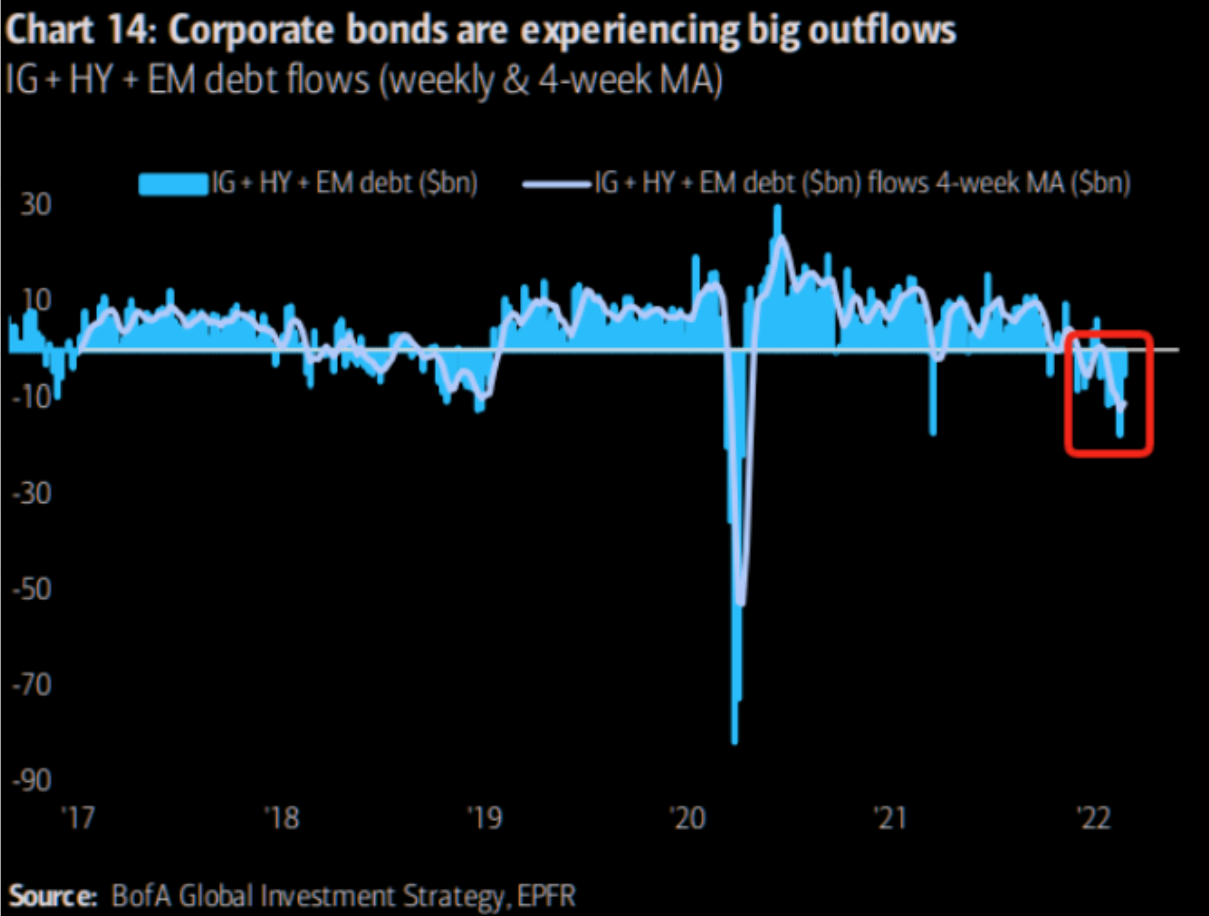

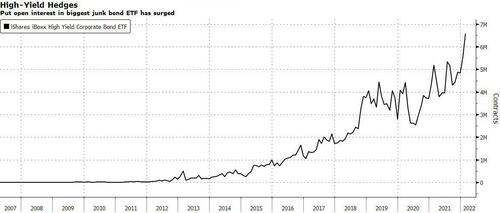

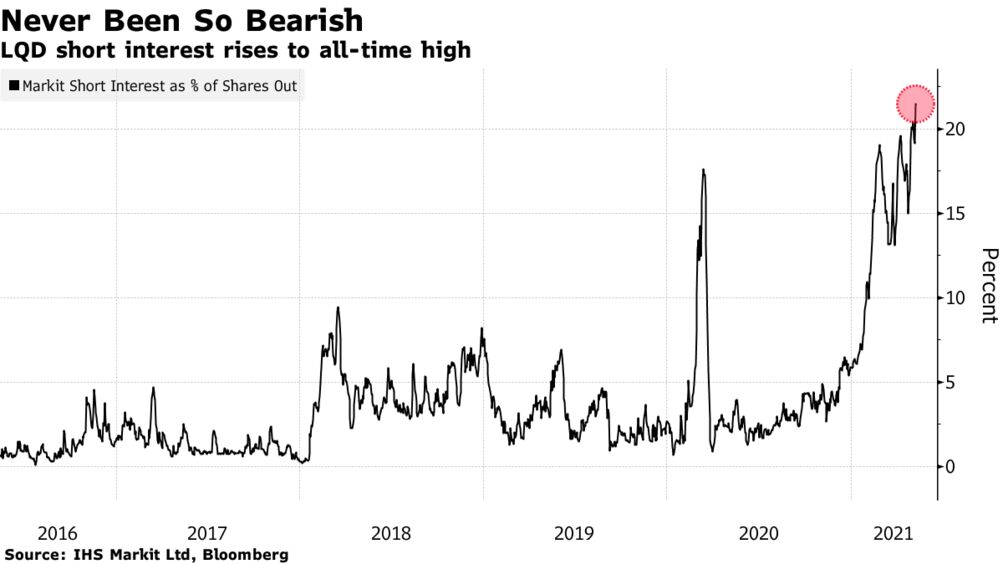

Credit Investors are notoriously more sophisticated readers of the “Tea Leaves” than Equity Market Investors. They don’t invest on “hope and sentiment”. They invest based on fundamentals, valuations and discounted free cash flows!

Credit Investors are notoriously more sophisticated readers of the “Tea Leaves” than Equity Market Investors. They don’t invest on “hope and sentiment”. They invest based on fundamentals, valuations and discounted free cash flows!