MACRO

US ECONOMICS – MONETARY POLICY

STAGFLATION STEADILY SHOWING

OBSERVATIONS: “THERE IS TOO MUCH MONTH LEFT AT THE END OF THE MONEY!”

I am witnessing young Americans increasingly dissatisfied! For them, like the elderly, the recent surge in prices for goods and services of everything has been devastating.

The young are living in a new America where necessities like food and rent have increased in price by more than 20%, while wage growth hasn’t kept up. To try to make ends meet, many have responded by picking up a second or even a third job, which is why a record number of Americans have more than one job. About 1 in 7 Generation Zs have maxed out their credit amid skyrocketing prices and sagging real wages.

What this means is their optimism and dreams are being crushed!

Young adults have been hit particularly hard because they’re less likely to have assets such as housing and stocks that would appreciate rapidly in this time of high inflation. Younger workers also tend to have jobs whose salaries adjust more slowly to inflation. They are therefore unable to save for their future dreams. Most young Americans aren’t saving at all and have stopped trying, adopting the YOLO (You Only Live Once) approach.

They are resigned to going into permanent debt.

Until the next paycheck comes, many Gen Zees are relying on credit cards to get by. As more of them max out their credit cards, however, there’s nowhere left to turn. In just four years, the American standard of living for young people has gone from being enjoyed to endured.

The situation is little better for millennials: 1 in 8 of that generation have maxed out their credit as well. Americans in both generations are abandoning hope of ever achieving long-term goals such as retirement or owning a home—anything that requires saving.

The average American’s hourly wage has risen $4.98 in the last 3 years, but what that larger hourly wage can purchase has dropped by 67 cents. The hourly loss from inflation is a whopping $5.65, which is more than the average worker loses per hour to federal income tax.

Even if a young family today does squirrel away the money for a down payment on a house, it’s impossible for most of them to afford the monthly payment. For just a median-price home, that payment has more than doubled in the last 3 years to about $2,100 per month.

That means it now costs over $13,000 more per year for the same house. If young Americans have to put groceries on a credit card, chances are they don’t have thousands of dollars lying around for a down payment on a house.

Likewise, many Gen Zees and plenty of millennials have stopped saving for retirement since things like 401(k) contributions don’t make much sense when you can’t make your car payment. And it’s no coincidence that auto-loan defaults for young Americans are rising at the fastest rate since the global financial crisis of 2007-2009.

They are completely tapped out.

Financially crushed Gen Zees, hit by this one-two punch, need to understand what is to blame for their troubles: the big-government agenda defined by multitrillion-dollar federal budgets and a burdensome regulatory state. If the leviathan isn’t turned back, younger generations will become a reflection of their government—perpetually in debt.

WHAT YOU NEED TO KNOW!

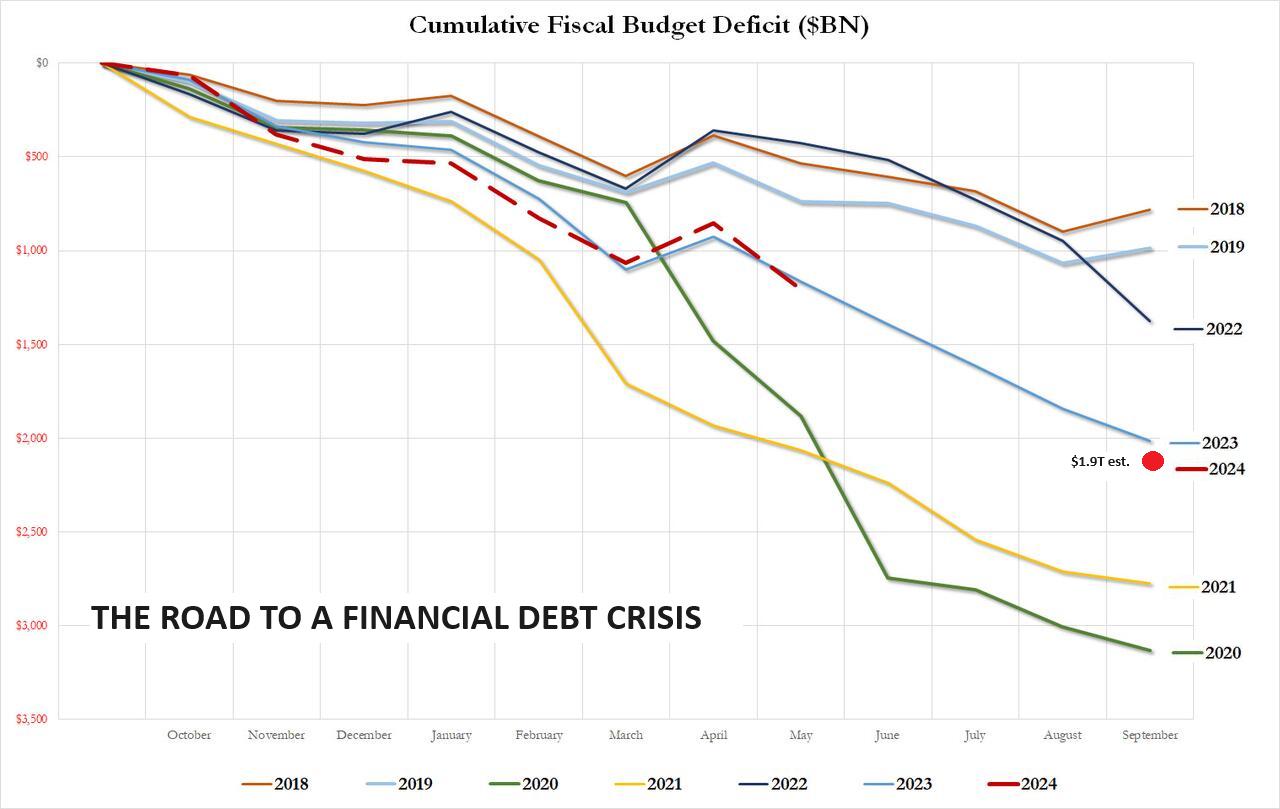

THE ROAD TO A FINANCIAL DEBT CRISIS

The US Fiscal Deficit is now estimated by the CBO to be $1.9T for 2024 (Fiscal Year ending September 2024).

The US Fiscal Deficit is now estimated by the CBO to be $1.9T for 2024 (Fiscal Year ending September 2024).

Chronic spending, more than you make year after year, can lead to only one result when the interest on the debt at 6-8% of GDP crowds out both discretionary and mandatory budget items.

US spending has truly reached the point of being “out-of-control”. The fact that neither Congress nor the Administration cares or has a solution may be even more of a concern?

RESEARCH

MID YEAR UPDATES TO LAST YEAR’S ANNUAL THESIS PAPER

THE GREAT STAGFLATION

RELEASED – 01-15-23 — 88 Page Paper

THE 2% INFLATION TAX – Soon to be 3%

-

- To understand modern inflation is to first under the Fiat Currency it is measured against. That is because inflation is the lost purchasing power of that currency.

- A Fiat Currency is inherently inflationary, gradually losing its purchasing power over time.

- This phenomenon disproportionately benefits a select few at the expense of the broader population.

THE 2% INFLATION IS A HIDDEN GOVERNMENT TAX.

-

- It is collected through Reduced Purchasing Power and the Time Value of Money Usage (i.e. the government spends it first at a higher Purchasing Power before Users finally spending it through Velocity of Money at lower levels of Purchasing Power).

THE 3% INFLATION TARGET

-

- Expect central banks to soon be increasingly talking about 3% Inflation as the New “Neutral Rate”.

- The reason for this is because the US Central Bank normally pursues a 6 percent annual growth in money supply to achieve 4 percent growth in nominal GDP. It is likely now to be composed on average of 1 percent of real growth and 3 percent of inflation (called Stagflation).

TIME VALUE OF MONEY v TIME VALUE OF MONEY USAGE

-

- The first user of the money (the government) has a higher purchasing power than the downstream users (you and I) as part of the flow and Velocity of Money.

- Increases in money supply set in motion an exchange of nothing for something. This diverts real savings from wealth generators to non-wealth generators. Consequently, this weakens the wealth-generation process and in turn the pace of economic activity.

- When money enters goods markets, it means that we have more money per good. This means that the price of goods has risen.

- What we have here is the increase in goods prices and a weakening in economic growth. This is what stagflation is all about.

- The outcome of the monetary pumping is always stagflation.

- It is not always visible, though. As the pool of real savings comes under pressure, the phenomenon of stagflation becomes more visible.

THE CONSEQUENCES WILL BE STAGFLATION

-

- Stagflation is the ultimate result of monetary pumping. Therefore, whenever the central bank adopts an easy monetary stance, it also sets stagflation in motion in the months ahead.

- The severity of stagflation depends on the state of the pool of real savings.

- If this pool is declining, then a visible decline in economic activity will likely ensue.

- On account of past monetary pumping and the consequent increase in price inflation, we will have a visible stagflation. Conversely, if the pool of real savings is still growing, economic activity is likely to follow suit.

- Given the rising momentum of prices, we will have positive correlation between economic activity and price inflation.

- We can conclude that if, on account of past monetary pumping, we do not observe the symptoms of stagflation, this raises the likelihood that the pool of real savings is still growing. Conversely, if we can observe the symptoms of stagflation, then most likely the pool of real savings is declining.

- As the pool of real savings comes under pressure, the phenomenon of stagflation becomes more visible.

DEVELOPMENTS TO WATCH

LIQUIDATION BEGINS – THE FIRST OUT WINS!

LIQUIDATION BEGINS – THE FIRST OUT WINS!

1- THE US COMMERCIAL OFFICE SPACE FIRESALE BEGINS

-

- Related Banks/CIBC and Blackstone CRE sales shows US banks have begun selling their best assets, because they can receive prices at least equal to what they are carrying in loans on their balance sheets. There is no other reason to sell good loans but to generate liquidity.

2- JAPANESE US TREASURY FIRESALE LOOMS

-

- Japan’s 5th largest bank, Norinchukin Bank has announced it will sell more than $63 billion of its holdings of U.S. and European government bonds during the year ending March 2025, as it aims to stem its losses from bets on low-yield foreign bonds, a main cause of its deteriorating balance sheet, and to lower the risks associated with holding foreign government bonds.

- Once Nochu begins selling, others are highly likely to join the club! Assuming comparable liquidation, this could potentially amount to (5X) $315B in US and EU sovereign bonds. This is the long relied upon Carry Trade in reverse!

TOGETHER THE ABOVE IS GOING TO POTENTIALLY PLACE UPWARD PRESSURE ON US TREASURY RATES.

THERE IS A POTENTIAL FOR A VICIOUS DEATH SPIRAL TO DEVELOP?

GLOBAL ECONOMIC REPORTING

POWELL ADMITS THE BIDEN ADMIN IS “OVERSTATING JOBS”

POWELL ADMITS THE BIDEN ADMIN IS “OVERSTATING JOBS”

“THERE IS AN ARGUMENT THAT PAYROLLS MAY BE A BIT OVERSTATED” – Jerome Powell

RETAIL SALES

-

- The headline M/M rose just 0.1%, up from the prior -0.2% (initially 0.0%) read, but beneath the 0.3% forecast, matching the most pessimistic estimates too.

- The core measure (ex-autos & parts) declined by 0.1%, despite expectations for a 0.2% gain, matching the pace of last month’s decline (initially 0.2%).

INDUSTRIAL PRODUCTION / CAPACITY UTILIZATION

-

- The Institute for Supply Management’s latest measure of factory activity shrank in May at a faster pace, as a gauge of output came close to stagnating.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.