MACRO ECONOMICS

REGIONAL FISCAL POLICY

SUDDENLY EVERYONE CITING

“WHATEVER IT TAKES!”?

OBSERVATIONS: MIGHT TRUMP BE PLAYING 4-DIMENSIONAL GEOPOLITICAL CHESS?

Under the terms of the EU’s Stability and Growth Pact (SGP), Member States pledged to keep their deficits and debt below certain limits: a Member State’s government deficit may not exceed 3% of its gross domestic product (GDP), while its debt may not exceed 60% of GDP.

EU ACTIVATES THE NATIONAL ESCAPE CLAUSE OF THE EU STABILITY & GROWTH PACK.

Well as we discuss in the Research area of this newsletter, the EU has stunningly & desperately activated the national escape clause of their Stability and Growth Pact. This makes it official that the EU experiment has failed! The EU can’t manage Monetary Policy while member states manage Fiscal Policy. It has been a shame that has only lasted this long, because the European T2 Account has been funded by Germany.

The excuse is to Re-Arm Europe, but if it wasn’t this excuse it was going to forced to soon come up with another.

Trump’s handling of Ukraine forced this. Why would the EU want war and not peace? Maybe peace would be advantageous while they began a military build up? A thousand questions here but Trump played this masterfully. Let’s see how.

TREASURY SECRETARY BESSENT’S 3-3-3 STRATEGY

As I recently wrote (03/09/25 Newsletter), Trump’s plan is a 3-3-3 Strategy.

-

- A 3% FISCAL DEFICIT

- A 3% RATE OF REAL GDP

- A 3M-bpd US OIL EQUIVALENT INCREASE

What is hidden in the mechanics of these goals is the funding of the massive US debt.

The US debt is now at an alarming level of ~124% of GDP.

At 124% Debt to GDP the US has crossed the 90% inflection point outlined in ground breaking work by Carmen Reinhart, Kenneth Rogoff. Historically when countries cross this level their economies soon fail through hyperinflation or debt default and financial ruin taking the form of devastating deflation and depression. The trick is to never go above this level and that is why the EU Stability and Growth Pact (SGP) mandated a maximum 60% public Debt-to-GDP level.

The failing comes when a country’s Debt grows at a faster rate than its Economy. The US has been in this position since the 2008 Financial Crisis. The EU is about to enter that zone with many of its member states already there. France for example already has a Debt-to-GDP level of 6.5% – well over the SGP. This is why I stated above, one way or the other the EU had to enact the National Escape Clause

So what is Trump’s strategy? The trick is to have a shrinking rate of Debt-to-GDP while other major lenders have an increasing rate. Financing will flow to where money is treated best because the risk is seen as less.

Initially you do this by reducing the acceleration of the rate of growth of the US Debt-to-GDP and have a negative rate of velocity of Debt-to-GDP growth – remember your calculus 101 of the 1st and 2nd derivative?

Bessent wants a 3% Real Rate of GDP. If we assume inflation stays in the 2.5 to 3% level. That means 5.5-6% Nominal levels pf GDP Growth. If you achieve taking the Deficit growth from a nominal ~-7% of GDP to 3% of GDP you have debt growing at a slower rate than the growth of the Economy!

What many Keynesian economist forget is that below 90% public Debt-to-GDP, a dollar of spending delivers over a dollar of GDP. When you are over 90%, a dollar of spending delivers less than a dollar of economic growth! Cut spending and change the rate differential and the US will be a magnet for global money looking for a “safer” risk adjusted place to invest.

HOW DO YOU DO THIS?

1- RESHORING IS A STRATEGIC IMPERATIVE – Tariffs are only a Tool to Re-Industrialize America.

2- REVITALIZING AMERICA – Reduce Stagnating Government GDP Dependency and Increase Private Sector Growth.

3- RIGHT-SIZED GOVERNMENT – Spending and the Growth of the Government is the problem.

4- A FOCUSED MILITARY – The US Can No Longer be the Police Force for the World.

-

- A New Era Monroe Doctrine 2.0

- Canada & Greenland Key to Prime Area of Conflict => The Arctic

WHAT YOU NEED TO KNOW!

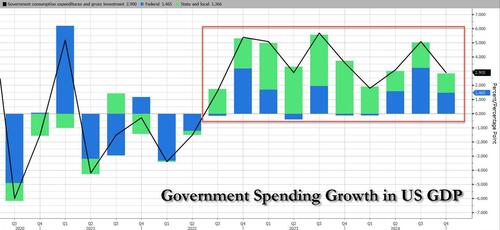

BIDENOMIC’S GOVERNMENT SPENDING COMES WITH A HANGOVER & A PAINFUL PERIOD OF “DETOX”

Amid groans about DOGE’s “austerity” and Trump’s anti-debt policies, the US could soon slide into a recession. Even Wall Street analysts have finally started to admit that the last 2 years of Bidenomics “growth” were nothing more than a debt-fueled mirage, where the only thing keeping the US economy from sliding into contraction was a surge in “government spending”, which of course is just a circuitous way of saying debt.

Amid groans about DOGE’s “austerity” and Trump’s anti-debt policies, the US could soon slide into a recession. Even Wall Street analysts have finally started to admit that the last 2 years of Bidenomics “growth” were nothing more than a debt-fueled mirage, where the only thing keeping the US economy from sliding into contraction was a surge in “government spending”, which of course is just a circuitous way of saying debt.

It’s not surprising then that after US nominal GDP was up a remarkable 50% in the past 5 years we are nearing the end of nominal “boom” as the Trump base wants smaller government/lower inflation, which so far has culminated with a 10% correction in 20 days, the 5th fastest correction in the last 75 years. (Fastest ever was 8 days during the onset of Covid – 2/27/20.)

RESEARCH – MARKET DRIVERS

1- EU: RE-ARM EUROPE PLAN

1- EU: RE-ARM EUROPE PLAN

-

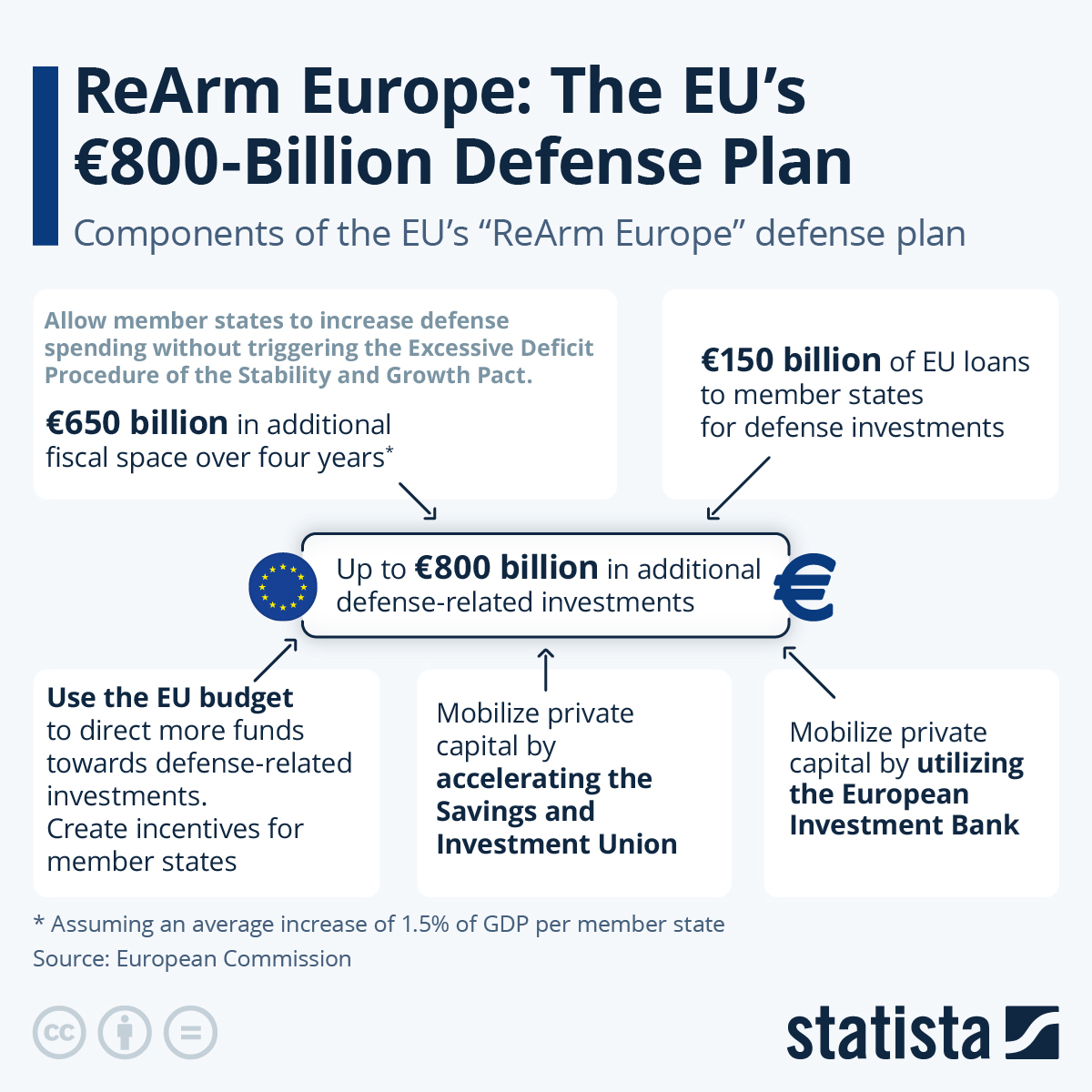

- To finance the “Europe Re-Arm Program” the EU exercised the “National Escape Clause” which removes the financial stability requirements from member countries as defined by the Stability & Growth Pact (SGP). Those constraints limited Debt-to-GDP to member states of 3%.

- Between increasing funding by a targeted 1.5% of GDP in each country and an additional €150B of lending, the EU hopes to target €800B for EU Defense over the next four years.

- The EU will propose additional possibilities and incentives for Member States that they will decide, if they want to use cohesion policy programs, to increase further defense spending.

2- THE GERMAN DEFENSE BAZOOKA

-

- The Bundestag voted on a massive package of fiscal stimulus that will revoke the constitutional brake on how much debt the government can take on, and green-light borrowing up to about $1 trillion to spend on defense and infrastructure.

- This authorization outstrips the spending booms that came with the postwar Marshall Plan and with German Reunification in the early 1990s.

- This is an epic change of direction, which brings profoundly held historical views into question. The last time Germany rearmed, in the 1930s, the result was global disaster, and German politicians had assumed for decades that the world would not countenance their return as a military power.

DEVELOPMENTS TO WATCH – POLICY DRIVERS

1- CHINA ANNOUNCES YET ANOTHER STIMULUS PLAN

1- CHINA ANNOUNCES YET ANOTHER STIMULUS PLAN

-

- China announced further plans to stem their current economic malaise.

- At annual parliamentary meetings this month, the country’s leadership made boosting consumption their top priority for the first time since President Xi Jinping came to power over a decade ago.

- Our analysis along with most others is that the plan continues to fail an inherent problem of raising the Chinese household share of GDP by 10% at the very least, which means equivalent reduction government controlled areas such as local government.

2- EXPLAINING SENATOR SCHUMER’S SHOCKING DEFECTION FROM THE DEMOCRAT STRATEGY

-

- There may be much more to Senator Chuck Schumer’s stunning decision to support the critically important GOP CR budget plan. Stopping the GOP plan meant would have meant shutting down the government and thereby allowing the Trump Administration complete authorization & control over the shut-down government & bank debt financing.

- During Senator Chuck Schumer’s (D-NY) political career, three of his five largest campaign donors have been Wall Street megabanks – Goldman Sachs, Citigroup and JPMorgan Chase. His second largest campaign donor over his political career are the partners and employees of Big Law firm Paul Weiss, where his brother, Robert, is actively engaged in Mergers and Acquisitions by major corporations that are publicly traded on Wall Street. Paul Weiss, as a firm, represents some of the largest banks and trading houses on Wall Street.

GLOBAL ECONOMIC REPORTING – ECONOMIC DRIVERS

FOMC ANNOUNCEMENT

FOMC ANNOUNCEMENT

-

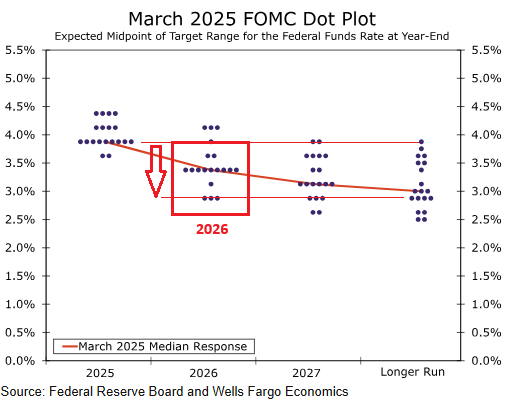

- The FOMC voted unanimously Wednesday to keep its target range for the federal funds rate unchanged at 4.25%-4.50%.

- The Committee also decided to dial back the pace of quantitative tightening by allowing only $5 billion worth of Treasury securities to roll off the Fed’s balance sheet every month.

- In a change from the last post-meeting statement, Wednesday’s statement noted that “uncertainty around the economic outlook has increased,” an apparent reference to the uncertain outlook for U.S. trade policy and the effects it may have on the economy.

- The median dot in the dot plot continues to look for 50 bps of rate cuts this year. However, there are now more FOMC members who think that less than 50 bps of easing would be appropriate than members looking for more than 50 bps of rate cuts.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.