MACRO – US

MONETARY POLICY

THE CHANGING POST “GREAT MODERATION” ERA

OBSERVATIONS: THE HIDDEN TAX OF INFLATION

John Maynard Keynes – Father of Modern Economics:

“By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens.”

All interventionist governments create and strive for Inflation.

Inflation is most fundamentally a Hidden Tax.

The math of government’s own 2-percent compound shrinkage target demonstrates that the Fed wants to depreciate the dollar’s purchasing power by 80 percent in each average lifetime. Somehow the political class never mentions this?

Governments actually love inflation and perpetuate it by printing money through deficit spending and imposing regulations that harm trade, competition and technological creative destruction.

Big Government is Big Inflation.

-

- Inflation is the way in which the government tricks citizens into believing that administrations can provide for anything.

- It disguises the accumulated debt, quietly transfers wealth from the private sector to the government and condemns citizens to being dependent hostages of government subsidies.

- It is the only way in which they can continue to spend a constantly depreciated currency and present themselves as the solution.

- It is the perfect excuse to blame businesses and anyone else who sells in the currency that the government creates.

The professional Political Class will do nothing to cut inflation because they need inflation to disguise the monster deficit and debt accumulation required to direct to and satisfy both the Donor & Entitlement Dependent Class.

In the latest figures, the US deficit has soared to $1.5 trillion in the first ten months of the fiscal year. Public debt has soared to $35 trillion, and in the administration’s own forecasts, they will add a $16.3 trillion deficit from 2025 to 2034.

It is worse. This does not include the highly likely $2 million in additional debt coming from the next administration’s

economic plan. Some “ruminations” on the enduring temptation of governments to inflate and depreciate their currencies:

-

- “By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens.”

-

- “Inflation is very much a political process.”

- “Left to their own devices, governments cannot help but be tempted by inflation.”

- “Governments can and will resort to inflation.”

WHAT YOU NEED TO KNOW!

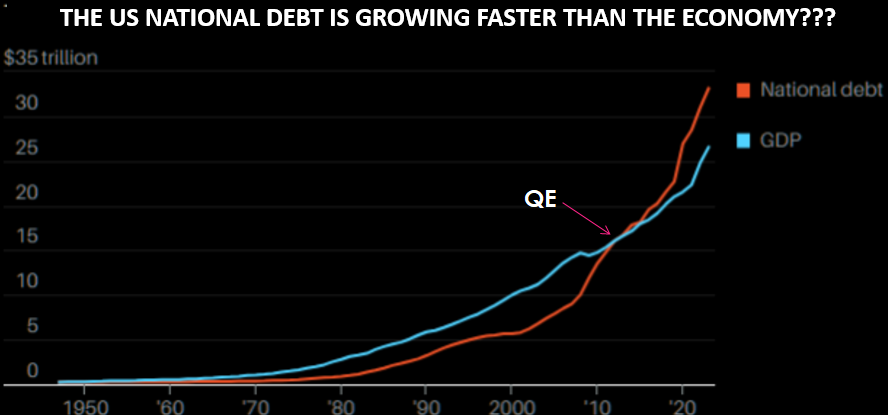

DEBT / CREDIT GROWTH NOW DETERMINES ECONOMIC GROWTH

DEBT / CREDIT GROWTH NOW DETERMINES ECONOMIC GROWTH

-

- Global Economic growth from 2020 to 2022 grew by $20T while Debt grew by exactly the same $20T.

- Globally we have reached the point of requiring $1 Debt for a $1 of Growth.

- In the US it now takes much more as $2.50 of New Debt is required to produce $1 of Growth.

- Additionally, in the US it now takes as much as $1.50 of Fiscal Deficit Growth to produce the $1 of Growth.

Without Credit there is no Debt, Without Collateral there is no Debt!

Where is the Required Collateral Coming From??

RESEARCH

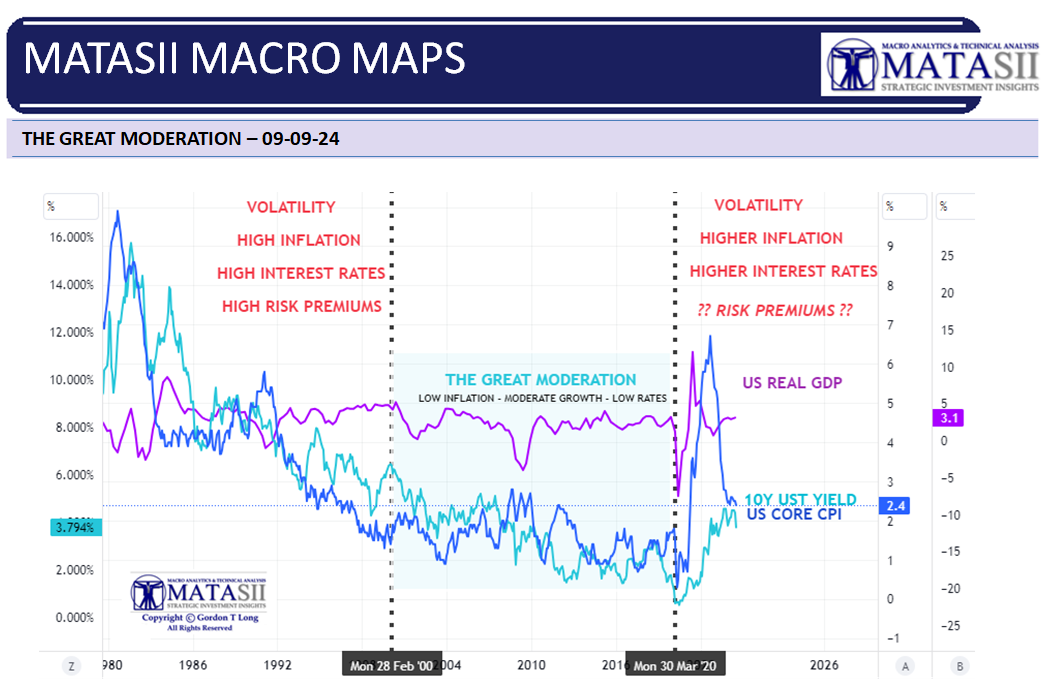

1- POST GREAT MODERATION – Missing Deflationary Pressures

1- POST GREAT MODERATION – Missing Deflationary Pressures

-

- Markets are pricing and trading as though Inflation has been brought under control. 3% inflation is not inflation under control!

- However, the market perception that Inflation is under control has temporarily slowed the expected increases in Bond Risk Term Premiums and higher Equity Risk Premiums.

- We should expect to see these premiums increase as two structural changes unfold:

- Awareness and emergence of the inflation elements of Wave 2

- The increasing impact of shrinking Deflationary pressures in 5 areas.

2- STIMULUS & DEBT FINANCING – A Serious Fundamental Misconception

-

- While deficit spending can be argued will provide short-term benefits, (what isn’t argued is that it primarily politically motivated to appease the electorate), it isn’t necessarily in the best long term benefit of the economy.

- In fact it can be shown that fiscal deficits spending impacts on economic prosperity have been negative. The real surprise is that increasing debts and deficits have not created more robust economic growth rates.

- It is only when you consume more than you produce you are forced to borrow more than your tax receipts allow.

- The solution is not to borrow more but rather to either produce more or consume less.That is an impossible argument for politicians to make without a crisis to sway public opinion.

- The solution therefore continues to be to structurally weaken the system through increased financial risk exposure until the inevitable day of reckoning allows the “deck to be cleared”. Until then we arrange the deckchairs on the US Titanic!

DEVELOPMENTS TO WATCH

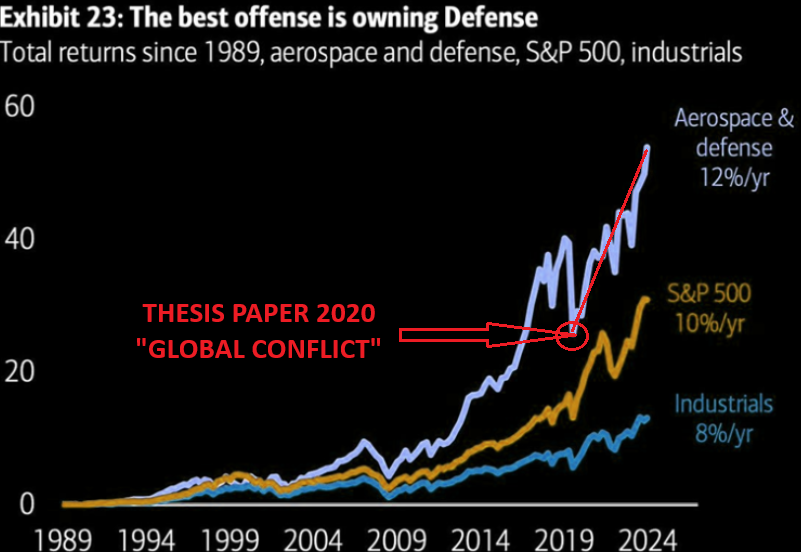

DEFENSE SECTOR PERFORMANCE – WHY ARE FEW TALKING ABOUT IT?

DEFENSE SECTOR PERFORMANCE – WHY ARE FEW TALKING ABOUT IT?

-

- As much as everyone believes the S&P 500 returns have been extraordinary, they are nothing compared to the Defense Sector.

- We identified this coming acceleration in our timely 2020 Thesis Paper “GLOBAL CONFLICT”.

- Few talk about this as it highlights the enormous US profits being made on the Ukraine and Middle East conflicts.

TAXING UNREALIZED GAINS – A TERRIBLY FLAWED APPROACH

-

- Presidential candidate VP Kamala platform proposes a new minimum tax of 25 percent on traditional income and unrealized capital gains for taxpayers with more than $100 million in total wealth. While ostensibly limited by a high net-worth threshold, such a tax would be economically destructive and administratively unworkable—not to mention unconstitutional.

- What’s wrong with taxing unrealized gains? A lot – we detail the core issues.

GLOBAL ECONOMIC REPORTING

LABOR REPORT – August NFP

LABOR REPORT – August NFP

-

- The US jobs report for August came in at 142k vs the prior revised lower 89k and beneath the expected 160k.

- Within the report, the unemployment rate ticked back lower to 4.2% from 4.3%, as expected, while the participation rate held at 62.7%.

- On the wages footing, average earnings rose 0.4% M/M (exp. 0.3%) with July’s figure revised to -0.1% from +0.2%, while the annual rate was 3.8% Y/Y (prev. 3.6%, exp. 3.7%).

THE YIELD CURVE UN-INVERTS!

-

- The moment many in the bond market had long awaited has finally come. The 10-year Treasury yield is ever so slightly higher than the two-year yield once more, so the infamous yield curve is no longer inverted. That ends 26 months of inversion.

- History suggests that this is a signal that a recession is now truly imminent. Expected rate cuts in the next two years will be enough to ensure that shorter rates are lower than long ones.

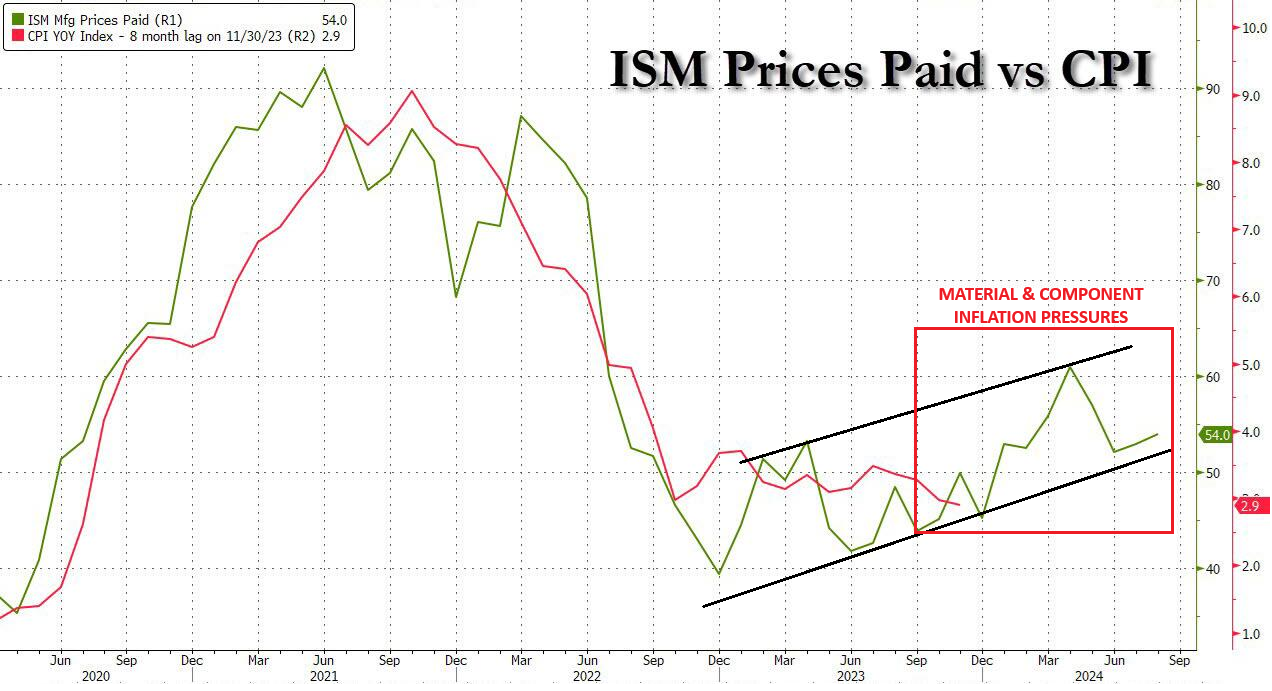

DETERIORATING ISM & PMI REPORTS

-

- A further downward lurch in the PMI points to the manufacturing sector acting as an increased drag on the economy midway through the third quarter. Forward looking indicators suggest this drag could intensify in the coming months.

- Slower than expected sales are causing warehouses to fill with unsold stock, and a dearth of new orders has prompted factories to cut production for the first time since January. Producers are also reducing payroll numbers for the first time this year and buying fewer inputs amid concerns about excess capacity.

- The combination of falling orders and rising inventory sends the gloomiest forward-indication of production trends seen for one and a half years, and one of the most worrying signals witnessed since the global financial crisis.

- Although falling demand for raw materials has taken pressure off supply chains, rising wages and high shipping rates continue to be widely reported as factors pushing up input costs, which are now rising at the fastest pace since April of last year.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.