|

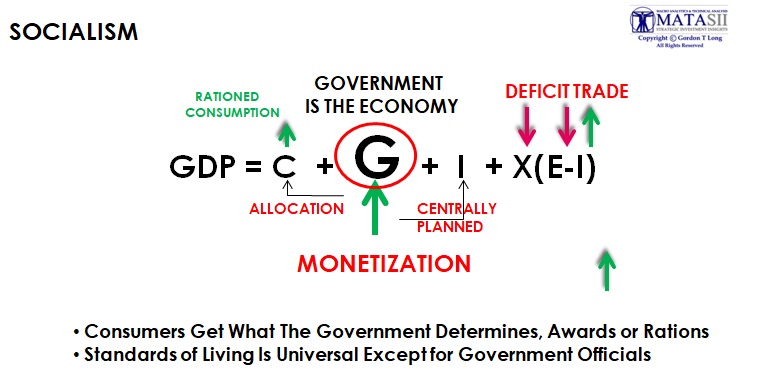

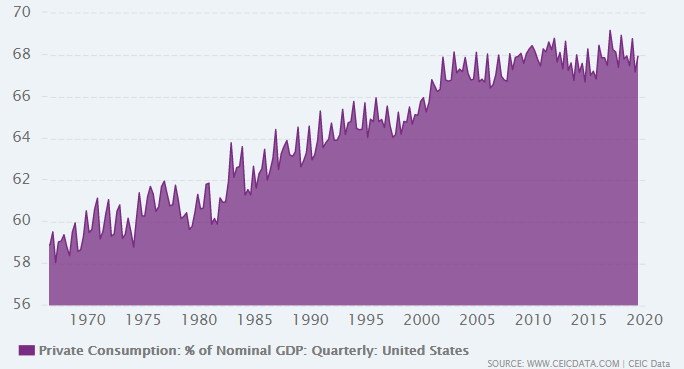

Over the last seven decades US consumption has shockingly approached 70% of the US Economy. No other global economy is even close. Retail space became an order of magnitude larger than other developed economies and the envy of emerging economies around the world. By the 1990’s business analysts were all questioning how long the US consumer could possibly keep consuming at such a rate. Instead it only got larger as consumer credit exploded with foreigners buying US Treasuries with their growing currency reserves, thereby keeping American credit readily available and at ever cheaper rates.

|

United States Private Consumption accounted for 68.5 % of its Nominal GDP in Dec 2020

AN ‘OVER-CONSUMING’ ECONOMY

In the 1990’s the US began a massive de-industrialization with companies moving offshore to capture labor arbitrage and competitive advantages. Initially Japan and the Asian Tigers and by the early part of this millennium China became the global industrial giants. However, because of their mercantile strategies of redeploying their US dollars earnings towards the buying of US Treasuries it intentionally kept the US consumption engine going. This strategy made foreign exporters even richer while pushing the US into inextinguishable levels of debt.

The problem however was the foreign export economies failed to foster their own middle class to offset excess US consumption rates and thereby the artificial global demand “run rates” which were inextricably tied to the US consumer.

The US as a result of it’s effective “de-industrialization” was forced to rely on becoming more of a “service” economy which resulted in an economy:

-

- CONSUMING more than it PRODUCED,

- Getting LESS for MORE (versus More for Less) in everything it Consumed and did,

- The next generation having it harder with less opportunity than the previous generation did.

As would be expected, in parallel the US Economy experienced chronic:

-

- Negative Trade Balances (Year after Year),

- Negative Current Accounts (Year after Year),

- Government Deficit Spending as it continues to increasingly spend More Than It Takes in (Year after Year),

- Credit Growth replacing Savings while Consumption increasingly replaces Capitalism.

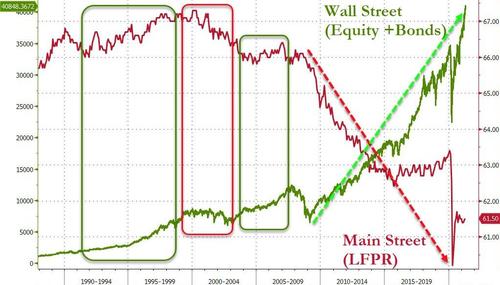

In the vividly clear chart below, LFPR stands for the ‘Labor Force Participation Rate’.

|

|

|

Here is how the labor force participation rate is calculated:

LFPR = Labor Force (Employed plus Unemployed) divided by Civilian Non-Institutionalized Population.

-

- Population (P): 260.92

- Not in Labor Force: 100.70

- Labor Force (LF): 160.21

- Employed: 150.23

A collapsing LFPR with exploding financial asset values not derived from productivity improvement is neither sustainable nor reflective of real economic growth. What we have instead is credit (debt) and financial leverage (risk) parading as economic growth.

|

|

|

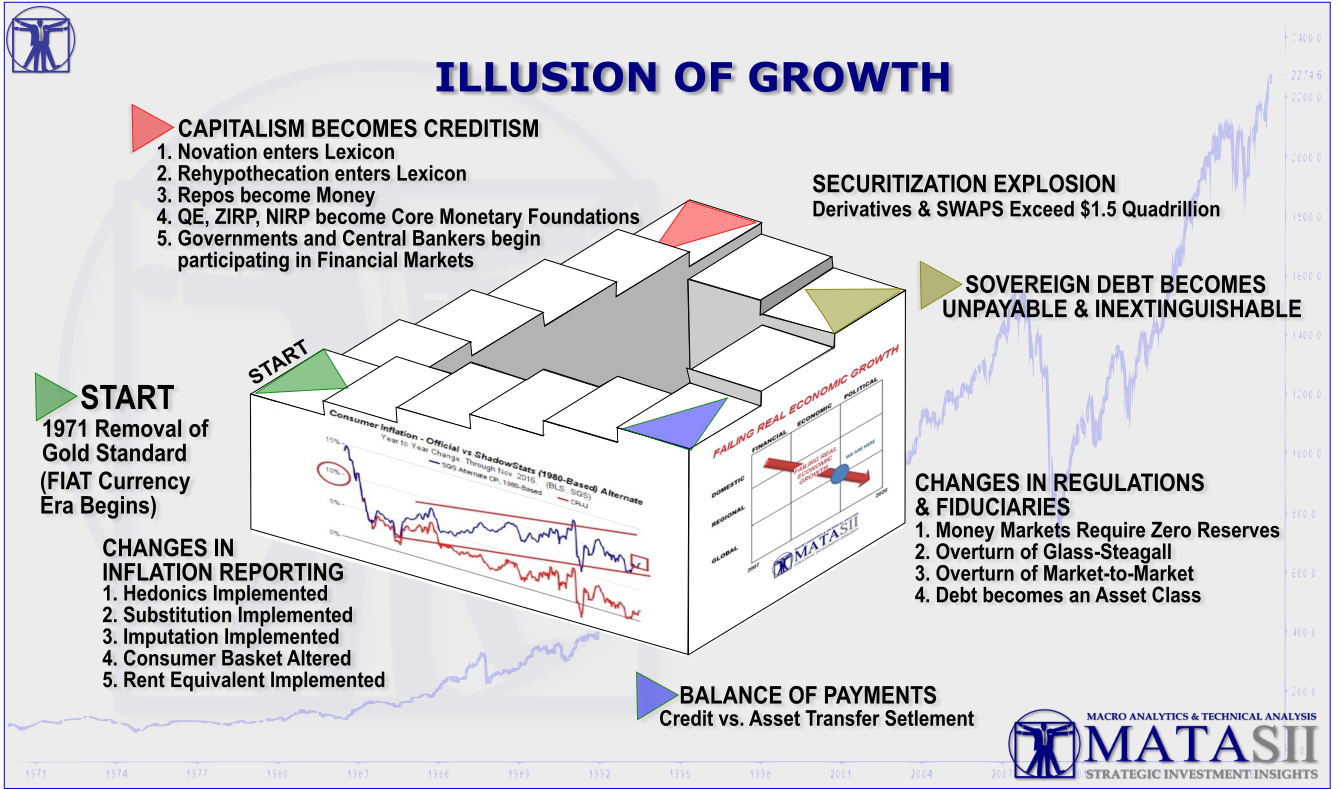

ITS ACTUALLY EVEN WORSE THAN EVERYONE UNDERSTANDS ITS ACTUALLY EVEN WORSE THAN EVERYONE UNDERSTANDS

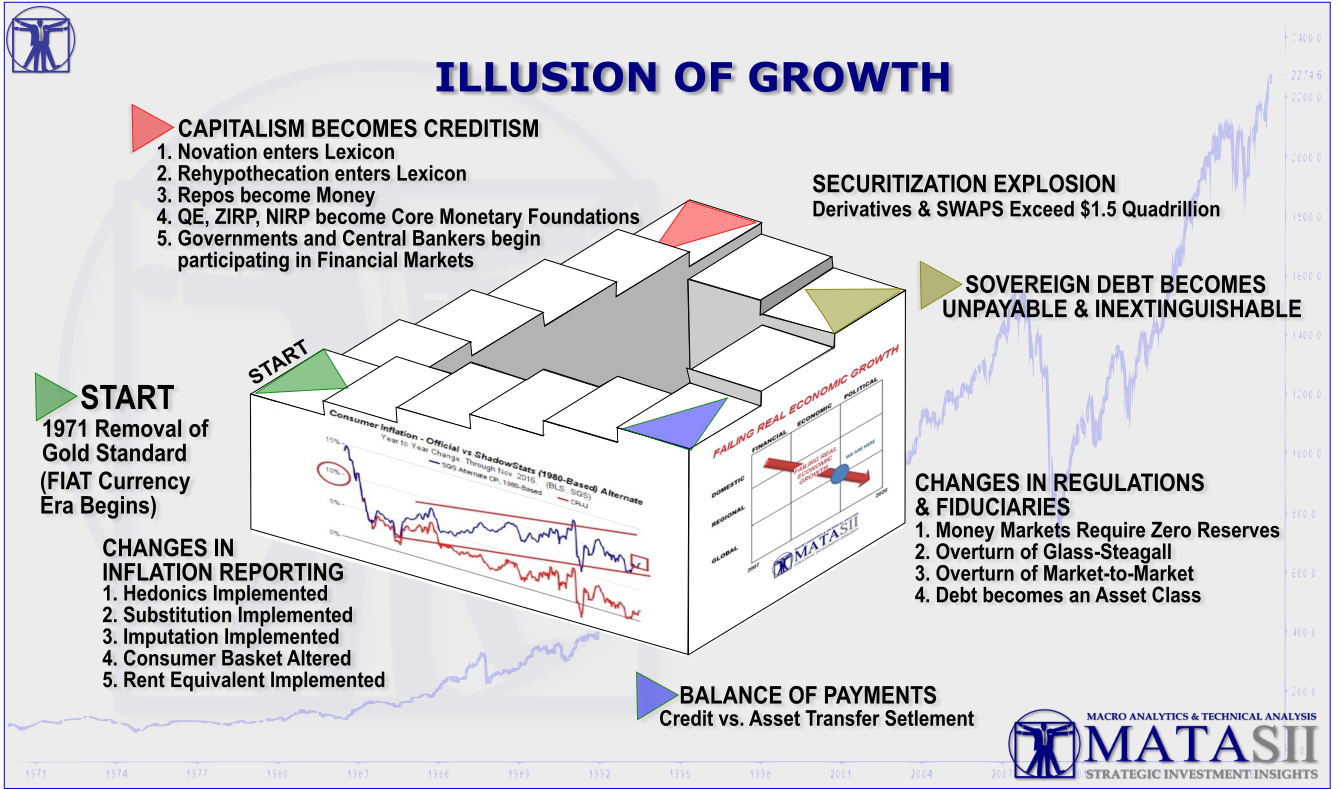

THE ILLUSION OF GROWTH

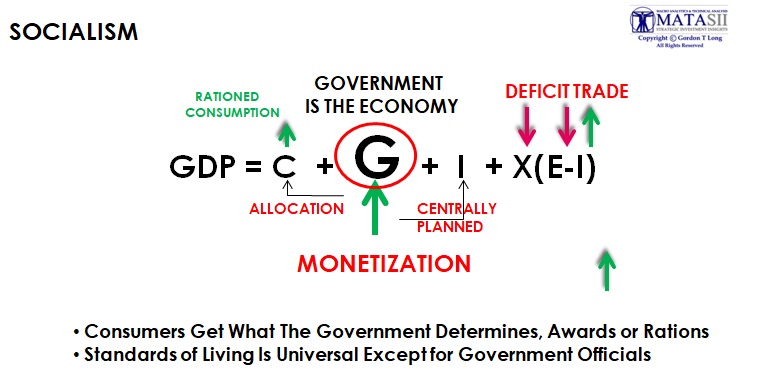

We spelled out in our 111 page 2017 Thesis paper entitled “Illusion of Growth” that we re living under the false belief we have real economic growth. This is an illusion built on a GDP formula that is flawed for a raft of reasons, but minimally unsuited for economies based on fiat currencies and gargantuan government debt deployed as transfer payments and investments income within the GDP formula.

We encourage you to read the paper.

2017 ILLUSION OF GROWTH – DOWNLOAD

|

|

|

|

HOW COVID ‘POPS THE BUBBLE’

THE UNINTENDED KILLING OF THE GOLDEN GOOSE

There are a raft of Monetary, Fiscal and Public Policy initiatives that have been initiated by the new US administration that will seriously impact the US and consequentially the global economy in coming years. They range in Presidential Executive orders that:

-

- REVERSE US ENERGY INDEPENDENCE:

- Curtail all Oil & Gas drilling licenses on Federal Land and the Gulf of Mexico,

- Stopping the Keystone Pipeline,

- Restrictions on US Coal Mining,

- Alaska, Texas and other states are now suing the Federal Government to stop the damage it will bring to these states.

- New Green Deal Policies& Carbon Tax will further curtail fossil energy independence

- REGULATIONS: All the prior administration’s regulation cancellations were immediately reinstated.

- IMMIGRATION: The US border has effectively been opened to mass illegal immigration which will place downward pressure on us labor wages and benefits.

Though the list goes on (via over 60 Executive Orders) there are two categories which will have eve more profound consequences and will herald in the next global financial crisis. This is because they administer an effective death blow to the US Consumer and Kill The Golden Goose the world as grown to depend on.

|

|

|

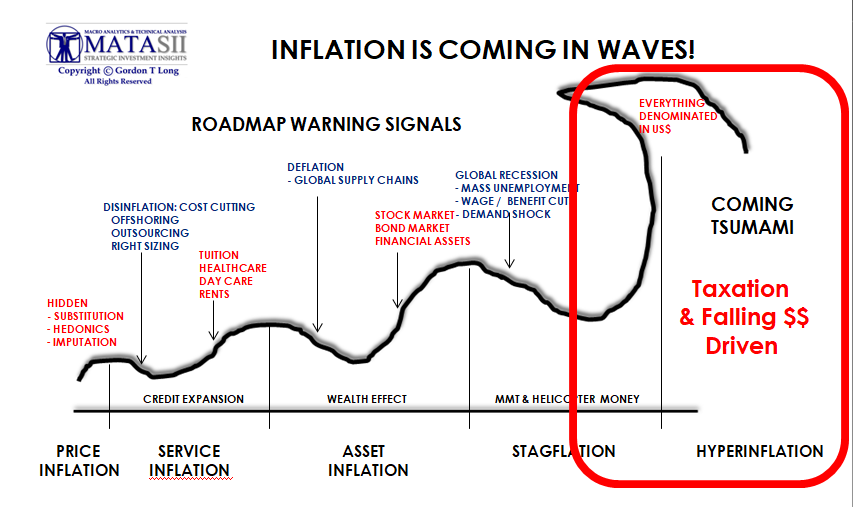

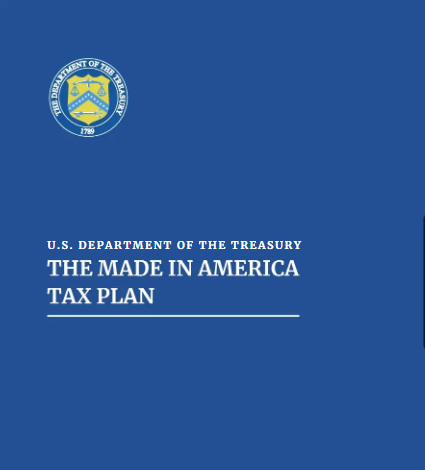

1- EXPLODING US TAXATION 1- EXPLODING US TAXATION

The planned explosion in US Taxes is unprecedented in the history of America. It covers Corporate and Personal Income Tax, Sales Taxes, Property Taxes, Licenses, Fees, Tolls and all manner of assessments at the Federal, State and Local levels of Government. Presently the most obvious and initial onslaught is on US Corporations and the Wealthy.

A SHOCK TO CONSUMER DISPOSABLE INCOME

Corporate Taxes will be passed on to consumers as price increases or in getting less for more. The Wealthy will have less to reinvest which means lower asset appreciation for IRA’s and 401K plans as well as new business ventures. All this will add up to significantly reduced Disposable Income and hence reduced consumption.

|

|

|

CORPORATE TAX

Biden’s Tax Plan Aims to Raise $2.5 Trillion and End Profit-Shifting – 04-07-21 – NY Times

- Aims to raise as much as $2.5 trillion over 15 years to help finance the infrastructure proposal.

-

- Includes bumping the corporate tax rate to 28 percent from 21 percent,

- Imposing a strict new minimum tax on global profits,

- Cracking down on companies that try to move profits offshore.

- Aims to stop big companies that are profitable but have no federal income tax liability from paying no taxes to the Treasury Department by imposing a 15 percent tax on the profits they report to investors. Such a change would affect about 45 corporations because it would be limited to companies earning $2 billion or more per year.

- Eliminates all subsidies specifically for oil and gas embedded in the tax code, including deductions for drilling costs.

Big Tech $100 Billion Foreign-Profit Hoard Targeted by Tax Plan – 04-22-21 – Bloomberg

- Biden plan takes aim at popular tech tax-code maneuvers

-

- Book income tax would have cost Apple alone $3.8 bln in 2020

- Apple, Microsoft, Amazon.com Inc., Facebook Inc., Intel Corp. and Alphabet Inc disclosed more than $100 billion in overseas pretax income in their most-recent financial years.

CAPITAL GAINS

Biden Eyeing Tax Rate as High as 43.4% in Next Economic Package – 04-22-21 – Bloomberg

-

- People earning $1 million would pay 39.6% plus Obamacare levy

- Total tax rates for New Yorkers, Californians could top 50%

- Rationale: “To help pay for a raft of social spending that addresses long-standing inequality”

YELLEN’S GLOBAL MINIMUM TAX

Yellen Unveils $2.5 Trillion Tax Reclamation Plan – 04-07-21 – Zero Hedge (Detailed pdf Document)

- Would increase the rate of what is essentially a minimum tax on money American companies earn abroad.

-

- It would apply that tax to a much broader selection of income.

- It would also eliminate lucrative tax deductions for foreign-owned companies that are based in low-tax countries — like Bermuda or Ireland — but have operations in the United States.

- Biden wants to increase the global intangible low tax income (GILTI) rate on foreign profits from 10.5% to 21%.

- He also supports a “claw-back” provision to force companies to return public investments and tax benefits when they eliminate jobs in the U.S. and send them overseas.

- He has also called for a 10% surtax on businesses that avoid U.S. taxes by sending jobs and manufacturing overseas and then sell goods back to Americans.

|

|

|

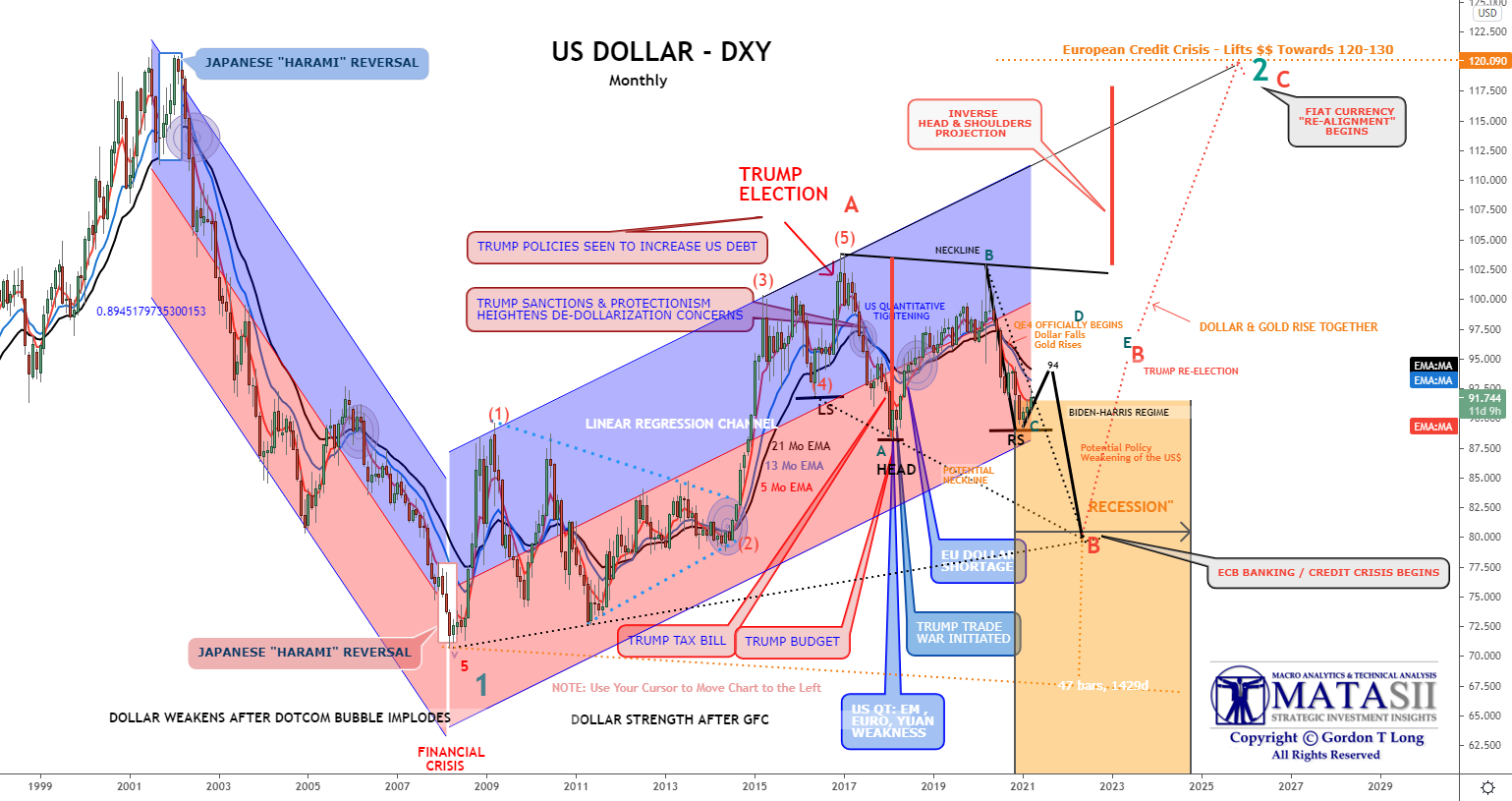

2- FALLING US DOLLAR 2- FALLING US DOLLAR

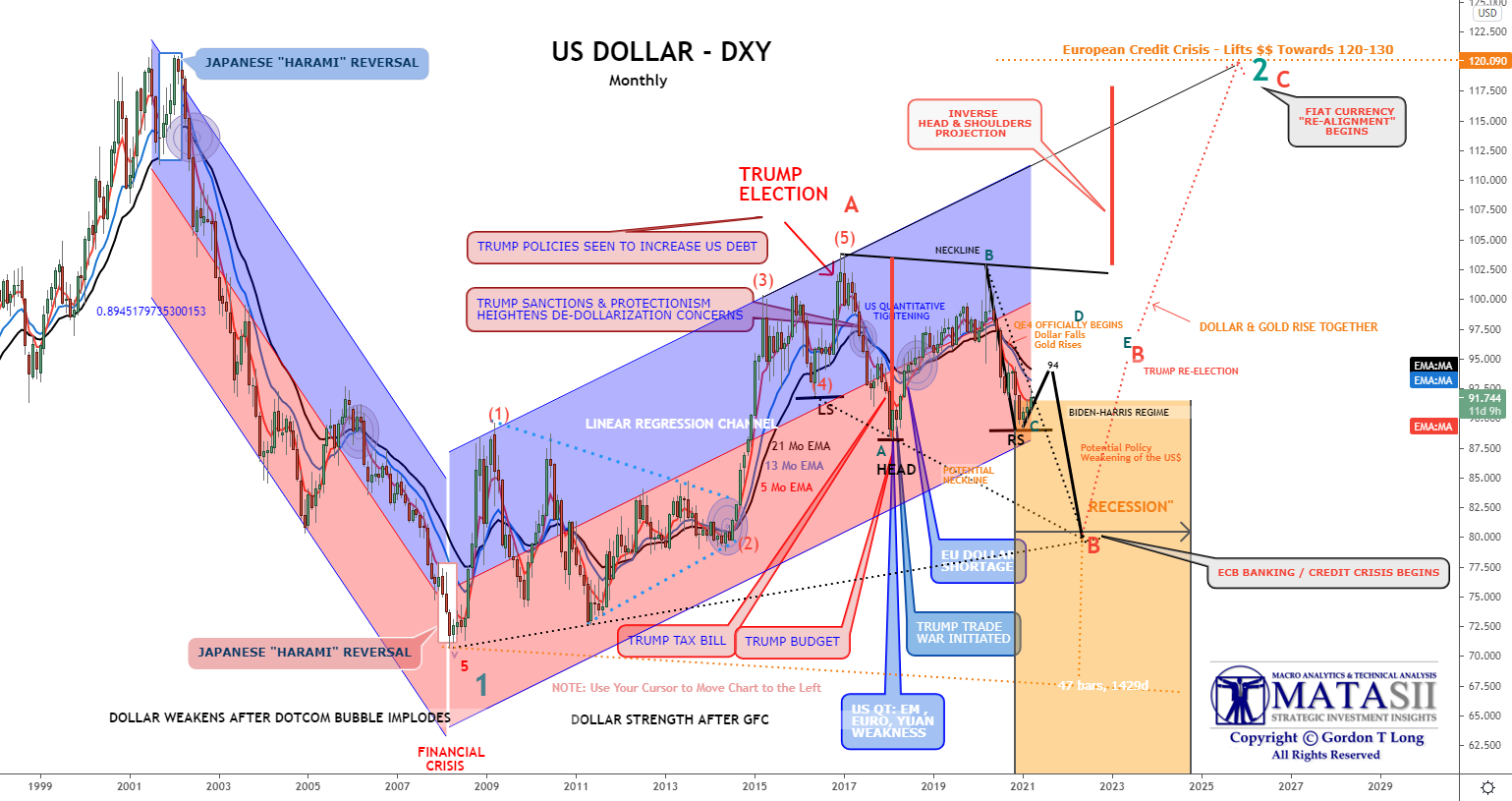

In our 2019 Thesis Paper entitled “De-Dollarization” we laid out the looming problems with the US Dollar.

2019 THESIS: De-Dollarization – DOWNLOAD

A CONSUMER INFLATION SHOCK FROM A FALLING $$

-

- Weaponization of the US dollar as a Foreign Policy tool for politically motivated Economic Sanctions,

- Rapidly growing global Bi-Lateral Trade Agreements to reduce US Dollar dependencies,

- Falling US Exports where US dollars are required,

- Global Oil and Gas Trade no longer needing to be conducted solely in IS dollars,

- The US Twin Deficits now pointing to a major reduction in the value of the US dollar,

- Falling bond rates thereby de-incentivizing the holding US Treasury debt and thereby further reducing foreign dollar needs.

These and other developments will act as a US Consumer Shock as “Exchange” Inflation pushes up US Domestic Consumer Prices for Foreign manufactured goods and services.

|

|

|

The question is how long will the rest of the world subsidize America’s standard of living? How long will other countries prop up a dysfunctional, weakening US economy by supplying it with goods it cannot produce for itself?

“And then the dollar crashes and that’s the end of this game. Because to the extent that we can only spend our dollars on the things that we produce ourselves, that’s where it hits the fan, because we’re not producing things. And then price increases are going to explode in a much more visible manner.”

Peter Schiff: America’s Consumption Economy Is A Bubble Economy

|

|

|

ITS ACTUALLY EVEN WORSE THAN EVERYONE UNDERSTANDS

ITS ACTUALLY EVEN WORSE THAN EVERYONE UNDERSTANDS

2- FALLING US DOLLAR

2- FALLING US DOLLAR