MACRO - US ECONOMY

DEBT MARKET

THE PIPER MUST BE PAID!

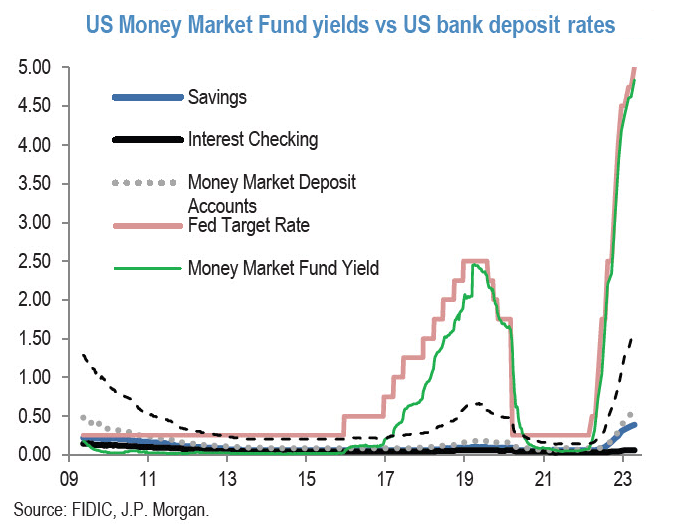

Unfortunately I am old enough to remember clearly when there were no credit cards, everything was transacted in cash (or consequentially simply not transacted at all) and banks lived by Borrowing Long Term and Lending Short Term. Those days have long gone and now all lending institutions Borrow Short and Lend Long. A thought that would have once been considered the “Road-to-Ruin-and-Damnation”!

With the yield curve inverted, how does today’s Lender borrow at high short term rates and lend at smaller long term rates? Was this the “Road-to-Ruin” that was referred to in yesteryear?

Or is it that banks used to buy long dated US Treasuries and then use the interest yield to lend it short term at much higher rates. When today US Treasury bond yields pay less than T-Bills, Is this the reversal that led to the “Road-to-Ruin”?

What bankers knew then was that nothing disappears faster than liquidity. They used to say banks lent you money to buy an umbrella, but as soon as it started to rain they wanted your umbrella back! Today they simply won’t lend you the money you need to survive and thereby have the rights to the collateral you consider your net worth (house, car, boat, cottage ..and umbrella).

In this newsletter we are going to explore how this “Road-to Ruin-and-Damnation” or “Doom Loop” came to reverse and how it will likely progress, since as yet another old expression goes – “The Piper Must Be Paid”!

WHAT YOU NEED TO KNOW

WHEN SHORT TERM RATES RISE, TODAYS LENDERS ARE IN TROUBLE!

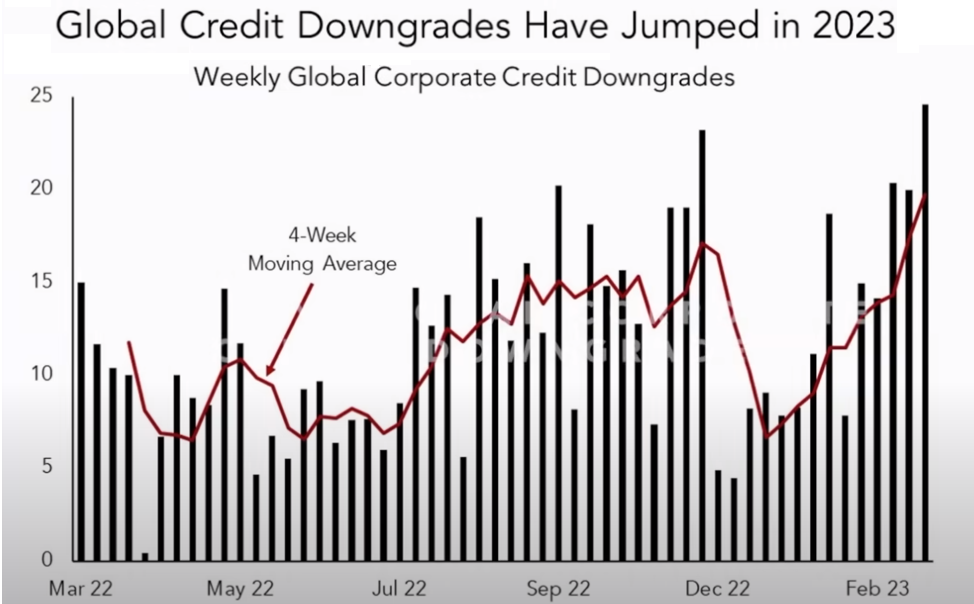

The chart to the right underscores the potential that the banking woes, and their own slow-moving impacts on broader credit conditions, will push policymakers to halt hikes sooner than they have been signaling. As the “Waterfall” chart in this newsletter illustrates, we are seeing exploding and unprecedented cascading impacts across multiple sectors as global lending pressures take their toll.

The chart to the right underscores the potential that the banking woes, and their own slow-moving impacts on broader credit conditions, will push policymakers to halt hikes sooner than they have been signaling. As the “Waterfall” chart in this newsletter illustrates, we are seeing exploding and unprecedented cascading impacts across multiple sectors as global lending pressures take their toll.

HOUSE OF CARDS

-

- The Structural reliance on “Borrowing Short and Lending Long” is choking on tightening lending standards, higher rates and increasing Risk premiums.

- The normalization of monetary policy was built on the idea of a soft landing for the economy. However, the Fed may be killing the private sector to save the government. Curbing inflation requires a significant reduction in the money supply and aggregate demand. However, if government deficit spending is left untouched, the entire burden of normalizing monetary policy will fall on the economic crippling of families and businesses. The current situation is the worst possible.

- The dramtic increase in US Government spending and finance has begun to steadily “crowd-out” private investment.

ZOMBIE CORPORATIONS – Out of Time & Options!

-

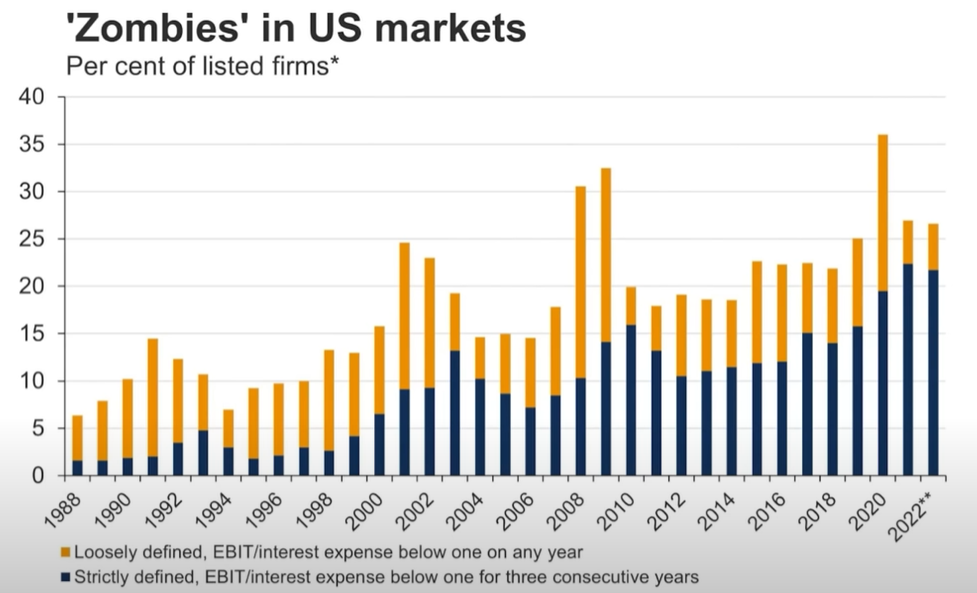

- Approximately 27% of all US publicly traded companies now deliver insufficent Earnings Before Interest and Taxes (EBIT) to cover the interest on their debt. The number, who have been in this situation for 3 or more years, has also dramtically increased.

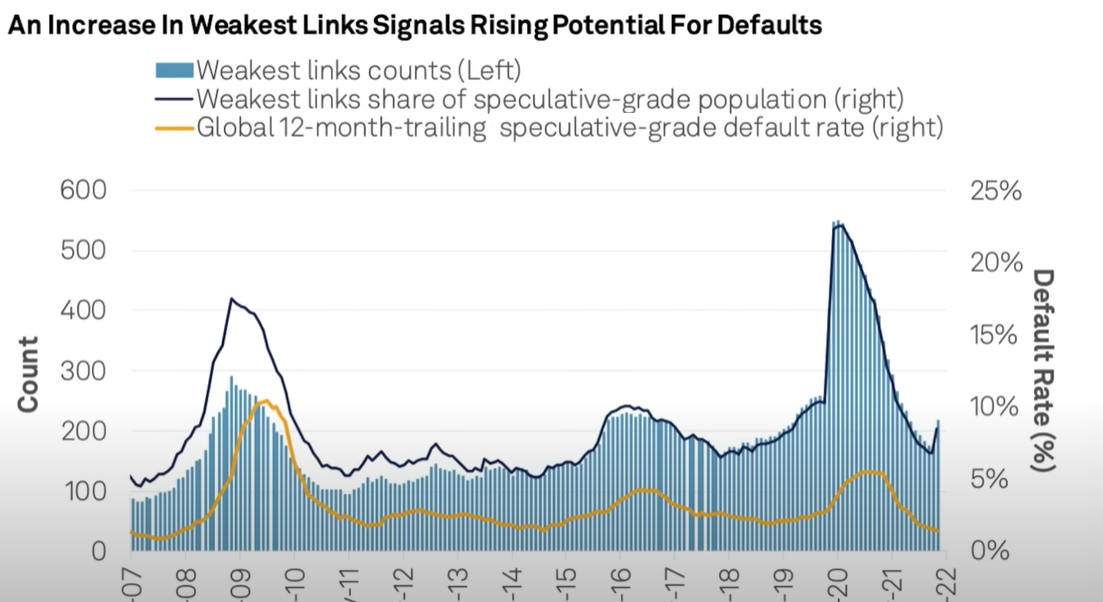

- Rating agency S&P sees the US junk-grade default rate reaching 4 per cent by December, from a rate of 2.5 per cent in the 12 months to March. Moody’s anticipates a US rate of 5.6 per cent by next March, up sharply from its own figure of 2.7 per cent as of March 31.

- Distressed corporations have bought time by turning to “Distressed Exchanges”. However, according to Moody’s, almost three-quarters of US corporate debt defaults last year were “Distressed Exchanges”.

FUNDING REALITIES OF ZOMBIE CORPORATIONS – A Labyrinth of Liquidity & Dependencies

-

- Recessions throughout the “Great Moderation” era were relatively few and short lived! We should now expect longer recessions and more re-occurring recessions during the post “Great Moderation” era, which will dramtically end the mal-investment era of “Zombie Corporations”.

- Zombie Corporations are currently surviving on Covid-19 Zero Bound financing, Distress Exchanges and Private Equity cash infusions. All of these are in the process of increasingly failing to supply the life blood for Zombie’s to continue to exist!

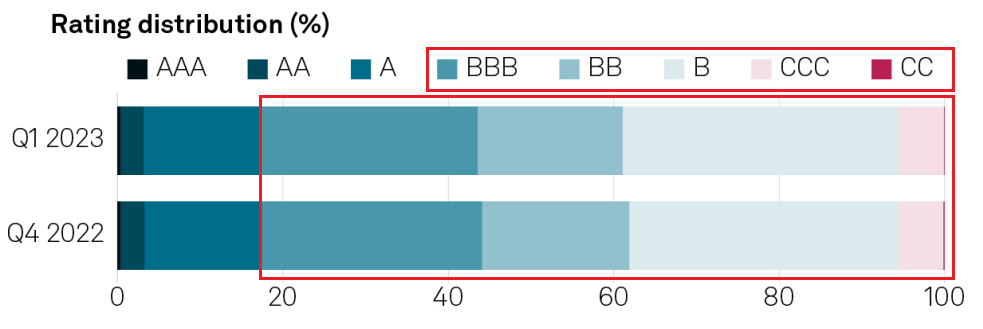

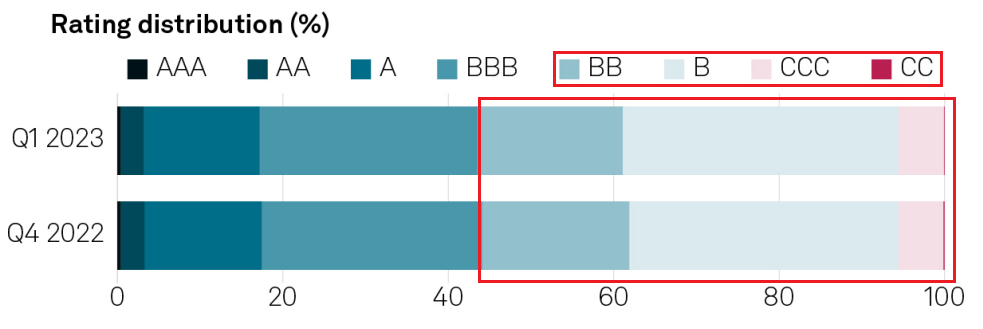

- Over the past few months we have seen a dramatic rise of the “weakest link shares of the speculative grade” population.

CONCLUSION

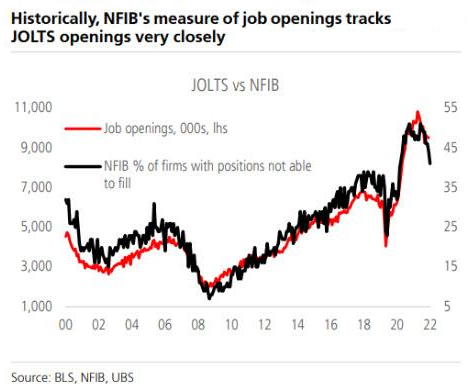

JOLTS REPORT

JOLTS REPORT

-

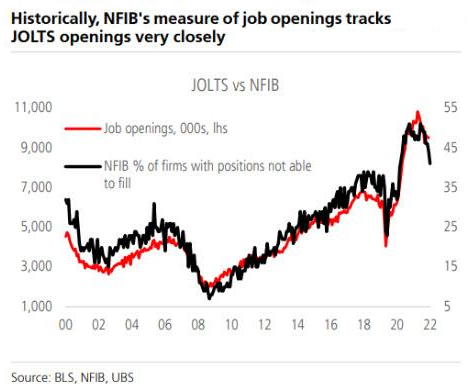

- Labor Market In Freefall As Job Openings Slide. Quits Tumble To 2 Year Low.

- With consensus expecting only a modest drop in March job openings after the February collapse and sharp downward January revision, what the BLS reported instead was yet another doozy for the third month in a row. in March there were just 9.590 million job openings, the lowest since April 2022, and a drop of 384K from the upward revised February print. Combined with the sharp drops in January (-671K) and February (-589K), the combined three-month drop in job openings was the 2nd largest on record!

NFP LABOR REPORT – APRIL

-

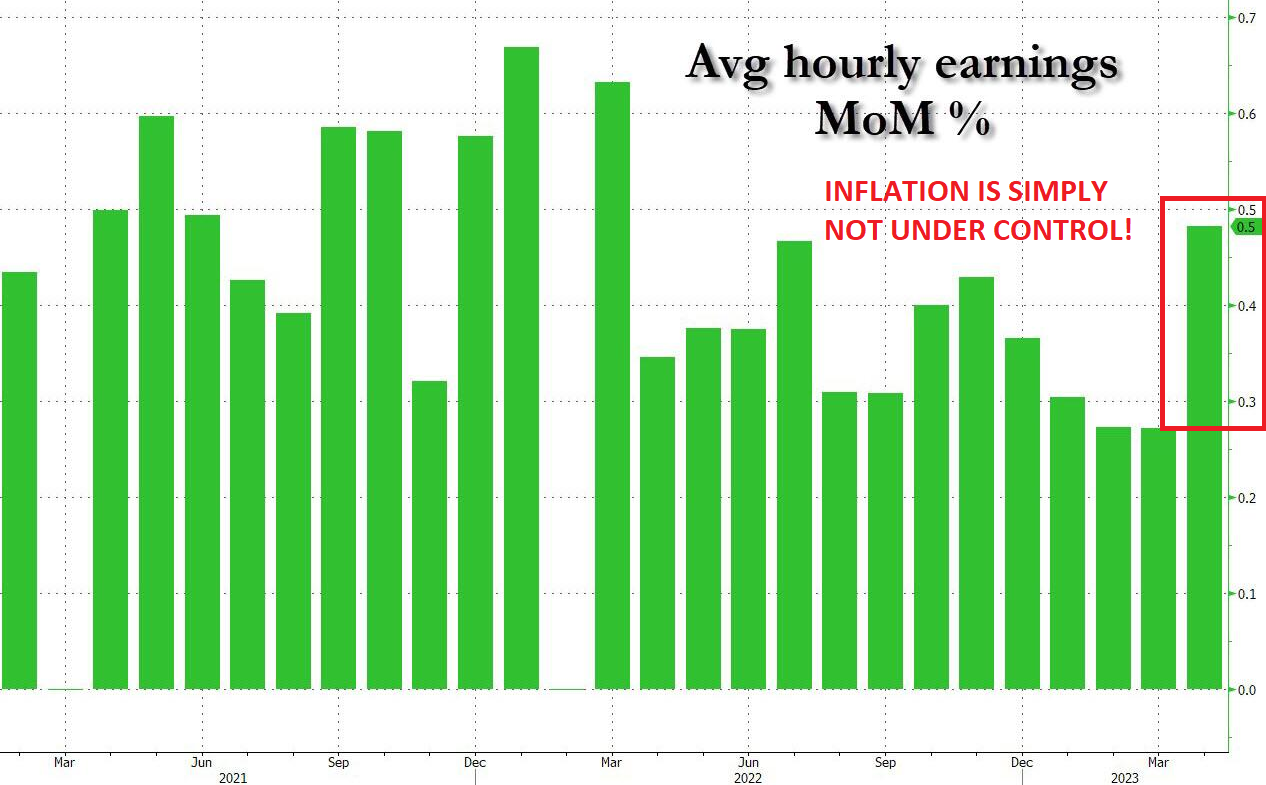

- The BLS reported a record 13th consecutive month of payrolls beating expectations.

- The BLS Reported a stunning Birth-Death Model Adjustment of 378K of new jobs.

- April payrolls reportedly rose by 253K, a big jump from the the March number which was a 3-sigma beat of expectations of 185K.

- The unemployment rate also shockingly dropped from 3.5% to 3.39%, much stronger than consensus expectations for an increase to 3.6%.

The Labor Report gives the Fed the cover it needs to hold rates higher for longer, since Inflation is just not coming down as fast as is required nor as expected by the Federal Reserve.

A HOUSE OF CARDS – Rising Rates Have Changed Lending Systemically

STRUCTURAL BORROWING SHORT AND LENDING LONG HAS COLLAPSED!

As we pointed out above, when short term rates are higher than long term rates, the whole house of cards for structural landing collapses. Inverted yield curves can not be maintained in the modern era but for the briefest of terms. The Yield Curve has been inverted sufficently long enough that lending institutions are now in trouble!

As we pointed out above, when short term rates are higher than long term rates, the whole house of cards for structural landing collapses. Inverted yield curves can not be maintained in the modern era but for the briefest of terms. The Yield Curve has been inverted sufficently long enough that lending institutions are now in trouble!

The banks are particularly being hit hardest in the early stages, because since 2008 they have been incentivised through Banking regulations to hold Sovereign Treasury debt. As rates go up, these bond values go down leaving banks with collateral, capital adequacy and solvency problems.

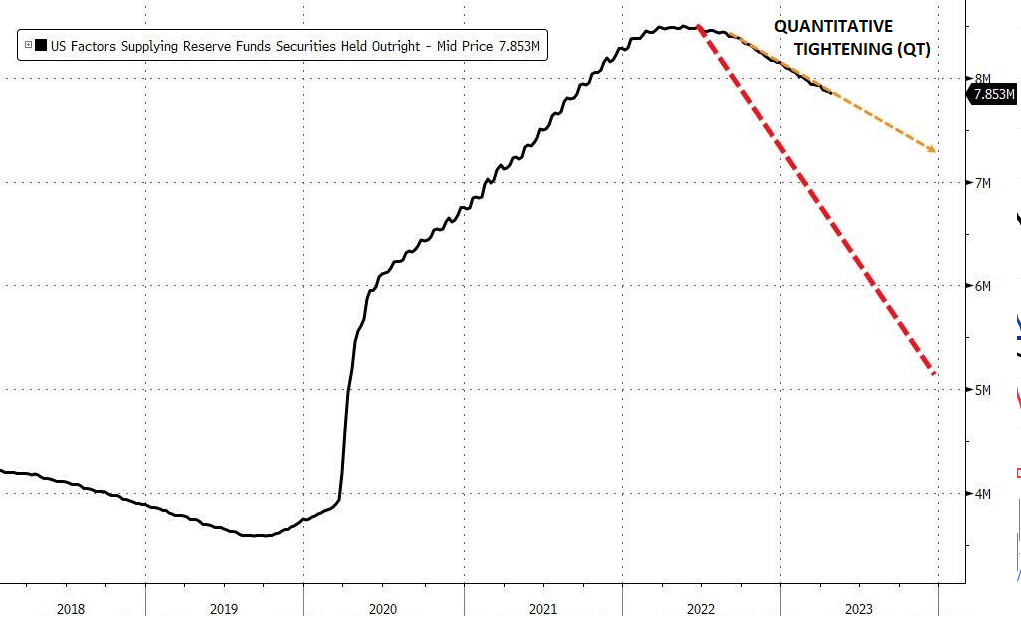

There is robust evidence of a negative trend in the real economy – rising federal expenditure, more bureaucracy, higher taxes and weaker activity in the part of the economy that drives growth and jobs. The Federal Reserve’s balance sheet reached its all-time high in May 2022. Since then, it was supposed to drop at a steady pace and shed three trillion US dollars by 2024.

There is robust evidence of a negative trend in the real economy – rising federal expenditure, more bureaucracy, higher taxes and weaker activity in the part of the economy that drives growth and jobs. The Federal Reserve’s balance sheet reached its all-time high in May 2022. Since then, it was supposed to drop at a steady pace and shed three trillion US dollars by 2024.

The normalization of monetary policy was built on the idea of a soft landing for the economy. However, the Fed may be killing the private sector to save the government. Curbing inflation requires a significant reduction in the money supply and aggregate demand. However, if government deficit spending is left untouched, the entire burden of normalizing monetary policy will fall on families and businesses. The current situation is the worst possible.

The Fed’s balance sheet is not falling as fast as it should. Government spending has not even been scratched while the money supply is falling at the fastest pace since the 1930s. Rate hikes are hurting the productive economy while the government seems unaware of the need to reduce its bloated budget.

Rate hikes have two direct negative effects on the economy, if the government does not reduce its deficit spending spree.

-

- They mean higher taxes, and

- A massive crowding out of available credit.

The government deficit is always going to be financed, even if it is at higher rates, but this also means less credit for businesses and families. The crowding-out effect of the public sector over the productive economy means lower productivity growth, weaker investment and declining real wages, as the government keeps inflation above target by spending additional units of newly created currency. But the productive sectors find it harder and more expensive to find credit.

-

- The first-quarter GDP figure is extremely concerning. Overnment spending showed yet another big rise at +4.7%, much higher than expected. However, consumption, at +3.7% annualized, was well below estimates and driven by a worrying new record in credit card debt. Even more concerning, gross private domestic investment fell by a massive 12.5%.

- The money supply is collapsing due to the inevitable credit crunch and the difficulties faced by consumers and businesses.

- It is impossible to grow with rising taxes, persistent inflation – a tax in itself – and carrying the entire burden of the normalization of monetary policy. Fighting inflation without cutting government spending is like trying to lose weight without eliminating fattening foods.

RESULTING BOTTOM LINE: Things Are Going to Get Worse Quickly!

A CASCADING WATERFALL HAS BEEN TRIGGERED

In the last newsletter we laid out some of the details we witnessed during the first three weeks of Q1 Earnings season regarding the following elements. A simplistc way of looking at what is underway is to consider them in the context of a “Waterfall”.

In the last newsletter we laid out some of the details we witnessed during the first three weeks of Q1 Earnings season regarding the following elements. A simplistc way of looking at what is underway is to consider them in the context of a “Waterfall”.

SLOWING LENDING

-

- BANKS: Major US Banks Overall Had a Solid Quarter – Small Banks “Not so Much”!

- LENDERS: Expecting Material Worsening of Labor Market (Capital One planning for 5% Unemployment)

- CRE: Major Player Vorando Delays Dividends and Shocks A Fragile Market

HALTED LENDING

-

- ZOMBIES: Out of Time & Options As “Distress Exchanges” Proving Insufficient!

- BIG EIGHT MARKET CAPS: Looking To Next Gen Artificial Intelligence (X.AI, GPT-4, TruthGPT)I For Growth

- SMALL BUSINESS: Fed Regional Surveys Receiving Brunt of the Feedback – “Inflation Is Killing My Business”!

SLOWING CONSUMPTION

-

- SHIPPING & PACKAGING: Economy Has Stalled On All Fronts – Trucking, Rail, Shipping and Short Delivery!

We have been reporting on a number of the sectors shown above in the “Waterfall” illustration. In the last newsletter, we mentioned Zombie Corporations, which we have warned about in a number of prior quarters. Matters were bad before lending standards tightened so severely, but have gotten much more serious since. (Part of the following is excerpted from the last newsletter specifically on Zombie Corporations – for your reference.)

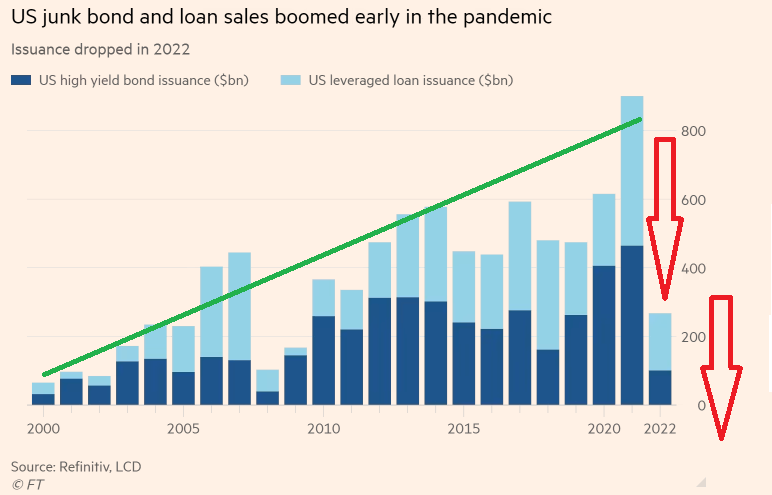

ZOMBIE CORPORATIONS: Out of Time & Options!

Rating agency S&P sees the US junk-grade default rate reaching 4 per cent by December, from a rate of 2.5 per cent in the 12 months to March. Moody’s anticipates a US rate of 5.6 per cent by next March, up sharply from its own figure of 2.7 per cent as of March 31.

Rating agency S&P sees the US junk-grade default rate reaching 4 per cent by December, from a rate of 2.5 per cent in the 12 months to March. Moody’s anticipates a US rate of 5.6 per cent by next March, up sharply from its own figure of 2.7 per cent as of March 31.

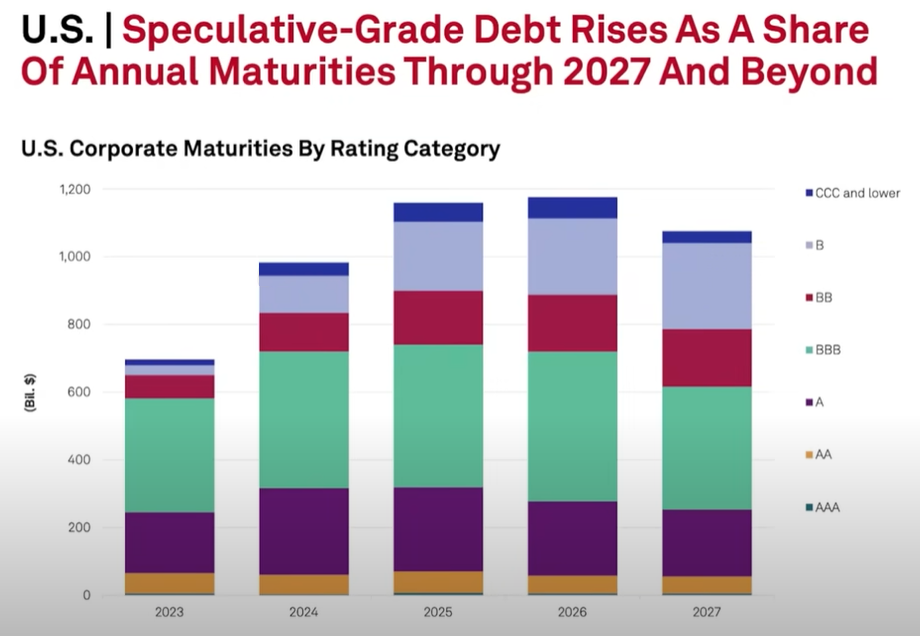

In recent years, much of this debt has comprised leveraged loans, instruments sold by “junk” grade businesses, whose coupons move with prevailing interest rates. These were considered attractive when monetary policy was ultra-loose — with issuance roughly doubling to $615bn between 2019 and 2021, as interest rates plunged early in the Covid pandemic. Leveraged Loans have lost much of their appeal as the Federal Reserve embarked on its most aggressive campaign of interest rate rises in decades to tame inflation.

Distressed companies face a combination of rising borrowing costs and a slowing economy. These difficulties and investor scrutiny of such businesses are likely to intensify this year against a backdrop of rising recession fears.

Distressed corporations have bought time by turning to “Distressed Exchanges”. However, according to Moody’s, almost three-quarters of US corporate debt defaults last year were “Distressed Exchanges”.

DISTRESSED EXCHANGES OPERATE IN THE “BBB” AND LOWER CREDIT QUALITY

(NOTE: Preponderance of “BBB” should have lower ratings, which would preclude them from Pension, Insurance & other Regulated Institutional Funding.)

THEY ARE NOW OUT OF TIME AND OPTIONS!

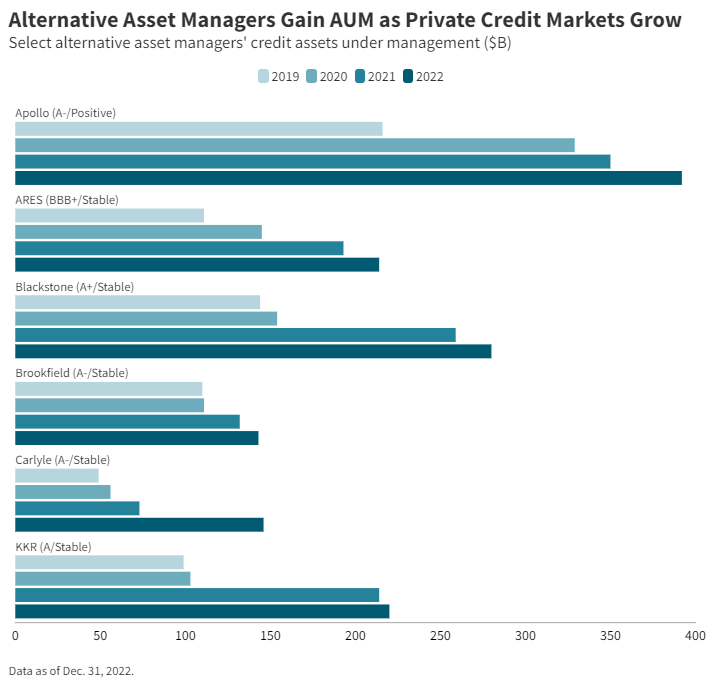

FUNDING REALITIES OF ZOMBIE CORPORATIONS – A Labyrinth of Liquidity & Dependencies

The prevalence of private equity-owned companies is more pronounced at the low end of the rating scale. About 75% of borrowers rated B and below (about 50% of all speculative-grade corporate borrowers) are fully or partially private equity owned.

The prevalence of private equity-owned companies is more pronounced at the low end of the rating scale. About 75% of borrowers rated B and below (about 50% of all speculative-grade corporate borrowers) are fully or partially private equity owned.

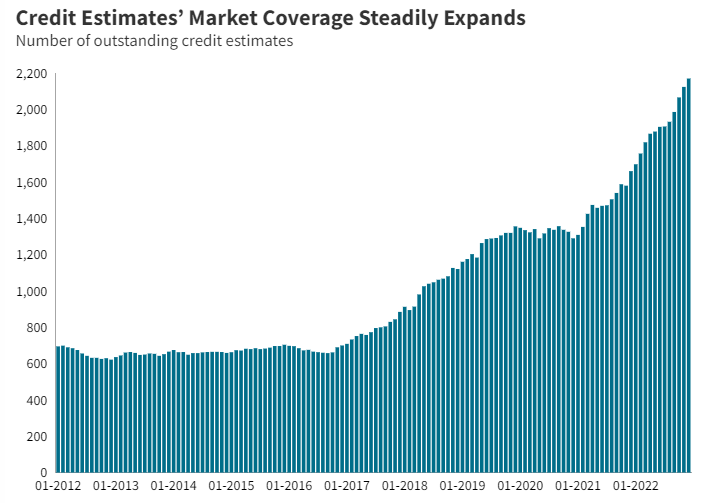

The median EBITDA for companies with credit estimates in 2022 was about $25 million. Many of the assessed companies were local or regional players with limited pricing power, narrow product or service offerings and high leverage. These companies are therefore more vulnerable to economic or financial downturns than larger counterparts in the Leveraged Finance (Levfin) market.

TIGHTENING LENDING STANDARDS AND HIGHER RATES IS A DEATH BLOW TO HIGHLY LEVERGED PRIVATE EQUITY FIRMS CURRENTLY FUNDING THE LOW END CREDIT RATED “JUNK”

TO UNDERSTAND ZOMBIES IS TO UNDERSTAND PRIVATE EQUITY & PE SPONSORED COMPANIES

The surge of Private Equity has largely fueled the expansion of the Levfin market across public and private lending over the last two decades since the Dotcom Bubble Implosion.

Companies wholly or partially owned by a Financial Sponsor make up about half of US and Canadian speculative-grade (rated BB+ or lower) corporate borrowers publicly rated by S&P Global Ratings. The prevalence of private equity-owned companies is more pronounced at the low end of the rating scale.

Private Equity Funds raised $1 trillion of capital in 2022, more than double 2013’s tally of $458 billion.

PRIVATE EQUITY-SPONSORED COMPANIES

Private Equity has additionally fueled the growth of M&A in the large corporate and middle-market segments. Coupled with the growing size of investments, this has positioned Private Equity-Sponsored Companies as more prevalent among rated issuers since they have taken on larger and larger investments, utilizing the Broadly Syndicated Loan (BSL) Market for funding.

Private Equity has additionally fueled the growth of M&A in the large corporate and middle-market segments. Coupled with the growing size of investments, this has positioned Private Equity-Sponsored Companies as more prevalent among rated issuers since they have taken on larger and larger investments, utilizing the Broadly Syndicated Loan (BSL) Market for funding.

-

- Sponsor-driven activity has propelled BSL volume to support M&A and sustained borrower funding needs for dividend recapitalizations and general corporate purposes.

- Leveraged finance has felt a significant impact, because of the growth of private lending and the interconnectedness of public and private lending.

WITHOUT ANOTHER GOVERNMENT SECONDARY MARKET CORPORATE CREDIT FACILITY (SMCCF), THIS MARKET WILL SOON COLLAPSE.

NOTE: The Federal Reserve Recognized this and IMMEDIATELY Enacted the SMCCF When Covid-19 Became

Even A Possible Economic Threat.

27% OF ALL US PUBLIC LISTED COMPANIES ARE NOW ZOMBIES

Note only is the growth in Zombie Corporations steadily increasing (yellow bars), but the blue shaded area shows the significant growth in those compaines unable to raise their EBIT/Interest expense over 1 for the last three consecutive years! What we have is more Zombie Corporations in even worst shape!

ABOVE: Zombie Corporations are going to need to refinance their debt in a major way in the Short to Intermediate Term.

In an era of higher nominal rates this is going to become a dominant problem than it has been over the last decade of mal-investment and under-priced risk premia!

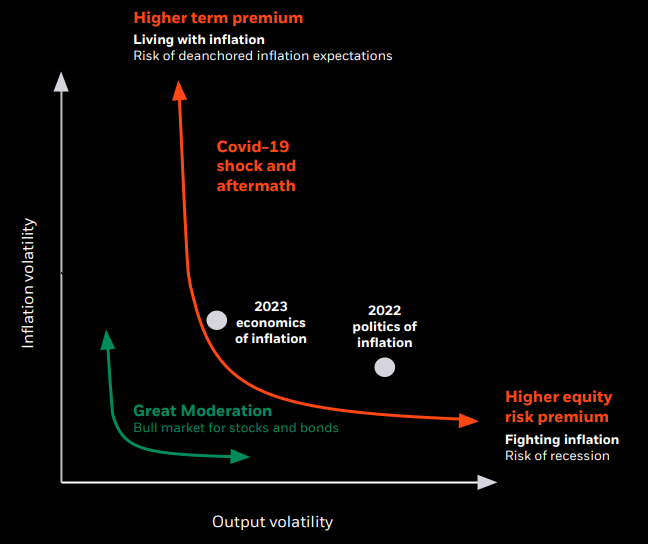

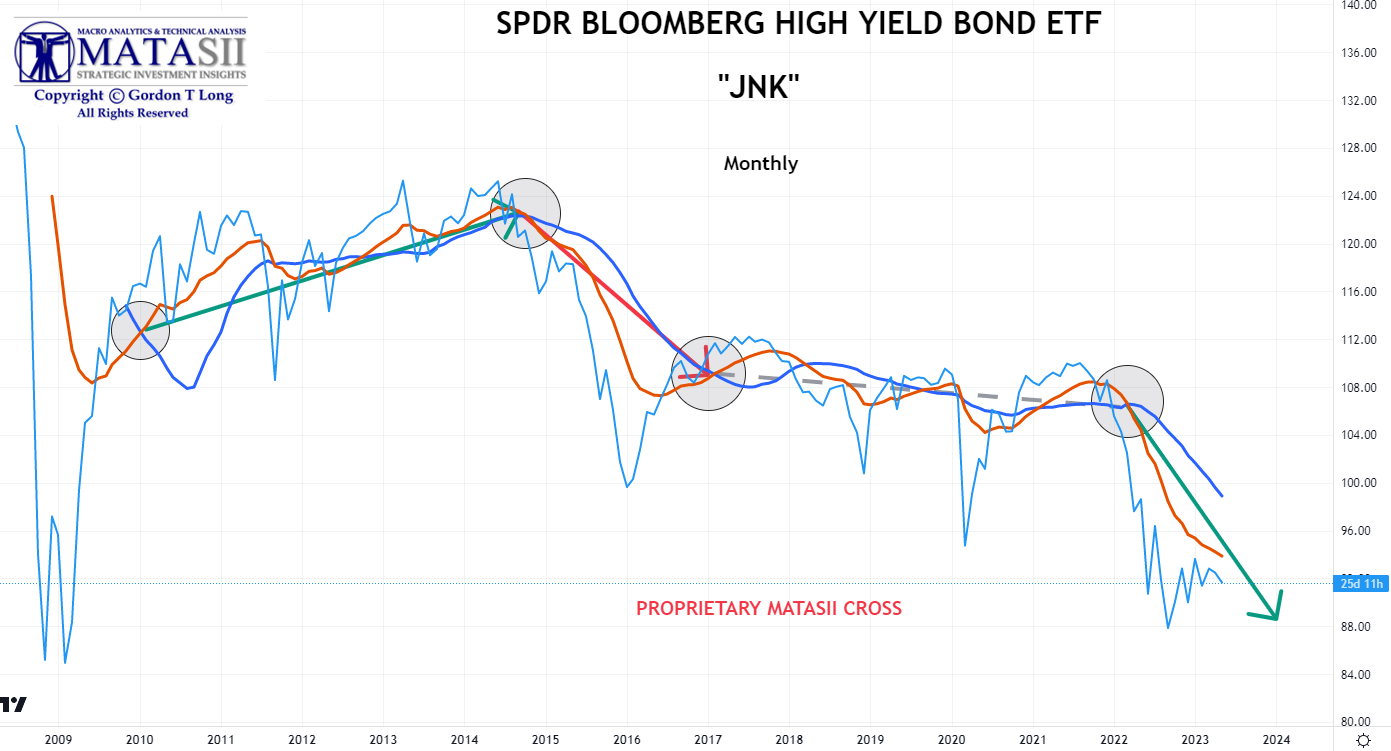

CHART RIGHT:

Our MATASII Thesis 2023 analysis suggests that nominal rates will stabilize at higher rates than we have experienced since the GFC in the post “Great Moderation” Era. Higher Risk Premia are to be expected!

Our MATASII Thesis 2023 analysis suggests that nominal rates will stabilize at higher rates than we have experienced since the GFC in the post “Great Moderation” Era. Higher Risk Premia are to be expected!

Recessions throughout the “Great Moderation” era were relatively few and short lived! We should now expect longer recessions and more re-occurring recessions during the post “Great Moderation” era, which will dramtically end the mal-investment era of “Zombie Corporations”.

ABOVE: We have seen over the past few months a dramatic rise (right side of above chart) of the weakest link shares of the speculative grade population.

CONCLUSION

A technical consolidation period in High Yield (JNK)and Zombie Stocks appears to be near completion and ready to resume a downward trend.

A technical consolidation period in High Yield (JNK)and Zombie Stocks appears to be near completion and ready to resume a downward trend.

This is supported by the rapidly deteriorating evidence of weakening overall employment in the economy. (NOTE: Do not be fooled by Fridays political NFP Labor Report which used a nonsensical “plug” number of 378K for the Birth-Death Model, which notoriously is always adjusted later).

JOLTS COLLAPSES

-

- Labor Market In Freefall As Job Openings Slide, Quits Tumble To 2 Year Low

- We saw an epic, long overdue thud in the number of artificially-inflated February job openings this week, which gave us yet another confirmation of just how painful the labor market’s reacquaintance with gravity and mean reversion will be.

- With consensus expecting only a modest drop in March job openings after the February collapse and sharp downward January revision, what the BLS reported instead was yet another doozy for the third month in a row.

- In March there were just 9.590 million job openings, the lowest since April 2022, and a drop of 384K from the upward revised February print. Combined with the sharp drops in January (-671K) and February (-589K), the combined three-month drop in job openings was the 2nd biggest on record!

NFP LABOR REPORT – APRIL

NFP LABOR REPORT – APRIL

-

- The BLS reported a record 13th consecutive month of payrolls beating expectations.

- The BLS Reported a stunning Birth-Death Model Adjustment of 378K of new jobs.

- April payrolls reportedly rose by 253K, a big jump from the March number, and was a 3-sigma beat of expectations of 185K.

- The unemployment rate also shockingly dropped from 3.5% to 3.39%, much stronger than consensus expectations for an increase to 3.6%.

The Labor Report gives the Fed the cover it needs to hold rates higher for longer, since Inflation is just not coming down as fast as is required nor as expected by the Federal Reserve.

REALITY

The reality is shown below on legal filings with State governments under WARN (Worker Adjustment and Retraining Notification Act of 1988) regulation requirements.

![]()

BEAR MARKETS HISTORICALLY HAVE DEVELOPED

WITH THE SAME TECHNICAL PROFILE!

THE BEAR MARKET TECHNICAL PROFILE

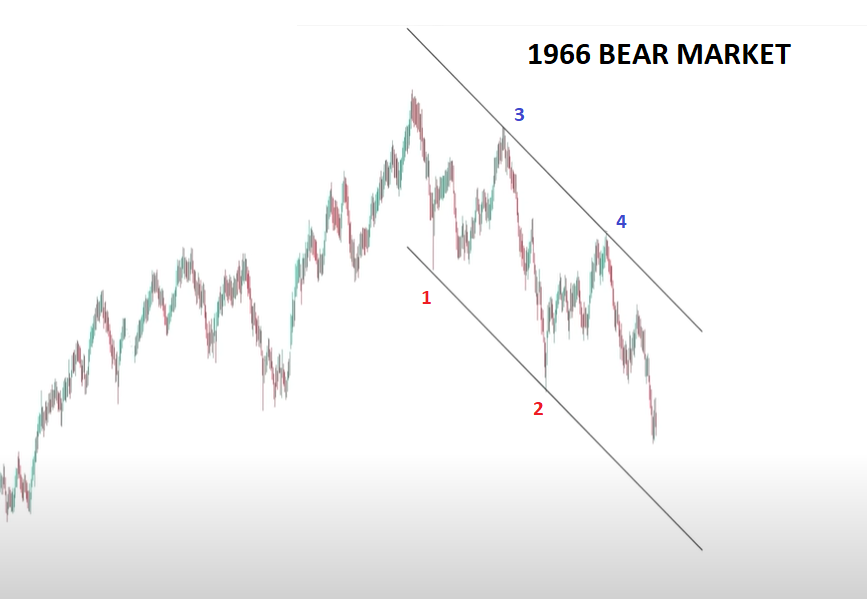

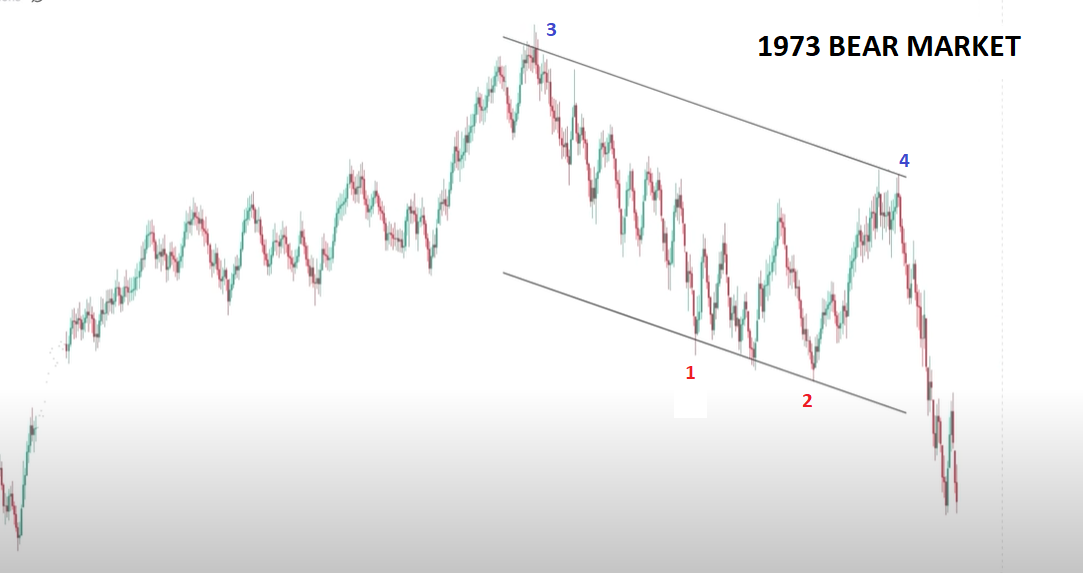

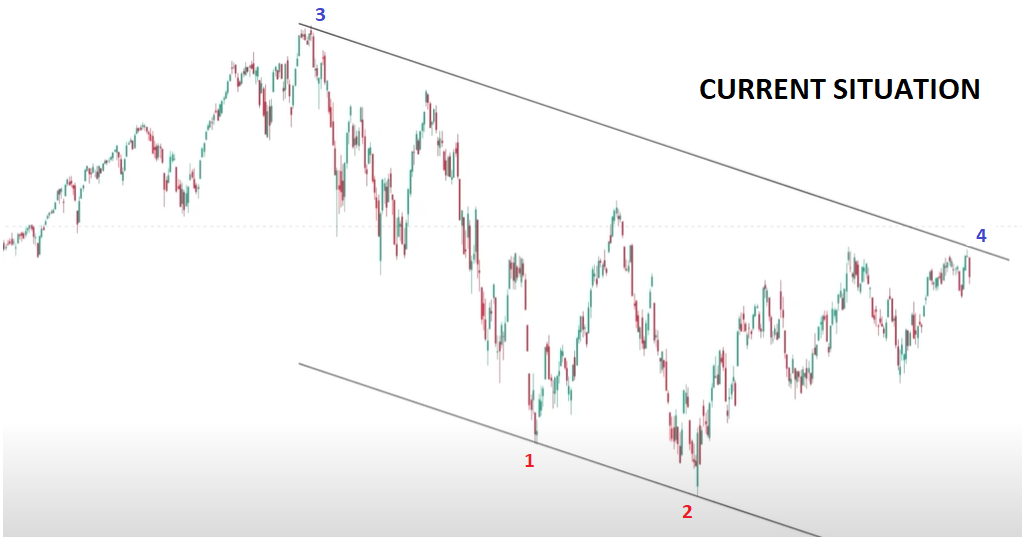

A basic technical analysis tool is the use of parallel trend channels. If drawn correctly and used in concert with other analytics it can be extremely predictive. I have found them to be particularly accurate in long term set-ups. It is the old adage, the more data the more accurate the prediction!

Bear Markets are normally long term events. We believe we have entered one in the US S&P 500. To illustrate that we explore the 5 MAJOR LONG Bear Markets going back to 1966.

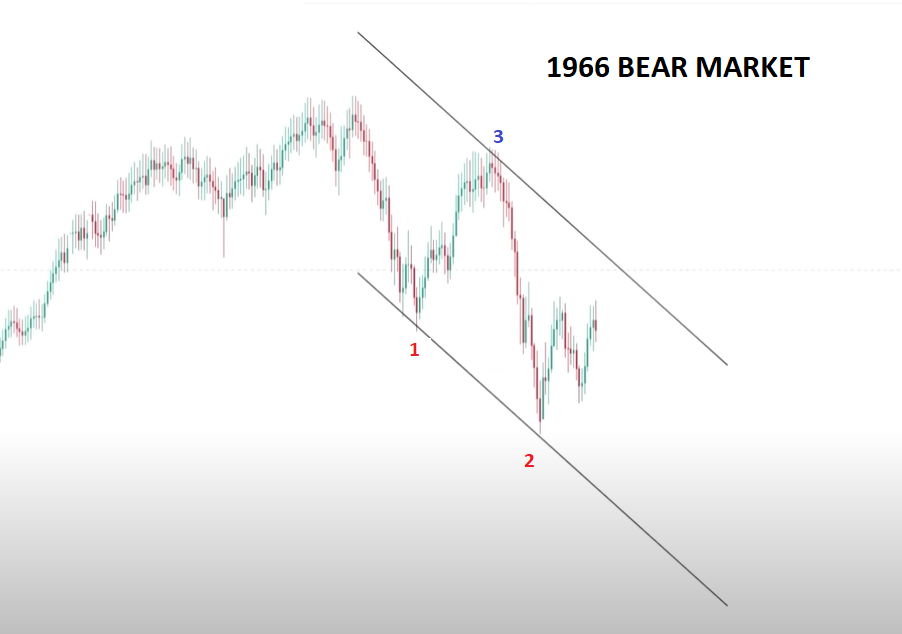

1966 BEAR MARKET

As the Bear Market develops we draw in the lower trend line when we have two strong points of support. This gives us the rate of decline allowing a projection of both time and price. We label those as point 1 and 2 in red above. With that,we then draw a parallel channel beginning with what we believe to be the beginning of the Bear Market. It is labeled by point 3 in blue above.

The Bear Market is confirmed when price subsequently rises back to the parallel channel. We have labeled that point #4 in blue above. At that point the Bear Market begins its “Capitulation” leg down to new lower lows.

1973 BEAR MARKET

2000 BEAR MARKET

2008 BEAR MARKET

CURRENT ENVIRONMENT

If history is any indication, then we should now be entering the “Capitulation” leg of this Bear Market taking us to new lows!

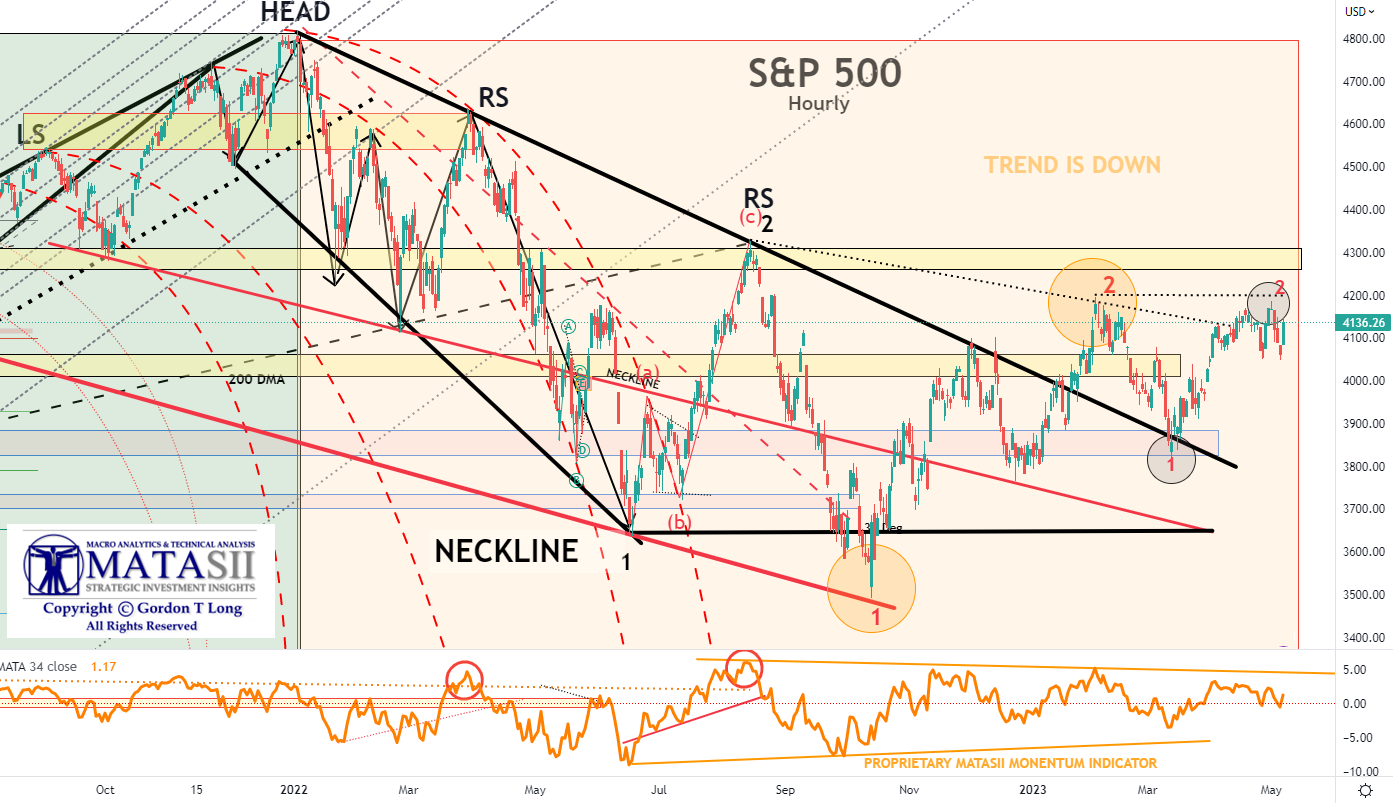

S&P 500 – LONG TERM HEAD & SHOULDERS

Our long term Head & Shoulders topping process confirms the above pattern.

YOUR DESK TOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

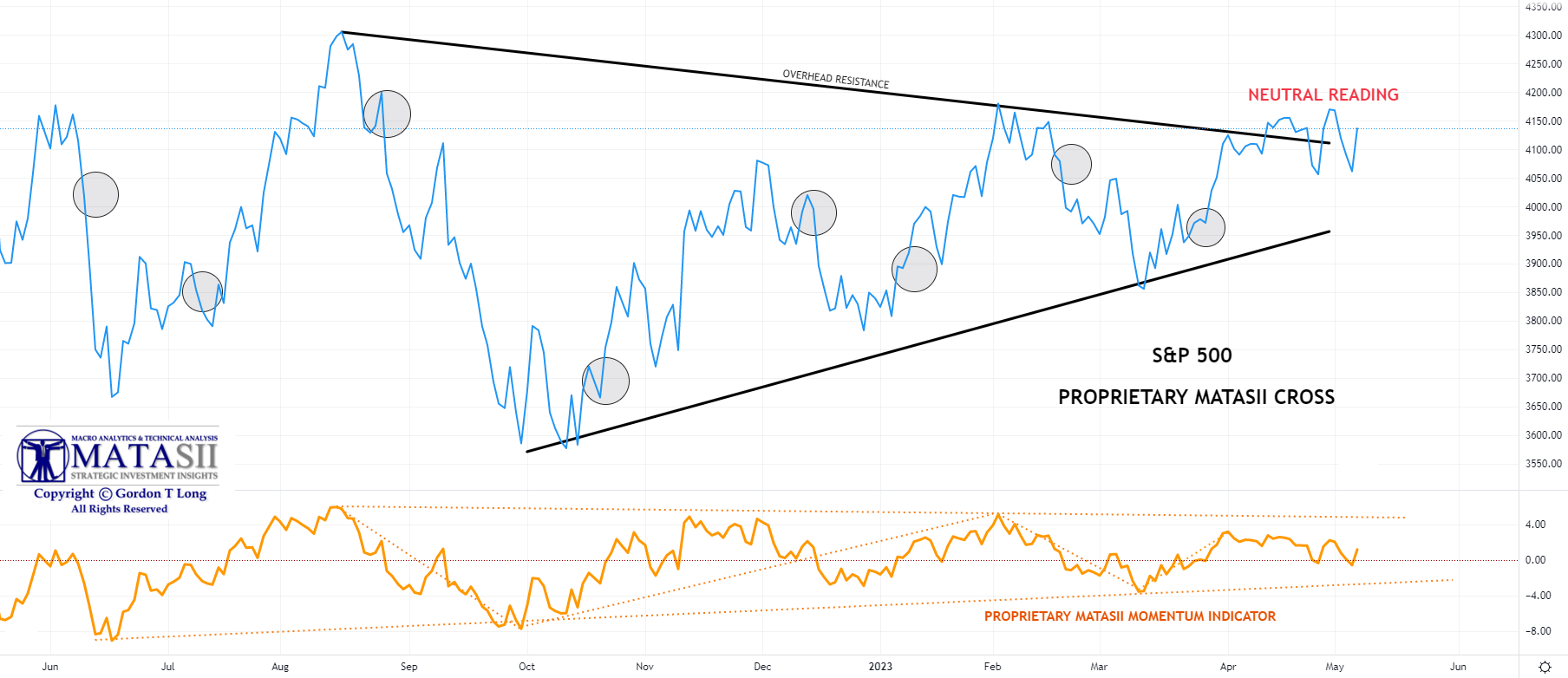

PROPRIETARY MATASII CROSS

The proprietary MATASII Cross is signalling a potential resumption of the downward trend.

COMPLETING A DOUBLE COMBO COMPLEX CONSOLIDATION

Our long term Double Combo Complex Corrective topping process is ready to confirm the Bear Market pattern.

YOUR DESK TOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.