BOTTOM LINE OF MY READINGS THIS WEEK:

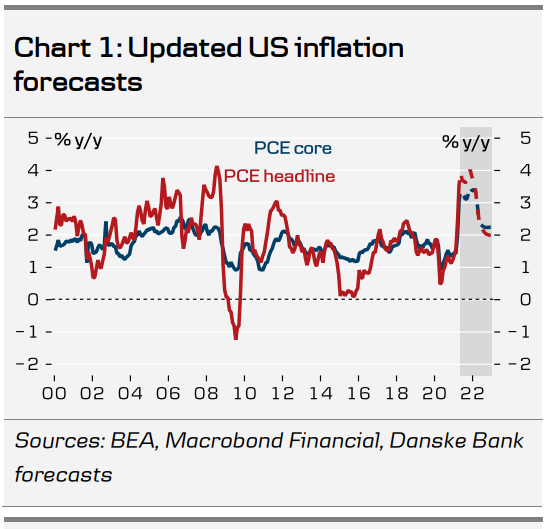

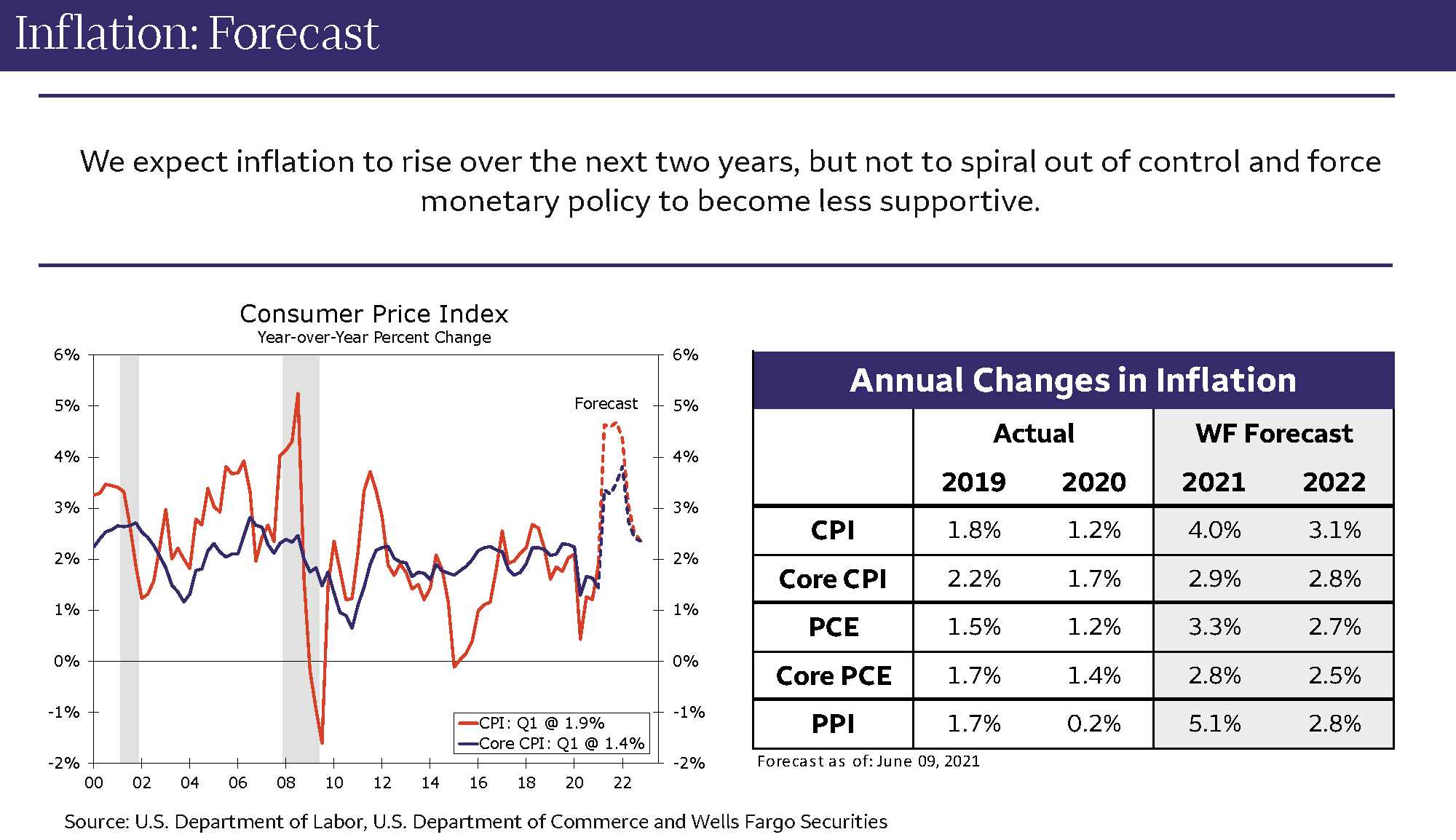

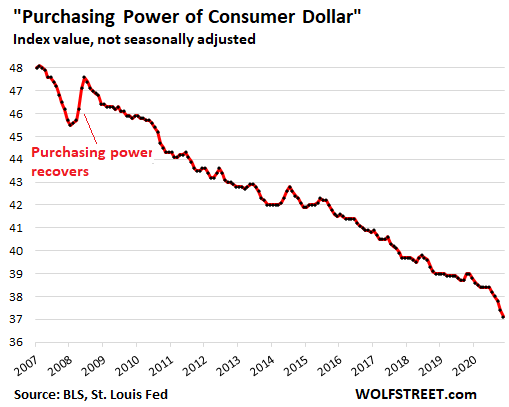

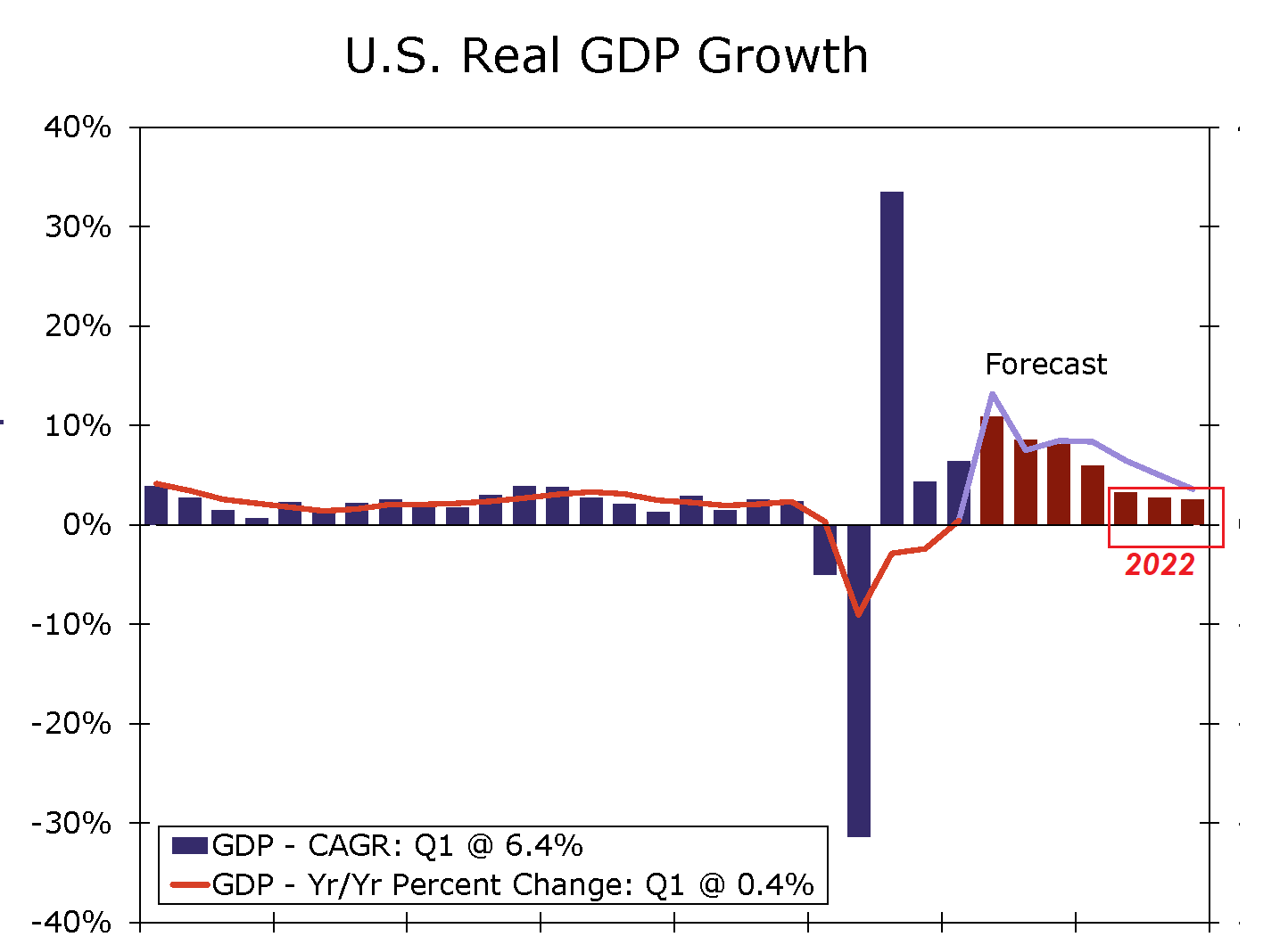

We are facing a serious erosion of our Purchasing Power (continued lowering of Standard of Living) as well as Economic Stagnation now becoming “baked in” to the outlook for 2022!

A REGIME SHIFT??

The big question is if the political crisis response to the pandemic will now lead us towards a marked regime shift or not. A crisis environment is the only environment that allows for changes to the policy mix that are large enough to potentially define a new era. Currently my readings suggest:

-

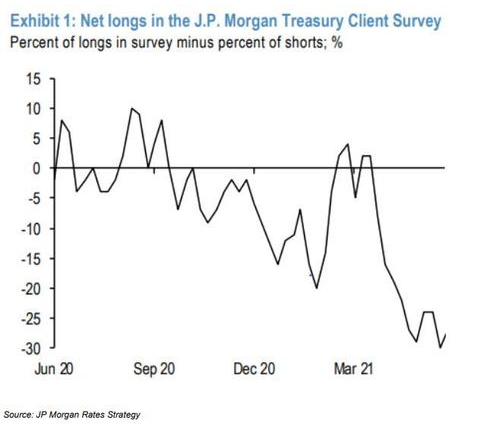

- Everyone and their mother is positioned for a massive inflation spike this summer already and

- No one dares to genuinely think that we have entered a sustained level shift in inflation rates over the coming decade.

Most people still lick their decade long wounds of trying to predict or bet on sustained higher inflation. Few economists ever got it right, one way or the other!

There are two types of recency bias in play in this inflation debate:

-

- First, there is clearly a recency bias in inflation expectations – why markets are already positioned for higher inflation. That is the only way you can explain how important oil is for inflation expectations over the coming 10 years.

- Second, there is a recency bias in the way the crisis response is calibrated. The most recent crisis in 2008/2009 was a material demand shock. This is why everyone currently suggests treating the pandemic as a demand shock, which it is most likely not. Bringing truckloads of fiscal fuel to the fire during a supply shock risks creating bizarre bottlenecks, such as the ones we are experiencing right now.

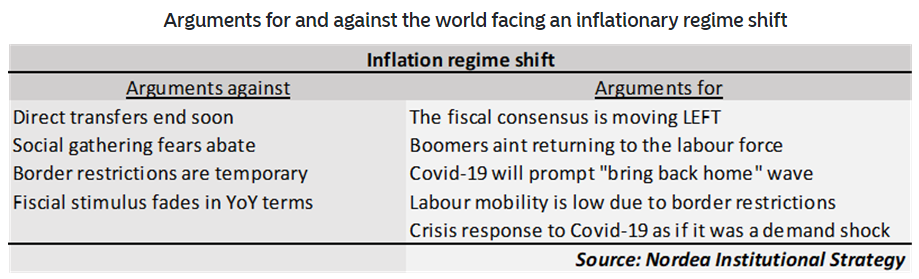

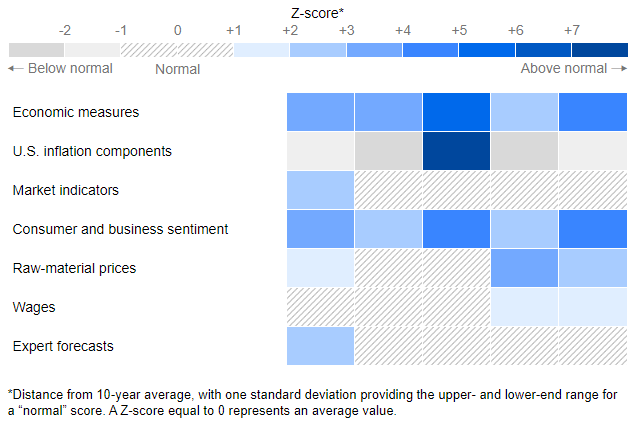

The Swedish Bank Nordea summarized the pros and cons of the inflationary regime shift debate in the table below. It finds more arguments in favor of a regime shift than against, not least due to the consensus moving leftwards fast on fiscal stimulus. This is a potential game-changer when it is happening amidst a supply shock crisis!