US MACRO

FISCAL POLICY

THE US GOVERNMENT NOW OFFICIALLY A “ZOMBIE”!

OBSERVATIONS: US GOVERNMENT NOW REQUIRED TO BORROW TO PAY DEBT INTEREST!

A Corporation is classified as a “Zombie” corporation when its interest payments are larger than its profits and it must borrow to pay the interest on its debt.

The US has now crossed that Minsky Moment and is presently forced to issue debt just to pay the interest on its existing debt. You don’t have to be an accountant to understand this is a problem. You are now “borrowing from Peter to pay Paul”!

We are actually being kind in classifying the US Government as a “Zombie” entity versus labelling it what some some would simply call a Ponzi Scheme. In a Ponzi scheme you must attract new buyer money to pay the existing buyers expected or promised returns. In this case isn’t that really the same thing??

-

- This year’s deficit is on track to be +6-7% of GDP or ~$1.8 – 2.1T.

- This year’s interest on the debt is expected to be a matching amount of ~1.8T – 2.1T.

-

-

- The Current 12m cumulative spending is $1.7T.

- The US Treasury has spent $1T in the last 100 days.

- The US budget deficit has averaged 9% over last 4 years.

-

The interest on the US debt now dwarfs the spending on the US Military and even the US Military-Surveillance Complex. How can this be sustained?

Last week Congress passed and Biden excitedly signed off on an unbudgeted additional $95B spending bill which includes:

-

- $61 billion to Ukraine

- $26 billion to Israel and

- $8 billion for Taiwan

Why is the US borrowing money, then paying interest on the loan to then give the money away? Why doesn’t the receiving country borrow the money directly? Israel and Taiwan aren’t broke with better Debt-to-GDP lending credit than us?? Minimally, why doesn’t the UN or IMF guarantee the loan? Why doesn’t the US guarantee the loan as part of foreign aid? No – we prefer to

A$61 billion to Ukraine

- $26 billion to Israel and

- $8 billion for Taiwan

Why is the US borrowing money, then paying interest on the loan to then give the money away? Why doesn’t the receiving country borrow the money directly? Israel and Taiwan aren’t broke with better Debt-to-GDP lending credit than us?? Minimally, why doesn’t the UN or IMF guarantee the loan? Why doesn’t the US guarantee the loan as part of foreign aid? No – we prefer to

add debt payments to the treasury auction market handled by the US money center banks. (We will save that discussion for another day!)

For the sake of full disclosure, if anyone cared enough to actually read the bill (you pay me to do that), you will find $3.5 billion buried in the Israel detail for “Migration and Refugee Assistance” for the State Department to “address humanitarian needs of vulnerable populations and communities.” This is what the State Department uses to pay the NGOs coordinating the illegal invasion at our southern border, and providing all the freebies once there in the US. All part of the $1.3T cost of illegal immigration I outlined in your last newsletter.

Does any of this pass your common sense test or have we all become just mental “Zombies”?

WHAT YOU NEED TO KNOW!

IS THIS THE REASON WHY MASS IMMIGRATION IS A PREOCCUPATION OF THE LEFT??

IS THIS THE REASON WHY MASS IMMIGRATION IS A PREOCCUPATION OF THE LEFT??

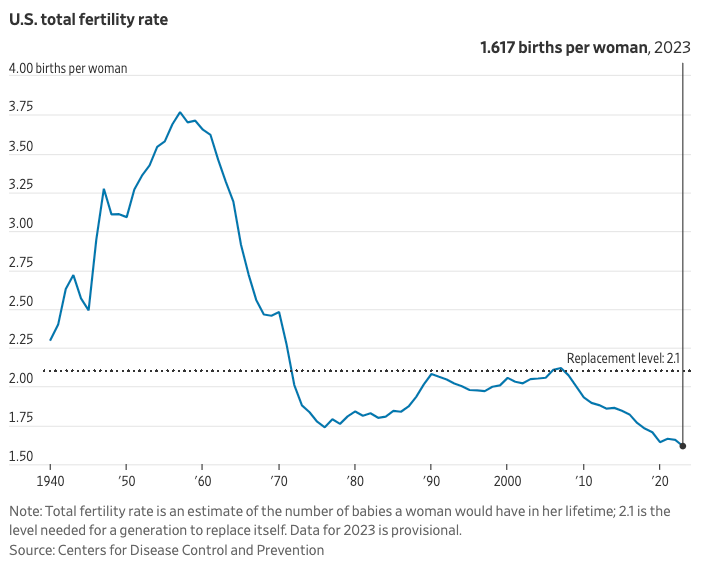

America’s declining total fertility rate peaked at 3.75 births per woman after World War II and has since collapsed to about 1.617, well below the replacement rate of 2.1.

A nation without children is a nation without a future. The intersection of deaths exceeding births per year now appears imminent.

With the total birth rate well under the level of replacement since 2007, it might be argued this is why the Biden administration has facilitated the greatest illegal alien invasion the US nation has ever seen? We can only hope?

RESEARCH

YELLEN’S ELECTION YEAR BAZOOKA

-

- Yellen faces the rising need to:

- Offset the Fed’s need for rates to be “higher for longer” to enable ongoing fight against inflation, while at the same time –

- Pump liquidity into the system through the Treasury General Account.

- Yellen now has nearly $1 trillion in the TGA, but minimally $208B additional cash available as a potential “risk-on” catalyst for equities and broad assets to bridge markets fighting higher rates until the election ballots are cast.

- THIS IS POTENTIALLY LARGE ENOUGH TO TRIGGER A SHORT SQUEEZE IN THE BOND MARKETS (Falling Bond Yields, Rising Bond Prices, Rising Dollar, Weaker Precious Metals).

- Yellen faces the rising need to:

2024 Q1 EARNINGS

-

- When Commercial Services becomes the Earnings & Revenue Leader, it confirms what you need to know about Earnings Season. Both are measured in Nominal versus Real terms. The largest increase currently in Inflation is SERVICES.

- NOMINAL RESULTS = REPORTED RESULTS.

- Real results are not reported BUT that is what you get to spend (after taxation payments) on the investment risk you took!

- On a risk adjusted basis, after tax and then adjusted for inflation – are you really getting the return you think??

- When Commercial Services becomes the Earnings & Revenue Leader, it confirms what you need to know about Earnings Season. Both are measured in Nominal versus Real terms. The largest increase currently in Inflation is SERVICES.

DEVELOPMENTS TO WATCH

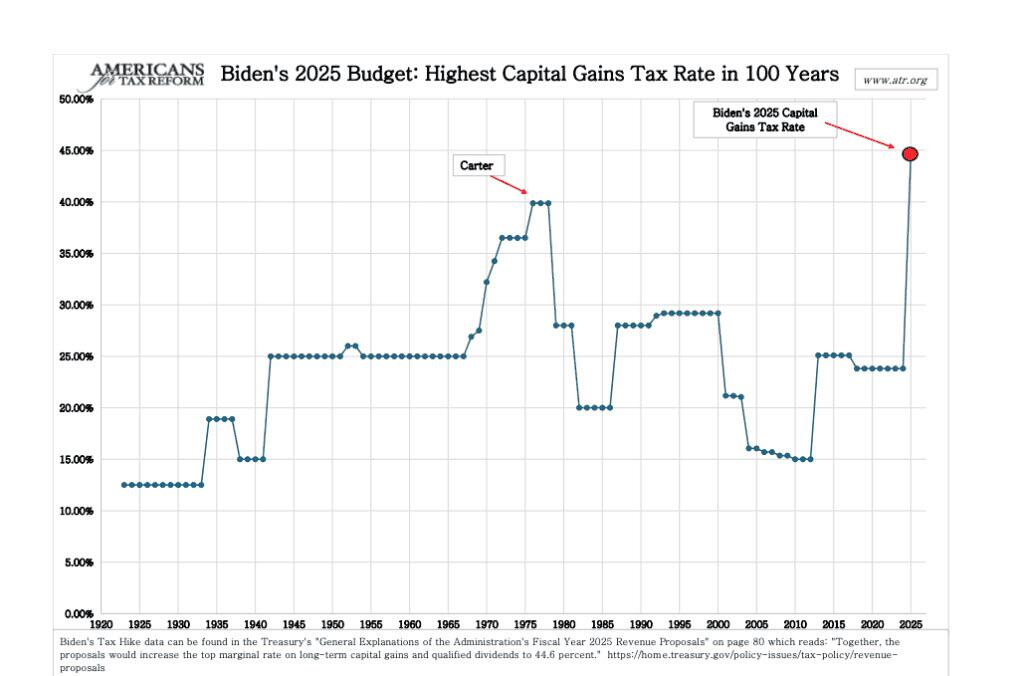

44.6% CAPITAL GAINS PLUS TAXING UNEARNED CAPITAL GAINS?

44.6% CAPITAL GAINS PLUS TAXING UNEARNED CAPITAL GAINS?

Biden’s 2025 budget calls for about $5 trillion in tax increases over the next decade. Here are a few of the ways:

-

- Increase Capital Gains Tax to 44.6%

- Increase Corporate Tax Rate to 28%

- Tax Unrealized Capital Gains for the first time in US history

- Repeal President Trump’s 2017 Tax Cuts and Jobs Act

YELLEN’S OWN US TREASURY BUYBACK PROGRAM??

-

- Why rely on the Fed for a QE Program? Yellen sees the US Treasury having its own program!!

- The first Treasury buyback program in more than 20 years has already conducted limited buyback tests this month and indicated that it will announce the date of its first regular operation as part of next Wednesday’s quarterly refunding announcement.

- “Dealers have noted that they expect robust participation in operations that occur in the late morning or early afternoon, with several suggesting that timing of auctions should be taken into account and conducting buybacks leading [up to] an auction would be helpful.”

GLOBAL ECONOMIC REPORTING

DURABLE GOODS ORDERS – Watching the Core!

DURABLE GOODS ORDERS – Watching the Core!

-

- Below the headline number and quite problematic is Core Capital Goods Shipments. This is used to help calculate equipment investment in the government’s gross domestic product report. It saw only a small 0.2% MoM rise. This left core shipments down 1.2% YoY – the biggest YoY drop since the COVID lockdowns.

Q1 GDP – 3 Sigma Miss With Lowest Print In 2 years

-

- US GDP unexpectedly collapsed to just 1.6%, down more than 50% from the Q4 print of 3.4%, the lowest print since Q2 2022 when the US underwent a brief technical recession.

- The GDP Deflator (price index) came in at 3.1%, hotter than the 3.0% expected and almost double the 1.6% in Q4.

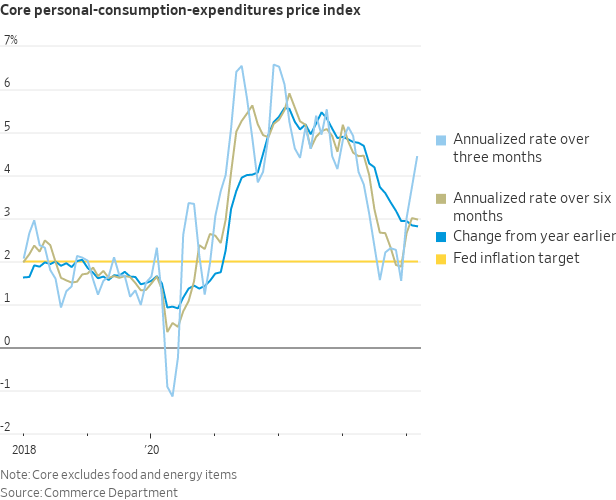

- Worse, the all important core PCE for Q1 soared from 2.0% to 3.7%, blowing away estimates of 3.4%, (we will get a more accurate core PCE print tomorrow for the month of March) and suggesting that the US is about to not only not pass go and overshoot soft-landing island completely, but crash-land straight into a stagflationary recession.

CORE PCE PRICE INDEX

-

- The closely watched 3-Month annualized core PCE jumped to 4.4%.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.