MACRO – US

MONETARY POLICY

TRUE MONEY SUPPLY & THE RATE OF CHANGE OF LIQUIDITY

OBSERVATIONS: COMMODITIES ARE THE FIRST CASUALITIES OF GLOBAL CONFLICT

EXPANDING THEATERS & ESCALATION OF GLOBAL CONFLICT

We are presently witnessing:

-

- ISRAEL v HEZBOLLAH, HAMAS, HOUTHIS

- ISRAEL v IRAN – Waiting on Iran’s Promised Retaliation for the Killing of Hamas’s political leader Ismail Haniyeh

- RUSSIA – UKRAINE – Incursions now into Russian Crimea

- NORTH KOREA + RUSSIA (Jointly supplying arms to Iran)

- SOUTH CHINA SEA & NATO EXPANSION – Canadian and other NATO Warships “patrolling” South China Sea

- NATO EXPANSION – To Include East Asian countries such as South Korea, Australia, New Zealand. New military alliances between Philippines, South Korea & US

- CHINA PREPARATION FOR CONFLICT – Recent 5 Year Plenary focused on “Fortress China” in preparation for threats of global conflict

- FACTIONS SUCH AS HOUTHIS ARMED WITH POWERFUL DRONES & MISSILES

BLOCKAGES, DISRUPTIONS LEAD TO SCARCITY

This occurs as a result of:

-

- Trade Conflicts, Tariffs and Currency Wars

- Global Shipping Choke Points

- Strategic Materials for Conflict & Warfare

COMMODITIES THE FIRST CASUALITIES OF CONFLICT

- COMMODITIES (Energy & Food)

- PRECIOUS METALS (Gold & Silver)

-

- CENTRAL BANK GOLD BUYING: Now broad based.

- PAPER ASSETS: As the Russians recently found, paper assets can easily and arbitrarily be confiscated. Therefore, gold will become necessary for them to trade. Gold means they don’t have to trust one another. Either that or they will go back to barter, which is both costly and inconvenient.

HISTORY

-

- Since the days of the Bible, war has included burning crops, cutting down the enemy’s orchards, and even salting the fields where grain grows. That’s unlikely to change. Battles are won by soldiers; wars are won by controlling resources and commodities.

- Japan is a classic example. The country has no hydrocarbons, no metals, and few resources of any kind. When the US cut off their oil and steel supplies in 1941, they felt war, however risky, was the only their alternative.

TRADE & ASYMMETRIC / PROXY WARFARE

-

- TRADE WARS: Most countries don’t produce much of anything locally anymore. The world turns on trade. If you cut off trade—a prime strategy during war—both exporting and importing countries are likely to suffer an economic collapse, or worse.

- Supply lines are now both highly complex and critically important to winning. And very easily cut with today’s military technology.

- ASYMMETRIC & PROXY WARFARE: Doubtful (I hope) that is not Kinetic (Armed Conflict), but rather Asymmetric Warfare as I outlined in the 2020 Thesis Paper “Global Conflict”.

- TRADE WARS: Most countries don’t produce much of anything locally anymore. The world turns on trade. If you cut off trade—a prime strategy during war—both exporting and importing countries are likely to suffer an economic collapse, or worse.

-

-

- CYBER: The whole world runs on computers. Computers control utilities, transport, the banking system, communications, commerce, distribution and everything else. If computer networks are massively hacked it could collapse civilization. The result could be mass starvation after a couple of weeks.

- BIOLOGICAL: And, of course, there’s a real possibility of biological warfare. If any of these things happen, it increases the odds of all of them happening.

-

FINANCIAL ADVANTAGE

-

- COUNTRIES ALREADY FINANCIALLY BROKE (Debt & Tax Levels):

- Along with unsupportable debt, and high levels of currency debasement, taxes are already at the 40%, 50% or 60% level for most countries. Before World War I and even before World War II, taxes, inflation, and debt were only a tiny fraction of present levels. Governments could access huge resources. Even though the world is much richer, it hardly seems possible now. They’re already running on empty.

- US can barely afford support of Ukraine or Israel

- COUNTRIES ALREADY FINANCIALLY BROKE (Debt & Tax Levels):

-

- CURRENCY DEBASEMENT: Governments have debased their currencies to finance their wars. Prices of commodities always rise, with prices for war material leading the way.

WHAT YOU NEED TO KNOW!

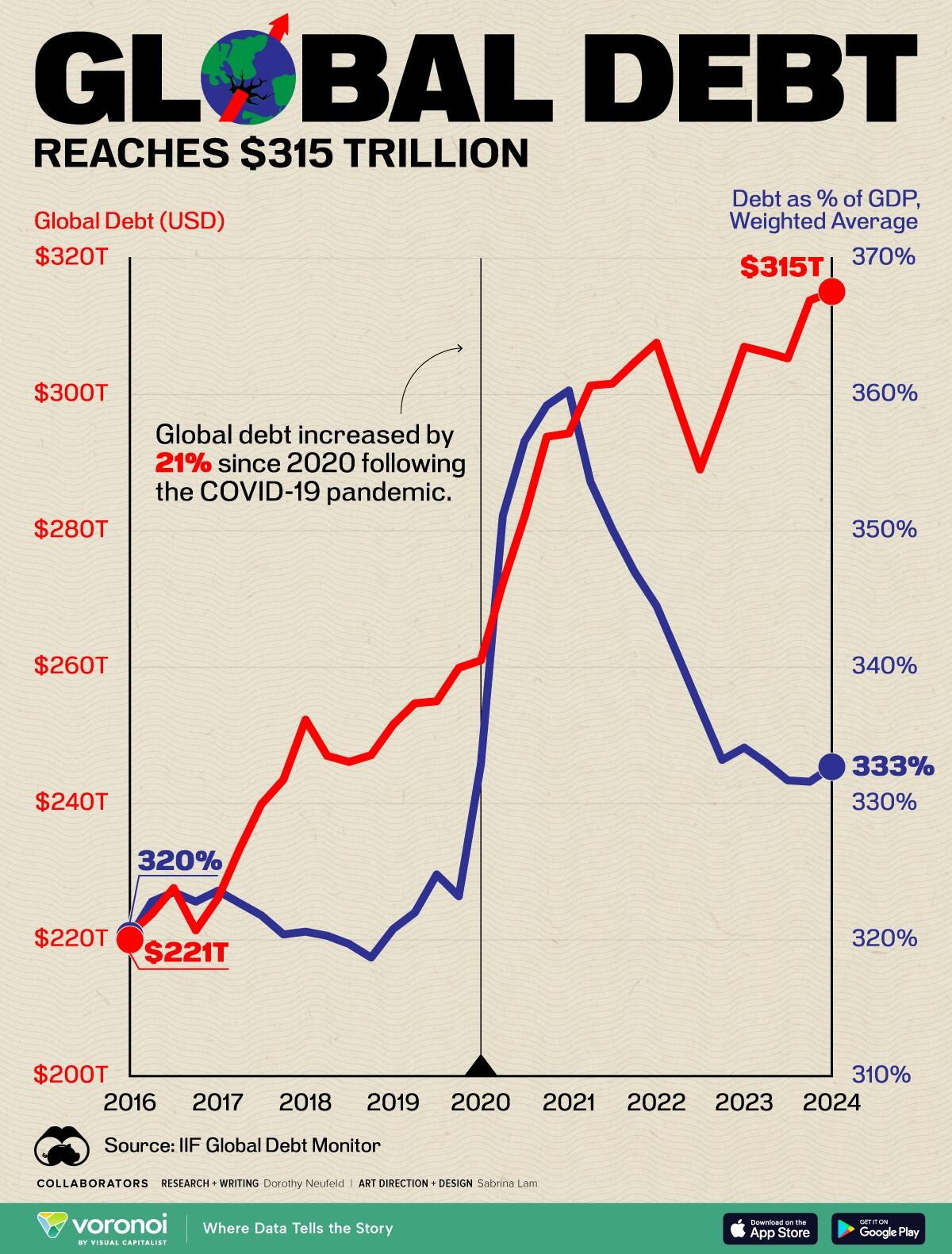

EXPLODING GROWTH OF GLOBAL DEBT

EXPLODING GROWTH OF GLOBAL DEBT

Global debt hit a new record in the first quarter of 2024, increasing by $1.3 trillion in just three months. While the U.S. and Japan were the largest contributors across advanced economies, China, India, and Mexico drove the largest share in emerging markets. Overall, the global debt-to-GDP ratio reached 333% as higher debt servicing costs and growing debt burdens continue piling up.

SINCE THE PANDEMIC debt has surged by 21%, adding $54.1 trillion to the global total. Today, the largest share of debt is held by non-financial corporations, at $94.1 trillion, while government borrowings follow closely behind at $91.4 trillion. Meanwhile, the financial sector holds $70.4 trillion in debt and households carry $59.1 trillion.

While stimulus measures fueled an influx of borrowing, it is leaving many economies in a more precarious state. Even more concerning is about a third of emerging markets have not recovered from the pandemic, with per capita income standing beneath levels seen in 2019. Over the quarter, debt held by emerging markets hit a record $105 trillion, climbing by $55 trillion over the last 10 years.

RESEARCH

TRUE MONEY SUPPLY (TMS) & RATE OF CHANGE OF LIQUIDITY

-

- The True Money Supply (TMS) tells us the key measure of Buying Pressure within the market.

- The trend now signals liquidity drying up. There may not be a recession, but monetary buying pressure is slowing down markedly. The tap is not closed, but the flow is now slow.

- The next wave of monetary excess will be more aggressive than the past one, that is guaranteed.

- That means markets will soar again. However, timing is key… and it may take a few painful months to arrive.

CONSEQUENCES OF A 3% INFLATION REALITY

-

- It takes a rate of US debt growth equal to twice the growth of needed nominal GDP.

- Assuming a target 3% REAL growth with 3% INFLATION (from above), it will require ~6% Nominal Growth.

- That will require (an expanding) ~12% growth rate in the US National Debt.

- That rate of growth in the national debt will likely mean it will be nearly impossible to keep Inflation below 3%!

DEVELOPMENTS TO WATCH

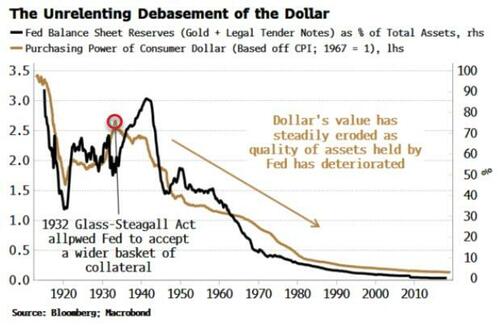

THE PATH TO FIAT CURRENCY EXTINGUISHMENT

THE PATH TO FIAT CURRENCY EXTINGUISHMENT

-

- The BOE’s new system moves away from excess reserve creation that is governed by the supply of government debt to one based on banks’ demand for reserves through repos. There lies the rub. The BOE is shifting away from a lender or dealer of last resort to one of first resort.

- This matters as it will inevitably lead to the BOE holding collateral of poorer quality than government debt outside of crises or their aftermath.

- The normalization of central-bank balance-sheet deterioration, and the banking and credit system’s zeal for creating collateral of poor or opaque quality (e.g. private credit), ensure fiat currencies will continue to bear the burden of asset-value depletion, with their real values facing years of further and unrelenting debasement.

KAMALA HARRIS’ ECONOMIC PLAN FOR “LOWERING COSTS FOR AMERICAN FAMILIES”

-

- Highlights included:

- Price Controls to crack down on ‘corporate price-gouging’ in the food and grocery industries.

- A $25,000 subsidy for first-time home buyers, under which those who have a two-year history of on-time rent payments, would be eligible for “down-payment support”

- A cap on prescription drug costs

- The elimination of medical debt for millions of Americans

- Child tax credit that would provide $6,000 per child to families for the first year of a baby’s life

- Highlights included:

GLOBAL ECONOMIC REPORTING

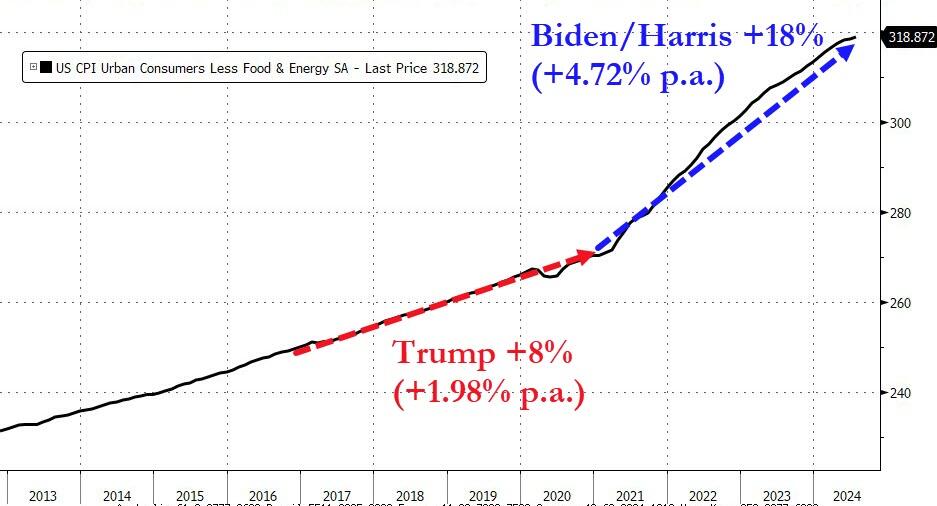

US CPI/PPI

US CPI/PPI

-

- CPI data was primarily in line with expectations, although when rounded, the numbers are a touch on the soft side. Headline CPI rose 0.155%, vs. the 0.2% expectation and prior -0.1%, with the Y/Y rising 2.9%, a touch beneath the 3.0% forecast and prior. Core metrics saw the M/M rise 0.165% vs. the 0.2% forecast and prior 0.1%. The Core Y/Y rose by 3.2%, in line with expectations and a touch beneath the prior 3.3%.

- Overall, the PPI data was cooler than expected. Headline PPI rose 0.1% M/M, beneath the 0.2% forecast and easing from the prior 0.2% pace with the Y/Y rising 2.2%, beneath the 2.3% forecast and down from the prior 2.7% (revised up from 2.6%). The Core metrics were also soft, with the headline unchanged at 0.0% M/M (exp. 0.2%, prev. 0.3%revised down from 0.4%), with Y/Y rising 2.4%, down from 3.0% in June and beneath the 2.7% consensus. It was also softer than all analyst forecasts with the lowest forecast penciling in 2.5%.

RETAIL SALES

-

- Retail Sales soared in August… thanks to massive historical revisions and a surge in Auto sales… but Auto production crashed by the most since COVID lockdowns (lowering GDP expectations)… and homebuilder sentiment slumped… and the Philly Fed business outlook plunged… and the Empire Fed Manufacturing survey remains in contraction for the 9th straight month… and import and export price inflation was hotter than expected… all of which sent the macro surprise index down to 2024 lows.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.