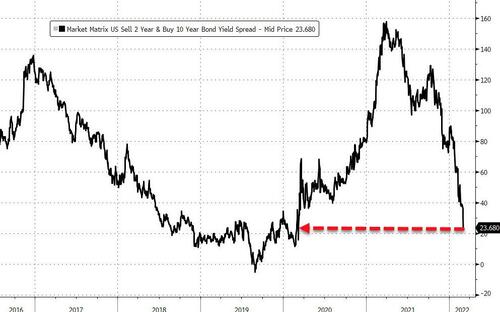

The US administration has chosen to restrict the US policy prescription for stopping Russian aggression and the slaughter in the Ukraine to the long term, and likely ineffective use of economic sanctions.

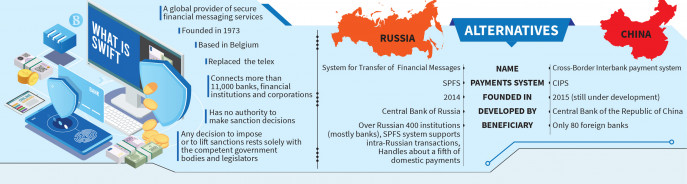

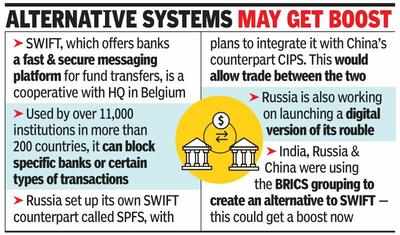

Russia, China, Iran and North Korea are well prepared for and fully expecting Sanctions to be the first policy reaction of the US. The use of sanctions has been used for over a decade as the US has effectively weaponized the US dollar through economic sanctions. The primary response of the US and G7 of removal of Russia from the SWIFT System is almost laughable, since the alternative Chinese CIPS System has quickly become a defacto alternative as a barrier to US economic sanctions.

SANCTIONS: A POTEMKIN FACADE

RUSSIA PREPARED FOR INCREASED SANCTIONS

-

- SPFS + CIPS.

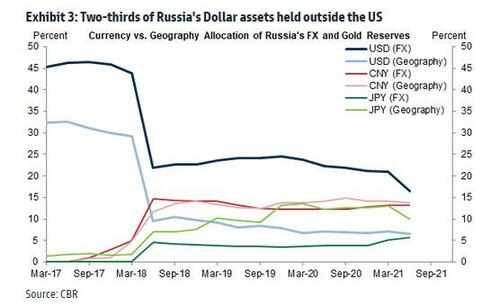

- Russia sold ALL of its US Treasury Holdings in 2018.

- Russia moved its financial assets to Gold Reserves, Liquid Non-Dollar Short Term FX Holdings, Domestic holdings and aligned BRIC sovereign countries.

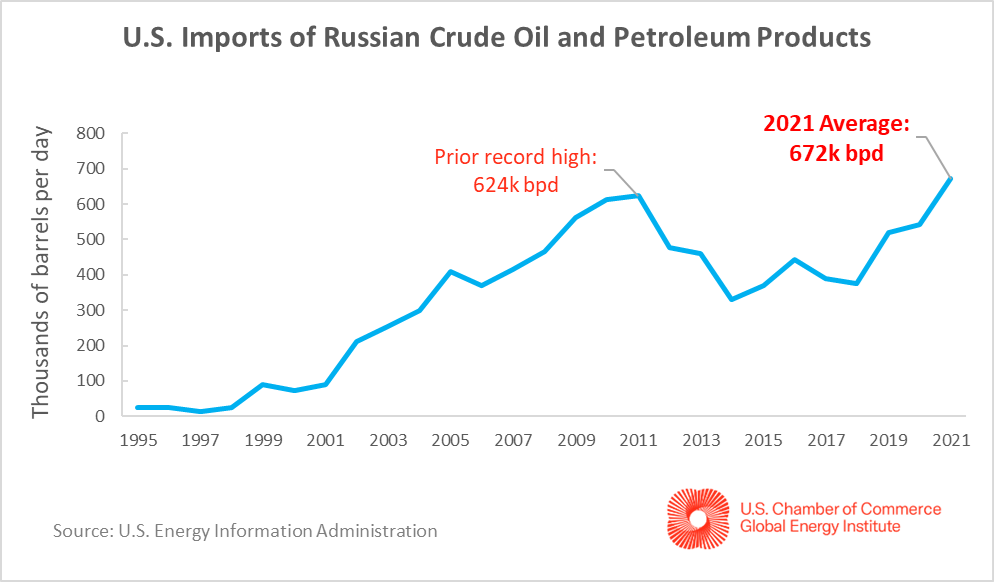

- Established European Dependency on Russian Energy Flows.

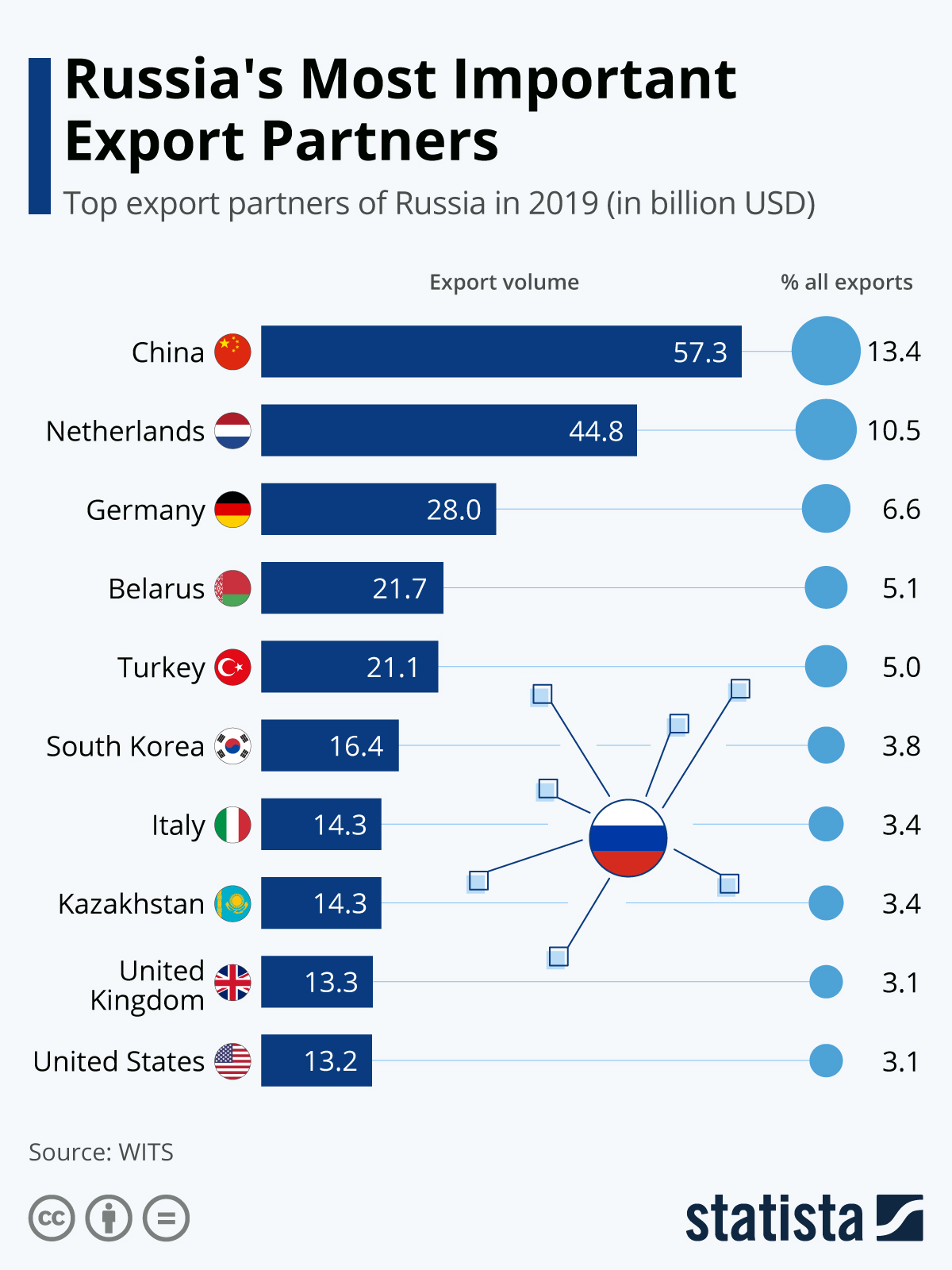

- Established trade relations with countries limiting trade exposure to the US and its Weaponization of the US Dollar.

1- SPFS + CIPS versus SWIFT + CHIPS

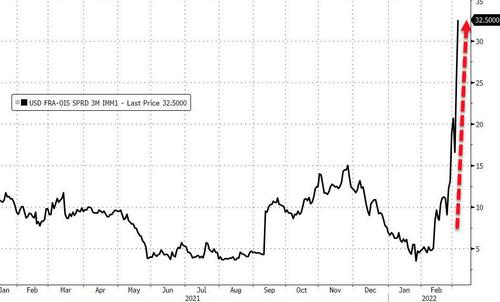

The move by the US, the UK and the EU to cut some Russian banks’ access to SWIFT accelerates the usage of China’s rival CHIPS as a payments system for global trade and finance, and thereby reduce the international clout of SWIFT and the dollar.

SWIFT & CHIPS

- The Society for Worldwide Interbank Financial Telecommunication, or SWIFT, is a global messaging system that relays instructions from one bank to another. Based in Belgium and overseen by the central banks of a Group of 10 countries, SWIFT was established in 1973 connecting about 11,000 financial institutions around the world. It is not a payment system as such, but a secure platform to communicate cross-border payment instructions among banks. At present, SWIFT is used by 200 countries and territories.

- On the other hand, CHIPS or the Clearing House Interbank Payments System, is a 43-member private club of financial institutions. Members of CHIPS settle $1.8 trillion in claims every day with the help of a pre-funded account at the Federal Reserve. CHIPS is subject to US law.