US MACRO

MONETARY & FISCAL POLICY

UNDERSTANDING THE US CREDIT DEFAULT SWAP – US TREASURY CORRELATION

OBSERVATIONS: CLOSELY WATCHING THE FED’S DECISION ON QUANTITATIVE TIGHTENING (QT)

The Fed pays interest on Bank Reserves and on Reverse Repurchase Agreements to prevent interest rates from plunging. That’s how the Fed controls the Federal Funds Rate and maintains it at ~5.5% in its current fight against Inflation. The level of Liquidity in the financial markets is affected by changes in the amount of funds held in Bank Reserves, Reverse Repos and the Treasury General Account (TGA). Liquidity is created and destroyed through Quantitative Easing and Quantitative Tightening. It is Quantitative Tightening, not government borrowing, that is draining Liquidity out of the financial markets at the rate of $95 billion a month. Therefore, it is QT, not budget deficits, that TRADERS (versus Investors) need to currently worry about.

The last time the Fed carried out Quantitative Tightening (from October 2017 to September 2019), it went too far and destroyed too much Liquidity causing a crisis in the Repo market in September 2019, which forced the Fed to abruptly end QT. The Fed hopes to avoid making that mistake again this time. All three component parts of the Core Personal Consumption Price Index are slowing rapidly (with Core Goods Prices actually deflating). These trends suggest Inflation will soon fall back to the Fed’s 2% target and support the idea that interest rate cuts and a reduction in the pace of Quantitative Tightening are on the horizon.

Therefore, the Fed is very likely to end QT before the point where Liquidity becomes too tight. The Fed has already begun to publicly discuss plans to slow the pace of QT. We’ll hear more about that at the Fed’s next FOMC meeting in March. Stock prices are likely to react positively to any news suggesting that the pace of QT will be reduced, just as stock prices are likely to react positively every time the Fed reduces the Federal Funds Rate this year, (by paying lower interest on Bank Reserves and Reverse Repos).

With rate cuts and less Quantitative Tightening on the horizon, the outlook for the stock market appears promising during the months ahead. Of course, many things could go wrong. Anything that causes Inflation to reaccelerate would turn this rosy scenario on its head by forcing the Fed to tighten Monetary Policy instead of loosening it. For instance, unexpected rapid economic growth in the US could drive up Demand and push Inflation higher. Likewise, a new war or anything that causes new disruptions to global supply chains could reduce Supply and push Inflation higher.

FEELING LUCKY?

Investing is always a gamble. Based on what we know now, the odds appear favorable but they are continually changing. Investment strategies must take into consideration that unforeseen developments can turn a favorable environment into a very unfavorable one in an instant.

WHAT YOU NEED TO KNOW!

WHERE 52.6% OF US JOB GROWTH IS OCCURRING

According to the US government’s own data, over half the job growth in 2023 were government, the new social assistance category, and health care jobs. Cities across America are struggling to keep up with migrants as the associated overwhelming costs are soaring out of sight. Hospitals are being pushed to the breaking point (here, here) as they are forced to deliver services to those who can’t or don’t pay. Studies show that

According to the US government’s own data, over half the job growth in 2023 were government, the new social assistance category, and health care jobs. Cities across America are struggling to keep up with migrants as the associated overwhelming costs are soaring out of sight. Hospitals are being pushed to the breaking point (here, here) as they are forced to deliver services to those who can’t or don’t pay. Studies show that

minimally, well in excess of the documented $100B in non-budged cost have been forced onto state and local budgets (here). I personally don’t recall voting for this while continuously being told the border was secure and then handed the bill. We had the same problem in 1773 when we had the Boston Tea Party over “Taxation Without Representation”!

RESEARCH

UNDERSTANDING THE US CREDIT DEFAULT SWAP – US TREASURY CORRELATION

-

- When assessing the amount of a government’s debt held by the public, it is customary to measure it relative to GDP. GDP serves as a rough proxy for the economy’s tax base—that is, its capacity to pay back the debt. ( i.e. default risk),

- With the US Debt of +$34T, it suggests we can expect the US debt growth in 2024 to be in excess of $2.55T, assuming the Deficit can be kept to -$1.7T. This is completely unsustainable!!

- We have been witnessing an unexpected collapse in government receipt, which according to the latest budget statement, are down a staggering 6.2% Y-o-Y

PLUMMETTING 2024 TAX RECEIPTS

-

BEST CHANCE OF US DEBT CONTROL

- PRODUCTIVITY: New technological advances, such as artificial intelligence, could fuel a productivity-led boost to long-run economic growth.

- RE-ESTABLISH US AS AN “ASSET SAFE HAVEN”: Events abroad could also increase the foreign demand for U.S. Treasury notes as a safe asset, helping to stave off projected increases in long-run U.S. interest rates.

- ENTITLEMENTS REVAMP: A complete re-evaluation of US entitlement programs – Social Security, Medicare, Disabilities and a multitude of other Social Programs

Q4 2023 EARNINGS SEASON:

-

- Earning projections reflect the increased optimistic outlook of the “Sell Side” analysts with their traditional year-end “Hockey Stick” for earnings.

- MATASII is not in that camp and believes earnings will turn out to be closer to being a much lower Q4.

- A Recession is ahead and it will be a “Hard Landing” with Increasing layoffs, loan default and bankruptcies increasing into the the US Presidential Election. It will likely only explode on the scene in 2025 when the Presidential year liquidity pumping finally ends!

DEVELOPMENTS TO WATCH

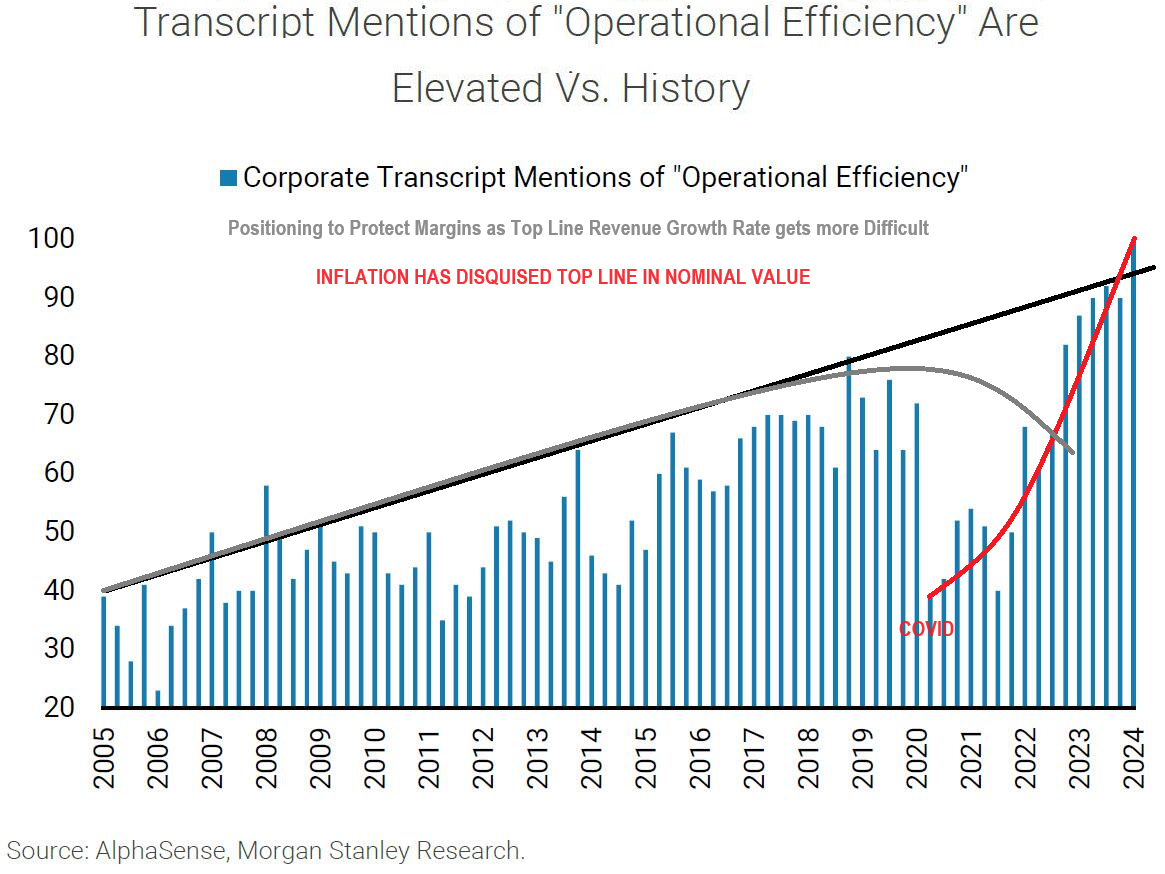

OPERATIONAL EFFICIENCY = LAYOFFS + AI

OPERATIONAL EFFICIENCY = LAYOFFS + AI

-

- The annual US Budget Gap widened a further 16% in the first four months of the 2024 government’s fiscal year as debt-servicing costs climbed further.

YET ANOTHER MASSIVE FEDERAL BUDGET OVER-RUN, WITH DEFICIT GROWTH

-

- Transcript mentions of “operational efficiency” are at highest ever in the US during this earnings season as companies focus on expense discipline, but also invest in technologies “that can drive future productivity like AI”.

- Most prevalent are: 1- Software, 2- Professional Services, 3- Health Care Services, and 4- Financial Services.

GLOBAL ECONOMIC REPORTING

JANUARY CPI: CPI is up 18% during the Biden Administration. The re-acceleration of inflation means wage growth is back in the red relative to prices.

-

- Overall, the inflation report for January was hotter than expected on all accounts and has pushed back money market pricing on rate cuts.

- The March rate cut probability has largely diminished while May is sub 50% with June fully priced for the first 25bp rate cut.

- The hot report, coupled with a strong January jobs report, shows the final stretch of the Fed’s fight to return to the 2% inflation target will likely be bumpy and uneven, and arguably the hardest part of the fight.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.