US MACRO

MONETARY & FISCAL POLICY

THE FED FUNDS RATE IS EFFECTIVELY ALREADY FALLING!

OBSERVATIONS: THE TARNISHED “MADE IN AMERICA” BRAND

I spent a lot of years earlier in my career involved in Manufacturing and Global Supply Chains. I have written in these pages on why I strongly feel Re-Shoring and De-Risking is a strategic imperative for the US. I believe that US Manufacturing superiority is in dire straights! Though I see the evidence almost daily, it again resonated with me when I read of Boeing’s relentless problems and the potential takeover of the once great US Steel. What are they telling us?

GREAT AMERICAN BUSINESSES: Boeing and US Steel

Boeing’s reputation is collapsing before our eyes from blatantly poor product and process quality problems. This once great “Made in America” brand now means nothing! It is perceived as reflection of the situation of US manufacturing capabilities overall!

US Steel is being taken over because it simply has lost its competitiveness due to US public policy having become almost predatory in its power generation & environment laws.

PRIMARY DRIVERS FOR OFFSHORING REMOVED

The reason that over 52,000 US manufacturing facilities left America after China entered the WTO in 2002 was primarily due to Chinese labor cost advantages and lower taxation. That is no longer the case. Chinese labor costs have soared. To compete it is about automation, which makes manufacturing Capital intensive – not labor intensive. US has the advantage here! Additionally, US corporate taxation is not what it used to be. The reasons that drove the offshoring wave have reversed!

The problem is that issues that were “annoying” 20 years ago are now show stoppers for investing in Manufacturing in the US.

SECONDARY FRUSTRATIONS GOT WORSE, MUCH WORSE!

-

- Unproductive Regulations [Got Much Worse!]

- Rule of Law: The safety of its employees and of business investment [Has Become a Problem from an Advantage]

- Business Friendly & Stable Government (Regime change, socialist threat) [Has become a Major Concern]

- Labor Pool: Union demands & worker expectations [College grads want nothing to do with this type of work.]

All these problems are fixable (like the US Fiscal Deficits), but it takes leadership, willingness to act and time. None of which we seem to have any of! The US is the Banana Republic of old that manufacturing investment avoided at all costs!!!

WHAT YOU NEED TO KNOW!

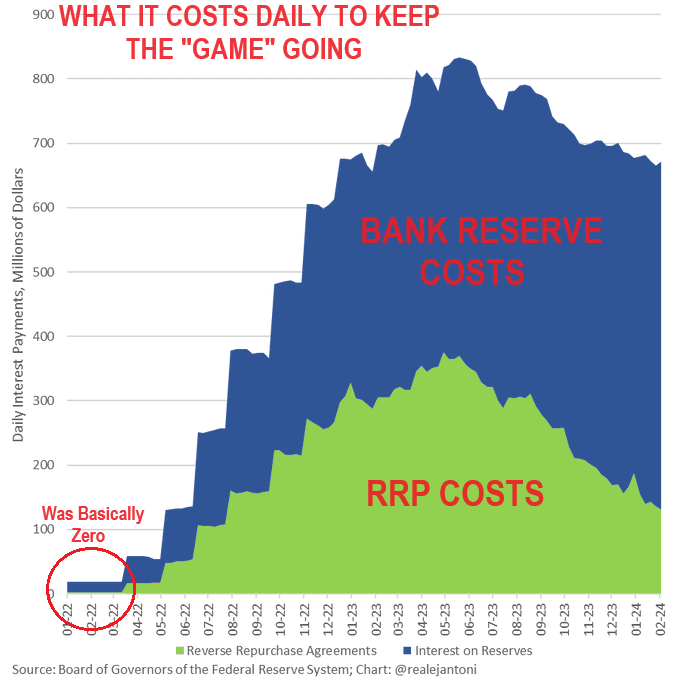

WHAT IT IS CURRENTLY COSTING THE FED TO KEEP THE “GAME” GOING!

WHAT IT IS CURRENTLY COSTING THE FED TO KEEP THE “GAME” GOING!

The Federal Reserve is paying out $670 MILLION DAILY on interest payments to try and hold the system together. Even if the Fed’s Reverse Repo account (RRPs) goes to zero, the money basically simply goes into bank reserves, which the Fed also pays interest on. Therefore, interest payments are here to stay unless Fed sells another $4.5 trillion off its balance sheet. This is hardly likely with QT soon to end and the Fed’s balance Sheet to once again explode higher in the coming years.

REMEMBER: The Fed now paying interest on Bank Reserves and Reverse Repos is by far the main factor affecting market-determined interest rates.

RESEARCH

THE FED FUNDS RATE IS EFFECTIVELY ALREADY FALLING!

-

- UNDERSTANDING WHY: Equities are RISING while Bonds are FALLING (Yields Rising)???

- Loosening Financial Conditions (as is to be expected) is now fostering a rise in Global Growth.

- Yields and yield curves therefore need to re-rate higher to reflect stronger nominal growth and a resurgence in global inflation.

- We need to understand that it is Forward rates (lower now due to the market expecting multiple rate cuts) PLUS Financial Conditions, which have eased significantly and is thereby providing the totality of the policy rate’s impact.

- Global central banks reached their peak rate restrictiveness last summer when banks in the aggregate stopped hiking, then some started cutting.

- As of February 1, 2024, the Federal Reserve Bank of Atlanta’s GDPNow model estimates real GDP growth at 4.2% for the first quarter of 2024. This is an increase from the 3.0% estimate from January 26, 2024.

SELLING US DEBT SOON TO BECOME A SYSTEMIC PROBLEM!

-

- In 2024 the US has $8.9 TRILLION in existing debt needing to be refinanced (“roll overed”). This is in addition to the expected $1.7 TRILLION 2024 fiscal deficit.

- There is now ~$224T of existing foreign debt that will also have rollover requirements in addition to the increases in global government, corporate and household debt, which are growing dramatically.

- The big problem facing the US is that foreign buyers have been steadily reducing their lending to fund US government debt due to De-Dollarization and shrinking growth rates of available FX reserves.

- With the rate of increase of the US Debt it is quickly becoming a matter of both sufficient lending volumes and at what rate?

Q4 2023 EARNINGS SEASON:

-

- S&P 500 Forward P/E Ratio Rose Above 20.0 For First Time in 2 Years.

- Percentage of Companies Beating EPS Estimates (75%) is Below 5-Year Average.

- Earnings Surprise Percentage (+3.8%) is Below 5-Year Average.

- Market Rewarding Positive EPS Surprises More Than Average.

- Percentage of Companies Beating Revenue Estimates (65%) is Below 5-Year Average.

- Revenue Surprise Percentage (+1.2%) is Below 5-Year Average.

- Financials: Banks Industry Leads Year-Over-Year Decline.

DEVELOPMENTS TO WATCH

WHAT DO HISTORIC MARKET EXTREMES ACTUALLY TELL US?

WHAT DO HISTORIC MARKET EXTREMES ACTUALLY TELL US?

-

- Equity Risk Premium (ERP)

- PE Ratios

- Velocity of Money

EXTREMES INDICATE WE ARE CONFUSED BY

WHAT IS HAPPENING!

US FISCAL POLICY: THE PROBLEM IS SPENDING

-

- The US Fiscal Deficit problem isn’t a lack of revenue, but rather the relentless growth of government.

- Congress has refused to do real budgeting for too long. America can’t afford for its leaders to sleepwalk their way to a national bankruptcy. It’s time to get serious…

- In case you haven’t figured it out yet, Congress has the sole purpose of keeping US spending GROWING at the current trend rate (or greater).

GLOBAL ECONOMIC REPORTING

-

- The US ISM Services PMI in January was hot.

- The headline rose to 53.4 from 50.5, above the expected 52.0, and above the upper end of the forecast range of 53.2, while prices paid surged to 64.0 (prev. 57.4), the highest since February 2023.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.