US MACRO

MONETARY & FISCAL POLICY

TREASURY REFUNDING DURING AN ELECTION YEAR’S DEFERRED DEBT CEILING WINDOW

OBSERVATIONS: THE TWO AMERICAS WE LIVE IN – PART II

Last week I shared with you some facts on the “Disconnected Elite” that originated from statistics produced by the polling firm Rasmussen Research. It appears I was not the only person intrigued by the research as former US House Speaker Newt Gingrich, having delved into the research, also interviewed Scott Rasmussen. This is important research as it makes it clear what is propelling the US into what many sense is an era of confusion and seeming chaos and social disconnect.

We now have a tiny group of elitists who control what Vladimir Lenin called “the Commanding Heights,” where the elements of power control the rest of us. Rasmussen is now calling, what I previously referred to as the “Disconnected Elite”, THE ELITE 1 (for Top 1%). These are people who can be defined as:

-

- Have Graduate Degrees (not just graduate studies)

- Family incomes above $150,000 a year

- Lived in large cities (more than 10,000 people per zip code)

- The most radical of the Elite 1 percent were educated at what Rasmussen calls the “Dirty Dozen: ” Harvard, Yale, University of Pennsylvania, Northwestern, John Hopkins, Columbia, Stanford, Berkeley, Princeton, Cornell, MIT and the University of Chicago.

Here are some more statistics on this group, which further polling research has brought to light:

-

- The Elite 1 percent are surprisingly young – 67% are between 35 and 54 years old.

- They are 86% white.

- It is the Elite 1 who dominate the universities, news media, judiciary, intelligence agencies, giant foundations and most major corporations.

- Although they are relatively few, they marry each other, their children go to the same schools, and they hire and promote each other.

- Graduates from “Dirty Dozen” universities work and play in the same zip codes. They are an isolated set and create a “power aristocracy” that has no knowledge of the rest of us – and contempt for most of us. (This perfectly explains Hillary Clinton’s “basket of deplorables” line).

Elite 1’s political views further supports this year’s MATASII Thesis Paper outlining the emerging “Regulatory State”:

-

- When all other voters gave President Joe Biden a 41% job approval, the Elite 1 rated him at 82% approval.

- Almost half of them (47%) favor “Sanders-like policies.”

- They are overwhelmingly Democrats (73%).

- While 57% of all voters say there is not enough individual freedom in America, 47% of the Elite 1 say there is too much freedom.

- If you ask the sub-group that is politically obsessed (people who talk politics every day), 69% say there is too much individual freedom in America.

- The Elite 1 have great faith in government. Some 70% trust government to do the right thing most of the time.

- 35% of the Elite 1 (and 69% of the politically obsessed Elite 1) said they would rather cheat than lose a close election.

- Among average Americans, 93% reject cheating and accept defeat in an honest election. 7% of Elite 1 reported they would cheat.

- While only 6% of most voters have a very favorable opinion of members of Congress, 69% of the Elite 1 have a very favorable view (this to me is almost unimaginable!).

- While 10% of all voters have a favorable view of journalists, the Elite 1 percent really like them (71% favorable).

-

- While 17% of all voters have a favorable view of college professors, the Elite 1 just love them (76%). (This tracks, because many of the Elite 1 may be college professors).

- The Elite 1 who graduated from the “Dirty Dozen” deeply believe in government.

- 55% believe there is too much individual freedom in America and that Americans should obey government and follow government leadership.

To illustrate the scale of the gap between the Elite 1 and the rest of the country, consider the Elite 1’s views on climate issues (and understand that these ideas are opposed by 63% to 83% of most Americans).

-

- 77% of the Elite 1 would like to impose strict restrictions and rationing on the private use of gas, meat, and electricity.

- 72% favor banning gas powered vehicles.

- 69% favor banning gas stoves.

- 58% favor of banning sport utility vehicles.

- 55% favor banning non-essential air travel.

- 53% favor banning private air conditioning.

As Rasmussen noted, the degree to which the Elite 1 think their views represent those of the average American is astonishing.

WHAT YOU NEED TO KNOW!

US MONEY SUPPLY MUST SOON GROW

US MONEY SUPPLY MUST SOON GROW

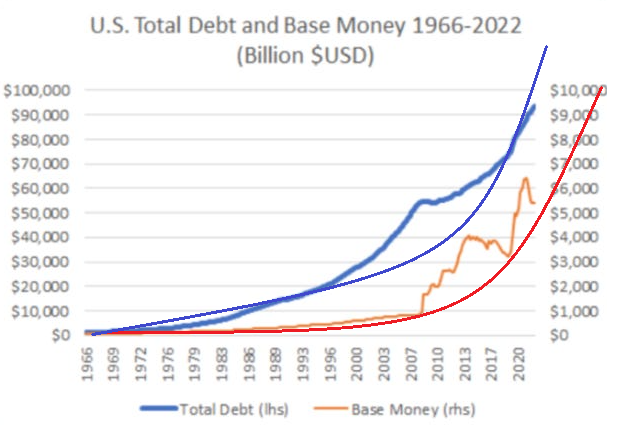

In a heavily indebted US system, the supply of money needs to continually grow or the debt becomes unserviceable. Therefore it is only a matter of time before the Fed will be forced to grow its balance sheet again (i.e. print significantly more money).

The only other option is for Foreigners to buy increasing amounts of US debt. However, that trend is actually trending down with China reducing, Japan buying being flat and other countries experiencing shrinking FX reserves to use to buy US Treasuries with. Therefore the US Money supply may be forced to DRAMATICALLY increase! This would not portend well for the US Dollar in Intermediate to Longer Term!

RESEARCH

TREASURY SECRETARY JANET YELLEN’S ELECTION YEAR SET-UP

-

- It is now clear that a very carefully crafted plan has been executed to give the Administration maximum control over the financial markets during the 2024 election year.

- The “BTFP “arb” has given the Primary Dealers the funding to finance any need the US Treasury may require during the 2024 election year, while at the same time protecting them from the risk of absorbing failed auctions.

- Treasury Secretary Yellen neither took the TBAC advice (normal procedure) nor consulted with the Primary Dealers (standard practice so Dealers are prepared for possible auction failures) in issuing the recent quarterly QRA. This is highly unusual?

- The QRA intentionally falsely set expectations low enough to keep rates lower than they might otherwise be.

- The newly announced use of Treasury controlled Buyback and TIPS procedures (buried in the QRA) will allow the Treasury to more effectively manage election year yield expectations:

- TIPS ISSUANCES can be expected to be used to drive Real Rates higher, assisting in making US debt rates more attractive to foreign carry trade and FX investors.

- BUYBACKS will give the Treasury effectively “QE” like powers while additionally being better able to manage the Yield Curve (with “YCC” like powers).

- Working closely with the BLS (US Economic Reporting), the PPT and the Federal Reserve (BLTP, RRP, Fed Funds Rate) has effectively given Yellen & the administration election year financial leverage.

Q4 2023 EARNINGS SEASON:

-

- If 1.6% is the actual growth rate for the quarter, it will mark the second-straight quarter that the index has reported earnings growth.

- We have a major divergence between the rate of growth of earnings and the rate of increase in stock prices. It is unusual for PE’s to expand when the LEI is signaling a high probability recession lies ahead.

DEVELOPMENTS TO WATCH

BTFP “ARB” STOPPAGE: “Immediate Halt!”

The Fed confirmed in a press release 01-24-24 that its infamous tool to deal with the March 2023 bank-panic and bank-liquidity crisis, the Bank Term Funding Program (BTFP), will cease making new loans to banks, as scheduled, on March 11.

Existing loans can continue for their term of up to one year.

-

- The Fed also said that, “Effective Immediately,” it would shut down the arbitrage with which large Money Center banks had been “gaming” the BTFP.

CONNECTING THE CRE CRISIS <=> BANKING CRISIS: A Global Surprise

THIS WEEK WE WITNESSED:

-

- New York Community Bancorp (NYCB) extended losses well below SVB lows.

- The US Commercial Real Estate (CRE) went global with massive US CRE write downs by Japan’s Aozora Bank.

- Western Alliance Bancorp’s stock got “clubbed” badly.

- Shares of Zions Bancorp, Comerica and Webster Financial tumbled along with Citizens Financial, Regions Financial, SouthState, Prosperity Bancshares, Schwab, PacWest, and Huntington Bancshares.

The goal here is to re-arm the Federal Reserve’s policy arsenal. While the projections of Fed officials for rate cuts in 2024 have been packaged as reflecting the growing strength of the US economy, the reality is that the Fed wants the option to lower rates as a strategic response to looming financial distress.

GLOBAL ECONOMIC REPORTING

-

- JANUARY LABOR REPORT (NFP): The NFP (Establishment Survey) report is now unusable from the distortions being created by new and revised “Seasonal Adjustments”. The Household Survey appears to be the only viable data source.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.