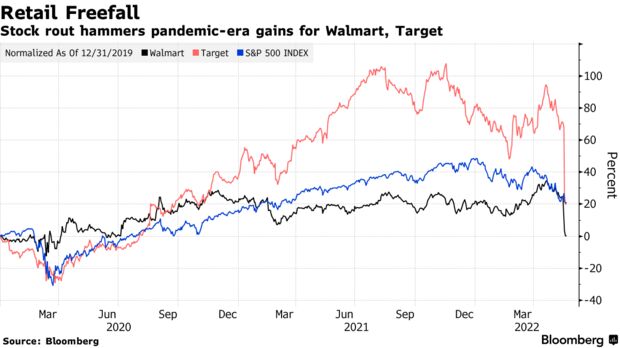

Walmart and Target both said more customers are trading down to cheaper, private-label groceries:

“The NEEDS are squeezing out the WANTS”

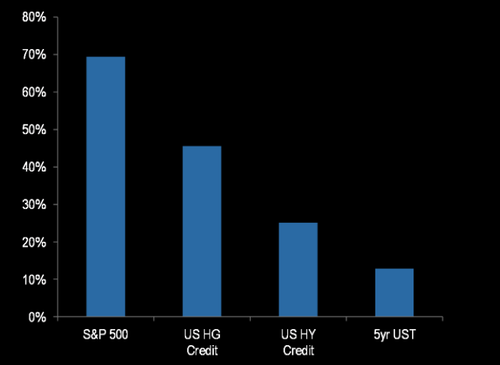

When solid, dull, boring and predictable retail businesses like Target are crashing 25% intraday… that’s as good a time as any to worry. The scale of the market crash is being magnified by the number of folks who’ve been expecting it, but also by algo/computer led sell programs kicking in as the market down-spikes.

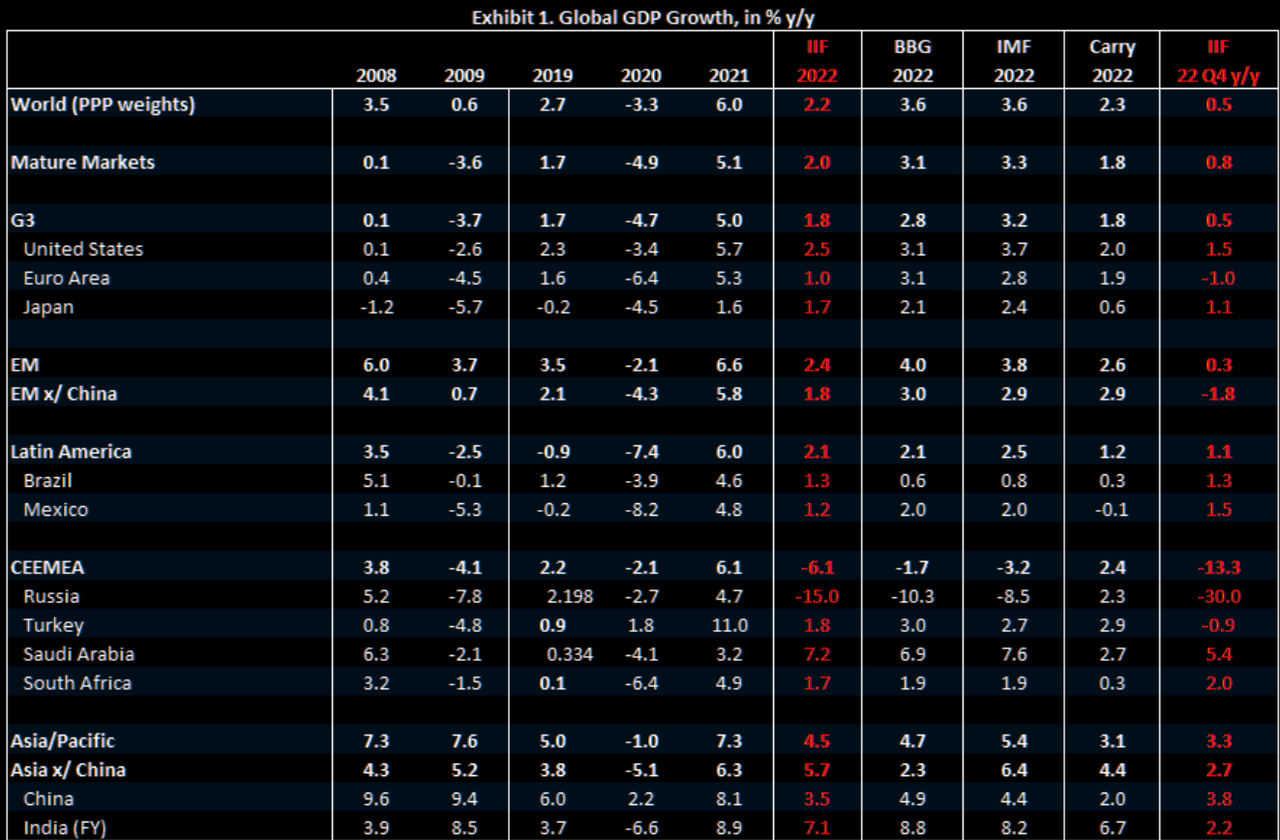

I am shocked the market was “surprised” by supply chain disruptions, rising fuel and freight costs, inflation outstripping wages and crashing consumer confidence impacting numbers at leading retailers. We have been yelling about this in these newsletters for months now!

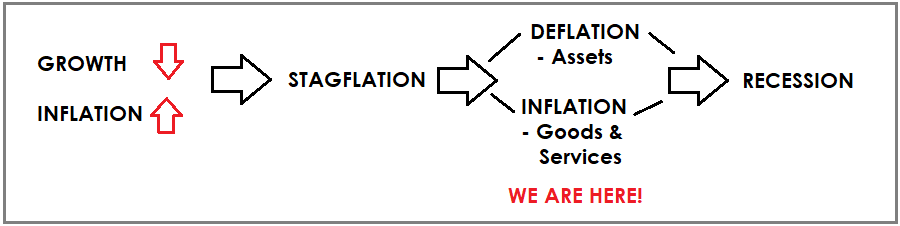

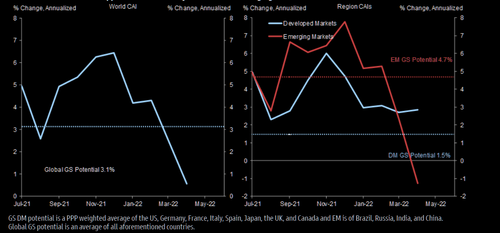

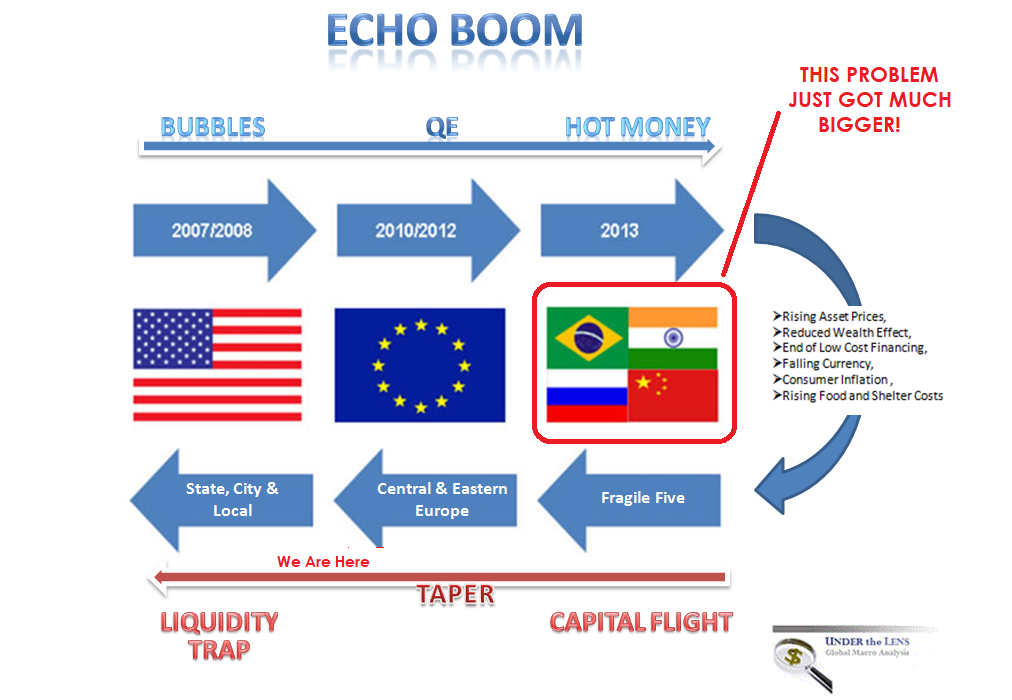

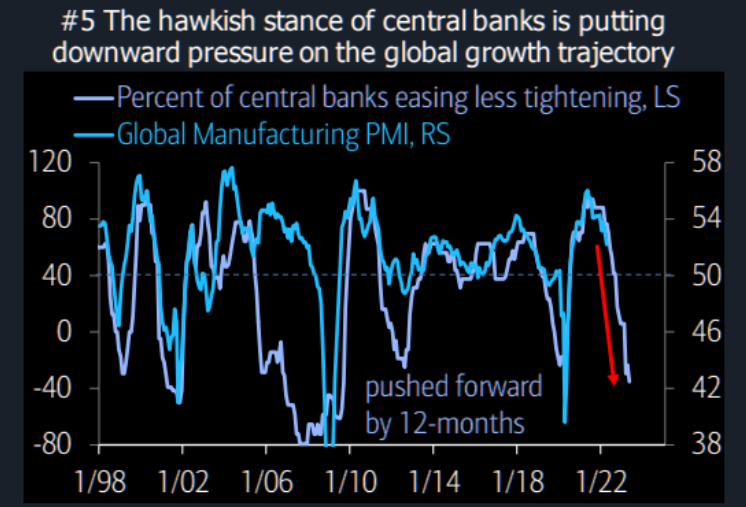

“… the unravelling of the last 14 years of Central Bank monetary distortion. In the normal business cycle the booms and bust come with the inevitability of the rising/falling tide. The wonderful sand-castles built on the beach of consumer spending is washed away… and you rebuild it tomorrow.. bigger and better..

This is different. We’ve been putting this off for too long. This is a tidal wave that threatens the very beach itself.

Yesterday I highlighted how a decade of central bank monetary distortion has changed the way capitalism works – I explained one of the reasons Boeing has gone from great to terrible company was the distorting effects of easy liquidity changing a brilliant engineering company to a terrible financial slash and burner.”