MACRO ECONOMICS

US INVESTMENT STRATEGY

US R&D HAS FALLEN SERIOUSLY BEHIND CHINA

OBSERVATIONS: US & CHINA LEADERSHIP VISIONS ARE INCREASINGLY A PROBLEM LEADERSHIP NEEDS TO PREPARE US FOR A NEW WORLD

Since the Bush 1 era the world has been preoccupied by:

-

- GLOBALIZATION – Labor Arbitrage through industrialized Supply Chains

- FINANCIALIZATION – Global cross border finance built on low low rates and easy central bank financial conditions.

- MODERN MERCANTILISM – Export countries using surging currency reserves to lower consumer lending rates, strengthen the US dollar and capture dominant market shares for competitive advantage.

I have spoken and written about all three many times. The casualty of this thinking is the US middle and working class paid the price as their standard of living became increasingly difficult to sustain, while the wealthy with assets and export lead countries have reaped historical rewards and become wealthy.

TWO DIFFERENT VIEWS

President Trump’s recent two Executive Memorandums (which I wrote about in a prior newsletter) and China’s Xi Jinping “Made In China 2015” plan clearly view the future differently.

CHINA’S XI JINPING –

-

- Manufacturing Leadership

- High End Equipment but Low End Cost to Own

- Open Source Software – DeepSeek

- Creates Revenue through Market Share

-

- Same strategy as now but going “upscale”

- Manufactured in China with advanced new manufacturing technologies

- Razor thin margins

- Exposed to foreign import tariffs

- Needs large Scale adoption for pricing advantage and therefore must dominate globally

TRUMPS FOCUS –

-

- Originates in America

- A Product = Hardware, Software or Service

- US is the Market – Anything else is a bonus

- Creates Jobs – Not necessarily Manufacturing but Service, Agriculture, Heath, Retail et al. that create value

THE REAL BAD NEWS –

It is a simple fact that AI, AI Agents, Robotics and Technology advancements will take away Jobs at an increasingly unprecedented rate. Having a job may potentially become the new American Dream!

As a result Tariffs are not going to be just a US strategy, but every nation will endeavor to use any technique possible to protect jobs as Guaranteed Basic Income becomes an increasing burden to nations as unemployment rises. What one of these directions recognizes is that 21st Century is going to be about Job Creation.

That is the bad news, but it is also the solution for America which Vice President JD Vance spelled out at the March 18th America Dynamism Summit.

Vance’s focus is the value of Jobs and Labor!

-

- We should embrace the future head-on. We shouldn’t be afraid of artificial intelligence and we shouldn’t be fearful of productive new technologies. We should seek to dominate them.

- In any dynamic society, technology is going to advance.

- In a healthy economy, technology should be something that enhances, rather than supplants, the value of labor.

- When we innovate, we do sometimes cause labor market disruptions. That has — that happens. But the history of American innovation is that we tend to make people more productive, and then we increase their wages in the process. And I think all of us believe that’s a good thing.

- It dignifies our workers. It boosts our standard of living. It strengthens our workforce and the relative value of its labor.

- Innovation is key to winning the worldwide manufacturing competition — competition to giving our workers a fair deal, and to reclaiming our heritage via America’s great industrial comeback. And I believe that’s what we’re on the cusp of — a great American industrial comeback.

- Because innovation is what increases wages. It’s what protects our homelands, and I know we have a lot of defense technology companies here. It’s what saves troops’ lives on the battlefield.

- We can only win by doing what we always did: protecting our workers and supporting our innovators, and doing both of those things at the same time.

- The Trump Administration’s great plan for staging the great American manufacturing comeback is simple. You’re making interesting new things here in America? Great. Then we’re going to cut your taxes. We’re going to slash regulations. We’re going to reduce the cost of energy so that you can build, build, build.

- Our goal is to incentivize investment in our own borders — in our own businesses, our own workers and our own innovation. We don’t want people seeking cheap labor. We want them investing and building right here in the United States of America.

WHAT YOU NEED TO KNOW!

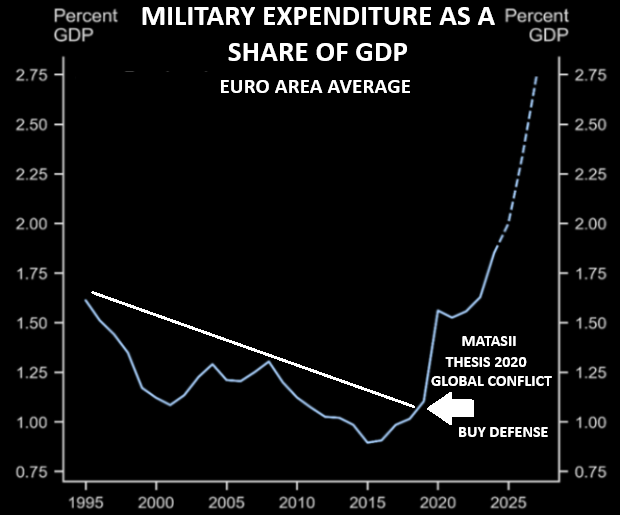

DEFENSE SECTOR BECOMES A HOT INVESTMENT THEME

DEFENSE SECTOR BECOMES A HOT INVESTMENT THEME

Global military spending is presently less than half the average observed during the Cold War.

-

- EU Defense & Aerospace socks surged 21% with troubled EU Banks suddenly becoming darlings, surging 14%.

- As European Defense Stocks in Q1 became arguably the new Magnificent Seven.

- Money flows headed for the EU with inflows in 4 weeks being the largest in 10 years.

- Germany currently only spends 7% of what the US does for defense. Germany legislation just approved ~ $800B primarily for Defense build-up.

RESEARCH – MARKET DRIVERS

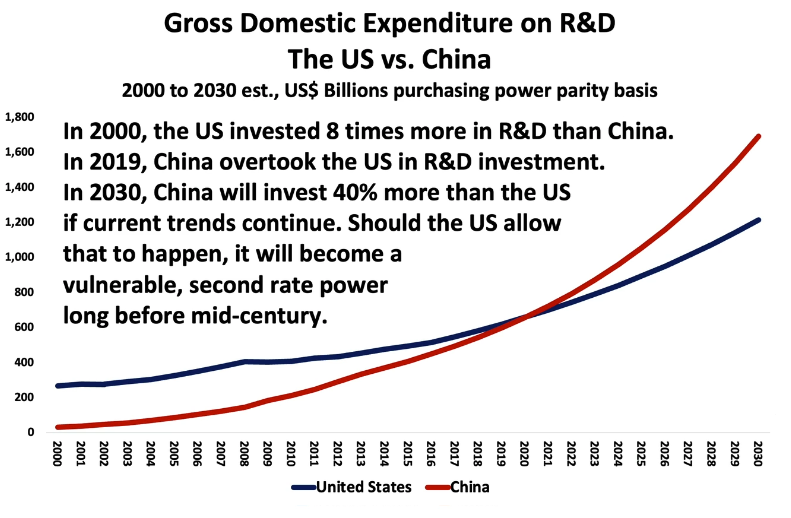

1- US R&D HAS FALLEN SERIOUSLY BEHIND CHINA

1- US R&D HAS FALLEN SERIOUSLY BEHIND CHINA

-

- Inadequate Investment describes investment in America! It is about its rate of growth, where the money is invested and who is making the investments.

- It also clear that the US is quickly losing its position as the world’s most powerful economy, because it invests far too little.

- Dangerously deficient government investment is primarily to blame!

- In 2019 China overtook the US to become the World Leader in R&D. While a great deal of extraordinary work in R&D is being done in the US, current levels are insufficient because China is simply investing more.

- China is also investing smarter because they have a plan – it is called Made in China 2025, initiated in May 2015.

- The cornerstone of that plan was to win the AI Race.

- Made in China 2025 is Stage One of an ambitious three stage, state led program with the ultimate aim of making China the world’s leading manufacturing power by 2049.

- It has established nine Priority Tasks and 10 Key Sectors to promote.

- The central problem is the US doesn’t have a plan nor feels one is needed, because the private sector will do that.

- The issue is this race is about the winner takes all!

THE US MUST IMMEDIATELY START INVESTING MORE IN R&D.

2- THE COMING “AI” AGENT MARKET EXPLOSION

-

- AI agents are seen to be the next big step in artificial intelligence.

- AI agents are software systems that use AI to pursue goals and complete tasks on behalf of users. They show reasoning, planning and memory, and have a level of autonomy to make decisions, learn and adapt.

- In artificial intelligence, an intelligent agent is an entity that perceives its environment, takes actions autonomously to achieve goals, and may improve its performance through machine learning or by acquiring knowledge.

- In order of simplest to most advanced, there are 5 main agent types:

-

-

- Simple reflex agents – the simplest agent form that grounds actions on current perception …

- Model-based reflex agents …

- Goal-based agents …

- Utility-based agent. …

- Learning agents…

-

DEVELOPMENTS TO WATCH – POLICY DRIVERS

1- CHINA’S STRATEGY UNFOLDING IN GLOBAL MARKETS

1- CHINA’S STRATEGY UNFOLDING IN GLOBAL MARKETS

-

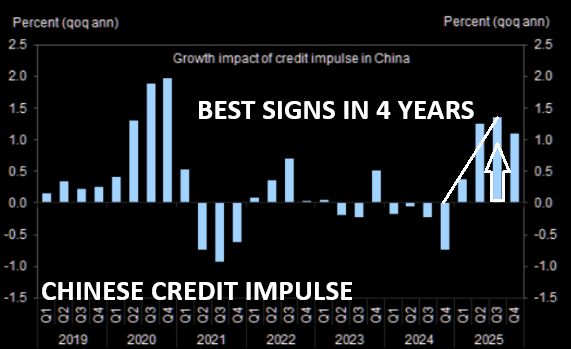

- President Xi Jinping triumphantly proclaimed four years ago that “the East is rising and the West is declining.”

- While the world’s second largest economy hasn’t exactly evolved the way he had predicted, Xi’s dream scenario of a bullish China, bearish US seems to be playing out in financial markets.

- Expectations among international asset managers for the Chinese economy are improving, while perceptions of US growth have deteriorated sharply, according to two latest polls published recently by Bank of America, reflecting the massive asset-allocation rotations underway.

2- TRUMP’S PLAN TO RESTRUCTURE THE GLOBAL TRADING SYSTEM

- A major shift in the United States global economic policy is underway.

- In November, Stephen Miran—now Chairman of President Trump’s Council of Economic Advisers —published a paper titled “A User’s Guide to Restructuring the Global Trading System“. That document appears to be the blueprint for the sweeping international economic strategy President Trump is now putting into action.

- This strategy is bold. It’s aggressive. And it has already begun to shake the foundations of the post-WWII international order. According to Miran’s paper, the U.S. may be preparing to use tariffs and the threat of military disengagement to pressure its trading partners into accepting a massive economic restructuring.

- If successful, this could re-industrialize the United States.

- If it fails, it could bring about an economic catastrophe of historic proportions.

GLOBAL ECONOMIC REPORTING – ECONOMIC DRIVERS

LIBERATION WEEK – UNFOLDING TRUMP TARIFFS

LIBERATION WEEK – UNFOLDING TRUMP TARIFFS

-

- Trump has so far enacted tariff changes that have lifted the trade-weighted average tariff rate on all US imports by around 5.5-6.0%-points. While re-rerouting of trade will decrease the effectiveness of tariffs over time, the current level is already close to the highest since the second world war.

- We recap:

- What has occurred

- What is Expected Next week as “Liberation Week”

- Reciprocal Tariffs

- Value Added Tax (VAT)

- EU Specific Tariffs & Targets

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.