SII

PRECIOUS METALS

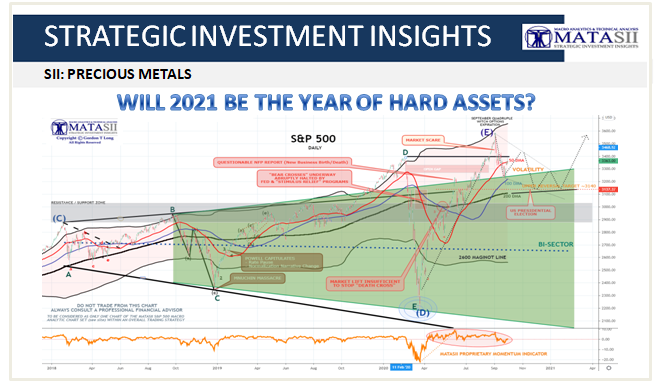

WILL 2021 BE THE YEAR OF HARD ASSETS?

-

- Increased taxes at all levels of government,

- Covid-19 retail and services ‘surcharges’,

- Rising interest rates,

- Higher import costs &

- Higher food costs.

-

- A decreased wealth effect, A

- A temporary slowing rate of government liquidity injections and

- Weak consumer demand due to unemployment and rising bankruptcies.

-

- Money was not Fiat and backed by gold (making “M” now obsolete),

- Economies were dominantly domestic with exports playing a relatively minor role, (Making “T” now obsolete),

- Government Debt and Stimulus Deficit Spending were minor (Distorting the whole GDP formula by Transfer Payments to “C” and foreign financing impacting “I”).

-

-

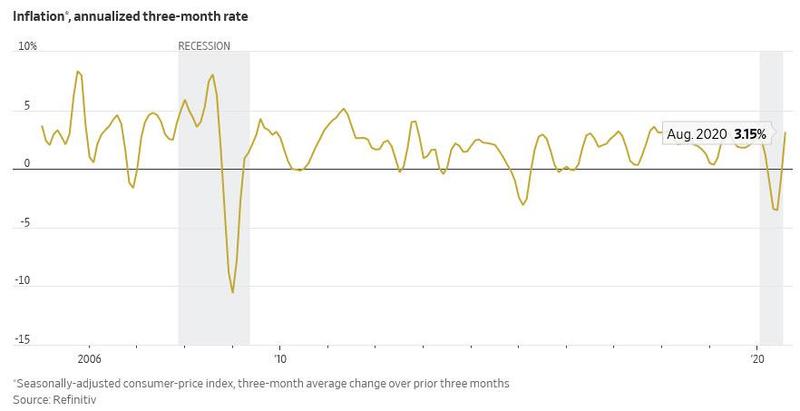

DEFLATION PRESSURES (HAPPENING)

- Unemployment (Demand Weakness),

- Reduced Wealth Effect, (Weaker Asset Prices),

- Slowing Temporary Liquidity Injection Rates,

- Rising Interest Rates (Chinese Credit Impulse Impact)

-

-

-

- Investment Grade Bonds,

- Dividend Paying Stocks,

- Consumer Staples

-

-

-

INFLATION PRESSURES (BUILDING PRESSURES)

- Taxes at all Levels of Government,

- COVID-19 Surcharges (Going Forward Costs), [Restaurants,

- COVID-19 “Pass Through Costs” (Profit Hole), [Travel, Hospitality,

- Rising Food Costs,

- Rising Import Costs,

-

-

-

- Precious Metals,

- Commodities

-

-

- The head of the UN World Food Program repeatedly warned us that we would soon be facing “famines of biblical proportions”, and his predictions are now starting to become a reality.

- We have already seen food riots in some parts of Africa, and it isn’t too much of a surprise that certain portions of Asia are really hurting right now.

- The UN World Food Program is projecting that the number of people facing “severe food insecurity” in Latin American and Caribbean nations will rise by a whopping 270 percent in the months ahead.

- Historic flooding has been going on in China for months that is wiping out crops on a massive scale… Experts from the global financial services group Nomura said that although the flooding is among the worst that China has experienced since 1998, it could still get worse in the weeks to come, with the nation poised to lose $1.7 billion in agricultural production. However, since the start of the monsoon season, the area of flooded croplands have almost doubled. Nomura’s estimates also do not include the potential loss of wheat, corn and other major crops. Therefore, China could be facing a far greater economic loss than current projections.

-

- We are being told that grocery stores all over the country are attempting to stockpile goods in an attempt “to avoid shortages during a second wave of coronavirus”…

- The Wall Street Journal is reporting that some chains are actually putting together “pandemic pallets” in anticipation of more shortages…

-

- U.S. farmers have been going bankrupt in staggering numbers during this downturn, and the federal assistance that was supposed to help them survive has mostly gone to “large, industrialized farms”…

- U.S. farm bankruptcies hit an eight-year high last year, and they are on pace to go even higher this year.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.