MACRO – US

FISCAL POLICY

THE COMING US SOVEREIGN WEALTH FUND

OBSERVATIONS: REMEMBERING THE IRISH POTATO FAMINE WHILE GROCERY SHOPPING TODAY

Living in the greater Boston area, I have come to know and appreciate the rich Irish heritage so evident in all facets of the culture that is Boston. As such, you are hard pressed to not know about the great Irish Potato famine that initially drove immigration to the Boston area.

The Great Famine, also known as the Great Hunger, the Famine and the Irish Potato Famine, was a period of starvation and disease in Ireland lasting from 1845 to 1852 that constituted a historical social crisis and subsequently had a major impact on Irish society and our Boston history as a whole.

I bring this up because I see clear parallels as I grocery shop today and the Irish stories I have heard. How so? P.J. Antoni reminded me of this with the facts that might help all of us better understand what is going on as we grocery shop today.

The stratospheric rise in food prices in the last three years has forced many families to forgo groceries they used to enjoy in exchange for cheaper alternatives. This change in consumer behavior is emblematic of the painful decisions American families must make in the Biden-Harris economy. Disturbingly, nationwide data is even showing the resurgence of an economic phenomenon made infamous in the 19th-century Irish potato famine.

When a blight decimated the potato crop in Ireland, the supply of potatoes dwindled, and their prices rose dramatically. Normally, higher prices cause consumers to demand less of a product or service, but not this time.

Instead, demand for meat and other foodstuffs collapsed, and consumers tried to buy more potatoes. The blight reduced the supply of potatoes available, so the Irish were able to buy fewer of them—and tragically, many people starved.

But why did the Irish want more potatoes and less meat at precisely the time the former became much more expensive? The answer lies less in the rapid rise of food prices and more in the relative prices between those foods.

Let’s say an Irish family previously bought 4 pounds of potatoes for $1 a pound each and 1 pound of meat for $2, spending $6 in total. If potatoes jump to $2 a pound and meat increases to $2.10 a pound, then the family must spend $10 for the same weight of food, except now it’s all potatoes. They’re spending two-thirds more and getting a lower-quality meal.

Even if all food prices were rising in Ireland, potatoes remained the cheapest food available, so demand for them skyrocketed. Disturbingly, the United States is now seeing a similar shift in consumer food purchases.

Recent survey data published by the Federal Reserve Bank of Dallas show food manufacturers have seen a significant increase in consumer demand for sausage—even though the price of sausage has risen substantially—while demand for more expensive protein, such as steak, has fallen.

The same economic phenomenon that increased demand for potatoes in 19th-century Ireland, despite higher potato prices, is causing Americans to buy more sausage in the face of higher sausage prices. There is simply little else many families can afford today.

To be clear, most Americans aren’t starving like the Irish did back then; we have a much larger economy, even on a per-capita basis. But Americans are going into debt to afford even the cheapest groceries. Credit card balances now exceed $1.1 trillion, and for the first time, Americans are spending over $300 billion annually just in interest on credit card debt.

There are even financing companies created in the last few years that extend credit only for groceries. Prices have risen so much faster than earnings in the last four years that people can’t afford to feed themselves and their families. The primary source of today’s food price inflation has been runaway government spending and borrowing.

By January, the Biden-Harris administration will have added $8.3 trillion in federal debt and run down the Treasury’s cash balance by $1 trillion. That’s a net overspend of $9.3 trillion in four years—a record that surpasses that of any other administration. And that includes former President Donald Trump’s term, which was inflated by emergency COVID spending.

President Biden and Vice President Kamala Harris will be responsible for one-quarter of federal debt accrued in a span of nearly 250 years. It’s no surprise then that food prices continue setting records and that families are forced to buy the cheapest meat available.

WHAT YOU NEED TO KNOW!

LOST PURCHASING POWER IS INFLATION – Not CPI nor the PCE!

LOST PURCHASING POWER IS INFLATION – Not CPI nor the PCE!

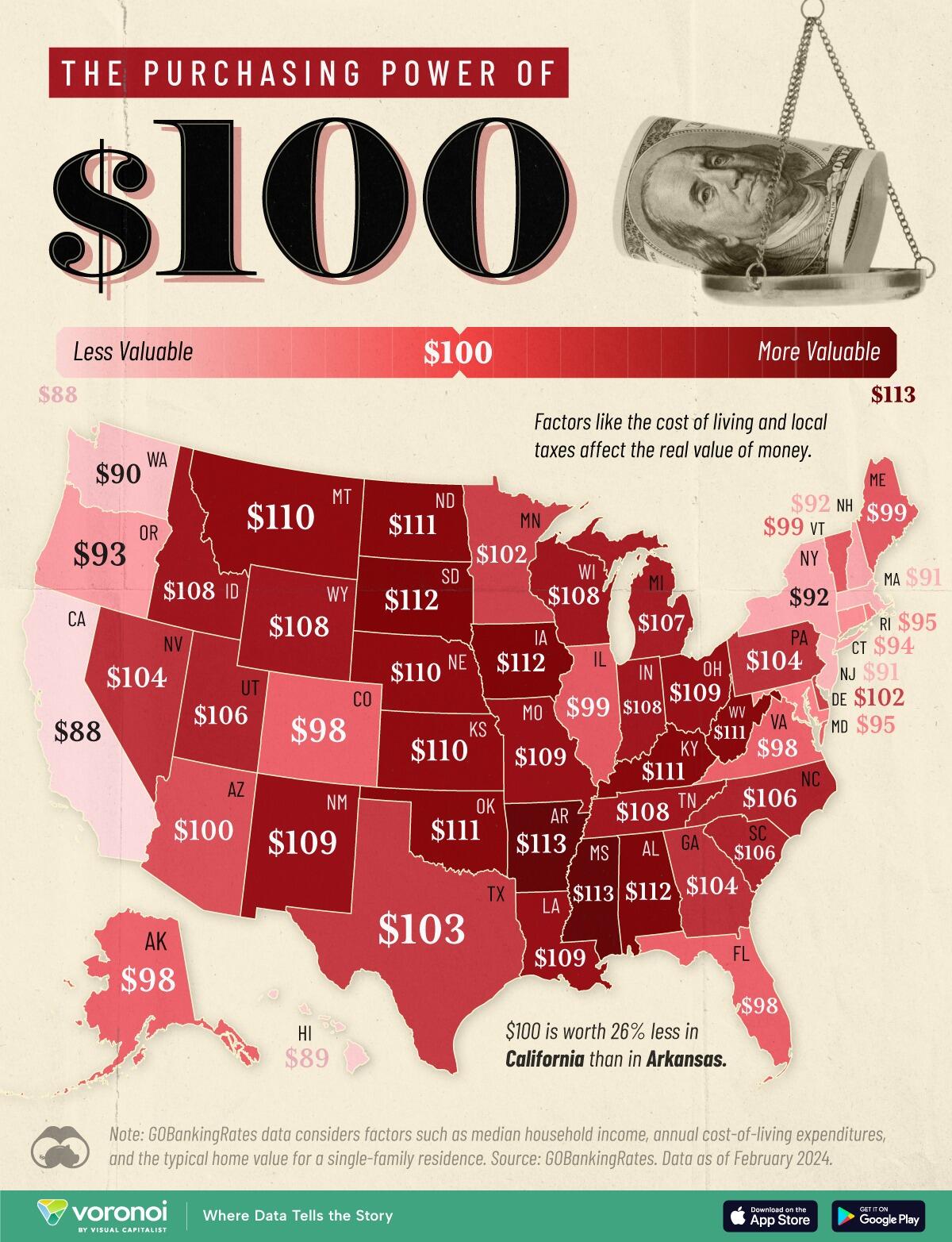

I have recently discussed in past videos and newsletters that Inflation is not the CPI or PCE. Those are metrics. Inflation is the lost purchasing power of the currency you transact with daily. It is falling across the US but in disproportionate ways.

While $100 may seem like it holds the same value across the U.S., that’s far from the reality. The purchasing power of a dollar can vary significantly from state to state, influenced by factors such as the cost of food, utilities, taxes, housing and transportation – all elements of political Public Policy.

This map, via Visual Capitalist’s Bruno Venditti, illustrates the purchasing power of $100 by state, using data from GOBankingRates compiled as of February 19, 2024. The purchasing power of $100 can vary by as much as 26% from state to state.

-

-

- California has the lowest purchasing power ($87.50), while Arkansas has the highest ($113.40).

- Among the states where money has the least purchasing power are Hawaii, Washington and Massachusetts.

- On the other hand, Iowa, North Dakota and Oklahoma join Arkansas as states where $100 stretches further.

-

RESEARCH

1- A US SOVEREIGN WEALTH FUND – Now In the Works & Gaining Momentum

1- A US SOVEREIGN WEALTH FUND – Now In the Works & Gaining Momentum

-

- President Biden and former President Trump both announced their support for the establishment of a US Sovereign Wealth Fund last weekend.

- My long time colleague Richard Duncan has been championing the need for a US Sovereign Fund for years now.

- Unfortunately there is a lot more going on behind the scenes. Intel, Boeing and U.S. Steel may actually hold the secrets to what is really going on behind all the talk of a U.S. Sovereign Wealth Fund. Nothing in Washington is ever as it appears!

2- OFF-BALANCE SHEET CONTINGENT LIABILITY GUARANTEE ACCOUNTING – It’s Unfolding as Expected

-

- I fully suspect the proposed US Sovereign Wealth Fund will be a target for the coming Off-Balance Sheet Contingent Liability Guarantees I have been expecting for some time now. (See a recent interview with Adam Taggard at Thoughtful Money).

- If the US government wants to increase Economic Growth, it must increase Money Supply which ignites Inflation and US Debt costs. Therefore being forced to continue expanding the Money Supply to achieve economic growth, the government must ensure that money growth goes into investments in real productive assets, which deliver Savings (Profits and Capital) and creates jobs and increases the standard of living.

- To achieve this, it is our studied opinion the government will be forced to use Off-Balance Sheet Contingent Liability Guarantee Accounting to control and balance the restricting financial / economic parameters involved.

- The US has long used this approach to fund Foreign Aid and why the US Fiscal Gap approximates ~$210T (“America’s Fiscal Insolvency and Its Generational Consequences“) Testimony to the Senate Budget Committee February 25, 2015 by Laurence J. Kotlikoff, Professor of Economics, Boston University).

DEVELOPMENTS TO WATCH

DRAGHI: EUROPE IN EXISTENTIAL DANGER WITHOUT MASSIVE NEW SPENDING & JOINT DEBT

DRAGHI: EUROPE IN EXISTENTIAL DANGER WITHOUT MASSIVE NEW SPENDING & JOINT DEBT

-

- Former ECB president/Italian PM Mario Draghi delivered a shocking report on the EU’s future. As Draghi asserted Europe must change radically to thrive, and while it’s not do or die, it’s

“Do this, or it’s a slow agony.”

-

- He lays out in 328 pages that the only way to avoid economic and geopolitical death by a thousand cuts includes investing an extra 5% of GDP (€800bn) annually.

- The Twin EU reports read like an implementation plan for our 2024 Thesis Paper: “The Regulatory State”!

COMMODITIES NEARING COMPLETION OF CORRECTIVE CONSOLIDATION

-

- We will soon begin Wave 2 for the following reasons:

- Services (Skilled Wage Pressures)

- Import Costs (Tariffs)

- Energy (Regulatory Crippling of Utilities)

- Food (Shortage of Agricultural Land)

- The Major Commodity Indexes reflect relatively close timeframes for the completion of what counts in Elliott Wave parlance as Wave 2.

- We will soon begin Wave 2 for the following reasons:

GLOBAL ECONOMIC REPORTING

AUGUST CPI / PPI

AUGUST CPI / PPI

-

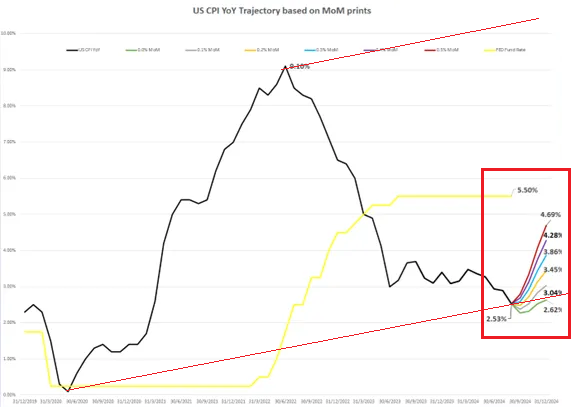

- Following the cooling of inflation pressures over the second quarter and an in-line July CPI, August’s headline CPI was also broadly in line with expectations, rising 0.2% MoM.

- Year-over-year, the headline CPI rose by 2.5%, in line with consensus and lower than the +2.9% YoY change in July, thanks to another month of favourable base effects.

ECB RATE CUT

-

- ECB cut Deposit Rates by 25bps to 3.5%, the Refinancing Rate by 25bps to 3.65% and the Marginal Lending Facility by 60bps to 3.90%, as expected.

- The ECBt said it is not pre-committing to a particular rate path and will continue to follow a data-dependent and meeting-by-meeting approach to determining the appropriate level and duration of restriction

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.