TIPPING POINTS

INFLATION & COST OF LIVING

THE EXPLODING COST OF LIVING PLACING RETIREMENTS IN JEOPARDY

OBSERVATIONS: THE BIDEN / HARRIS SOLAR PROGRAM

After witnessing my government spend $1.9T in money they had to borrow in 2024, $1.8T in 2023, $1.7T in 2022, $2.8 in 2021 and $3.1T in 2020 for a total of $11.3T, I felt I needed to personally capture some of the benefits of all this debt growth. With the interest payments alone on all the accumulated debt totalling $1.1T in budget interest this year and resulting in driving inflation into almost every corner of goods and services I rely on to live, I decided I needed to take advantage of all the Climate Change / Renewable Energy / Green Environment programs to possibly capture some of the benefits I have had my tax dollars spent on.

After listening to incessant ads about; “Free Solar Panels, Free Installation; Free Site Assessment”, I decided to explore installing Solar panels to handle my exploding electricity bill along with the addition of a Heat Pump (to help address by equally exploding heating bills).

I called in one of the US largest and most reputable providers of home Solar Systems! That is when I started to realize everything isn’t as it appears.

In preparation for the first meeting I did some web research and consistently read that I should expect to pay between $13K and $20K with an average cost of $16.4 for Solar panels. Obviously they weren’t free, but the government was prepared to give me a tax credit of 30%.

So maybe my after tax cost would be (30% X $16.4K X 35% tax rate = $1754 benefit ) or $16.4- $1.754 = $14.7. Not exactly free? However the State of Massachusetts was also willing to assist with another 10% to a max of $1,000. Well that gave me another $1K, so maybe I actually have to figure out where to get the unexpected $13.7K to begin to get some benefits for all the money my government is spending to help me?

The first meeting arrives and I am told they can’t possibly give me a quote until I first have a full site survey done. I am told this is to my benefit, because there are a lot of other costs involved which the supplier can claim on my behalf to avoid further costs out of my pocket. Those costs went from electrical code requirements for fuse box upgrades, to site requirements for tree removal to building code requirements for the roof .. and more … much more. With this full site report there was a good chance a significant amount of these costs could be claimed from programs I was already paying for in my existing electrical bill under “Delivery Services”. Somewhere within nine billing line items money was being accumulated for possible Solar conversion. This was getting complicated fast, especially when I saw that 56.6% of my electric bill was actually going towards “Delivery Services” versus my actual electricity cost.

During the next meeting I discovered that I had to sign a number of agreements so that there would be no cost for the site survey. It appeared the money for the site survey would also come from these Delivery Services billings which began to be referred to as the “Slush Fund”.

It was stressed that my costs would be greatly reduced with a successful site survey if the solar supplier was fruitful in getting significant money from the Slush Fund. It all sounded like a lot of double dipping, but what do i know? My wife meanwhile was asking me about where is the Free part in any of this since we paid for the Slush Fund?

When I said I couldn’t agree to any further activity without a better understanding of where the Free was, I was told that if I buy the Solar System it will cost somewhere from $45-$50K (not $16.4K), which included installation and any further costs that can’t be claimed by them against the Slush Fund. However, if I was to lease the system it would be free. Finally, the word FREE!

Tell me about the lease I asked? Well, it is for 35 years and caps your electric bill to going up to only 3.5% per year, they told me. So I still have an electric bill I asked? Yes, but it will be less and capped! – What if I want to cancel the lease? – You pay out the remainder of the contract and what you would have spent on electricity over the course of the 35 year contract as a penalty!

In summarizing, I quietly said: “So, I allow you to install equipment on my house for a 35 year commitment and you agree to charge me only a 3.5% increase per year over what I am paying today? Tell me again where the Free part is??”

Only a Washington politician could dream this approach up as part of justifying $11.7T in deficit spending!!

WHAT YOU NEED TO KNOW!

CREDIT GROWTH – THE PROBLEM THAT MUST BE SOLVED!

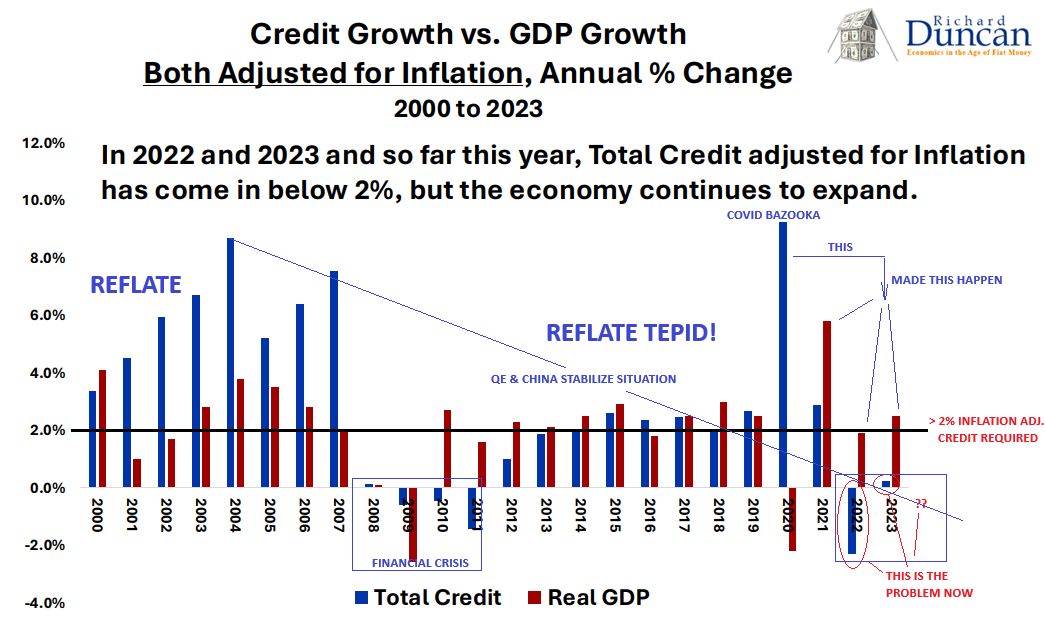

The main driver of economic growth in the post-gold standard era has been credit expansion. However, the growth of total credit has weakened significantly. In Q2 2024, credit grew by just under $4 trillion compared to over $8 trillion at the peak of the pandemic stimulus. Historically, such weak credit growth has led to recessions.

The main driver of economic growth in the post-gold standard era has been credit expansion. However, the growth of total credit has weakened significantly. In Q2 2024, credit grew by just under $4 trillion compared to over $8 trillion at the peak of the pandemic stimulus. Historically, such weak credit growth has led to recessions.

Between 1952 and 2009, every time Total Credit adjusted for Inflation grew by less than 2% a year, the US went into Recession. After 2009, this pattern hasn’t held. Total Credit adjusted for Inflation has been below the 2% Recession Threshold for the past 11 quarters, but economic growth has remained relatively robust. The explanation for this anomaly is likely that the combination of very aggressively fiscal and monetary stimulus in response to the Covid pandemic was so great that it has continued to drive the economy ever since.

The problem now is that any reduction in the size of the budget deficit would mean that the increase in Government Debt would slow, and the slowdown in the growth in Government Debt would cause a slowdown in Total Debt Growth, i.e. Credit Growth, (which is already weak), and that would tip the US into Recession. The answer is to increase spending but into productive assets and not more consumer consumption. Governments have no capability of recognizing a productive asset, but they have never met a consumer where they didn’t promise them something for nothing!

RESEARCH

1- THE EXPLODING COST OF LIVING PLACING RETIREMENTS IN JEOPARDY!

1- THE EXPLODING COST OF LIVING PLACING RETIREMENTS IN JEOPARDY!

-

- The under appreciated problem is that the $4.4 million estimated to achieve the American Dream (chart right) exceeds the average lifetime salaries of both men ($3.3 million) and women ($2.4 million) with a Bachelor’s degree.

- Retirement is the biggest component of the American Dream and since the late 1990’s Corporations have moved from Defined Benefits Plans to Contributory Plans, then to increasingly stripped down contributions from employers.

- As the US workforce ages, the reality of what has happened regarding Retirement security has become a frightening reality. Since WWII it had been a bedrock of being able to realize the American Dream!

2- Q3 EARNINGS – UTILITIES SECTOR

-

- As US grid operators revise load forecasts for AI-driven data centers and increased electric vehicle adoption, large customers are seeking atypical projects and power purchase agreements (PPAs) to secure sufficient power. This shift has sparked renewed interest in nuclear energy.

- Constellation Energy plans to restore one unit at the Three Mile Island nuclear facility in Pennsylvania for at least $1.6 billion to supply Microsoft with a 20-year PPA. Other tech giants are also investing in nuclear.

- Google will purchase power from Kairos Power’s Small Modular Reactors (SMRs).

- Amazon has invested in Talen Energy’s Susquehanna nuclear facility in Pennsylvania and four SMRs in Washington state via Energy Northwest.

- As US grid operators revise load forecasts for AI-driven data centers and increased electric vehicle adoption, large customers are seeking atypical projects and power purchase agreements (PPAs) to secure sufficient power. This shift has sparked renewed interest in nuclear energy.

DEVELOPMENTS TO WATCH

BETA DROUGHT DECADE – Over-Concentrated Markets

BETA DROUGHT DECADE – Over-Concentrated Markets

-

- We have been warning about historical narrow breadth and writing about the Beta Drought Decade for over 2 years now.

- This week Goldman Sachs came out “full throated” echoing our position. Frankly, it had been a lonely view, but now appears to be going mainstream.

- We point in bullet form what Goldman Sachs said and how they arrived at our conclusion.

BRICS-24 – KAZAN RUSSIA

-

- The summit was intended to showcase the group’s collective economic might and also entice new countries into a coalition that Moscow and Beijing hope will help form a new world order not dominated by the West.

- Putin is using the BRICS summit to project strength and counter Western isolation, while also pushing for initiatives like an alternative payment system and grain exchange. (See last week’s Newsletter on a Payment System versus a Reserve Currency System).

- Putin was expected to push negotiations to build an alternative platform for international payments that would be immune to Western sanctions Russia, the world’s top wheat exporter, also proposed the creation of a BRICS grain-trading exchange as an alternative to Western markets where international prices for agricultural commodities are set.

- BRICS members are divided on their approach to the West, with some seeking to reform the current international order and others aiming to dismantle it.

- Members and would-be members alike are also looking for alternative sources of financing than available from the World Bank and International Monetary Fund (IMF), and are looking to gain better access to burgeoning markets that could better define the global economy in the coming decades. The IMF and World Bank located in Washington DC are viewed as US controlled entities.

GLOBAL ECONOMIC REPORTING

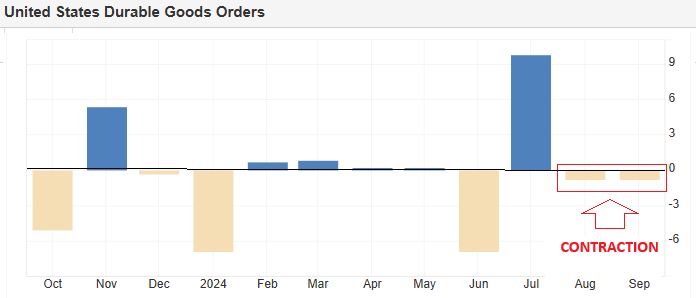

DURABLE GOODS

DURABLE GOODS

-

- Overall, Durable Goods were mixed. The headline fell by 0.8%, matching the prior month’s pace of decline, albeit it was not as steep as the expected 1.0% decline.

PMI FLASH REPORT

-

- US S&P Global Flash Manufacturing PMI for October rose to 47.8 from 47.3, and above the expected 47.5 but still in contraction (<50%).

FED BEIGE BOOK

-

- Reports on consumer spending were mixed, with some Districts noting shifts in the composition of purchases, mostly toward less expensive alternatives.

- Regarding the labour market, employment increased slightly during this reporting period, with more than half of the Districts reporting slight or modest growth and the remaining Districts reporting little or no change.

- Many Districts reported low worker turnover, and layoffs reportedly remained limited.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.