MACRO ECONOMICS

GERMANY’S FISCAL POLICY

GERMANY’S “WHATEVER IT TAKES” MOMENT

OBSERVATIONS: THE BIDEN “EXCESS DEBT” RECESSION IS NEAR!

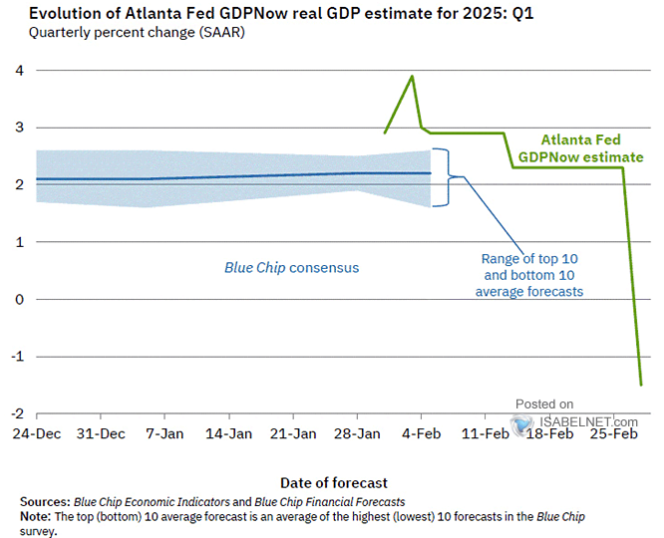

The Federal Reserve Bank of Atlanta’s GDPNow model projection for real GDP growth in the first quarter of 2025 (Q1 2025) is now showing a slump to -1.5%. This marks a significant downward revision from the previous estimate of 2.3% on February 19, 2025. How did we go from +2.3% to -1.5% in less than a month?

The immediate and expected reaction from the media will be to call this the beginning of a “Trump recession” and blame it on President Trump’s policies. It is almost hilarious (if not alarming) to read the hundreds of comments arguing that the Atlanta Fed NowCast means that the new administration’s policies are causing a recession.

First of all let us appreciate that the United States has been in a private sector recession for months. However, an abnormal increase in government spending during a period of growth and a risky borrowing policy led to a bloated Gross Domestic Product (GDP). The United States had a $7.59 trillion nominal GDP increase between 2021 and 2024 compared to a rise of $8.47 trillion in government debt. This marks the worst GDP growth adjusted for government debt accumulation since the 1930s.

The US government spending financed by increasing federal debt accounted for about 22% to 25% of the total US GDP growth over 2021–2024. This extraordinary increase in government spending in the middle of a recovery led to record-high government debt and was the leading cause of money supply growth and, with it, the inflation burst that Americans are suffering today.

WHAT IS GOING ON?

The short answer is Keynesian Stimulus Spending no longer works and Biden knew it! The math is simple:

- In the US it now takes as much as $2.50 of New Debt to produce the $1 of economic growth.

- In the US it now takes as much as $1.50 of Deficit Growth to produce $1 of economic growth.

- In Q4 2024 it took $5.8 Debt = $1 GDP; In Biden’s last year of 2014 it took $3.9 Debt for $1 GDP.

The Biden Administration’s spending was out of control and they knew it! The leading money supply growth soared and the cumulative inflation suffered by Americans in the past four years was over 20.9%, with groceries and gas prices rising by more than 40%. Excessive government spending was not only the cause of the rise in money supply growth and the burst of inflation, but also led to an $8.47 trillion increase in debt and an unsustainable path to financial ruin if policies remained the same. The Biden’s expectations were that the Regulatory State would shift in his second term to even more control (Price Controls, YCC, QE) as the government took full control of a more centralized liberally planned economy.

According to the Congressional Budget Office, with no policy changes, the United States would have accumulated deficits of $12.6 trillion between 2025 and 2030.

Net interest outlays were expected to grow from $881 billion in 2024 to $1.2 trillion by 2030, even assuming no recessions or unemployment increases.

Cutting government spending is essential to reduce prices, bring inflation under control and stop the looming public finance disaster. By 2024, it became evident that revenue measures would not reduce the United States federal deficit. Deficits are always a spending problem.

We must remember that 2024’s 2.8% GDP growth reflected almost $2 trillion in borrowing, a roughly one-to-one spending-to-growth ratio and a dangerous path to a debt crisis.

Private GDP should measure the economy, as government spending and debt do not drive productive growth. Stripping government spending can give us a more accurate picture of the reality of the productive sector in America. The latest Atlanta Fed estimates show a massive decline in net exports (-3.7%) due to a large increase in imports, a small decline in consumption of goods (-0.09%), but strong services (+0.62%), rises in government expenditure (+0.34%) and a healthy increase in investment (+0.62%).

Thus, the surprising factor is an abnormal slump in exports and a rise in imports that may be revised, because the trade deficit in December 2024 rose to a record $98.4 billion and GDP did not reflect such a massive slump in net exports. The concerning thing is that government spending continues to be excessive, and the United States is running an annualised $2.5 trillion deficit.

The United States will not enter a recession due to the change of administration, but because of the excess spending policies of the Biden years. Reducing federal spending, deficit and debt accumulation is essential to recover the health of the economy.

Bloating GDP with public spending and debt is not growing; it is the recipe for disaster.

WHAT YOU NEED TO KNOW!

FED’S US GDPNow REAL GDP FORECAST PLUNGES DRAMATICALLY!

FED’S US GDPNow REAL GDP FORECAST PLUNGES DRAMATICALLY!

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2025 projections plummeted to a -1.5% annualized increase. This was largely seen to be due to plummeting net exports.

We believe it was due to surging Imports “front running” US Tariffs.

This leaves many wondering what happened to the so-called “Golden Age of America.”

RESEARCH – MARKET DRIVERS

1- GERMANY’S “WHATEVER IT TAKES” MOMENT

1- GERMANY’S “WHATEVER IT TAKES” MOMENT

-

- A Massive Reflation Bazooka of €900B is now being placed in the German Legislative Plan.

- The leaderships of Germany’s traditional two dominant parties, the Social Democrats and Christian Democrats, announced their intention to borrow €900 billion to be spent on two funds covering defense and infrastructure.

- To do this, Germany plans to amend the German constitution in the two weeks before the next legislature is convened.

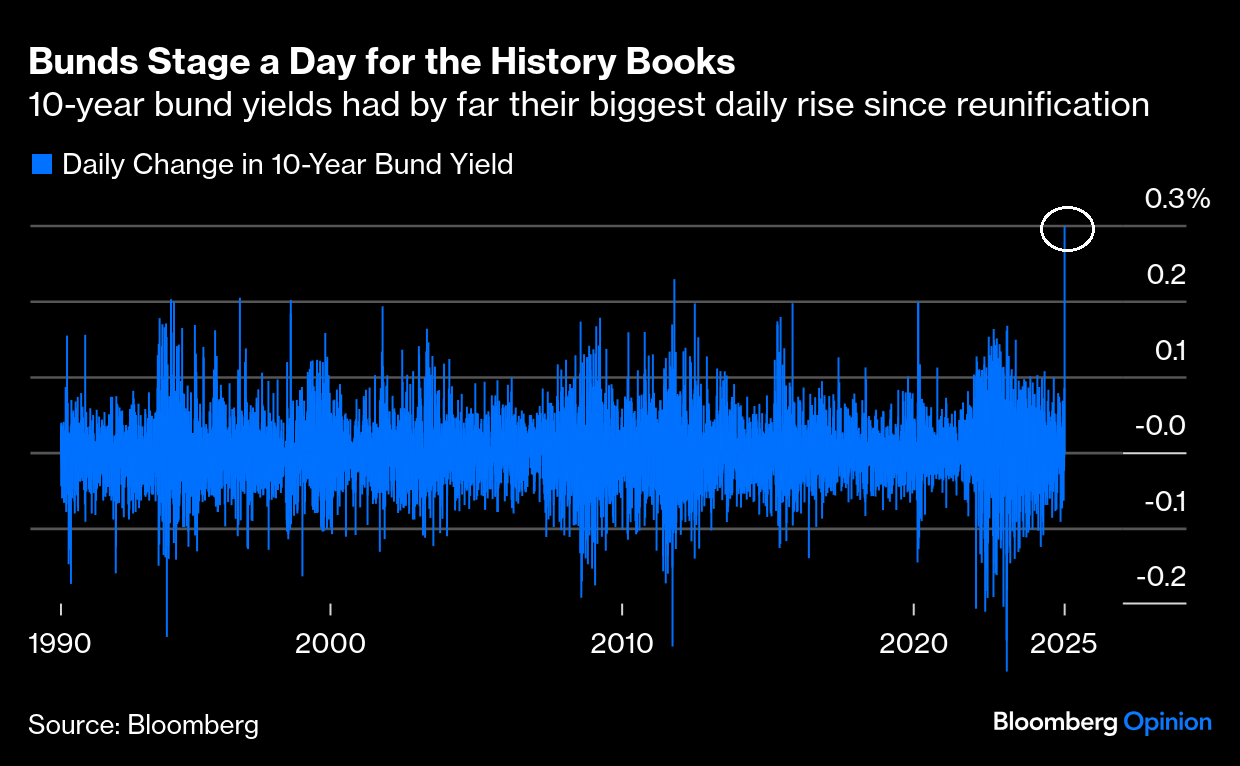

- The most consequential was in the 10-year bund yield, which rose 30 basis points for its biggest one-day rise since Germany reunified in 1990.

- The euro has surged against the dollar, and appeared to break conclusively out of what many thought would be a protracted downward trend.

2- POTENTIAL MACRO TRADING SCENARIOS

-

- With the macro landscape continuing to price in a US growth slowdown, Goldman Sachs goes through Five potential macro scenario moving into 2025 and how best to play it via an equity theme across the US, Europe and ROW.

- Three factors to consider when deciding upon the equity theme:

- Growth slowing or accelerating?

- Inflation rising or falling?

- Central Banks easing or tightening?

DEVELOPMENTS TO WATCH – POLICY DRIVERS

DEVELOPMENTS TO WATCH – POLICY DRIVERS

1- THE NEW STRATEGIC RESERVE – Bitcoin

-

- President Trump just signed an executive order on Thursday creating a Strategic Bitcoin Reserve, marking a major shift in U.S. digital asset policy.

- Instead of acquiring crypto assets, White House Crypto and AI Czar David Sacks, a Silicon Valley venture capitalist, indicated that the reserve will be funded exclusively with bitcoin seized in criminal and civil forfeiture cases, ensuring that taxpayers bear no financial burden.

2- RESCISSION v IMPOUNDMENT – Key To DOGE Budget Results Not Stopped By Courts

-

- Rescission is an alternative to “impoundment,

- RESCISSION: Ensures DOGE cuts stick via this relatively expeditious budget-slashing technique.

- The approach could guide DOGE cuts around federal judges who consider executive-branch-initiated spending cuts as exceeding constitutional authority.

- Rescission offers a means by which presidents can collaborate with Congress to cancel previously-appropriated spending. Enabled by Title X of the Congressional Budget and Impoundment Control Act of 1974, the rarely-used process starts with the president sending a special message to Congress, providing specific details about which budgetary authorities he wants to rescind.

- IMPOUNDMENT

- Rescission is an alternative to “impoundment,” by which presidents unilaterally delay Congressionally-directed spending.

GLOBAL ECONOMIC REPORTING – ECONOMIC DRIVERS

LABOR REPORT (NFP)

LABOR REPORT (NFP)

-

- Most notably in the February Labor Report was the Underemployment rate, which jumped to 8%, its highest level since October 2021, as household employment dropped by 588K (See chart below right).

- The jump in broad unemployment is pretty noteworthy.

- Underemployment jumped from 7.5% to 8% even as the labor participation rate fell. That is the highest it has been since when we were still in the aftermath of COVID).

ECB RATE CUTS

-

- The ECB’s rate cut was not in doubt by anyone, and the ECB did not disappoint, cutting rates for the 6th time in a row by 25bps across the board.

- Deposit rate to 2.5% from 2.75%

- Refinancing Rate to 2.65% from 2.90%

- Marginal lending to 2.60% from 2.85%).

- What everyone was focusing on was whether the ECB would use the word “restrictive” in the statement. And while it did use it, here is what it said: “Monetary policy is becoming meaningfully less restrictive, as the interest rate cuts are making new borrowing less expensive for firms and households, and loan growth is picking up.”

- The ECB’s rate cut was not in doubt by anyone, and the ECB did not disappoint, cutting rates for the 6th time in a row by 25bps across the board.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.