MACRO ECONOMIC

GERMANY

WILL GERMANY TAKE THE EU ECONOMY DOWN WITH IT?

OBSERVATIONS: I Smelled Major German Problems In The Air.

I have just spent two weeks in Europe and I came away with worrying concerns about the EU, and Germany in particular.

The smell of diesel is still the smell tourists will immediately notice when arriving in Europe. Nothing has changed in that regard since I last lived in Europe in the early 90’s. For all the power of the “Green Party”, I noticed few, if any EV charging stations as well as less hybrid and EVs than in the greater Boston area.

On a flight between two major cities I became engaged in a conversation with a high level corporate planner on the way to a meeting with a major German automotive corporation. The meeting was to be about planning steel supply changes to the German auto corporation. The problem was EV sales are not meeting forecasts, meanwhile existing production was being wound down. The ramifications to the supplier meant seriously smaller volumes. Smaller volumes meant penalties and increased costs to the automotive corporations. I suspect the plane had other types of suppliers onboard. The EU transition in Europe is signaling a mounting debacle of losses and layoffs.

For those not familiar with the German Economy, the dependency of the German economy on the automotive industry would be equivalent to the imapct on the State of Michigan’s economy facing massive problems in Detroit when the “Big Three” were at their height of automotive dominance during the 60’s!

Inflation and disgust with the EU (and government in general) is the normal tone of conversation, punctuated with bursts of anger about Immigration and energy policies. On a flight into Vienna I couldn’t help notice the sea of Wind Turbines surrounding the landscape of the city. However, homes with solar panels on the roof were no more prevalent than is currently seen in the US Northeast. For all of the EU’s Green initiatives, the homes I visited were all burning gas. Many in the Austrian Alps (where I visited some relatives) are still burning wood and have zero plans or incentive to change.

Europe appears to have blundered into a problem of monumental proportions that is only going to get worse across most of the EU. As I wrote in last week’s newsletter, green energy is a Good Idea, but has saddled many economies with a bad and cripplingly destructive implementation plan. When I read of Germany’s 1T Euro Green Heating Law, I was left wondering if the EU and Germany can actually survive what clearly lies ahead? We explore that outlook below.

WHAT YOU NEED TO KNOW!

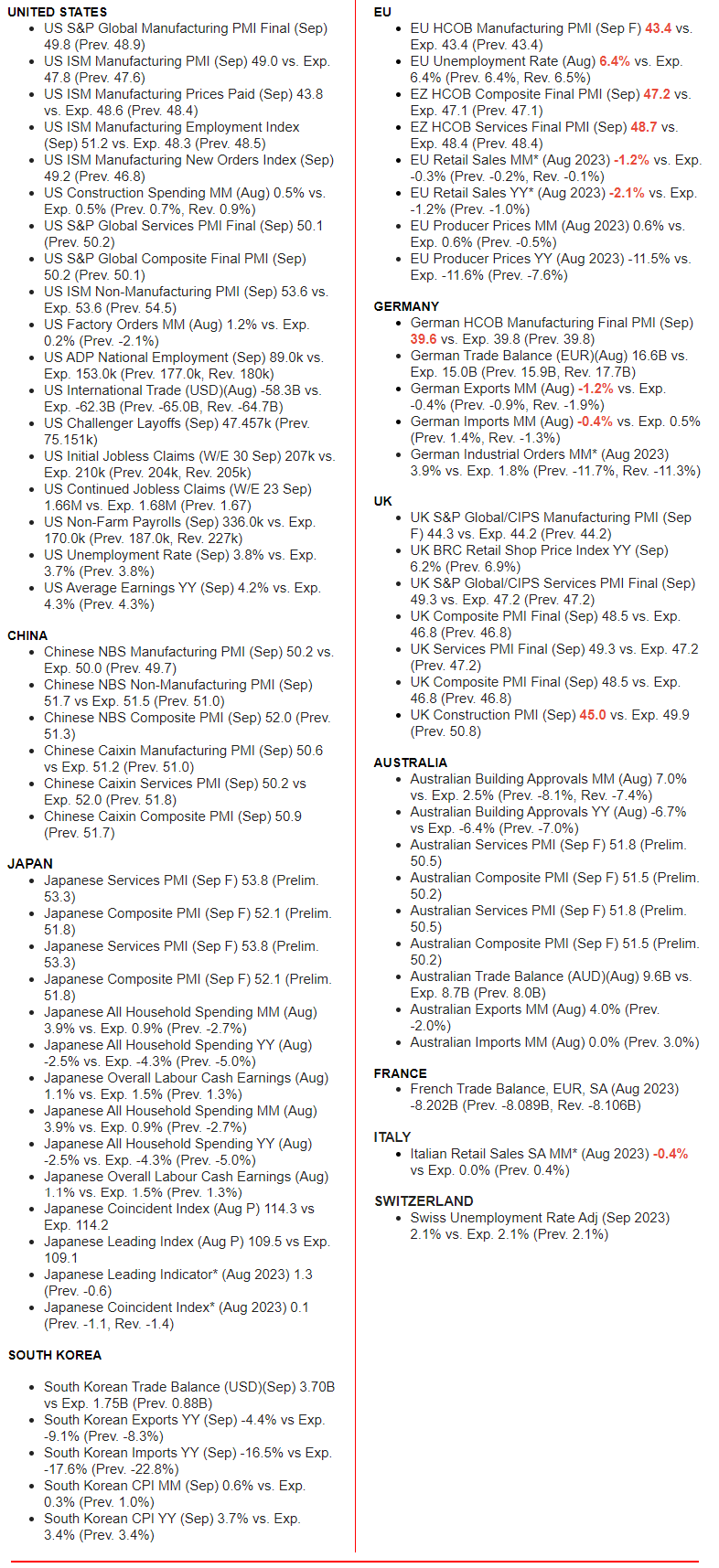

I have been cautioning about a coming dramatic shift in Corporate Equity Buybacks which has been a major pillar of US equity markets. It should be fully expected that current economic conditions and tightening of credit will prompt CFO’s to “pull in their horns” at least temporarily to preserve cash balances. Buybacks will be the first to be placed on “pause”!

I have been cautioning about a coming dramatic shift in Corporate Equity Buybacks which has been a major pillar of US equity markets. It should be fully expected that current economic conditions and tightening of credit will prompt CFO’s to “pull in their horns” at least temporarily to preserve cash balances. Buybacks will be the first to be placed on “pause”!

As a potential recession unfolds the shift will increase in size. As markets potentially fall on tougher financial conditions and weakening equity markets (aided by falling Buybacks), the problem will then get even worse. A potential self-reinforcing cycle could become a catalyst for a crash as public ETF holders hit the panic SELL button as losses mount.

NOTE: Buybacks are currently in a Blackout Window, which began on 09/15/23 and lasts 4-6 weeks depending on a company’s Q3 earnings release.

RESEARCH

WILL GERMANY TAKE THE EU ECONOMY DOWN WITH IT?:

-

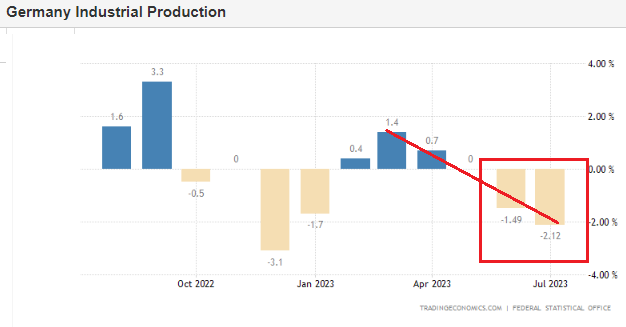

- The German Industrial Export giant has serious problems in front of it. Exports and Industrial Production continue to slow.

- The German Auto Industry is facing slowing sales and a transition to EV technology that is not materailizing in sales as cheaper subsidized Chinese EV products are becoming a major trade threat.

- Many of the problems are self inflicted as a result of poor policy choices.

- German issues are structural in nature and can not be fixed quickly.

- A “sick” Germany will increasingly expose the fundamental flaws in the EU Experiment.

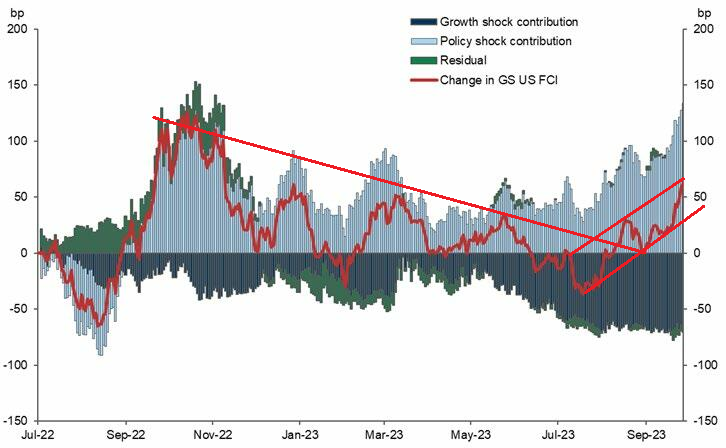

- German Government expects GDP to decline by 0.4% in 2023 in draft Autumn projections. Reasons for the expected mild GDP contraction in 2023 are: i) high energy prices, ii) high inflation and iii) weakness in international trade.

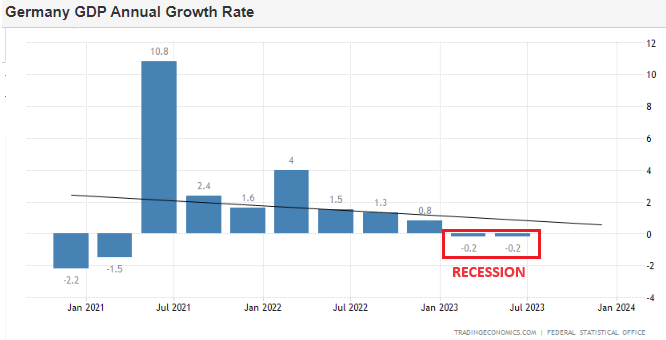

GLOBAL ECONOMIC REPORTING: What This Week’s Key Global Economic Reports Tell Us?

-

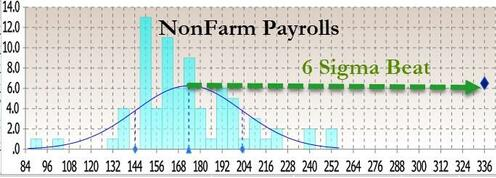

- NON-FARM PAYROLLS: At 336K vs a median forecast of 170K, the September NFP was the first 6-sigma beat of expectations in a long time.

- Having become the butt of all data goal seeking jokes in recent months after revising every single month in 2023 lower, the BLS decided to avoid becoming a complete lackey of the Biden Regime, revised higher not only August but also July. Of course this was now required to support the “Higher-for-Longer” Fed Policy stance to reign in the Biden Regime’s historic budget deficits.

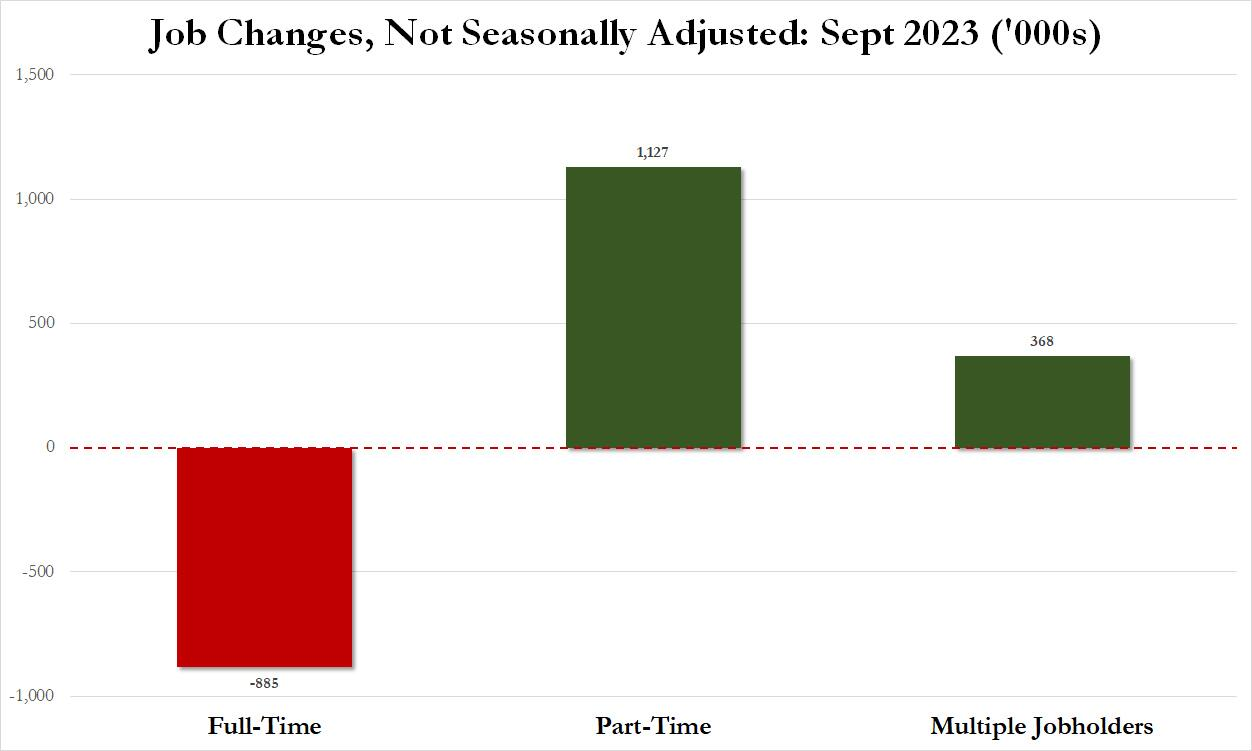

- The bottom line, when you take out the gimmicks, is all of the job gains in September were either from part-time workers or multiple jobholders forced to get another job in addition to their current one, and thus be counted by the BLS as two distinct jobs (or more).

- In September, the subset of multiple jobholders who held both a primary and secondary full-time job just hit an all time high.

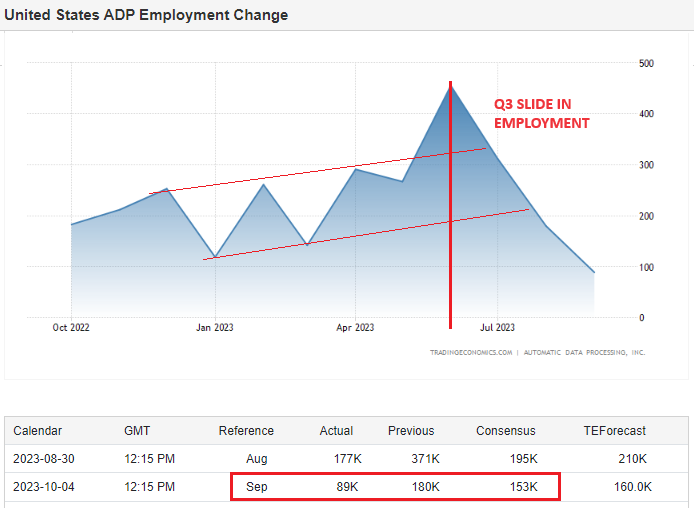

- ADP JOBS REPORT: Private businesses in the US hired 89K workers in September 2023, the least since January 2021 when private employers shed jobs, and well below market forecasts of 153K.

- JOLTS REPORT: The BLS absolutely shocked and stunned markets, strategists and economists when the DOL decided to come up with the largest data fabrication in years, and reported that in August job openings exploded from 8.827MM to a mind-blowing 9.61 million (a 5 Sigma Increase). The increase, a staggering 690K (from the upward revised July print of 8.920MM), was the biggest monthly increase since July 2021.

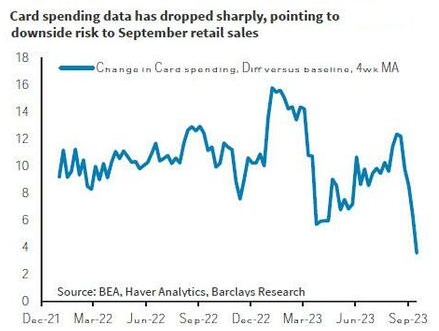

- CONSUMER CREDIT: Real-time data on card spending has taken another leg lower and is significantly weaker than prior levels.

- NON-FARM PAYROLLS: At 336K vs a median forecast of 170K, the September NFP was the first 6-sigma beat of expectations in a long time.

DEVELOPMENTS TO WATCH

TIGHTENING FINANCIAL CONDITIONS INDEX

TIGHTENING FINANCIAL CONDITIONS INDEX

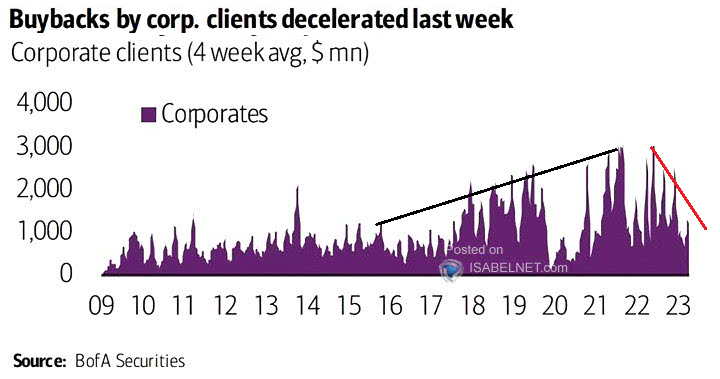

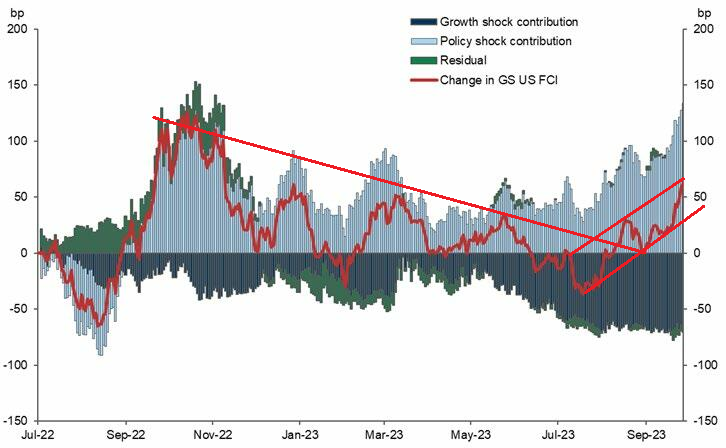

We’ve had a meaningful tightening in financial conditions from the July trough. The FCI has tightened by 100bp and is around 60bp tighter relative to the Jun-Aug average and nearly 40bp since the September FOMC.

INCREASING GLOBAL RECESSION WARNINGS

More organizations are warning of slowing economic and trade conditions which precursors a Global Recession. A Recession that could also drag the US into a Recession.

WILL GERMANY TAKE THE EU ECONOMY DOWN WITH IT?

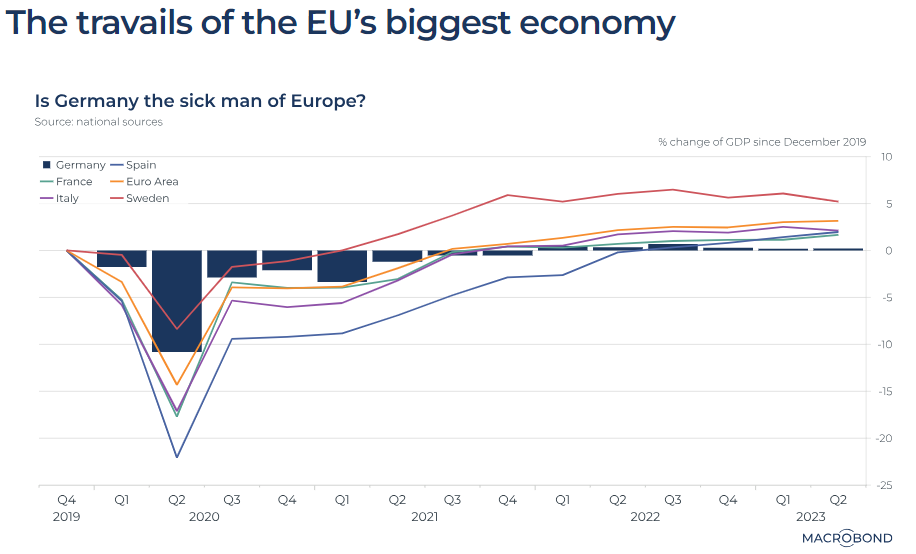

Germany is the world’s worst-performing major developed economy, with both the International Monetary Fund and European Union expecting it to shrink this year. Germany is the only major country whose output is forecast to shrink this year.

Germany is the world’s worst-performing major developed economy, with both the International Monetary Fund and European Union expecting it to shrink this year. Germany is the only major country whose output is forecast to shrink this year.

Germany’s economy is predicted to contract by 0.4% in 2023, which is 0.6 percentage points lower than an estimate made in May. The European Commission also cut its growth expectations for Germany in 2024, from 1.4% to 1.1%.

RECESSION

Germany’s economy fell into recession in the first quarter of 2023. The country’s GDP contracted by 0.5% in the final quarter of 2022 and again in the first quarter of 2023. The European Commission predicts that Germany will be the only major European economy to experience an economic contraction in 2023.

Germany’s economy is still in a phase of weakness. In the second quarter of 2023, GDP stagnated at 0%, below forecasts of 0.1% growth. Household expenditure stabilized after a weak winter half-year.

The European Commission says that weak consumption and a decline in construction investment are expected to negatively impact growth. However, there has been an increase in equipment investment.

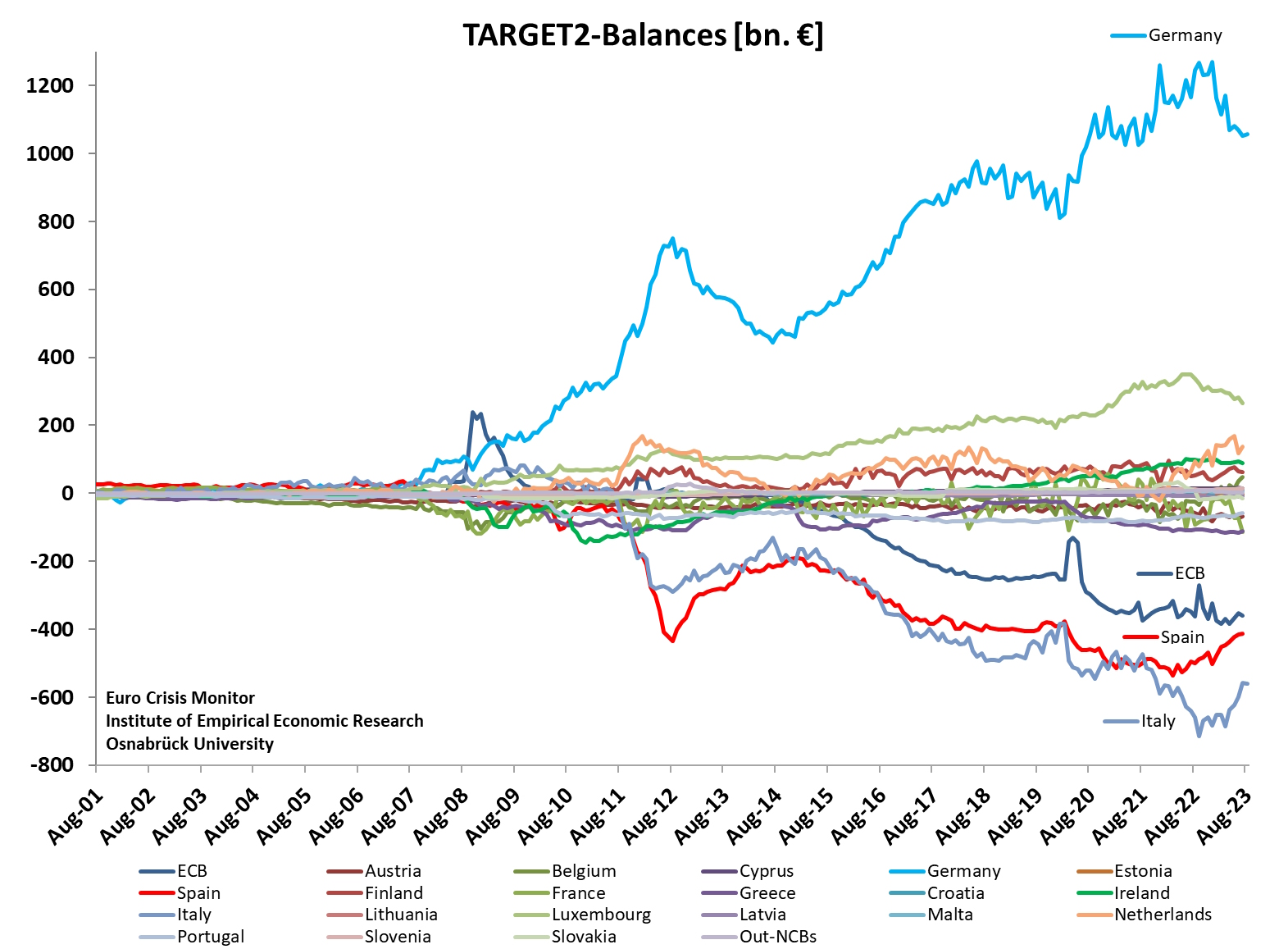

THE EU T2 ACCOUNT SHOWS THE EU DEPENDENCY ON GERMANY

The viability of the EU is solidly dependent on Germany as evidenced by the ECB T2 Central Bank Account Balances.

Some factors that are contributing to Germany’s economic slowdown include:

Some factors that are contributing to Germany’s economic slowdown include:

-

- The war in Ukraine, which caused Germany to turn its back on Russia, its former trading partner

- The loss of cheap Russian natural gas needed to power factories

- Falling private and public spending

- The European Central Bank hiking its main interest rate to a historic high of 3.75% to help curb rising prices

- German industrial production dropping by 0.8% month-on-month in July, from -1.4% MoM in June

Other indicators of Germany’s economic slowdown include:

-

- GDP stagnating at 0% in the second quarter of 2023

- The Purchasing Managers’ Index (PMI) tumbling to 44.7 in August, from 48.5 in July

- Industrial production dropping by 2.1% for the year

- Industrial production being more than 7% below its pre-pandemic level

STUMBLING EXPORT MACHINE

Germany is struggling because the export machine is stumbling. For the first time in decades Germany reported a foreign trade deficit of 1 billion euros ($1.03 billion) for May 2022, marking a shift from its trade surplus to importing more than it exports.

Germany’s economy is struggling because it’s heavily reliant on manufacturing and world trade. It’s particularly vulnerable to global turbulence, including:

-

- Supply-chain disruptions during the pandemic

- Surging energy prices after Russia invaded Ukraine

- The rise in inflation and interest rates

- The uneven post-pandemic recovery in China

- The rise of the electric vehicle

Germany’s economy is also struggling because of longer-term factors, including:

-

- An aging population

- Lagging use of digital technology in business and government

- Excessive red tape that holds back business launches and public construction projects

- A shortage of skilled labor

GERMAN ECONOMIC WEAKNESS

-

- German Government expects GDP to decline by 0.4% in 2023 in draft Autumn projections, according to Reuters citing sources. German government foresees GDP growth of 1.3% in 2024 and 1.5% in 2025, and expects inflation of 6.1% in 2023 and 2.6% in 2024.

- Reasons for the expected mild GDP contraction in 2023 are

-

-

- High energy prices

- High inflation and

- Weakness in international trade

-

To a large extent, Germany’s issues are homemade:

-

- Supply chain frictions in the wake of the pandemic

- The war in Ukraine and

- The energy crisis

have only exposed these structural weaknesses. These deficiencies are the flipside of fiscal austerity and wrong policy preferences over the last decade.

The biggest con of living in Germany is the high amount of tax that is deducted from a worker’s pay. Depending on an expat’s salary, income tax can be as high as 40 percent of their income. The upside of these high taxes is the fact that it allows many subsidies, free education and free healthcare.

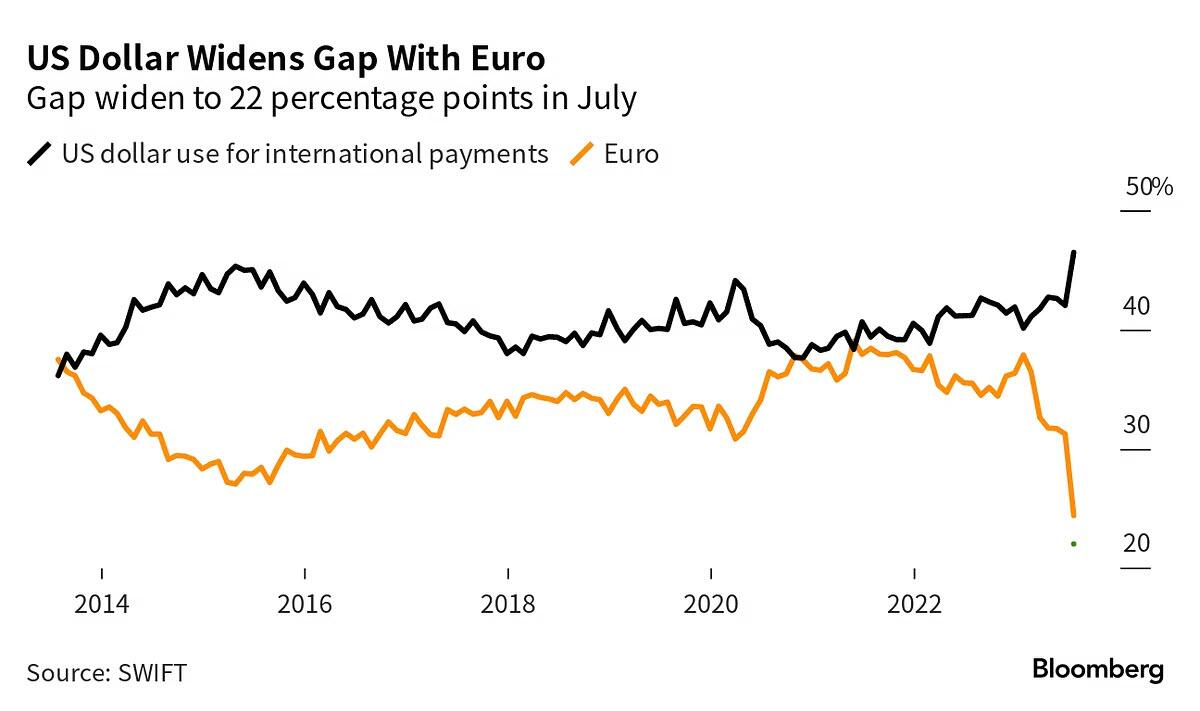

Since mid-July, the common currency has lost nearly 8% against the dollar.

Since mid-July, the common currency has lost nearly 8% against the dollar.

According to data from SWIFT – the global messaging service for cash transactions – the use of the euro has collapsed in the past nine months.

Its share in transactions dropped from 38% in January to 23.2% at the end of August, which is the lowest level recorded in, at least, twelve years.

CONCLUSIONS

-

- The German Industrial Export giant has serious problems in front of it. Exports and Industrial Production continue to slow.

- The German Auto Industry is facing slowing sales and a transition to EV technology that is not materailizing in sales, as cheaper subsidized Chinese EV products are becoming a major trade threat.

- Many of the problems are self inflicted as a resut of poor policy choices.

- German issues are structural in nature and can not be fixed quickly.

- A “sick” Germany will increasingly expose the fundamental flaws in the EU Experiment.

GLOBAL ECONOMIC INDICATORS: What This Week’s Key Global Economic ReleasesTell Us

ADP JOBS REPORT

Private businesses in the US hired 89K workers in September 2023, the least since January 2021 when private employers shed jobs, and well below market forecasts of 153K. It follows a revised 180K increase in August, compared to an initial 177K. The services sector added 81K jobs, namely leisure/hospitality (92K), financial activities (17K) and education and health services (10K). Construction also added 16K and natural resources/mining created 4K jobs. In contrast, losses were seen in professional and business services (-32K), trade, transportation and utilities (-13K) and in manufacturing (-12K). Large establishments drove the slowdown, losing 83K jobs and wiping out gains they made in August. On the other hand, small companies added 95K jobs and mid-sized ones 72K. Meanwhile, annual wage growth slowed to 5.9%, the 12th consecutive monthly decline. Pay gains also shrank for job changers to 9%.

Private businesses in the US hired 89K workers in September 2023, the least since January 2021 when private employers shed jobs, and well below market forecasts of 153K. It follows a revised 180K increase in August, compared to an initial 177K. The services sector added 81K jobs, namely leisure/hospitality (92K), financial activities (17K) and education and health services (10K). Construction also added 16K and natural resources/mining created 4K jobs. In contrast, losses were seen in professional and business services (-32K), trade, transportation and utilities (-13K) and in manufacturing (-12K). Large establishments drove the slowdown, losing 83K jobs and wiping out gains they made in August. On the other hand, small companies added 95K jobs and mid-sized ones 72K. Meanwhile, annual wage growth slowed to 5.9%, the 12th consecutive monthly decline. Pay gains also shrank for job changers to 9%.

NON-FARM PAYROLLS REPORT (NFP)

At 336K vs a median forecast of 170K, the Sepember NFP was the first 6-sigma beat of expectations in a long time. Having become the butt of all data goalseeking jokes in recent months after revising every single month in 2023 lower, the BLS decided to avoid becoming a complete industry joke, revised not only August but also July higher. Of course this also supports the “Higher for Longer” Fed Policy stance to reign in the Biden Regime budget deficits.

At 336K vs a median forecast of 170K, the Sepember NFP was the first 6-sigma beat of expectations in a long time. Having become the butt of all data goalseeking jokes in recent months after revising every single month in 2023 lower, the BLS decided to avoid becoming a complete industry joke, revised not only August but also July higher. Of course this also supports the “Higher for Longer” Fed Policy stance to reign in the Biden Regime budget deficits.

The change in total nonfarm payroll employment for July was revised up by 79,000, from +157,000 to +236,000, and the change for August was revised up by 40,000, from +187,000 to +227,000. With these revisions, employment in July and August combined is 119,000 higher than previously reported.

Perhaps the most remarkable divergence in the report is that with headline payrolls surging 336K (establishment survey), the Household Survey indicated that the pain continues, as the number of people employed not only rose by less than 100K (86K to be precise), but it was all part-time workers, which increased by 151K. Full-time workers dropped by 22K, and the lowest since February.

-

- Government employment increased by 73,000.

- Leisure and hospitality added 96,000 jobs.

- Health care added 41,000 jobs.

- Social assistance added 25,000 jobs.

One final observation on the multiple jobholders: in September, the subset of multiple jobholders who held both a primary and secondary full-time job just hit an all time high.

KEY NOTE: All of the job gains in September were either from part-time workers or multiple jobholders forced to get another job in addition to their current one, and thus be counted by the BLS as two distinct jobs (or more).

KEY NOTE: All of the job gains in September were either from part-time workers or multiple jobholders forced to get another job in addition to their current one, and thus be counted by the BLS as two distinct jobs (or more).

Growth in Multiple jobholders stood out n September. The aparent good news in the September Jobs report was actually bad news because it wa about part time job and mutliple jobholders with ab actual shrikage in Full Time Employment (Charts right and below).

US JOB OPENINGS REPORT (JOLTS) (REPORT)

US JOLTS Job Openings (Aug 2023) 9.61M vs. Exp. 8.8M (Prev. 8.827M, Rev. 8.92M)

The BLS absolutely shocked and stunned markets, strategists and economists when the DOL decided to come up with the largest data fabrication in years, and reported that in August job openings exploded from 8.827MM to a mindblowing 9.61 million. The increase, a staggering 690K (from the upward revised July print of 8.920MM), was the biggest monthly increase since July 2021.

“Someone has to tell Biden that at the rate he is fabricating data, he will break absolutely everything”

– Tyler Durden, ZeroHedge.

CONSUMER CREDIT

Real-time data on card spending has taken

Real-time data on card spending has taken

another leg lower and is significantly weaker than prior levels.

Credit Card data showed that total spending in Sept. week 5 (ended 9/30) decreased 11.3%, a deceleration compared to the week ended 9/23, which was -10.9%.

This points to a potentially weak retail sales print in September, though that is scheduled to be released on Oct. 17.

“The XRT retail ETF is at the lowest level since June after peaking on the “last Fed hike” in late July, and as we enter into 4Q, there is a lot on the line in the consumer space, something that has not been lost on the market. Shorting in the consumer discretionary space is at YTD highs as a result of a growing multitude of macro issues.”

Goldman Consumer Trader Scott Feiler

DEVELOPMENTS TO WATCH

INCREASING GLOBAL RECESSION WARNINGS

INCREASING GLOBAL RECESSION WARNINGS

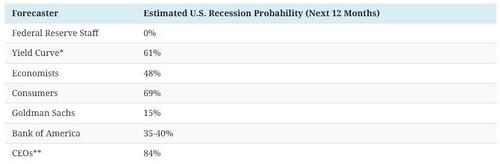

More organizations are warning of slowing economic and trade conditions which is a harbinger of a Global Recession. A Recession that could also drag the US into a Recession.

-

- World Trade Organization (WTO): “The trade slowdown appears to be broad-based, involving a large number of countries and a wide array of goods.The Geneva-based institution expects the merchandise trade volume in 2023 to slightly increase by 0.8% from last year, compared with an April forecast of 1.7%. That’s well below the 2.6% annual growth recorded since the global financial crisis about 16 years ago.

- UN Conference on Trade and Development (Unctad) : “The global economy is stalling, with Europe teetering on the edge of recession, China facing strong headwinds and financial stresses are reappearing in the United States.”

-

Conference Board: Consumers share a more cautious sentiment, with over 69% saying that a recession is likely in the next year, based on a Conference Board survey.

Conference Board: Consumers share a more cautious sentiment, with over 69% saying that a recession is likely in the next year, based on a Conference Board survey.- Q3 CEO Survey: Probability of a recession over the next 12-18 months is 84%.

TIGHTENING FINANCIAL CONDITIONS INDEX

We’ve had a meaningful tightening in financial conditions from the July trough. The FCI has tightened by 100bp and is around 60bp tighter relative to the Jun-Aug average and nearly 40bp since the September FOMC.

We’ve had a meaningful tightening in financial conditions from the July trough. The FCI has tightened by 100bp and is around 60bp tighter relative to the Jun-Aug average and nearly 40bp since the September FOMC.

“Rules of Thumb” suggests that 25bp of FCI tightening is roughly equivalent to a 25bp rate hike and 25bp off growth over the next 12 months. This is starting to be meaningful for Fed choices and reinforces forecasts that the Fed will not hike in November.

Even before this latest FCI spike, US data surprises have shifted from firmly positive to mildly negative on a 1-month rolling basis and forecasts a Q4 pothole that sees slower GDP growth.

SPIKING RATES SENDING SHOCK WAVES

ACROSS THE MARKETS!

AT EXTREME LEVELS OF MARKET FEAR

Click All Charts to Enlarge

1 – SITUATIONAL ANALYSIS

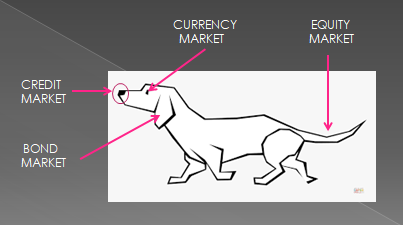

The credit markets almost always smell problems first. Like a dog’s nose, it detects danger or opportunity before it sees or hears its. All three senses become attuned before the “equity” tail stops wagging!

The credit markets almost always smell problems first. Like a dog’s nose, it detects danger or opportunity before it sees or hears its. All three senses become attuned before the “equity” tail stops wagging!

-

- NOTE: We will discuss credit and bond yield in this newsletter and leave early weakness in the US$ and Equity Markets for an expanded detailed disucssion in this week’s LONGWave video release.

CREDIT MARKETS SOUNDING THE EARLY ALARM!

SOMETHING IS BEING TRIGGERED?

SOMETHING IS BEING TRIGGERED?

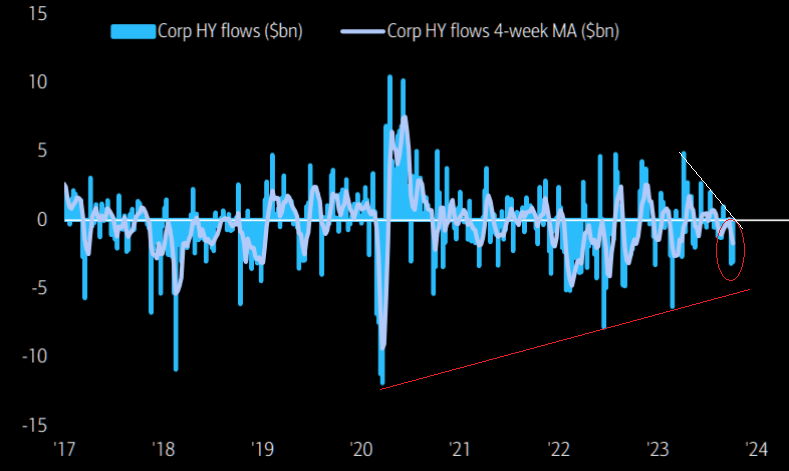

Chart Right

We just witnessed the biggest outflows in HY bond fund outflows over the past 5 weeks since SVB hit the world.

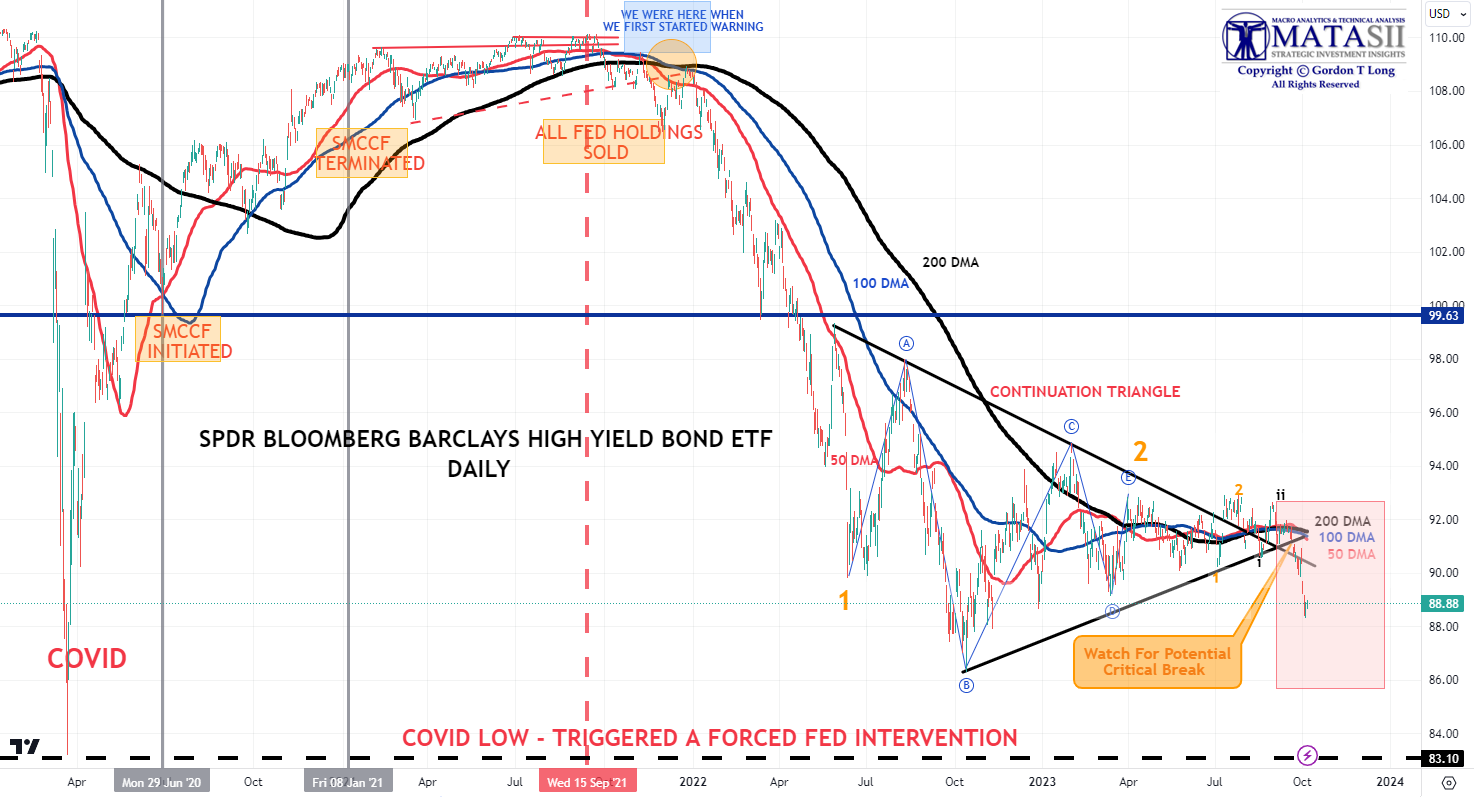

Chart Below

-

- Clear Breakout of “coiling” consolidation continuation triangle

- Concurrent 50/100/200 DMA Death Crosses

YOUR DESK TOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

FEAR PERMEATING MARKETS

2 – FUNDAMENTAL ANALYSIS

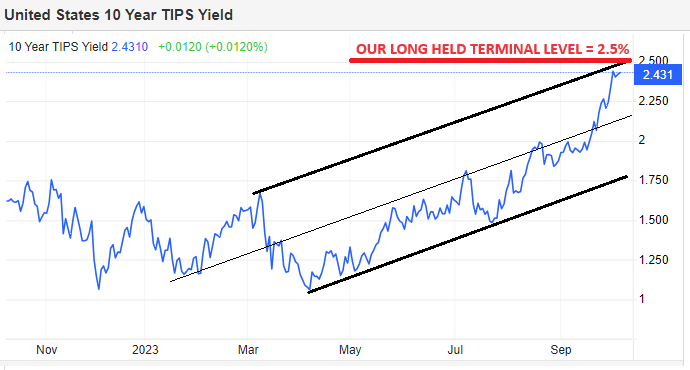

REAL RATE SURGE

REAL RATE SURGE

- Tightening Financial Conditions (FCI) are driving a surge in Real US Rates. (Chart Right)

- Surging Real Rates are driving rising Nominal Yields.

FISHER’S EQUATION

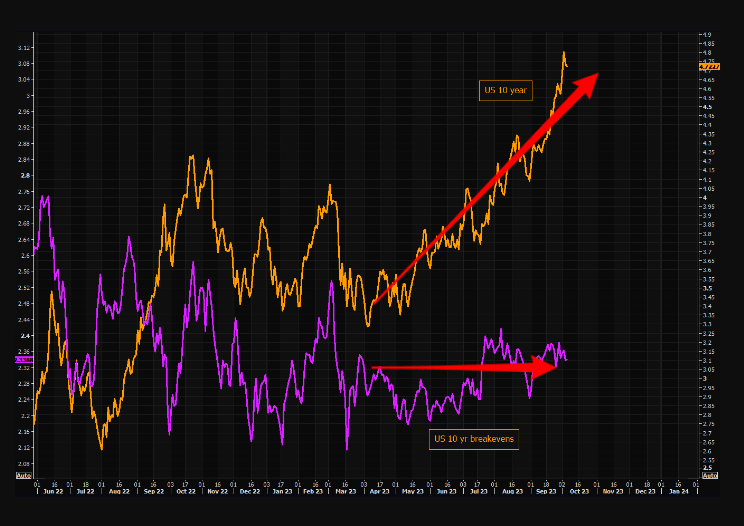

NOMINAL YIELDS = INFLATION BREAK EVEN RATE + REAL RATE (Represented Below By 10Y TIPS Yield)

3 – TECHNICAL ANALYSIS

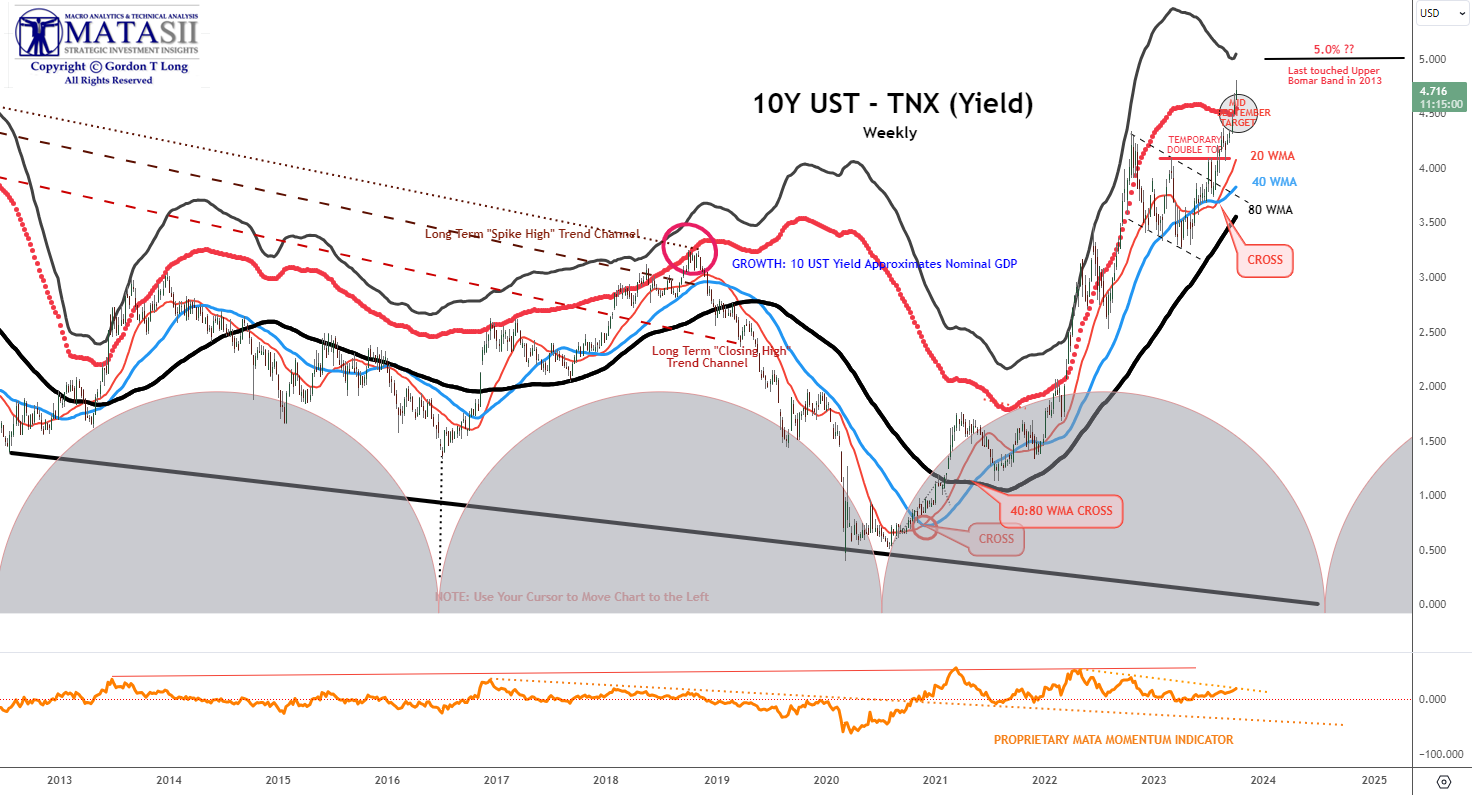

10Y US TREASURY YIELD – “TNX”

10Y US TREASURY YIELD – “TNX”

It is clear when you compare the moves in Real Rates versus Infaltion Breakevens for the 10Y US Treasury Note that its recent surge in Yields is being driven by rapidly rising Real Rates (Chart Right). Meanwhile, Inflation Breakevens are being driven by the move in oil which they track tick for tick.

The rise in Real Rates is being driven by:

-

- Tightening of the Financial Conditions Index

- Fed’s QT reduction of its balance sheet now down to ~$7.9T

- Fed’s level of increase in the Fed Funds Rate relative to other Central Bank levels

- The change in perception that the US is likely to experience a “Soft Landing” or even the possibility of avoiding a Recession. (Note: We completely disagree with this trading sentiment.)

If our assessment of an near term upper bound of 2.5% on real rates, then we should see US 10Y Treasury Yeilds facing some technical upper resistance. This is exactly what the charts below for the 10Y Treasury Yield suggest.

WEEKLY TNX

YOUR DESK TOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

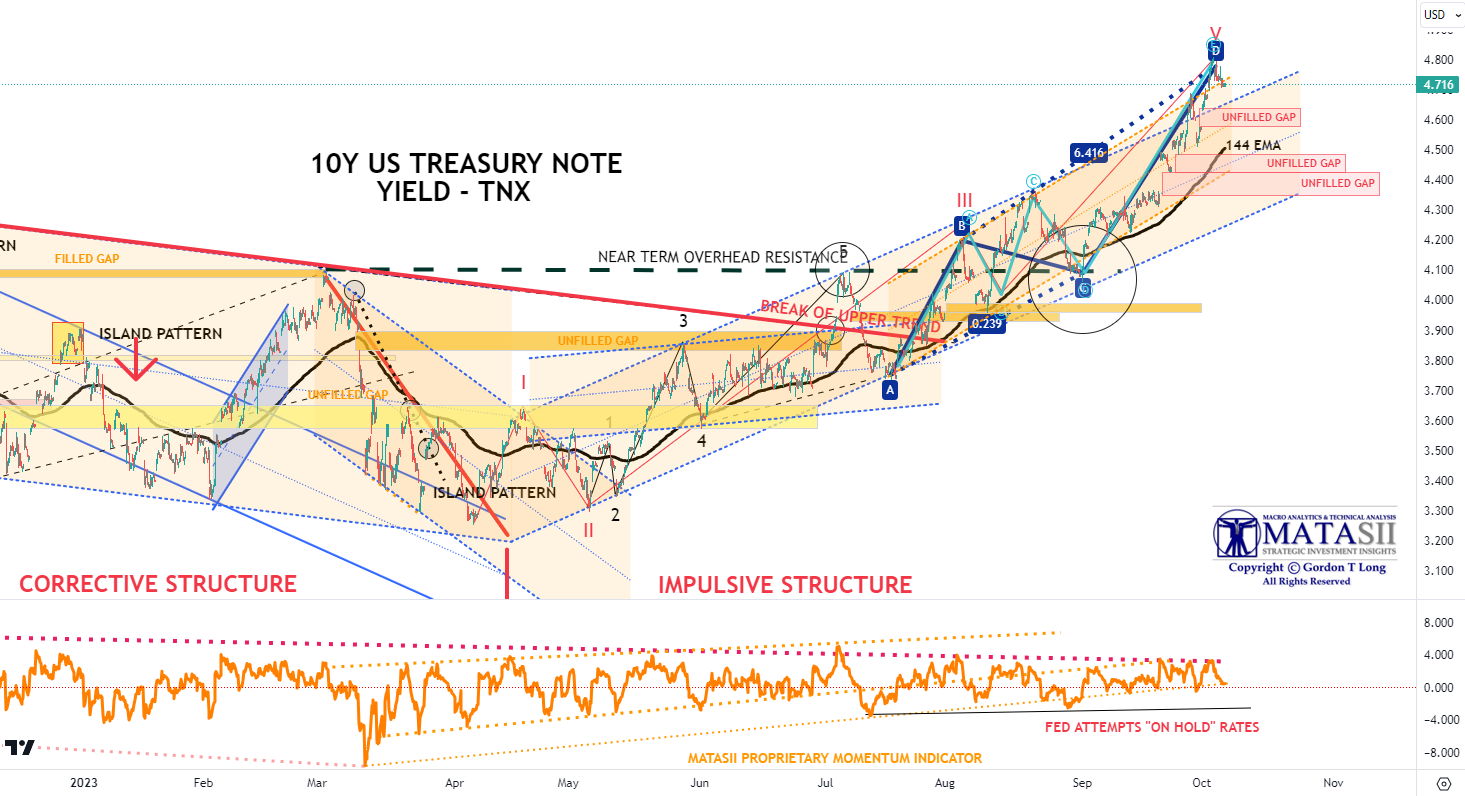

HOURLY TNX

The short term hourly chart for the 10Y Treasury Note Yield (“TNX) suggests we are completing a final “throw-over” before consolidating with the filing of a number of open Price Gaps.

YOUR DESK TOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

S&P 500 – CRITICAL SUPPORT TEST

We leave you with one chart on the S&P 500 to illustrate the critical support level it is currently testing. So far the SPX has bounced right on the massive trend line and the 200 day moving average. Note the shorter term trend channel that has been in place since July highs. The upper part of that channel is the first big resistance, the 4400 area. (Also see your MATASII S&P Chart: https://www.tradingview.com/chart/VvTLZ5gj/ )

If yields begin to consolidate at slightly lower levels, this is likely to be a catalyst in pushing equities moderately higher.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.