MACRO ECONOMIC

JAPAN

TIME TO PAY ATTENTION TO THE JAPANESE CARRY TRADE!

OBSERVATIONS: WHO IS BIDENOMICS HELPING MOST?

We are going to focus on the Japanese Carry Trade in this newsletter, but first we need to make a few points on the Bidenomics debt buildup which the Japanese Carry Trade will be relied on to finance, along with the additional 84,000 new IRS agents being hired & trained!

President Biden and his allies in Congress have increased federal spending with apparently no plans nor means to actually finance the Trillion dollar budget deficits that the world will be required to ante-up? The Green Energy jobs promised are not being created to the degree taunted and Climate Change has only delivered more regulatory burdens.

The vast subsidies for “green” energy products, like electric vehicles, are turning out to be handouts to the wealthy. Lower and middle-income families cannot afford $60,000 for an electric vehicle, so the tax breaks that accompany the purchase of the vehicle go almost exclusively to upper-income earners or more specifically, the political donor class.

Bidenomics is not merely regressive because of the inflation it causes. Many specific policies promoted by Bidenomics are giveaways to the very groups Biden demands “must pay their fair share.” Bailing out student loan borrowers disproportionately helps people with higher lifetime earnings, at the expense of taxpayers who never went to college and didn’t borrow to attend college.

Meanwhile higher interest rates have drastically increased the cost to finance anything—credit card interest rates are at record highs, and mortgage rates are almost three times as high as they were three years ago. The combination of higher home prices and higher interest rates has broken America’s housing market.

Since Mr. Biden became president, the median home price has jumped over 27%, and interest rates have risen from 2.8% to 7.2%.Those two factors have caused the monthly mortgage payment on a median-priced home to more than double, from $979 to $2,075.That’s costing a family more than $13,000 extra per year for the same house. This has forced many Americans to rent instead, and the increased demand for apartments has driven rents to record highs.

The percentage of take-home pay that must go to paying a mortgage is much higher today because home prices have risen so much faster than incomes for decades. Consequently, homeownership affordability today is at one of its lowest levels in American history.

The entire destructive process can be short-circuited, however, if we just remove the first link in the chain: excessive government spending. If Bidenomics is not reversed, don’t expect the housing market, or for that matter, anything else to improve.

The hallmark of Bidenomics is becoming clearer by the day. It is nothing more than bigger government, including more regulation and taxation, sold as saving the world from Climate Change.

The question is who is going to finance this reckless spending?

WHAT YOU NEED TO KNOW!

2Y US INFLATION SWAPS SURGING

2Y US INFLATION SWAPS SURGING

The market’s expectations for short-term inflation are surging! Now at 6-month highs.

This activity by institutional professionals (who trade these Swaps) supports our belief that we are entering the 2nd (of three) Inflation Waves.

Wave 2 will be driven initially by Energy price,s resuming their rising prices and then rising food prices, driven by fertilizer and distribution transportation costs.

RESEARCH IN THIS NEWSLETTER

TIME TO PAY ATTENTION TO JAPAN: The Japanese Carry Trade is Not To Be Fooled With!

-

- With the emergence of BRICS-11 and gaining momentum of De-Dollarization, Japan has become central to the US funding its growing government debt.

- For the last decade China and Japan have been the dominant offical players in the purchase of US Debt.

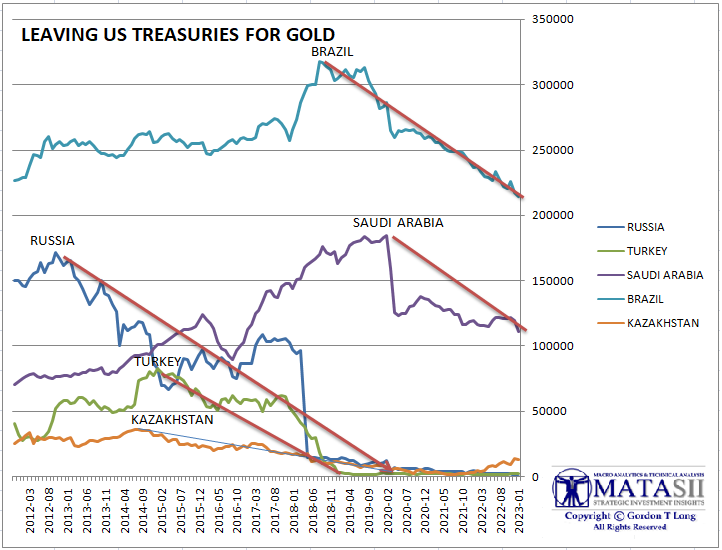

- China has been steadily selling US Debt, Russia has sold all US debt holdings and other US sanctioned countries have sold their US debt or minmally stopped buying more.

- That has left the US dependent on Japan to not simply maintain its current holdings (as they roll-over) but substantially increase their holdings.

- You can be assured that US and Japanese officials from the Fed/BOJ to US Treasury/Japan Treasury to major banks are closely involved in ensuring the Japanese Carry Trade does not weaken, In fact it is critically important to financing US debt growth that it now be significantly increased!!

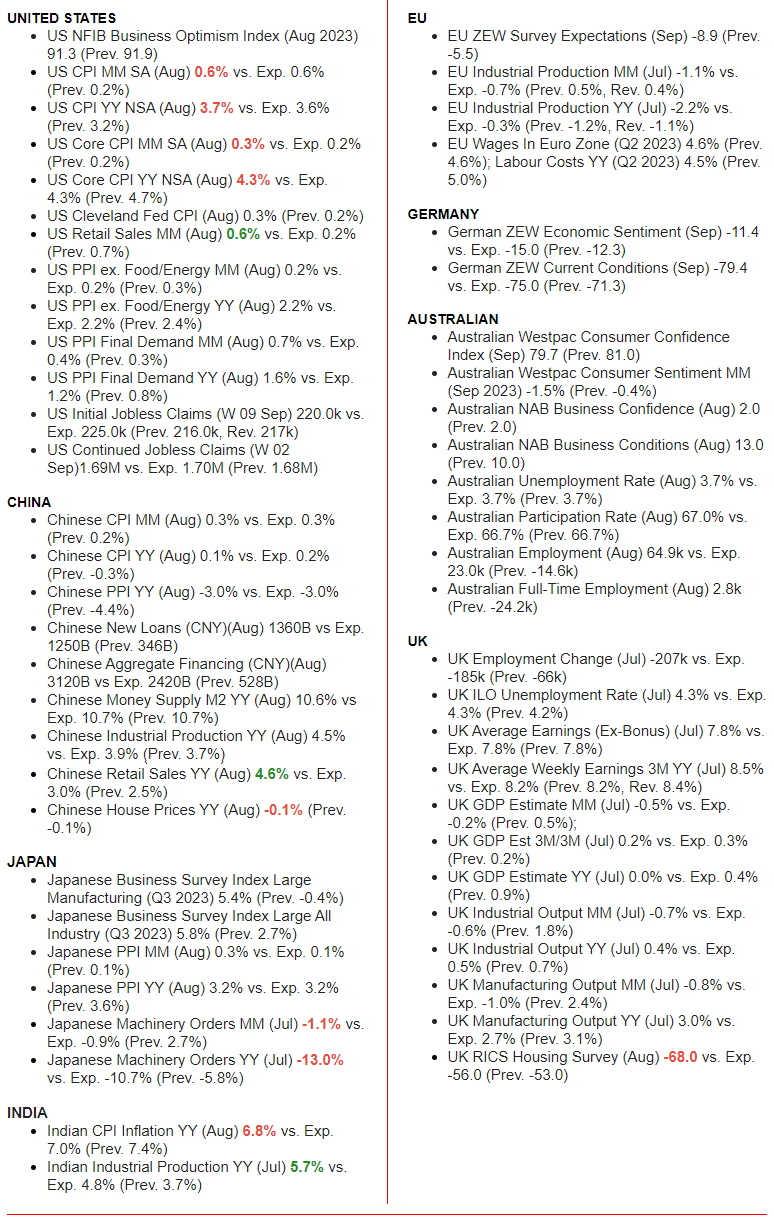

GLOBAL ECONOMIC REPORTING: What This Week’s Key Global Economic Reports Tell Us!

-

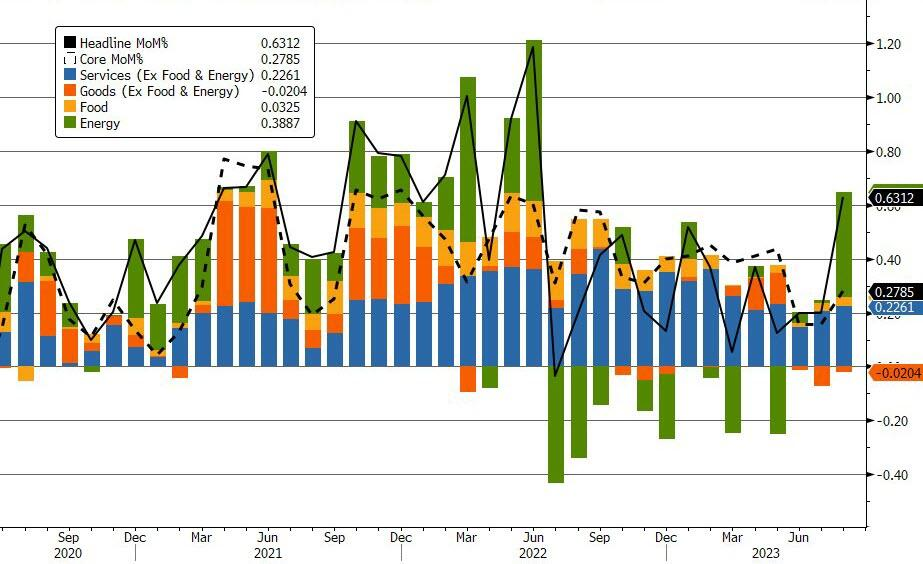

- US CPI: US CPI MM SA (Aug) 0.6% vs. Exp. 0.6% (Prev. 0.2%), US CPI YY NSA (Aug) 3.7% vs. Exp. 3.6% (Prev. 3.2%)

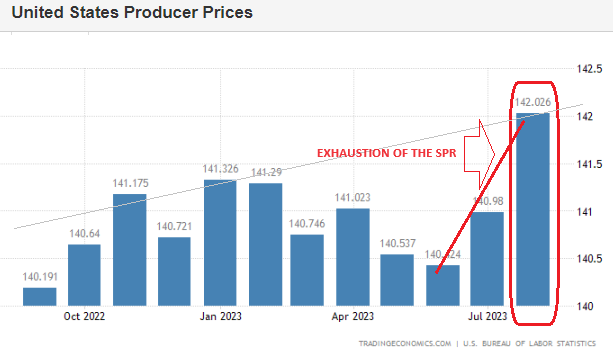

- US PPI: US PPI ex. Food/Energy MM (Aug) 0.2% vs. Exp. 0.2% (Prev. 0.3%), US PPI ex. Food/Energy YY (Aug) 2.2% vs. Exp. 2.2% (Prev. 2.4%)

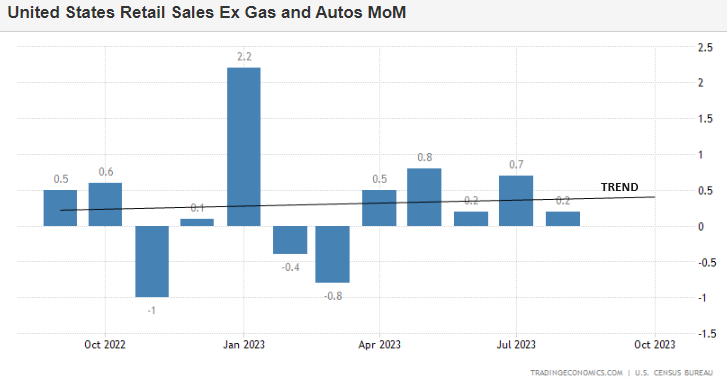

- US RETAIL SALES: US Retail Sales MM (Aug) 0.6% vs. Exp. 0.2% (Prev. 0.7%)

- ECB HIKED RATES BY 25bps to lift the Deposit Rate to 4.0% and the Refinancing Rate to 4.5%, while it stated rates have reached levels that maintained for a sufficiently long duration. This will make a substantial contribution to the timely return of inflation to the target.

- PBoC CUT THE RRR by 25bps effective September 15th with the weighted average deposit reserve ratio of financial institutions to be approximately 7.4%. This excludes financial institutions that have implemented a 5% deposit reserve ratio, while it will maintain the basic stability of the exchange rate, firmly support the sustainability of the real economy and promote the economy to achieve effective qualitative improvement and reasonable quantitative growth. PBoC’s RRR cut is to release over CNY 500bln of liquidity, according to Chinese state media.

DEVELOPMENTS TO WATCH

RISING GASOLINE PRICES NOW THAT BIDEN’S SPR GAMESMANSHIP IS DEPLETED

RISING GASOLINE PRICES NOW THAT BIDEN’S SPR GAMESMANSHIP IS DEPLETED

Surging oil prices are dragging wholesale gasoline prices higher again, which will inevitably drag pump prices higher. (CHART RIGHT). This means inflation will be on the top of consumers’ mind once again! Meanwhile it appears the Biden admin has used up its geopolitical (Saudi) and domestic (SPR) ammo to do anything about it.

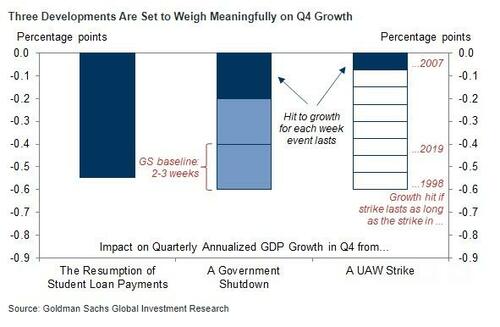

THREE DEVELOPMENTS TO WATCH CLOSELY

-

- The resumption of Student Loan Payments (Began 09/01/23 with payments beginning in October)

- A potential Temporary Federal Government Shutdown (Deadline 09/30/23)

- Reduced auto production from the UAW Strike to slow US GDP growth in 4Q23 (Initial Deadline 09/14/23)

According to JP Morgan this has the potential to slow US GDP growth in 4Q23 to +1.3% from 3.1% this quarter.

TWO MACRO RISKS

-

- The economy slows down faster or more than expected

- Inflation stays sticky (oil not helping) and Fed must raise rates/keep higher for longer

TIME TO PAY ATTENTION TO JAPAN: The Japanese Carry Trade is Not To Be Fooled With!

To address the significance of what is unfolding in Japan and what it potentially means to America, we need to examine the following:

-

- How Important is The Japanese Carry Trade to America and the World?

- Key Components to the Japanese Carry Trade

- Current Developments in Japan

- What these Developments Mean?

- Ramifications to Your Investment Strategy?

THE JAPANESE CARRY TRADE – The Last Man Standing For America?

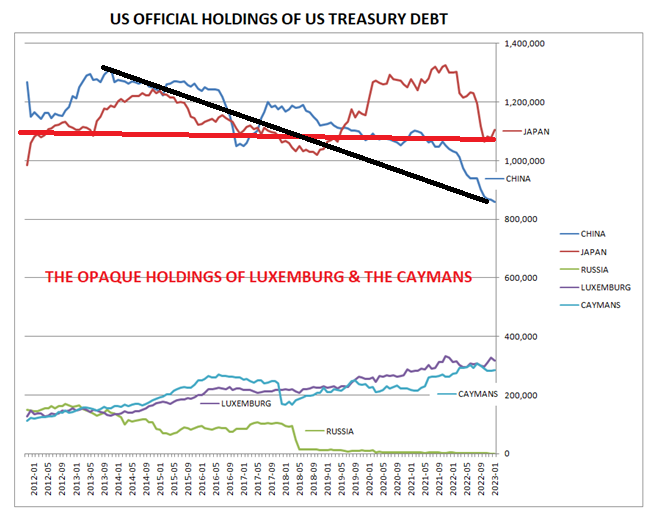

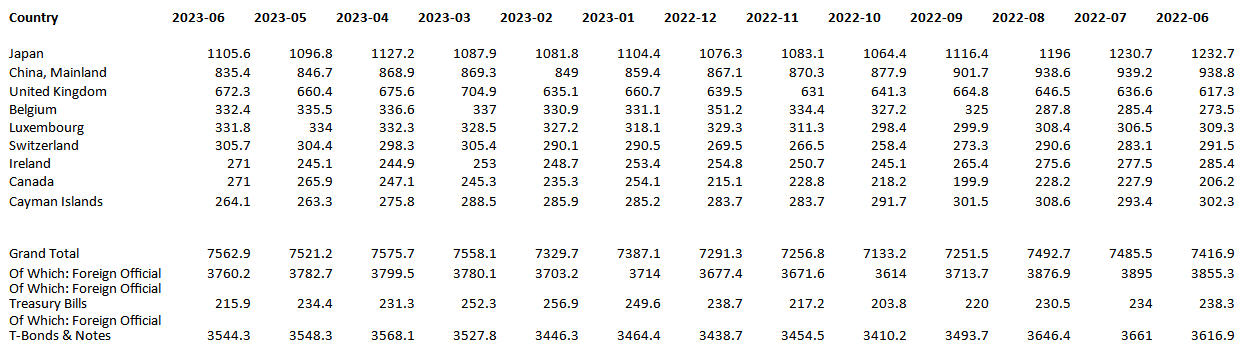

IMPORTANCE OF JAPAN BUYING US DEBT

IMPORTANCE OF JAPAN BUYING US DEBT

With the emergence of BRICS-11 and gaining momentum of De-Dollarization, Japan has become central to the US funding its growing government debt. For the last decade China and Japan have been the dominant offical players in the purchase of US Debt. China has been steadily selling US Debt (See chart right in black), Russia has sold all US debt holdings, and other US sanctioned countries have sold their US debt or minmally stopped buying more. That has left the US dependent on Japan to not simply maintain its current holdings (as they roll-over), but substantially increase their holdings.

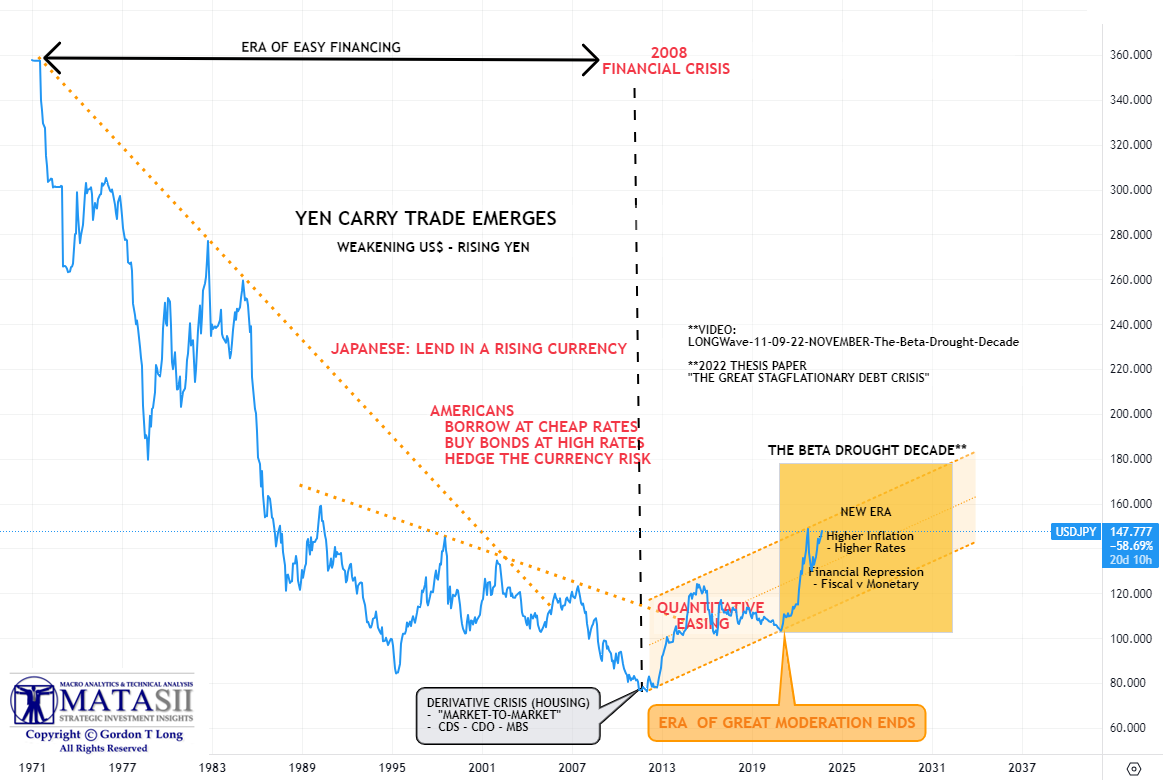

IMPORTANCE OF JAPANESE CARRY TRADE

The Bank of Japan (BOJ)’s offical buying of US debt is reflected in the table below. What is not clearly evident in the chart is the impact of the Japanese Carry Trade in also purchasing US debt. Global banks, Financial Institutions, Pension Plans, Insurance Companies, Hedge Funds and Large Fund Managers world wide engage in borrowing at near zero interest in Japan, buying US debt (currently yielding 4.3% on the US 10Y) and profit the difference after any currency hedging costs. It is quite literally like printing money. These transactions are often held in accounts in the Grand Caymans and Luxemberg. ANY CHANGE TO THIS FLOW AND THE US DEBT PYRAMID COLLAPSES!!

WHAT DOES ALL THIS POSSIBLY MEAN?

THE JAPANESE CARRY TRADE

GENERIC CARRY TRADE

-

- For a Carry Trade to work there must be an interest rate differential between two countries sufficent to motivate institutions to capture that differential.

- There also must be an incentive for lenders in the low interest bearing nation to want to lend. The motivation here is usually to protect against currency devaluation or capture that expected devaluation.

- Both of these requirements have been abundant in Japan for decades and assisted in funding the US as it slowly became a country consuming more than it produced.

- The borrower has added incentive to borrow if the lending country’s currency is devaluing, because they will pay the borrowing back at a lower currency value since the debt was taken out in the local currency.

- However, the borrowing country can experience the exposure to an appreciating currency in the country to which the carry is invested. Currency Hedging is therefore required which has costs that must be netted against the Carry gains.

- As simple as this seem, it requires an institutional framework to execute effectively cross border as rates, currencies and taxations changes.

SITUATIONAL ANALYSIS

JAPAN IS DIFFERENT IN THREE MAJOR REGARDS

-

- Politicians (Ministry of Finance) control interest rates in Japan, not the central bank (BOJ).

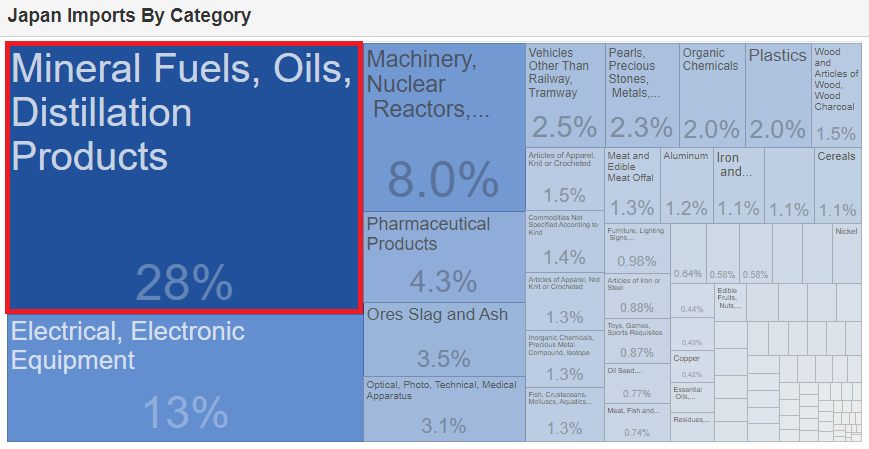

- Japan is an island and as such is dependent on Imports for almost everything. It makes a living exporting value add to the materials and components it initially imported (i.e. Cars and Electronics).

- Mrs. Watanabe

-

-

- Mrs. Watanabe is a collective term for thousands of Japanese housewives who invest while at home. The term is a metaphor for Japan’s housewife yen speculators. It entered the vernacular in 1997 when The Economist wrote about individual retail investors in Japan.

- Mrs. Watanabe is a common Japanese surname. The original meaning of the name was occupational, referring to the “ferrymen’s guild”. It is one of the ten most common surnames, especially in eastern Japan.

- Mrs. Watanabe is a carry trader who makes a profit by selling the low interest JPY.

- In 2022, Mrs. Watanabe broke retail FX trading records.

- The Carry Trade is Carried out by Foreigners but Financed by Low lending rates offered by willing Japanese Banks, Investors & BOJ.

-

JAPANESE CARRY TRADE:

-

- The massive Japanese Carry Trade requires higher yielding foreign bond yields, while their rising currency relative to the Yen means high profits are repatriated into low cost yen. Those profits, if spent on consumption by private lenders (Mrs Wantanabe), must absorb inflation while lending institutions must use local currency hedges to capture the small lending yields.

- If however they are only lending nation investments, they will be pledged as collateral and investments taken out in high yielding cash overseas (like US T-Bills, Money Market Funds et al.).

- The process and rewards are different for Japanese Private Investors, Japanese Banks, The BOJ and Foreign Lenders. All come with their own levels of complexity.

BOJ CAN’T RAISE RATES SIGNIFICANTLY BECAUSE:

-

- The Japanese economy is now built on low rates. Rate increase must be gradual, but rates have been a US driven de-stabilizing shock.

- Though Japan recently raised the YCC upper band modestly, it has become problematic to sustain.

- Higher interest rates are expected to stil be a few years away, because the Bank of Japan needs to manage any risk to the economy from sudden hikes.

PROBLEM:

-

- Policy of Sustained Low Rates & YCC initiated to counter deflation

- Japan’s central bank, the Bank of Japan (BOJ), has kept its benchmark rate at -0.1% since 2016. It is the only nation still maintaining negative rates.

- Low rates have made Japanese Yields less attractive than American rates and is thereby weakening the Yen versus Dollar and other currencies.

- Yen is at a three decade low versus the dollar, which is making imports (as an import nation) more expensive and pushing inflation up. This places more pressures on rates needing to be higher.

- Japan’s debt is owned primarily by itself and maintains a possible trade balance.

- It is currently expected that the US Dollar may reach 170 if Japanese rates continue to be maintained at current low levels.

PERCEPTION: WHY THE BOJ HAS NOT RAISED INTEREST RATES IS BECAUSE:

-

- Japan’s government is heavily indebted. A rate increase could make it more difficult for Japan to service its debt.

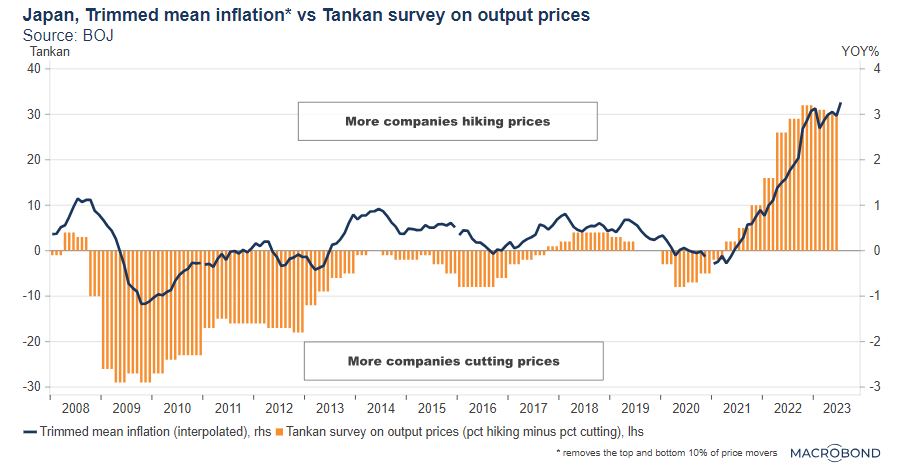

- Tightening monetary policy prematurely could put Japan’s goal of attaining stable 2% inflation at risk.

- The government, not the central bank, has jurisdiction over exchange-rate policy.

- The BOJ forecasts lower future inflation.

The BOJ has recently taken steps toward allowing interest rates to rise. Japan’s Ministry of Finance has stated it will raise its assumed long-term interest rate to 1.5% for the fiscal 2024/25 year.

“SIGNALS” OUT OF JAPAN

To get a clearer perspective of what the current Japanese developments potentially mean, it would be valuable to read the following studies for current context and many excellent charts.

To get a clearer perspective of what the current Japanese developments potentially mean, it would be valuable to read the following studies for current context and many excellent charts.

-

- 09/07/23: Will markets force the BOJ to finally abandon negative rates? With a resilient US facing higher rates for longer, the weak yen could lead to a big change in Japan.

- 08/10/23: Japan’s inflation revolution Nominal GDP, wages and corporate revenues are growing at the fastest rate in 30 years.

- 07/11/23: Forward guidance on… wages? Japan’s companies promise higher pay and consider AI – as stocks and GDP forecasts perk up As Japanese demographics suddenly turn inflationary, companies are scrambling for solutions.

- 04/05/23: As Ueda takes the helm of the Bank of Japan, do record wage hikes finally portend “good inflation?” There are implications for major companies, yield curve control and the central bank’s swollen balance sheet.

- 01/23/23: The Kuroda Code: No virtuous wage-price spiral in Japan Bank of Japan Governor Kuroda wants a “virtuous wage-price spiral” to push inflation to his target.

BANK OF JAPAN GOVERNOR KAZUO UEDA stirred the markets when he somewhat surprisingly told a Yomiuri newspaper interview last Saturday the BOJ could get enough data by year-end to judge whether conditions are in place to raise short-term interest rates.

Reuters is streaming reporting on this development:

-

- Bank of Japan Governor Kazuo Ueda said the central bank could end its negative interest rate policy when achievement of its 2% inflation target is in sight, a Yomiuri newspaper reported. This signaled possible interest rate hikes.

- The central bank could have enough data by year-end to determine whether it can end negative rates, Ueda told the paper in an interview on Wednesday.

- “Once we’re convinced Japan will see sustained rises in inflation accompanied by wage growth, there are various options we can take,” Ueda was quoted as saying.

- “If we judge that Japan can achieve its inflation target even after ending negative rates, we’ll do so,” he added.

- The BOJ currently guides short-term interest rates at -0.1% under its negative rate policy. It also caps the 10-year government bond yield around zero as part of efforts to reflate the economy and sustainably achieve its target.

- With inflation exceeding its 2% target for more than a year, markets have been rife with speculation the BOJ will soon start raising interest rates.

- But Ueda has stressed the need to maintain ultra-loose policy until the BOJ is convinced inflation will sustainably stay around 2% backed by solid demand and wage growth.

- Ueda repeated the stance in the interview, saying the BOJ will “patiently” maintain ultra-loose policy for the time being.

- “While Japan is showing budding positive signs, achievement of our target isn’t in sight yet,” he told the interviewer.

- The BOJ will not turn a blind eye to the risk of inflation exceeding expectations, Ueda said, adding wage rises are beginning to push up service prices.

- The key is whether wages will keep rising next year, Ueda said. “We can’t rule out the possibility we’ll get enough information and data by year-end,” he was quoted as saying on the timing for ending negative rates.

- Under a negative rate policy, banks and other financial institutions are required to pay interest for parking excess cash — beyond what authorities say they must keep on hand for safety reasons — with the central bank.

Bank of Japan policymakers have been increasingly talking up the need to shift away from the massive monetary stimulus of the past decade, even as growing global risks heighten concerns about a fragile economic recovery. A series of hawkish comments by BOJ speakers in recent weeks suggest the bank is preparing markets for an eventual policy change amid growing price pressures in deflation-prone Japan. Even dovish members of the BOJ board have expressed an openness to talk about a long-awaited exit from the extremely accommodative policy of former governor Haruhiko Kuroda, acknowledging changes in conditions may warrant a tweak in monetary settings.

Ueda’s remarks, which pushed up the yen and bond yields on Monday, followed those of BOJ board member Naoki Tamura last month that suggested the bank could safely hike short-term rates without hurting the economy.

-

- “Even if the BOJ were to end negative rates, it won’t be scaling back monetary easing as long as it can keep interest rates low,” said Tamura, a former commercial bank executive.

- The commentary contrasts in tone to the pro-growth posture adopted under Kuroda, an advocate of aggressive monetary easing to shock Japan out of its deflationary mindset.

- It also suggests the BOJ under Ueda will be more inclined to prioritize unwinding the Kuroda-era policy framework, which has been blamed for distorting bond markets and crushing bank margin.

- “The BOJ will proclaim that Japan has achieved 2% inflation and end negative rates in April,” said Mari Iwashita, chief market economist at Daiwa Securities and a veteran BOJ watcher.

- To be sure, the BOJ is in no rush to phase out stimulus until there is enough data suggesting the economy can withstand the impact of weakening global demand and allow firms to keep hiking wages, say three sources familiar with its thinking.

- But growing signs of change in Japan’s deflation-prone economy are making policymakers more open to discussing the hurdles for an exit, a sign they see decision-time approaching.

- Inflation has exceeded the BOJ’s 2% target for more than a year as companies pass on higher costs to households. Firms also offered the largest pay hikes in three decades. Even doves in the nine-member board have noted these changes.

- “I believe Japan’s economy is finally seeing early signs of achieving the BOJ’s 2% inflation target,” said Hajime Takata, one such board member.

- “We need to patiently maintain the current massive monetary stimulus. At the same time, we need to respond nimbly against uncertainties as we’re seeing early signs of a positive cycle emerge” between wages and inflation, he said.

- Another board member, Junko Nakagawa, laid out the conditions for ending negative rates, notably a continued improvement in household confidence.

- “When we see many people share prospects that wages will keep rising, we may be able to exit (negative rates).”

NO PRE-SET TIMING

-

- Since taking the helm in April, Ueda has moved steadily toward phasing out stimulus. The BOJ tweaked policy in July to allow long-term rates to rise more reflecting higher inflation.

- The next step would be to ditch or hike a 0% target set for the 10-year bond yield, and raise short-term rates from -0.1%.

- Policymakers’ recent remarks suggest the BOJ could act sooner than markets expect. A majority of analysts polled by Reuters in August saw the BOJ scaling back stimulus only in a year’s time. Less than half expect negative rates to end in 2024.

- There seems to be no consensus within the BOJ board however on when or how the bank would dismantle Kuroda’s complex policy framework.

- Ueda said the BOJ could end negative rates if it believed that inflation would sustainably hold above the target.

- His deputy Shinichi Uchida appeared to set a higher bar for ending negative rates, saying last month there was “still a long way to go” before conditions were met.

- Next year’s wage outlook remains key.

- Japanese firms traditionally kick off their spring “shunto” wage negotiations with unions in March. But the BOJ could get information before those talks through its regional branch offices and comments from corporate executives on the wage outlook, the sources said.

- The global outlook would also be crucial with a downturn in the U.S. and Chinese economies hurting manufacturers and discouraging pay hikes, the sources said.

- “There’s so much uncertainty on the outlook for wages and Japan’s economy,” one of the sources said. “The BOJ probably doesn’t have a pre-set timing in mind on when it can take the next step.”

Subsequentially a Nikkei article stated:

- There is a sense at the BoJ that December is too soon to end negative rates and although the government is keen on moves that could support the weak Yen, December is a politically difficult time and a January decision appears to be a more realistic scenario.

More Developments:

-

- Japanese PM Kishida said he will ensure the end of deflation and will take steps to attract investments by the private and public sectors sized around JPY 150tln. Kishida also said he will instruct the cabinet to compile pillars of a new economic package by the end of this month, while he cannot say when the government will decide on the start of the tax hike for the defense budget.

- Japan’s new economy minister Shindo said they will mobilize all possible policy measures to support the economy and will consider bold measures to ease the pain of price hikes, according to Reuters.

LARGE DIFFERENTIALS ARE SUPPORTIVE OF A JAPANESE CARRY TRADE

(WITH A WEAKENING YEN – See Current Current Market Perspective)

![]()

INVESTMENT PERSPECTIVES

Our analysis suggests the following for consideration:

-

- SHORT YEN – Through Year End 2023

- LONG HIGH QUALITY JAPANESE EQUITIES – Short-to-Intermediate Term

- LONG US TREASURY NOTES & BONDS – Intermediate Term

- SHORT US DOLLAR – Short-to-Intermediate Term

See this week’s Current Market Perspective for Technical Analysis and Charts for Japan

GLOBAL ECONOMIC INDICATORS: What This Week’s Key Global Economic ReleasesTell Us

US CPI – 09-13-23

US CPI – 09-13-23

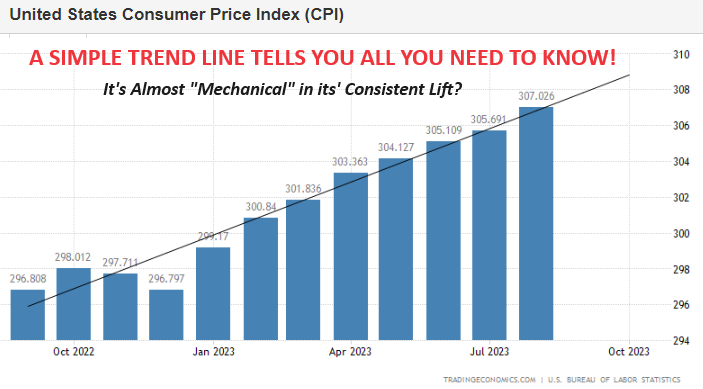

The Consumer Price Index in the United States increased by 3.7% year-on-year to 307.026 points in August 2023, which was an acceleration from the 3.2% growth recorded in the previous month. Market expectations had predicted a smaller 3.6% increase in the CPI to reach 306.976 points.

-

- Headline CPI rose 0.6% MoM (as expected), but pushed the YoY change to +3.7% (up from 3.2% prior and hotter than the 3.6% exp). That is the largest MoM since June 2022.

- Core CPI rose 0.3% MoM (more than the 0.2% expected), but the YoY declined to 4.3% (as expected) from 4.7% prior.

- The Fed’s new favorite inflation signal – Core Services CPI Ex-Shelter surged 0.53% MoM (most since Sept 2022) and YoY remains above 4%.

- Goods and Services inflation slowed (with the former at its lowest since July 2020). Services remains extremely hot.

-

The index for all items less food and energy rose 4.3 percent over the past 12 months. The shelter index increased 7.3 percent over the last year, accounting for over 70 percent of the total increase in all items less food and energy.

The index for all items less food and energy rose 4.3 percent over the past 12 months. The shelter index increased 7.3 percent over the last year, accounting for over 70 percent of the total increase in all items less food and energy.

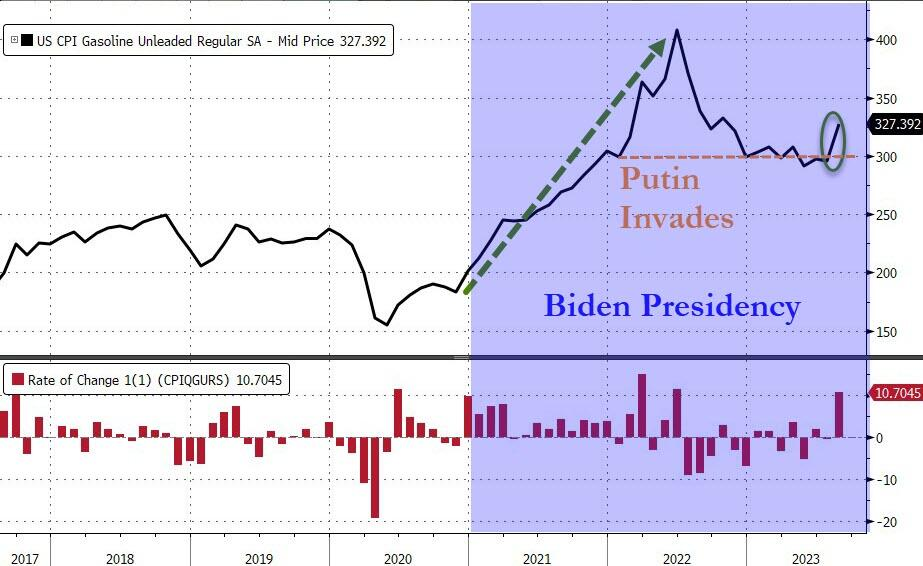

CHART RIGHT

-

- Gasoline’s 10.5% MoM jump dominated (now the SPR has been emptied).

- Gasoline price jump coincides with the CPI index level at the start of Putin’s invasion of Ukraine.

- This index is up 78% since President Biden took office…

CHART RIGHT

-

The index for gasoline was the largest contributor to the monthly all items increase, accounting for over half of the increase. Also contributing to the August monthly increase was continued advancement in the shelter index, which rose for the 40th consecutive month, but is now rapidly declining.

The index for gasoline was the largest contributor to the monthly all items increase, accounting for over half of the increase. Also contributing to the August monthly increase was continued advancement in the shelter index, which rose for the 40th consecutive month, but is now rapidly declining.- The energy index rose 5.6 percent in August as all the major energy component indexes increased.

- The food index increased 0.2 percent in August, as it did in July. The index for food at home increased 0.2 percent over the month while the index for food away from home rose 0.3 percent in August.

-

- Airline fares rose 4.9% after dropping 8.1% in each of the previous two months.

- August Rent Inflation 7.76% YoY, down from 8.03% in July and lowest since November.

- August Shelter inflation 7.27% YoY, down from 7.69% in July and lowest since November.

- Transport beats out Shelter for the first time as largest driver of core CPI.

US PPI – 09-14-23

US PPI – 09-14-23

-

- US PPI rose 0.7% M/M in August, above the expected and prior 0.4%, marking the largest increase since June 2022 and heavily driven by a 10.5% increase in the energy component.

- The headline Y/Y figure rose 1.6%, above the expected +1.2%, and up from the prior +0.8%.

- Looking at the core, M/M rose 0.2%, in line with expectations and down from the prior +0.4%, while the core Y/Y printed 2.2% as expected.

- Pantheon Macroeconomics highlights that the fuel price increases fed into the core via a 1.6% jump in transportation prices following eight straight monthly declines.

- Meanwhile, “trade services – that is, gross margins for retailers and wholesales – fell by 0.3%, mostly in the auto retailer component”, which the consultancy says, “pushed margins below their year-ago level for the first time since the pandemic-driven surge, and the improvement in supply chains over the past 18 months points to further declines ahead.”

- Pantheon concludes that PPI is unlikely to fall much further over the next few months amid the oil price surge, “but we expect new lows next year, with a real chance of zero core PPI inflation in the spring. That, in turn, implies further downward pressure on the core PCE and GDP deflators

US RETAIL SALES

US RETAIL SALES

-

- Headline retail sales rose 0.6% in August, up from 0.5% in July (revised down from 0.7%) and well above expectations of a 0.2% gain.

- Looking into the report, a lot of the headline upside was led by a surge in gasoline station sales, which rose 5.2% from July’s 0.1% gain, offsetting some of the sting given how volatile this component can be and its sensitivity to gas prices.

- Meanwhile, auto prices rose 0.3% in August M/M, which is hotter than what analysts at Oxford Economics were looking for, given the decline in manufacturers’ auto sales.

- The ex-autos rose 0.6% (exp. 0.4%), while the prior was revised down to 0.7% from 1.0%.

- The control metric posted a surprise gain of 0.1% despite expectations for a 0.1% decline, although the prior was revised down to 0.7% from 1.0%. Ox Eco writes the strength in July, despite being revised down, “still implies real consumer spending growth is tracking close to 3% annualized in Q3, but momentum appears to be fading”.

- Overall, although the data was hotter than expected, the downward revisions do offset some of the heat and a lot of the upside was led by the jump in gas sales and autos, seeing the super core, ex-gas and autos, rise just 0.2%, cooling from the prior 0.7%, which was also revised down from 1.0%.

- Looking ahead, Oxford Economics suggest clearer signs the labour market is losing momentum, while higher gasoline prices put pressure on real income again, and the additional drag from student loan repayment resumption, “it is hard to see consumers spending as freely over the rest of the year”.

- OxEco expects “a sharp slowdown in consumption growth, which will be the decisive factor tipping the economy into a mild recession over the coming quarters.”

ECB RATE INCREASE

ECB RATE INCREASE

-

- ECB hiked rates by 25bps to lift the Deposit Rate to 4.0% and the Refinancing Rate to 4.5%, while it stated rates have reached levels, that maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target.

- ECB Staff Economic Projections showed headline inflation forecasts were upgraded for 2023 and 2024, but growth downgraded for 2023-2025 with headline inflation to average 5.6% in 2023 (prev. 5.4%), 3.2% in 2024 (prev. 3.0%) and 2.1% in 2025 (prev. 2.2%), while Core inflation seen at 5.1% in 2023 (prev. 5.1%), 2.9% in 2024 (prev. 3.0%) and 2.2% in 2025 (prev. 2.3%). ECB expects the economy to grow 0.7% in 2023 (prev. 0.9%), 1.0% in 2024 (prev. 1.5%) and 1.5% in 2025 (prev. 1.6%).

- ECB President Lagarde said the economy is likely to remain subdued in the coming months and noted during the Q&A that “a few” members did not draw the same conclusions and would have preferred to have paused, although a “solid majority” agreed with today’s decision. Lagarde said the ‘door is not open or closed’ on future moves and she is not saying they are currently at peak rates, while she added that ‘as long as necessary’ and ‘substantial contribution’ cannot be pinned down. Furthermore, she replied the ECB did not discuss what ‘long enough’ means and will continue to be data dependent. When asked what ‘sufficiently long’ refers to she said this was not even a word that they verbalized when asked about rate cuts.

GLOBAL MACRO

WHAT DOES YOUR SCAN OF THE DATA BELOW TELL YOU? – THE MEDIA AVOIDS BAD NEWS!

We present the data in a way you can quickly see what is happening.

THIS WEEK WE SAW

Exp=Expectations, Rev=Revision, Prev=Previous

DEVELOPMENTS TO WATCH

RISING GASOLINE PRICES AS BIDEN’S SPR GAMESMANSHIP IS DEPLETED

RISING GASOLINE PRICES AS BIDEN’S SPR GAMESMANSHIP IS DEPLETED

The Fed and The White House have a problem as those surging oil prices are dragging wholesale gasoline prices higher (with gasoline stocks at the lows of the year), which will inevitably drag pump prices higher. (CHART RIGHT)

This means inflation (perceived by the average Joe) will be top of the mind once again and the Biden admin has used up its geopolitical (Saudi) and domestic (SPR) ammo to do anything about it this time.

THREE DEVELOPMENTS TO WATCH CLOSELY

THREE DEVELOPMENTS TO WATCH CLOSELY

-

- The resumption of Student Loan Payments (Began 09/01/23 with payments beginning in October)

- A potential Temporary Federal Government Shutdown (Deadline 09/30/23)

- Reduced auto production from a potential UAW Strike to slow US GDP growth in 4Q23 (Initial Deadline 09/14/23)

According to JP Morgan this has the potential to slow US GDP growth in 4Q23 to +1.3% from 3.1% this quarter.

TWO MACRO RISKS

-

- The economy slows down faster or more than expected.

- Inflation stays sticky (oil not helping) and Fed must raise rates/keep higher for longer.

ADDITIONALLY:

ADDITIONALLY:

-

- Mounting Mortgage Paper Problems (Details Here)

-

- The US government is reportedly looking to offload almost USD 13bln of mortgage bonds it amassed from Silicon Valley Bank and Signature Bank following the collapse of the lenders,** according to Bloomberg.

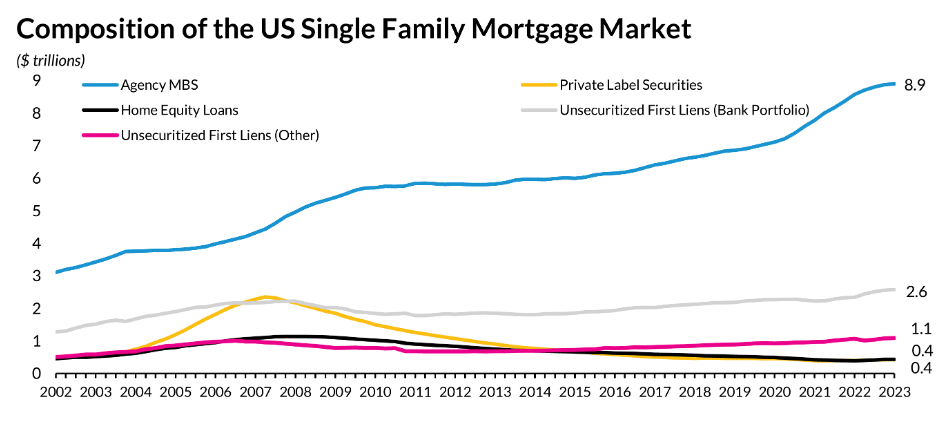

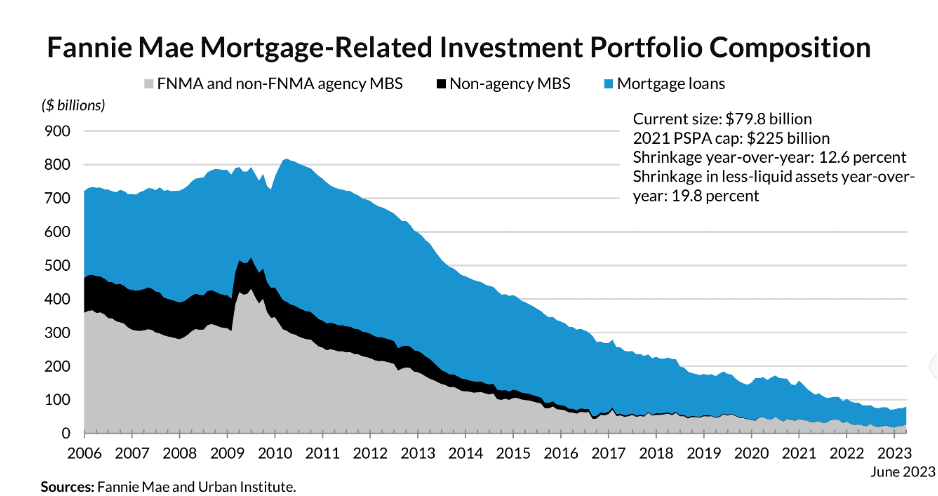

- The question many in capital markets have been asking since the GSEs were put into conservatorship is this: Without Fannie, Freddie, or the Fed’S QE, who will buy the agency MBS? Today we are seeing this play out with a shortage of MBS buyers to the tune of about $2 billion in demand per day.

- When demand is low, MBS prices will drop at sale and the corresponding yields will rise.

- Late last year, Laurie Goodman, the famed MBS expert and a leader at the Urban Institute in Washington, penned an article in Barrons to explain why rates were so high. She gives a very thorough explanation as to why the 30/10 spread is so high, stating, “Before and during the Great Financial Crisis, the Fannie Mae and Freddie Mac portfolios essentially served as shock absorbers, buying mortgage-backed securities, or MBS, when spreads were wide, selling when they narrowed.”

THE CRITICAL JAPANESE CARRY TRADE!

THE YEN, DOLLAR & US TREASURY DEBT

Click All Charts to Enlarge

1 – SITUATIONAL ANALYSIS

Of the three major central banks, the U.S. Fed is already withdrawing accommodation; the European Central Bank (ECB) may follow in the second half of 2022, but the BoJ is not expected to shift policy accommodation as it welcomes the arrival of inflation to completely break the psychology of deflation that it feels has held the economy back over the last several decades. This means that the JPY might face the most pressure among the majors, and in competition with emerging market currencies offering relatively high interest rates.

Of the three major central banks, the U.S. Fed is already withdrawing accommodation; the European Central Bank (ECB) may follow in the second half of 2022, but the BoJ is not expected to shift policy accommodation as it welcomes the arrival of inflation to completely break the psychology of deflation that it feels has held the economy back over the last several decades. This means that the JPY might face the most pressure among the majors, and in competition with emerging market currencies offering relatively high interest rates.

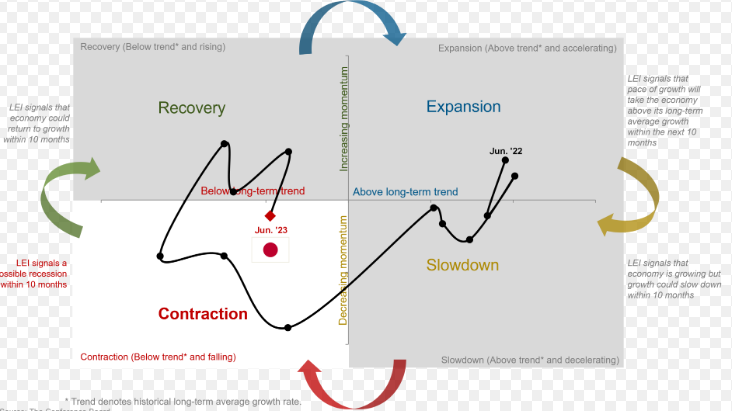

The Japanese LEI slipped back into Contraction signalling likely headwinds to economic growth (chart right).

AN INDUSTRIAL IMPORT NATION WITH FEW NATURAL “MATERIALS”

AN INDUSTRIAL IMPORT NATION WITH FEW NATURAL “MATERIALS”

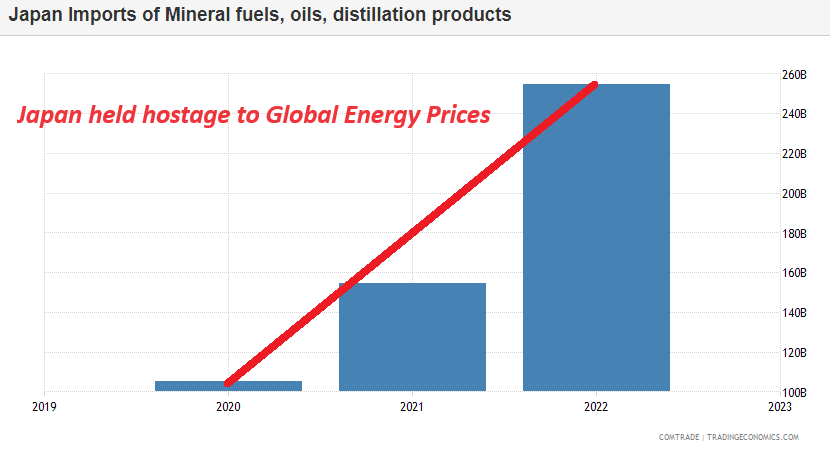

Japan imports 98% of its crude oil and most of its natural gas and coal.

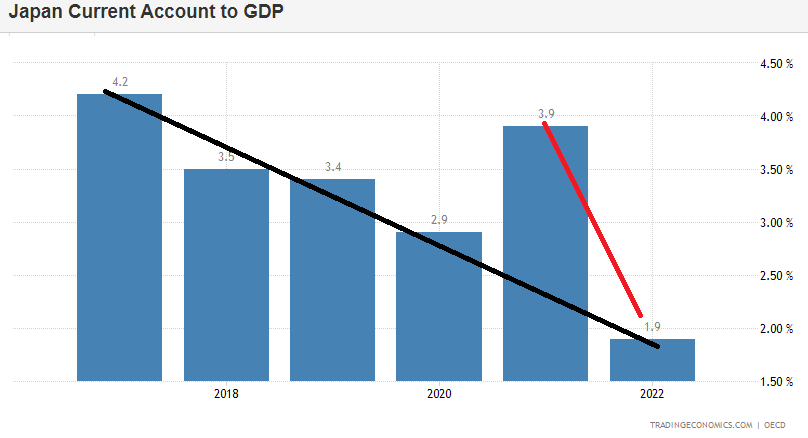

As such, higher energy prices continue to threaten to erode Japan’s current account surplus relative to the U.S.— to the disadvantage of the yen.

2 – FUNDAMENTAL ANALYSIS

2 – FUNDAMENTAL ANALYSIS

According to SWIFT the yen is the third most widely used currency in the world for international trade, behind the U.S. dollar and the euro. Even so, it is used in only 3% of global commercial transactions compared to around 80% for the dollar.

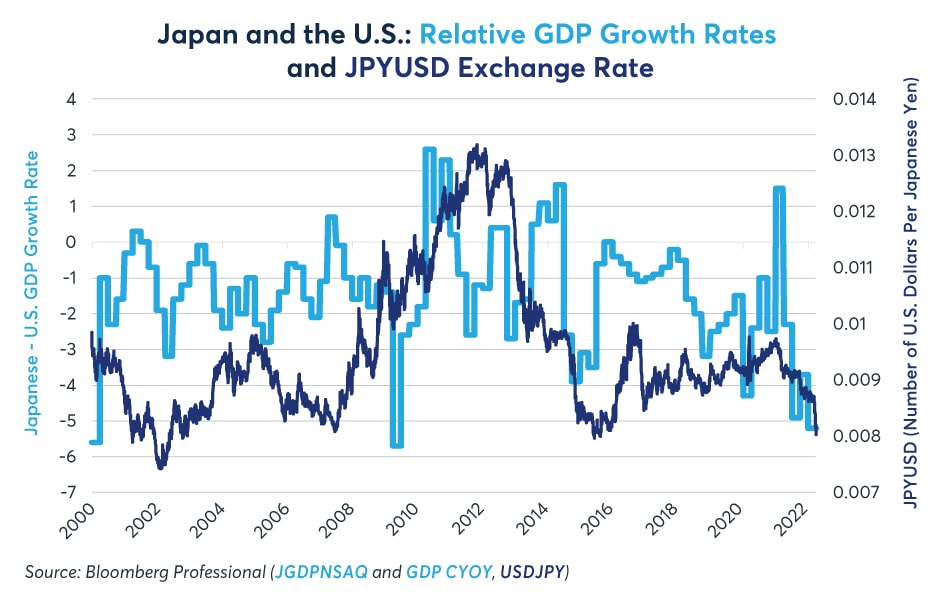

When Japan’s current account surplus is growing as a percentage of GDP relative to the U.S. current account, JPY tends to rise in value. The opposite tends to happen when Japan’s current account surplus shrinks relative to the U.S.

A CONTINUED WEAKENING IN THE YEN IN THE NEAR-TO-INTERMEDIATE FUTURE IS QUITE LIKELY

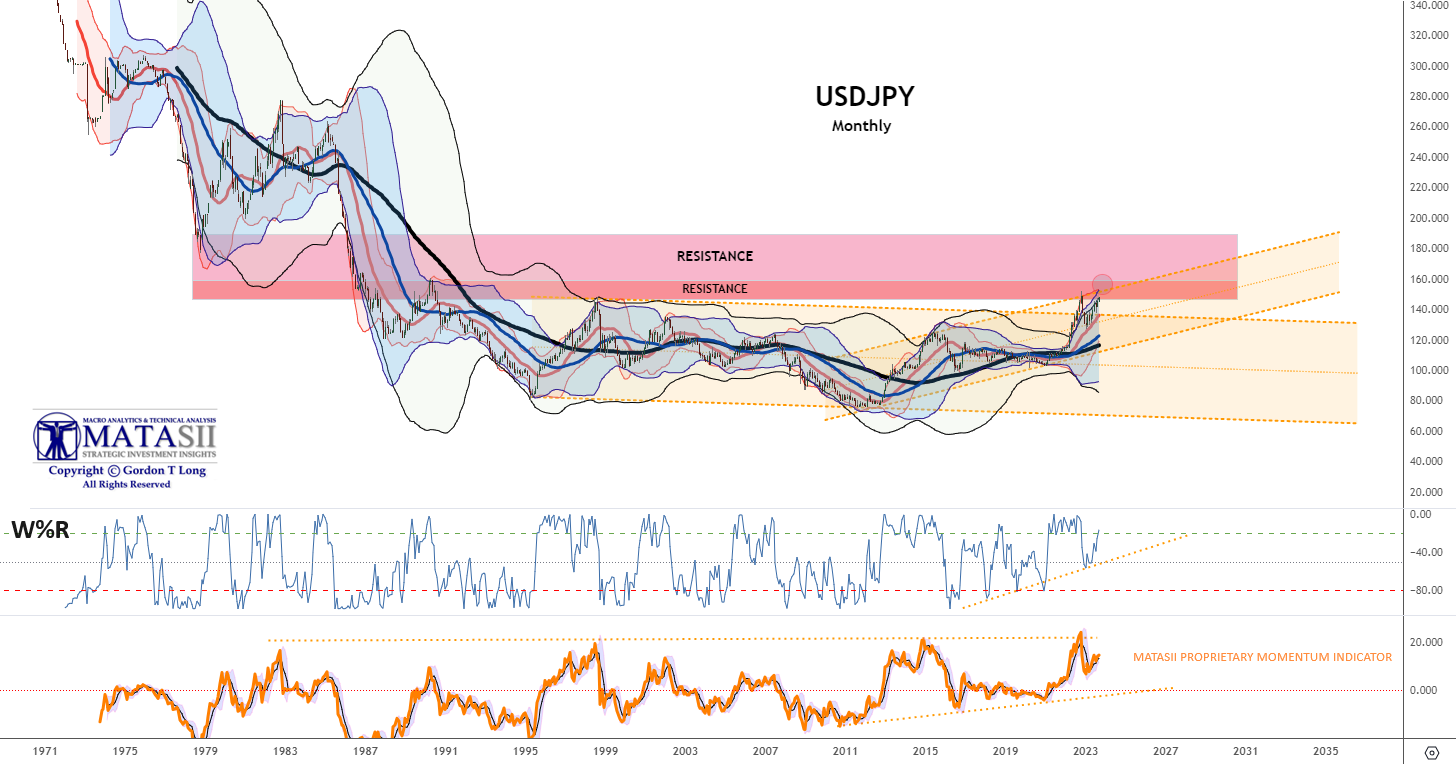

3 – TECHNICAL ANALYSIS

THE TECHNICAL ANALYSIS SUGGESTS THE YEN HAS MORE TO FALL AND THE NIKKEI225 MORE TO RISE

USDJPY – Monthly

US Dollar strength relative to the Yen appears to have a little further to run before reaching strong overhead resistance.

YOUR DESK TOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

JPYUSD – Weekly

I have flipped to the reverse of the traditional USDJPY below to use the Weekly JPYUSD. This emphasizes that it is a falling relative YEN that is important to fostering the Yen Carry Trade. The Japanese lend their money at very low rates to make (or protect) profits from a falling Yen.

These charts are suggesting that we are likely to see further weakness, at least through year end 2023. A weaker yen normally pushes the Nikkei higher (takes more Yen to buy the same basket of global earning stocks).

YOUR DESK TOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK (Set Chart to “W” for Weekly)

NIKKEI – JAPANESE EQUITIES

CHART RIGHT

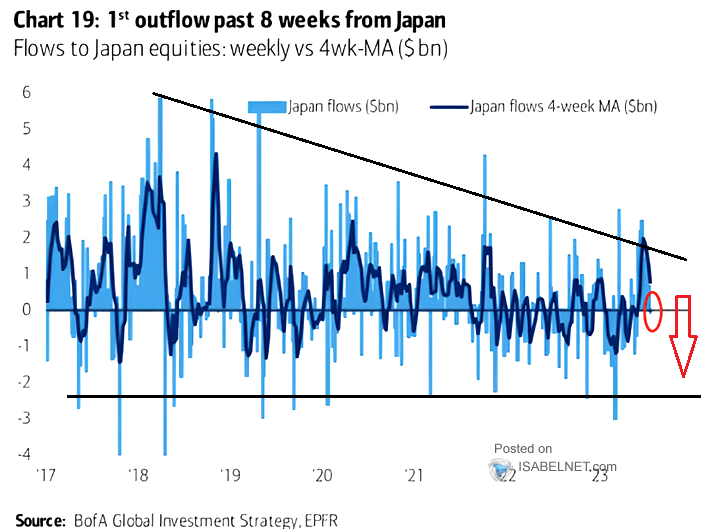

We have witnessed outflows over the past 8 weeks from Japan inflows to equities

CHART RIGHT

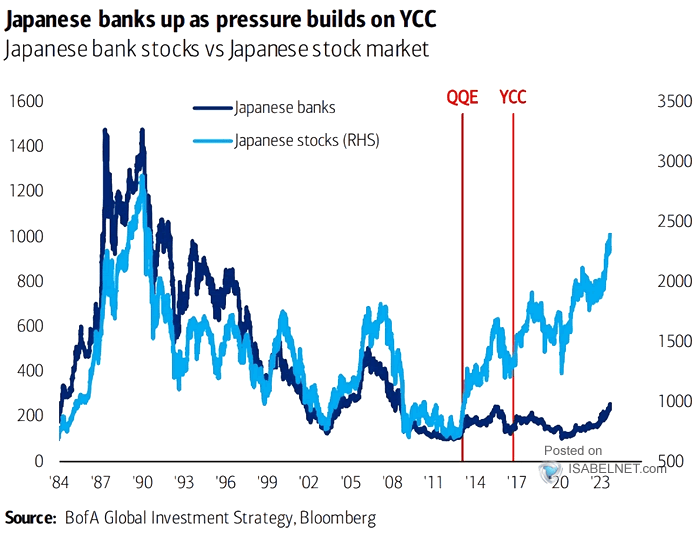

A Weak Yen and large Interest Rate Differentials between Japanese and US Bonds are good for Japanese Banks, Stocks and the financing of the US debt!

CHART BOTTOM

However, when we overlay the MATASII CROSS which maintains a “BUY” signal, there is a strong possibility we are looking to test the long term top within the current rising trend channel.

YOUR DESK TOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.