US ECONOMICS

FISCAL POLICY

LOOKING FOR THE NEXT LONG TERM INVESTMENT

OBSERVATIONS: WHAT ARE THE $100/DAY GOLD SURGES TELLING US?

What is going on with gold?

The answer is actually quite simple. Gold recognizes that there is no situation in which the Fed doesn’t end up printing money in the next six months.

Gold is increasingly being seen as seat in a lifeboat where we experience the biggest monetary flood in modern times – if not history. But it’s not just the size of the bailout that’s alarming. It is increasingly the pace.

- Bernanke printed $2–3 trillion in three or four years.

- Powell? $5 trillion in 18 months.

- This time — it’s going to be $7 to $10 trillion.

This is likely to not end with another round of pain and paper promises but rather a one-time reset. We are likely not going to simply see a typical recession cycle but rather the “endgame” fiat currencies and unsound money – it is inevitable!

Expect a hard pivot away from fiat. A revaluation of gold and possibly a price explosion before the Fourth Turning is over!

We are headed to a return to sound money. Specifically, increasingly more partially gold-backed currencies.

The US economy is rolling over. Consumer spending accounts for 70%-75% of U.S. GDP. And consumers are panicking due to the trade war with some readings coming in at levels not seen since the Great Financial Crisis.

The Survey of Consumers from the University of Michigan showed that consumer confidence has declined four months in a row. That same survey showed that the share of consumers expecting unemployment to rise this year had risen five months straight and was at its highest level since 2009, (after the Great Financial Crisis).

At the same time as consumers are panicking, the stock market has staged one of its most aggressive collapses in history, with stocks declining over 20% peak to trough in just six weeks. Over $11 TRILLION in wealth has been erased.

The Fed claims they will NOT act to support the markets, but who are we kidding? Do you really think the Fed would stomach a deflationary collapse that triggers systemic risk?

In simple terms, it’s only a matter of time before the Fed turns on the printing presses again. Small wonder then that gold has been on a tear.

Gold has figured out that there is NO WAY out of the current financial mess that doesn’t involve money printing.

Indeed, if the policymakers’ actions during the pandemic taught us anything, it’s that the only thing they DO know how to do when stuff hits the fan is print money.

The precious metal is currently correcting. But don’t be fooled, this bull market in gold is highly likely NOWHERE near over.

Meanwhile all of this is happening at a time when the USD$ is on beginning to collapse!

This is an extremely dangerous situation. Money printing by the Fed will only accelerate the $USD collapse… which by itself can be expected to ignite another round of inflation.

WHAT YOU NEED TO KNOW!

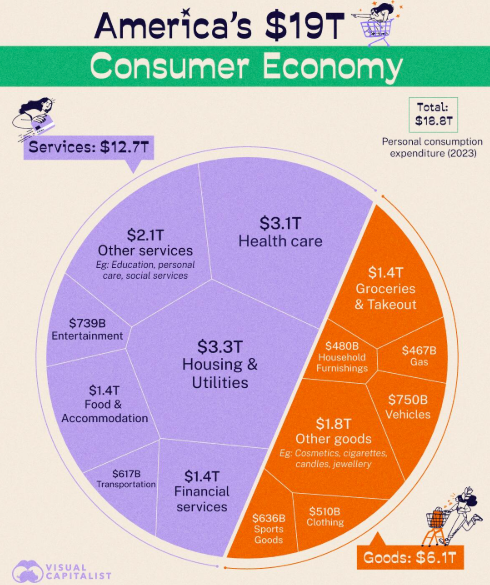

THE $19T US CONSUMER ECONOMY

THE $19T US CONSUMER ECONOMY

The world’s largest economy is also the world’s largest consumer economy. America’s consumer class spent nearly $19 trillion on goods and services in 2023. For context, this was about 68% of the U.S. GDP that year. It was also larger than China’s overall GDP that year as well ($17.8T).

Tellingly, services account for nearly 70% of America’s personal consumption expenditure. This is matched by the supply side as well where nearly 80% of America’s jobs are in the service sector.

America’s transition away from manufacturing into services has driven the growth of high-value technology and financial companies while concurrently resulting in the loss of blue-collar jobs in America.

Broad-based tariffs on imported goods have been declared to reduce trade deficits and to incentivize companies to move their manufacturing back into the country. However, modern manufacturing is built off global supply chains and just-in-time shipping. Expect disruptions which, everything else being equal, will only raise prices for Americans. However, everything else won’t stay the same – and that may be the magic elixir few yet grasp!

RESEARCH – MARKET DRIVERS

1- LOOKING FOR THE NEXT LONG TERM INVESTMENT WHEN THE BOTTOM IS IN

1- LOOKING FOR THE NEXT LONG TERM INVESTMENT WHEN THE BOTTOM IS IN

-

- What industry will outperform all others over the next decade? We need to identify a sector that mirrors software’s advantages 20 years ago:

i) Extremely rapid growth and

ii) High entry barriers that limit competition.

-

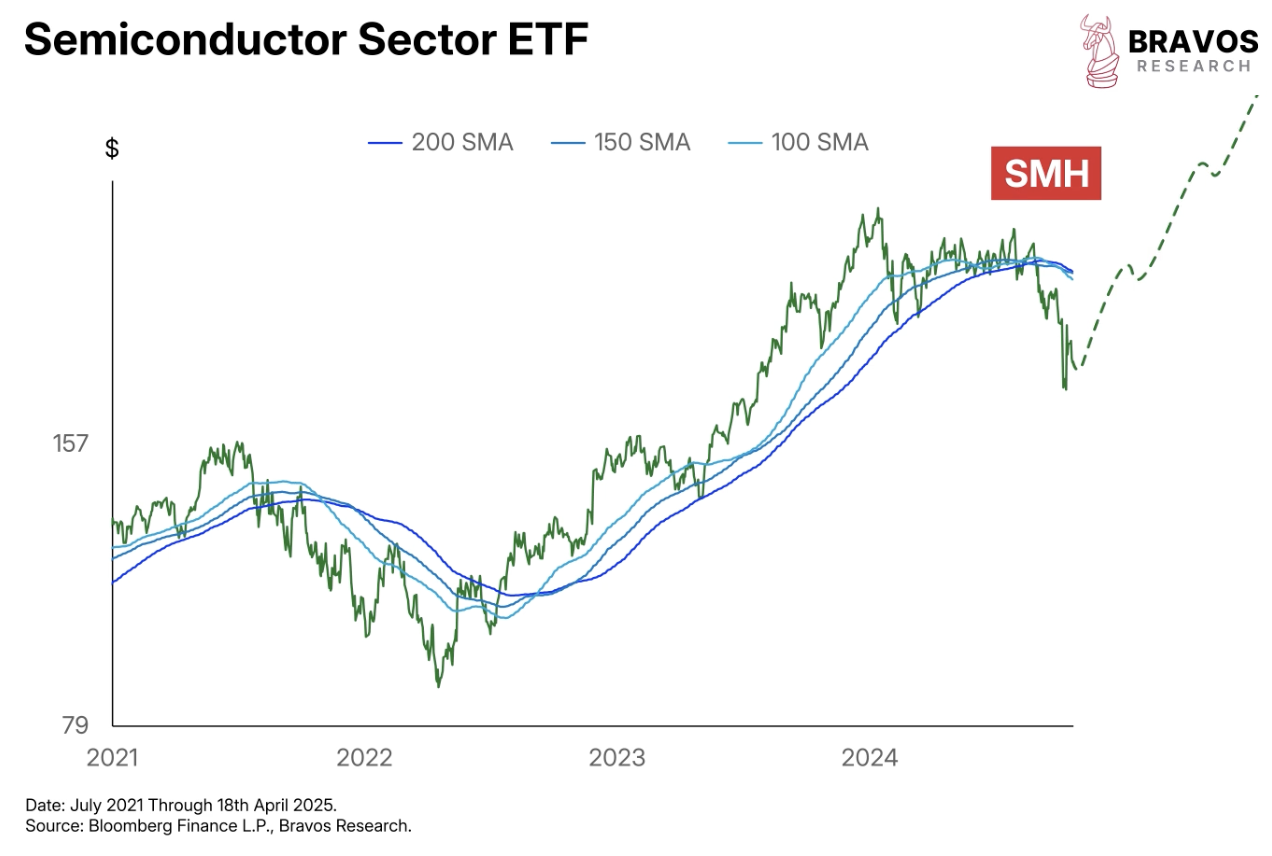

- So, what industry will outperform next? Semiconductors appear to fit the requirements perfectly according to Bravo Research.

- Demand for semiconductors has grown exponentially over the last 2 years and will likely continue at a rapid pace.

- Similar to how businesses needed software in the early 2000s, today’s companies need to adopt AI – and the biggest bottleneck for AI adoption is the semiconductor industry.

2- POSSIBLE MARKET PATHS FORWARD

-

- There are three Technical pattern scenarios that appear will help guide us and, in time, assign better odds as to which of the three paths will be the “right” path.

- Importantly, we can also lay out the possible economic, geopolitical and monetary policy scenarios that would likely correspond with each forecast.

- SCENARIO A: is the most bullish scenario. In this scenario, the S&P 500 has already seen its lows for the cycle. The market will grind higher until it meets resistance near the key 50- and 200-day moving averages. After a brief period of consolidation, the market would break above those important moving averages, the death cross between the two important moving averages would flip back to a golden cross, and new highs would follow.

- SCENARIO B: is the most likely path. It argues that, like scenario A, we may have seen the year’s lows, but the stock market will consolidate in a wide range for many months before resuming a bullish trend.

- SCENARIO C is the most concerning path. It entails a series of lower highs and lower lows for the foreseeable future. Moreover, a recession would most likely accompany this scenario.

DEVELOPMENTS TO WATCH – POLICY DRIVERS

1- CHINA VOWS TO STABILIZE SINKING ECONOMY

1- CHINA VOWS TO STABILIZE SINKING ECONOMY

-

- In an economic-analysis meeting on 04/18/24, the 24-man Politburo, China’s main decision-making body headed by President Xi Jinping, said authorities would roll out specific plans to support companies and individuals affected by the trade war. They pledged to:

-

-

- Coordinate domestic economic work with international economic and trade engagements

- Resolutely focus on doing our own affairs

- Steadfastly expand high-level opening up, and

- Focus on stabilizing employment, businesses, markets and expectations

-

2- WHY APPLE IS SHIFTING FROM CHINA TO INDIA

-

- Apple is turbocharging its “friend-shoring” strategy, thanks in large part to President Trump’s ongoing trade war with Beijing, by initiating plans to shift all iPhone production for the U.S. market from China to India starting next year, according to the Financial Times, citing sources.

- The move marks a significant step toward diversifying Apple’s supply chain away from China, in an effort to avoid tariffs.

- The sources said the continued diversification of the supply chain into India may suggest that iPhone production could be ramped up to 60 million units by the end of 2026, or the amount required to satisfy the U.S. market.

GLOBAL ECONOMIC REPORTING – ECONOMIC DRIVERS

GERMANY EXPECTS RECESSION FOR 3RD STRAIGHT YEAR

GERMANY EXPECTS RECESSION FOR 3RD STRAIGHT YEAR

-

- Entering 2025, Germany’s economic situation had never been worse following a 6th consecutive GDP contraction in Q4.

- The country which was once Europe’s growth dynamo, has contracted for 6 consecutive quarters, the longest recessionary stretch in modern German history, (since its 1989 reunification).

- Germany desperately needs a much weaker euro, the concurrent collapse in the dollar – which will unleash a surge in US exports just as the Mar-A-Lago accord had stipulated – means the euro will stay strong. Only a fresh NIRP cycle by the ECB, one which sends the deposit rate from 2% currently back to sub zero, has any hope of kick starting growth in what was once Europe’s strongest economy and is now officially the sick man of Europe.

US CONSUMER STRESS UNDER APPRECIATED

-

- Consumer sentiment is plummeting, delinquency rates are rising, and nearly three-quarters of all U.S. consumers admit that they are “financially stressed”. If U.S. consumers are experiencing this much pain now, what will things look like six months from today if there are empty shelves and widespread shortages?

- We witnessed a brief period of severe financial stress during the early days of the last pandemic, but we would have to go all the way back to the Great Recession to find a time that is truly comparable to what we are enduring now.

- U.S consumers have been getting hammered for years, and now it appears that our problems are about to go to an entirely new level. The following are 12 signs that U.S. consumers are experiencing far more financial stress than most people realize

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.