TIPPING POINTS

US BANKING CRISIS

AMERICA’S “POTTERSVILLE” NEARLY 80 YEARS LATER!

In 1947 the classic Christmas movie “It’s A Wonderful Life” was released. The depiction of the banking turmoils of George Bailey fighting rival small town banker “Old Man Potter” warm the hearts of all Americans at Christmas. The movie’s message is clear: doing the right thing for people over the evils of being solely driven by profit is the morally right and human thing to do. Oh, if only bankers hadn’t forgotten that their core business is about the well being of their depositors!

Today’s banking crisis is an embodiment of this movie where small town Savings & Loans banks are dependent on local depositors and their success, versus larger banks where depositors are paid nothing for their deposits and charged for fees for anything they bother the bank with. This has lead to yet another banking crisis.

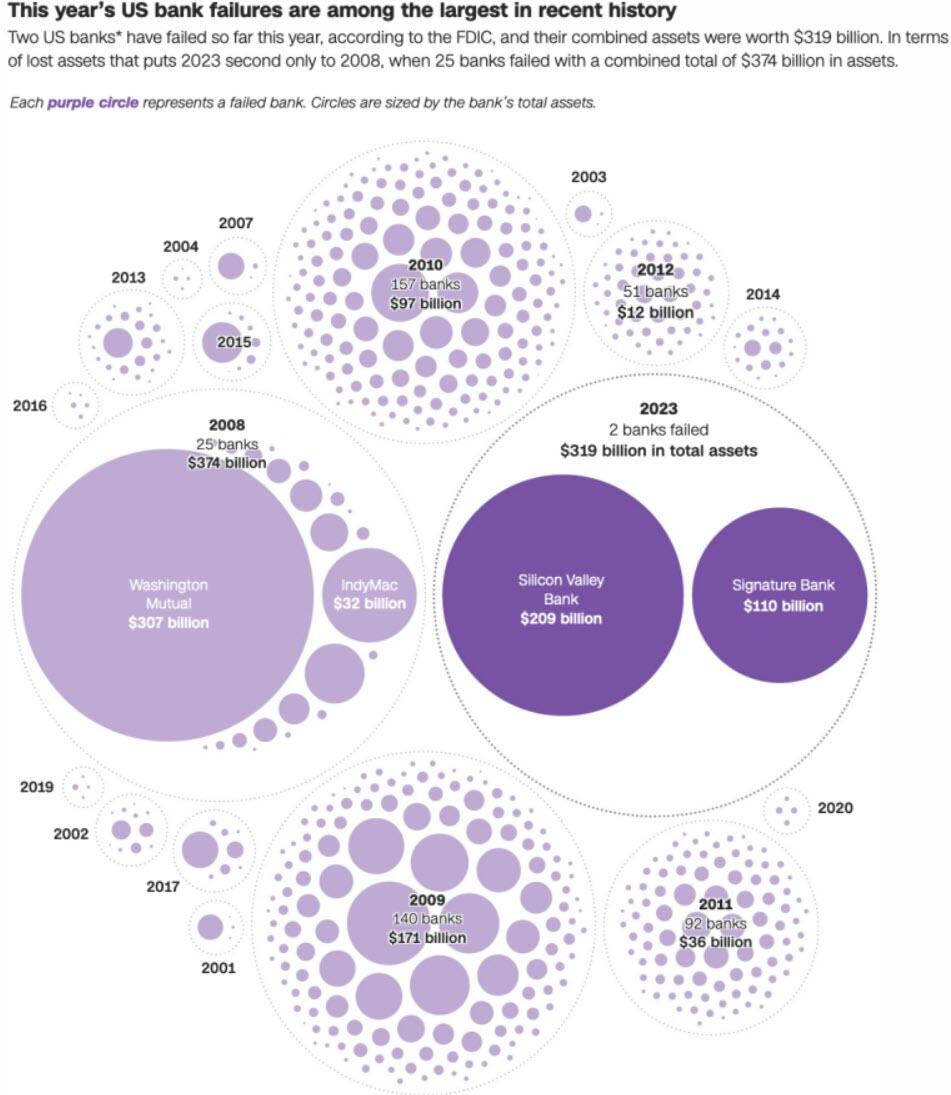

n 2008 it was about banks being “Too Big To Fail”.

Today it is about “Too Many To Fail”!

=========

WHAT YOU NEED TO KNOW

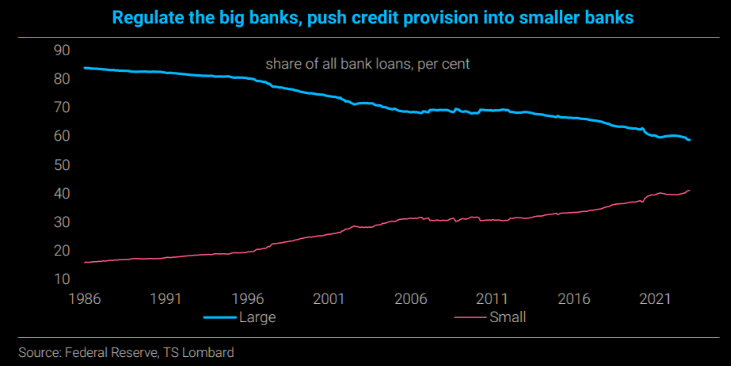

US regulators focused on making the big banks safer but forgot that the smaller banks – which have been responsible for much of the credit creation of the past decade – could pose systemic risks, at least in aggregate. What initially was a liquidity crisis risk is becoming a credit crisis, which will likely soon become a commercial property sector debacle.

US regulators focused on making the big banks safer but forgot that the smaller banks – which have been responsible for much of the credit creation of the past decade – could pose systemic risks, at least in aggregate. What initially was a liquidity crisis risk is becoming a credit crisis, which will likely soon become a commercial property sector debacle.

NOW THE BANKS EXPECT TO BE BAILED OUT: Yet Another Every Decade Government Transfer Process?

-

- For much of my career I have witnessed that every decade or so we can count on the US banking sector to require another government bailout or major regulatory risk giveaway.

- Between decades the business plan of larger banks is to steadily rob savers to lend to those increasingly requiring debt to simply survive.

- The current crisis however is more than just another bank bailout. It is additionally about further predatory banking sector consolidation.

- The larger banks now require the smaller bank deposits and small business collateral assets, ideally without the risk.

BANK DEPOSIT RATES: Reverse Bank Robbery!

-

- Banks have been paying depositors almost nothing for their deposits for so long that many younger people no longer see banks as a facility where you keep your saving. (Of course this is if you actually have any savings?)

- Today you pay the bank, the bank doesn’t pay you!

- Because Credit Card bills must be paid, your bank account is solely a cash transfer mechanism between your income and credit card balances.

- On credit cards you pay exorbitant credit card fees if your bank cash balances don’t allow a monthly “zeroing out”.

- On Debit Cards you better have sufficient none yielding cash balances.

- Everything you might bother a bank for such as a money transfer, overdue needs, currency exchanges etc., the bank charges a fee for.

THE MONEY MARKET GAME: When Deposits Are Not Deposits

THE MONEY MARKET GAME: When Deposits Are Not Deposits

-

- Banks seldom remind depositors that Bank Deposits versus Bank Money Market Funds come with differing risk.

- Deposits are insured by FDIC up to an account limit of $250,000.

- Money Markets are considered an investment and therefore are uninsured!

- Both however have become today equivalent bank assets.

BANK DEPOSIT INSURANCE: FDIC’s $250K Limit

-

- The FDIC’s guarantee to reimburse all the rich uninsured depositors at the two failed institutions, making an exception to its $250,000 cap, and no matter how big the depositors’ accounts, is more alarming.

- Such measures take the United States down a road toward total nationalization of the banking system and removes the indispensable elements of accountability and discipline all businesses need: certainty that misjudgment and irresponsibility must come with a cost.

- When Washington bails that out, America turns into Potterville.

CONCLUSION

RISK TRANSFER:

-

-

- Banks Get the Profits, Public Assumes the Risk

-

A CONSOLIDATION:

-

-

- Just More Money to Support the Derivative Monster!

-

COMMERCIAL REAL ESTATE:

-

-

- There is a high probability of a coming Crisis in Commercial Real Estate as a direct result of this Banking Crisis.

- The last Banking Crisis only impacted Residential Real Estate.

-

THE CURRENT ACTIONS ARE RESULTING IN EFFECTIVELY CHOKING SMALL BUSINESS AMERICA,

THE LIFE BLOOD OF THE NATION, ALREADY REELING FROM COVID-19.

=========

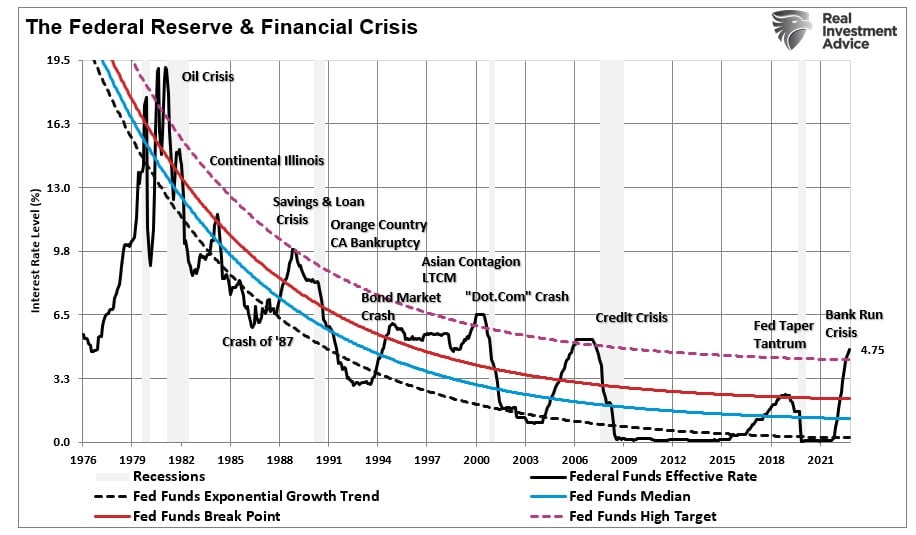

NOW THE BANKS EXPECT TO BE BAILED OUT: Yet Another Every Decade Government Transfer Process?

It is becoming almost assured that every decade (or sooner) we have a financial crisis centered on the banking industry and driven by the US central bank rate increases. (See milestone chart to the right tracking both.)

It is becoming almost assured that every decade (or sooner) we have a financial crisis centered on the banking industry and driven by the US central bank rate increases. (See milestone chart to the right tracking both.)

Every time we can count on the US banking sector to require another:

Between decades the business plan of larger banks is to steadily rob savers to lend to those increasingly requiring debt to simply survive.

ABOVE: The Federal Reserve and Regular Financial Crisis.

The current crisis however is more than just another bank bailout. It is additionally about further predatory banking sector consolidation by the large political donor money centered banks.

The current crisis however is more than just another bank bailout. It is additionally about further predatory banking sector consolidation by the large political donor money centered banks.

The larger banks now require the smaller bank deposits and small business collateral assets, ideally without the risk.

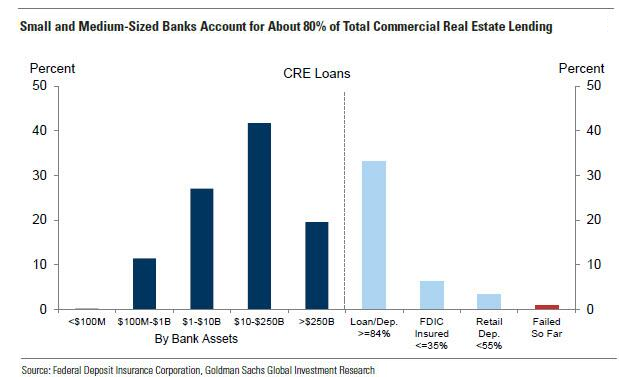

CHART RIGHT: Small & Medium sized Banks account for ~ 80% of the total Commercial Real Estate (CRE) lending in America.

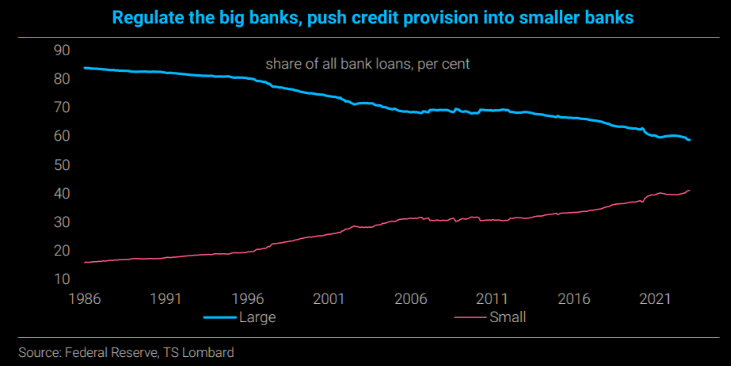

CHART BELOW: Bank loans are increasingly being driven in America by the smaller banks. Larger banks increasingly make their profits through trading, M&A, international needs, derivative operations and the needs of major financial institutions and corporate America. Small business need not apply!

SOMETHING SERIOUSLY WORRYING IS ABOUT TO HAPPEN TO

SMALL BUSINESS AMERICA!

Small to Medium sized banks are the backbone of lending to small business in small town America. This is the foundation of America – not the large corporations!

Small to Medium sized banks are the backbone of lending to small business in small town America. This is the foundation of America – not the large corporations!

The smaller banks’ customers are George Bailey’s Main Street retailers, restaurants, contractors, the trades trade, barbers, famers, ranchers, truckers etc. Their survival depends on the survival of local banks, savings & loans and credit unions.

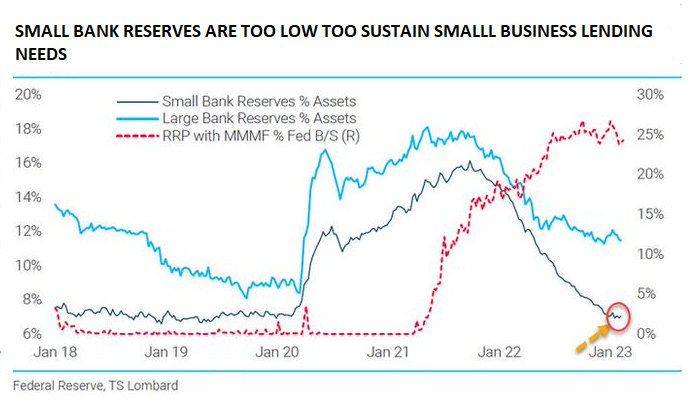

The small to medium sized banks are in trouble because their reserves have become insufficient to meet their needs.

The small to medium sized banks are in trouble because their reserves have become insufficient to meet their needs.

With reserves constrained, this almost guarantees more things are going to “break.”

Banks were already facing two major problems:

-

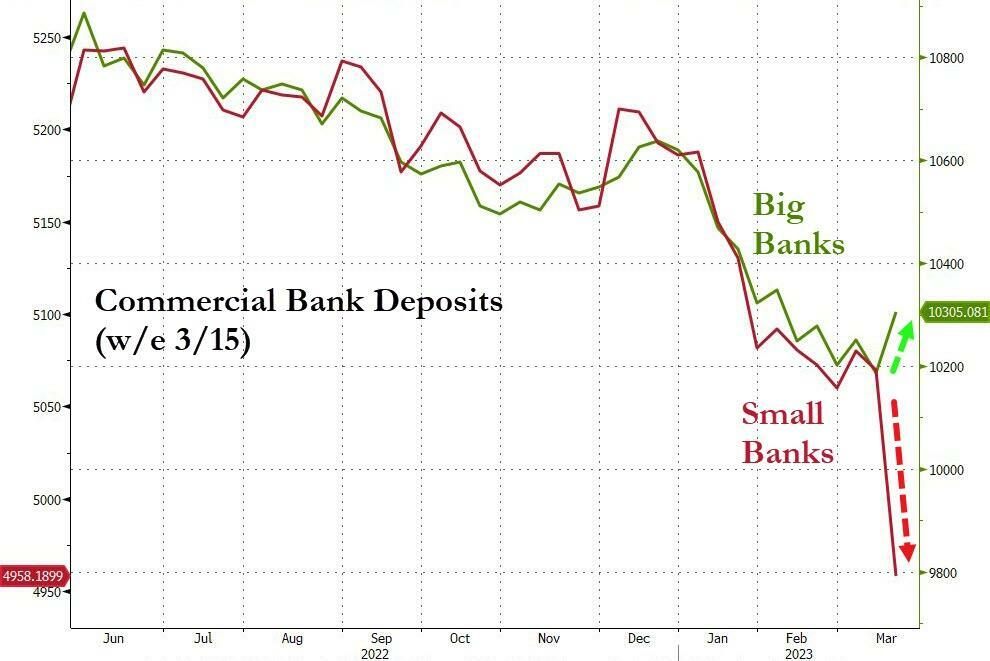

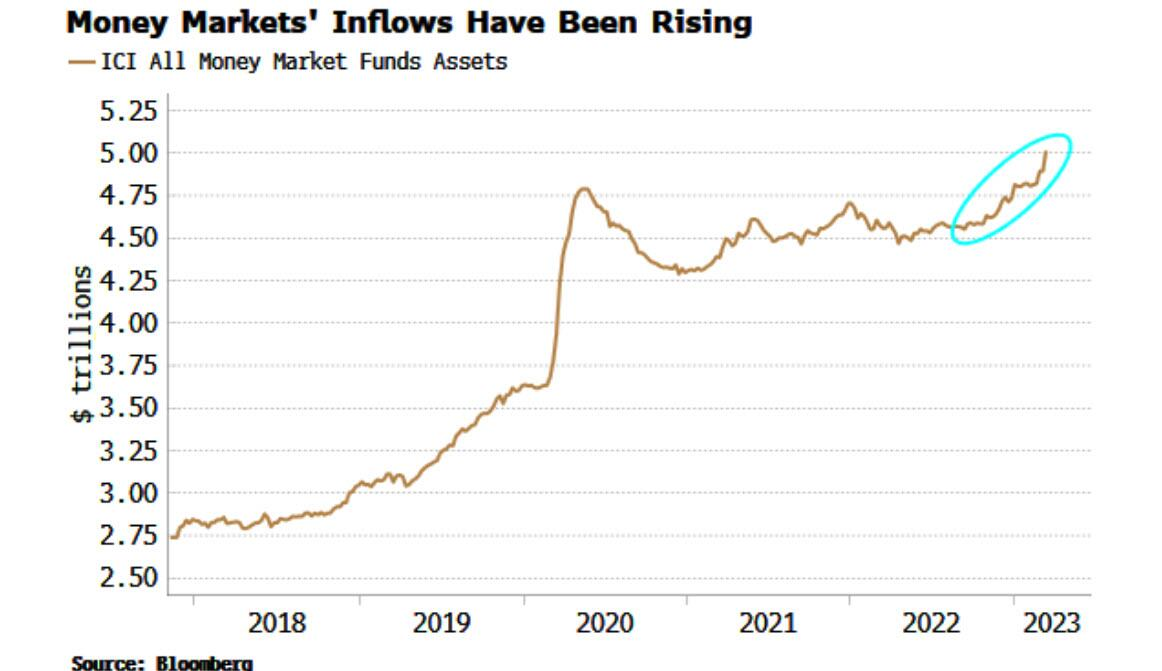

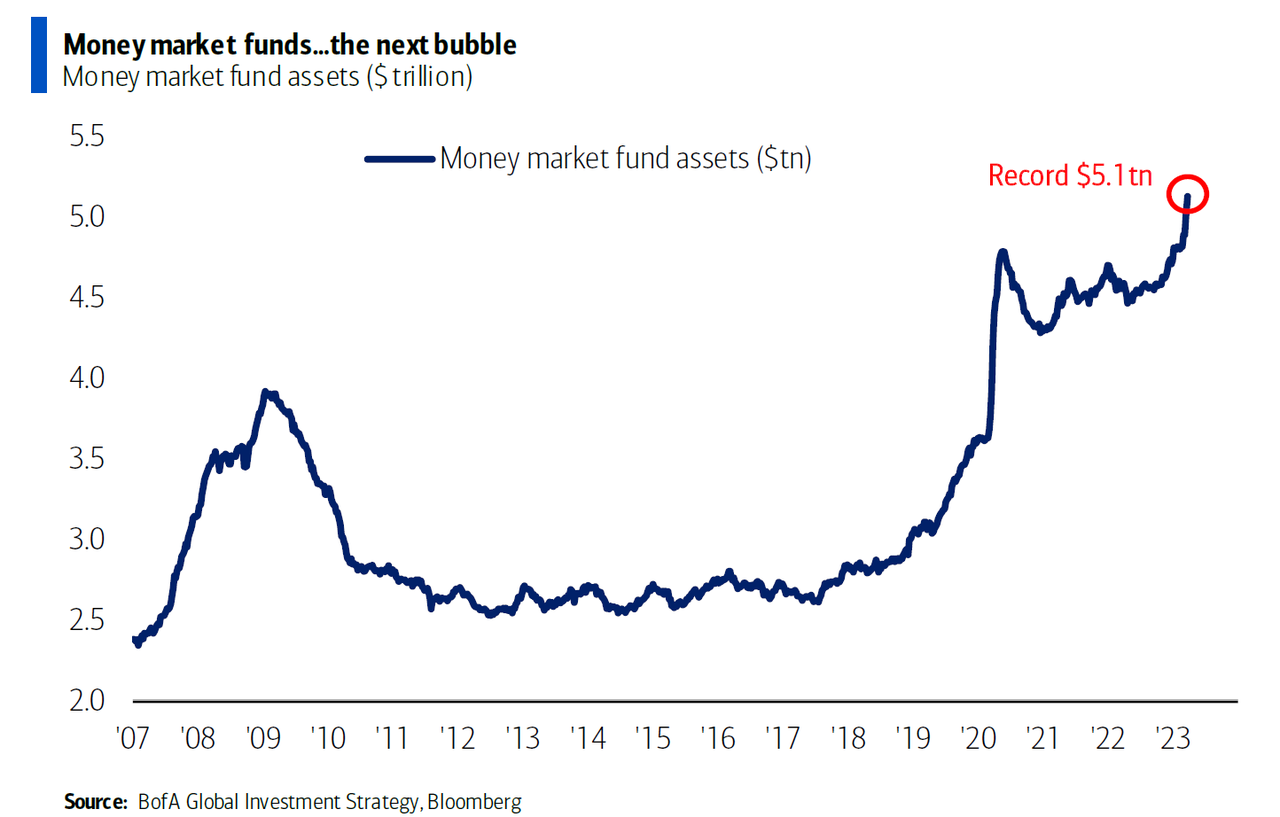

- They pay only 0.23% or so on deposits when depositors can earn 3%-4% in a Money Market Fund or Short-Term U.S. Treasuries. So money was fleeing banks for those higher yielding investments.

- Depositors were terrified of bank failures. And so even MORE money was fleeing.

Now after the bailout of Credit Suisse by UBS and the assistance of NSB, banks face a new issue: trying to attract investors when there’s a very real possibility that both bondholder and stockholders would get wiped out if a bank failed.

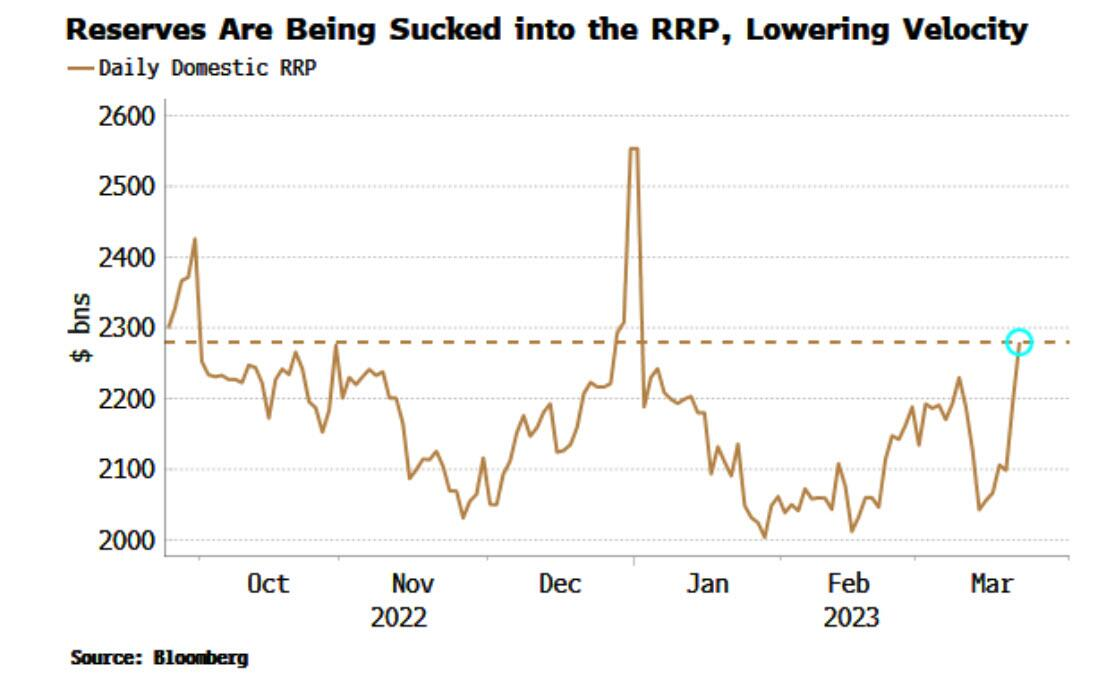

Deposits have recently been headed to higher paying Money Market Funds, which are able to capitalize on Federal Reserve facilities such as Reverse Repurchase agreements paying out advantaged rates that smaller banks don’t have direct access too without intermediation. The big banks don’t want the deposits and may, as they have done before, point larger depositors into their MMFs. They offer a higher yield, and even though they’re uninsured, they invest mostly in ultra-safe assets, so they are very low risk.

Deposits have recently been headed to higher paying Money Market Funds, which are able to capitalize on Federal Reserve facilities such as Reverse Repurchase agreements paying out advantaged rates that smaller banks don’t have direct access too without intermediation. The big banks don’t want the deposits and may, as they have done before, point larger depositors into their MMFs. They offer a higher yield, and even though they’re uninsured, they invest mostly in ultra-safe assets, so they are very low risk.

There is effectively a growing banking monopoly in American banking with “entitled access”. With the overnight RRP facility still offering ~15 bps more than a 3-month Treasury bill after Wednesday’s FOMC rate hike, there’s a strong likelihood that MMFs will continue depositing cash there.

Tighter lending standards resulting from the overall banking stress will likely subtract ¼-½pp from GDP growth in 2023, equivalent to the impact of 25-50bp of tightening in the financial conditions index or 25-50bp of Fed rate hikes. The estimated impact is relatively moderate in part, because lending standards had already tightened sharply in prior quarters due to widespread recession fears and in part because the multiplier effect should be low in an economy with excess demand for workers. However, the risks are tilted toward a larger effect and the uncertainty will likely linger for a while.

THIS IS RESULTING IN EFFECTIVELY CHOKING SMALL BUSINESS AMERICA,

THE LIFE BLOOD OF THE NATION ALREADY REELING FROM COVID-19.

BANK DEPOSIT RATES: Reverse Bank Robbery

Banks have been paying depositors almost nothing for their deposits for so long that many younger people no longer see banks as a facility where you keep your saving.

Banks have been paying depositors almost nothing for their deposits for so long that many younger people no longer see banks as a facility where you keep your saving.

(Of course this is if you actually have any savings?)

Today you pay the bank, the bank doesn’t pay you!

Because Credit Card bills must be paid, your bank account is solely a cash transfer mechanism between your income and credit card balances. On credit cards you pay exorbitant credit card fees if your bank cash balances don’t allow a monthly “zeroing out”. On Debit Cards you has better have sufficient none yielding cash balances,

Everything you might bother a bank for such as a money transfer, overdue needs, currency exchanges etc. you pay a fee for.

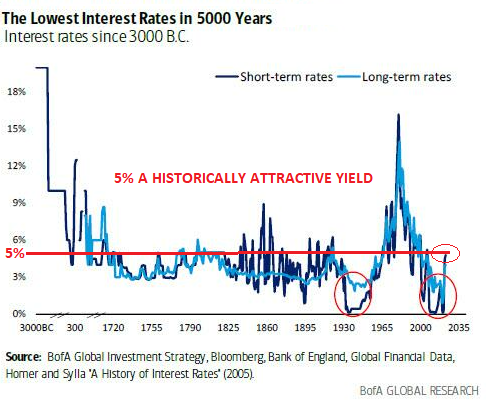

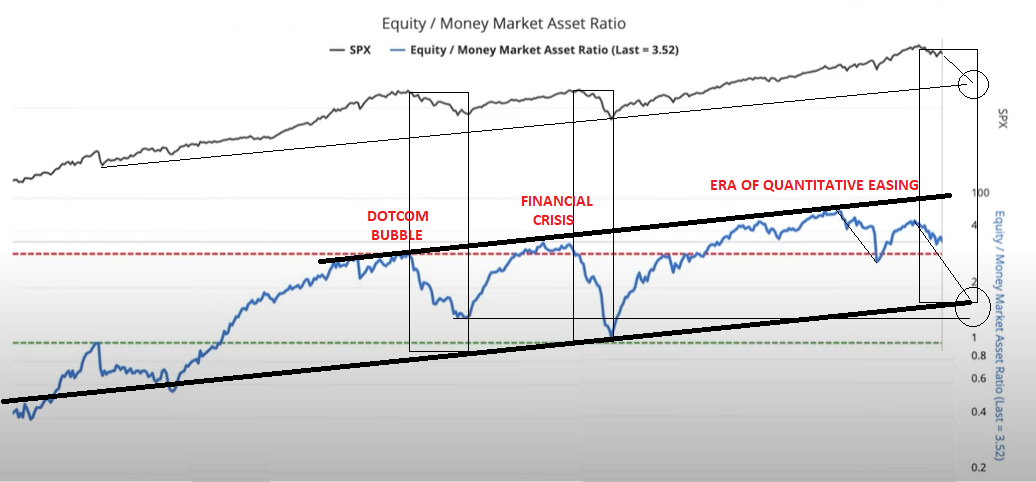

CHARTS BELOW: A Major Shift to Money Markets would be sustained if rates remained elevated relative to what we have seen over the last two decades while we experience the “Beta Drought Decade” in equities.

SHORT TERM: The trend to Money Markets Funds may be overdone in the short term …..

….. but in the longer term this may be major trend in markets during what we called in this year’s Thesis paper as the “Beta Drought Decade”.

THE MONEY MARKET GAME: When Deposits Are Not Deposits

Banks seldom remind depositors that Bank Deposits versus Bank Money Market Funds come with differing risk. Deposits are insured by FDIC up to an account limit of $250,000.

Banks seldom remind depositors that Bank Deposits versus Bank Money Market Funds come with differing risk. Deposits are insured by FDIC up to an account limit of $250,000.

Money Markets are considered an investment and therefore are uninsured!

Both however have become today equivalent bank assets.

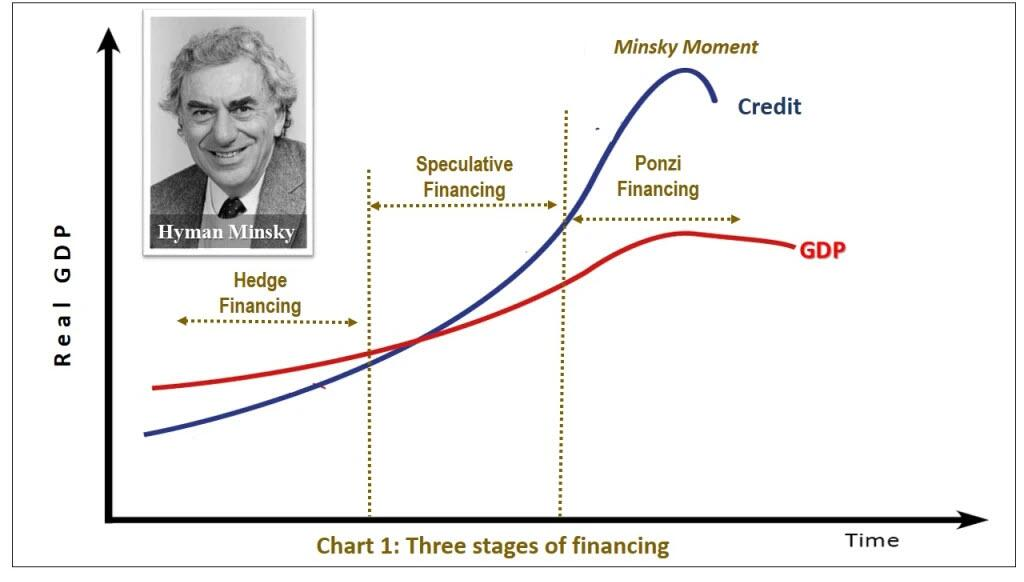

CHART RIGHT: The “Financialization” of the global economy along with the shift from Capitalism to “Creditism” has left us is Stage 3 of a Minsky Moment when investment can best be described as “Ponzi Financing”. When bank “deposits” are technically no longer deposits but investment vehicles, we are in Ponzi Financing because risk has been transferred to the “naïve” and uninformed.

BANK DEPOSIT INSURANCE: FDIC’s $250K Limit

The Biden administration’s nearly $5 trillion in spending is the engine behind the inflation that forced the Federal Reserve to embark on an extended policy of raising the interest rates under its direct control—which in turn has put the squeeze on banks, especially those conducting fast and loose financial practices.

The Biden administration’s nearly $5 trillion in spending is the engine behind the inflation that forced the Federal Reserve to embark on an extended policy of raising the interest rates under its direct control—which in turn has put the squeeze on banks, especially those conducting fast and loose financial practices.

But as scary as that chain reaction may be, the FDIC’s guarantee to reimburse all the rich uninsured depositors at the two failed institutions, making an exception to its $250,000 cap, and no matter how big the depositors’ accounts, is more alarming.

Such measures take the United States down a road toward total nationalization of the banking system and removes the indispensable elements of accountability and discipline all businesses need: certainty that misjudgment and irresponsibility must come with a cost.

When Washington bails that out, America turns into Potterville.

CONCLUSION

RISK TRANSFER

RISK TRANSFER

Banks Get the Profits, Public Assumes Risk.

A CONSOLIDATION

Just More Money to Support the Derivative Monster!

CHART RIGHT: The red arrows on the right hand side of this chart,(which we have discussed many times in prior newsletters), is where the bank bailout money is headed to keep the system afloat!

COMMERCIAL REAL ESTATE: The Coming Crisis

Small banks account for a staggering 70% of total CRE loans outstanding excluding multifamily, farmland, and construction loans.

This share is particularly notable considering declining CRE transaction volumes over that period.

CMBS issuance, on the other hand, has tracked CRE transaction volumes lower throughout last year and has remained depressed. This is a problem since credit availability to CRE borrowers was already challenged coming into this year, given the troubles in CMBS with issuance having slowed to a crawl.

CMBS, in the post-GFC era, has constituted roughly 20% of CRE loan origination volumes annually. Smaller banks potentially retreating as well can cause a credit crunch in secondary/tertiary CRE markets (defined as markets outside of Boston, Chicago, LA, New York, SF, and DC), where it’s likely CMBS and smaller balance sheet lenders like banks dominate origination activity. In CMBS, while the largest loans in a typical securitization are backed by properties located in major markets, we know the majority of CMBS lending is against properties located in secondary/tertiary markets. If both spouts are turned off, who is left to lend in these markets? It does not seem likely that larger banks will pick up slack in a meaningful way. It’s possible that opportunistic private debt funds will get involved, but likely at a significantly higher cost of financing and unlikely at the needed scale.

And now that smaller banks are certain to retreat further amid the bank collapse contagion, this will cause an acute credit crunch in secondary/tertiary CRE markets.

A DEEP RECESSION IS NOW HIGHLY LIKELY IN THE CARDS!

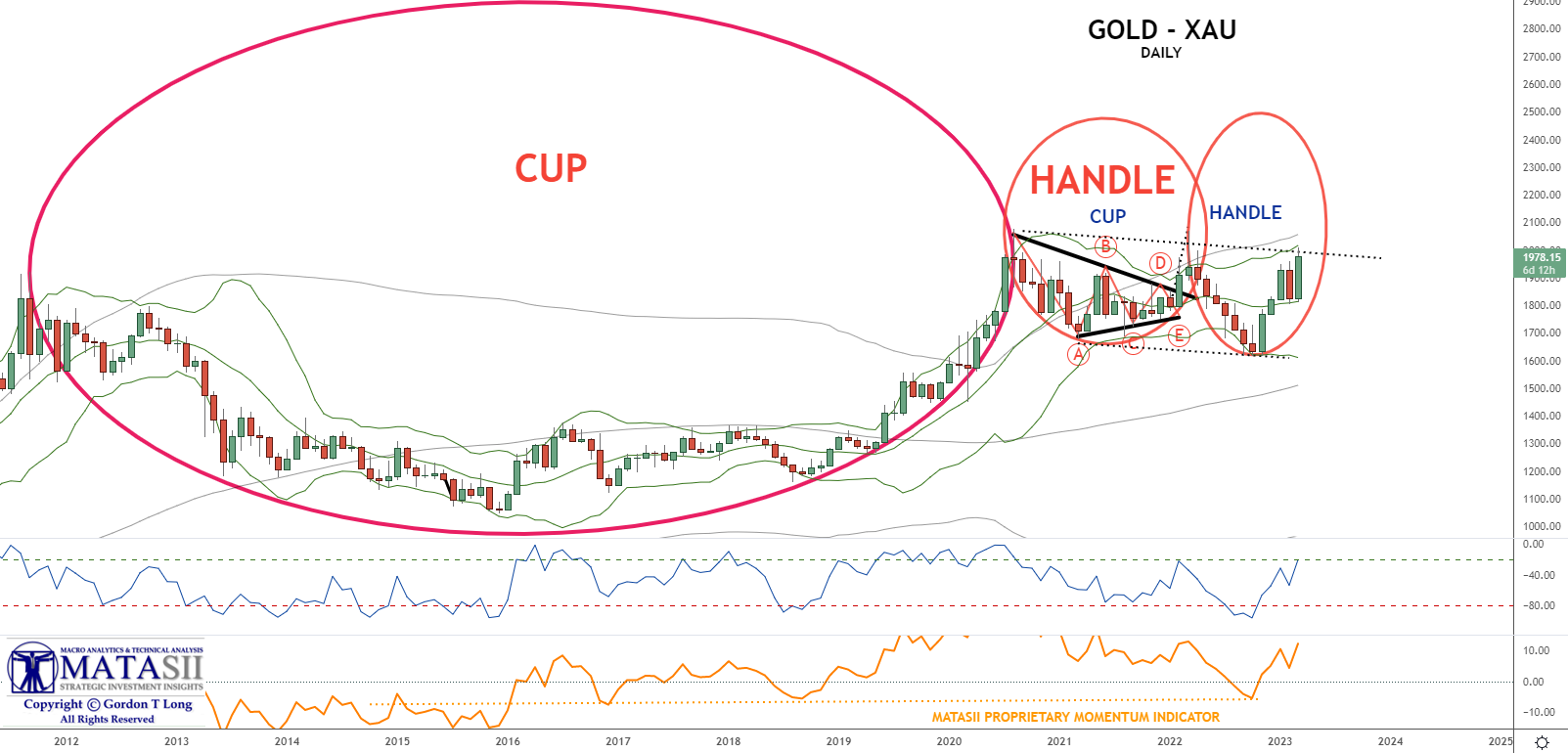

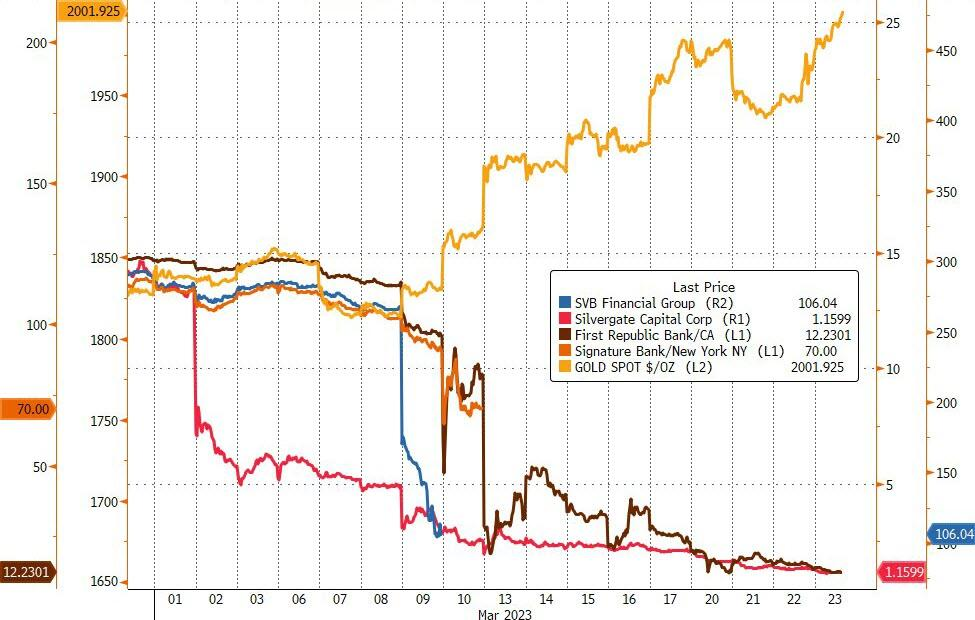

GOLD IN THE LIMELIGHT!

THE FEAR TRADE

The sharp spike in gold prices is almost entirely explained by an increase in fear-related demand for gold. This is in line with the fall in the10-year real rates. ‘FEAR’ is the key medium as the short-term driver for gold.

The sharp spike in gold prices is almost entirely explained by an increase in fear-related demand for gold. This is in line with the fall in the10-year real rates. ‘FEAR’ is the key medium as the short-term driver for gold.

The catalyst for the current rise in ‘fear’ is not only banking and funding stress to levels last seen in March 2020, but also a sharp rise in the market-implied probability of a US recession in the next year. With bank deposits at smaller regional banks now declining at speed and risks of this capital flight persisting, there is a direct pass-through to the real economy via higher funding costs that is hard to ignore.

The fact that macro markets have become unusually fragile or ‘gappy’ in the recent period, likely driven by policy uncertainty, positioning risk and illiquidity, could further fuel fear-driven demand for gold, suggesting this may be a slow grind for higher gold prices from current levels. In particular, uncertainty over when central banks will eventually pivot in the face of record macro data volatility may prevail, fueling the risk of sharp, hard-to-anticipate and uncharacteristically large moves in asset prices.

For Gold to continue its dramatic rise from current levels then one or both of the following must occur:

-

-

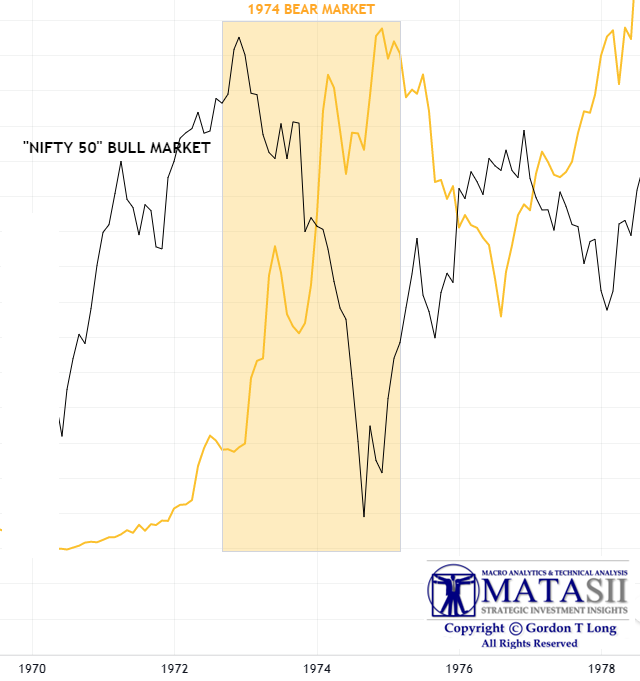

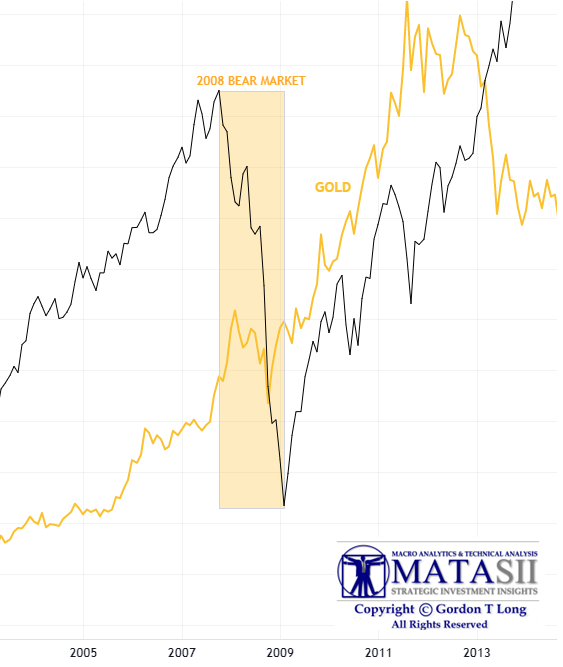

- The Fed must beginning cutting rates as it did in 1974 and 2008.

- The Geoeconomic Macro Trade must “kick-in”.

-

1- FED FUND RATE CUTS

1974 MARKET COLLAPSE v GOLD

Markets fall violently, gold rises just as violently!

1974 MARKET COLLAPSE v GOLD

Markets fall violently, gold rises just as violently!

2- THE GEOECONOMIC MACRO TRADE

The primary reason for gold prices to sustainably detach from the underlying shorter term variables in gold pricing is if central banks (particularly the Fed) lose control over the monetary environment. Thus, it seems that the gold market is now pricing in a significant risk that the Fed can’t get inflation back under control.

As the long term charts below suggest, gold is nearing overhead resistance. “Fear” can only take gold so far before the issue of ‘out of control’ inflation and a falling dollar must be the drivers.

READ:

CHARTS:

The chart below will help you recognize technically when that has occurred versus what the media is reporting as the currently “accepted” narrative.

|

|

|

|

|

|

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.