TIPPING POINTS

US BANKING CRISIS

BIDEN BONDS TOO HOT FOR BANK COLLATERAL!

The net of the current banking crisis is that:

1 – Biden’s Spending => 2 – Inflation => 3 – Exploding Yields => 4 – The Instability of Banks’ Core Stabilizing Asset

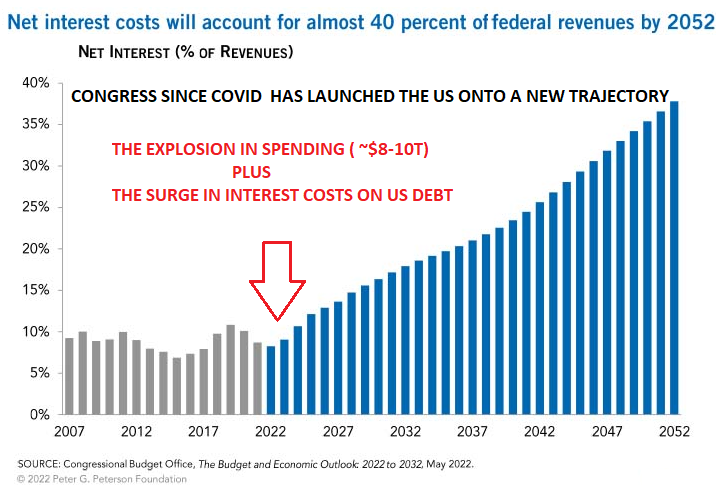

Since the post WWII Bretton Woods conference, the US Treasury Bonds (specifically the 10Y UST) have been the Risk Free interest rate benchmark. This requires that it be maintained by responsible economic and fiscal policy management. The global Basel Bank Accords built on this in centering US Government Treasuries as a core block in establishing VaR metrics, Capital adequacy and lending ratios.

However, the Biden administration’s $6 – $7.6 TRILLION spending shock:

-

- The $1.9T American Rescue Plan projected to realistically involve $3.5T in spending

- The $740b Inflation Reduction Act

- The $1.2 Trillion Infrastructure Bill

- The $280B CHIPS Bill

- $200B Ukraine Military Support

- The January $1.7T Omnibus Bill

In addition to last week’s expanded $6.8 TRILLION budget submission, has simply been too much for the banking sector to juggle before the carefully constructed stability metrics “tilted” out of balance!

=========

WHAT YOU NEED TO KNOW

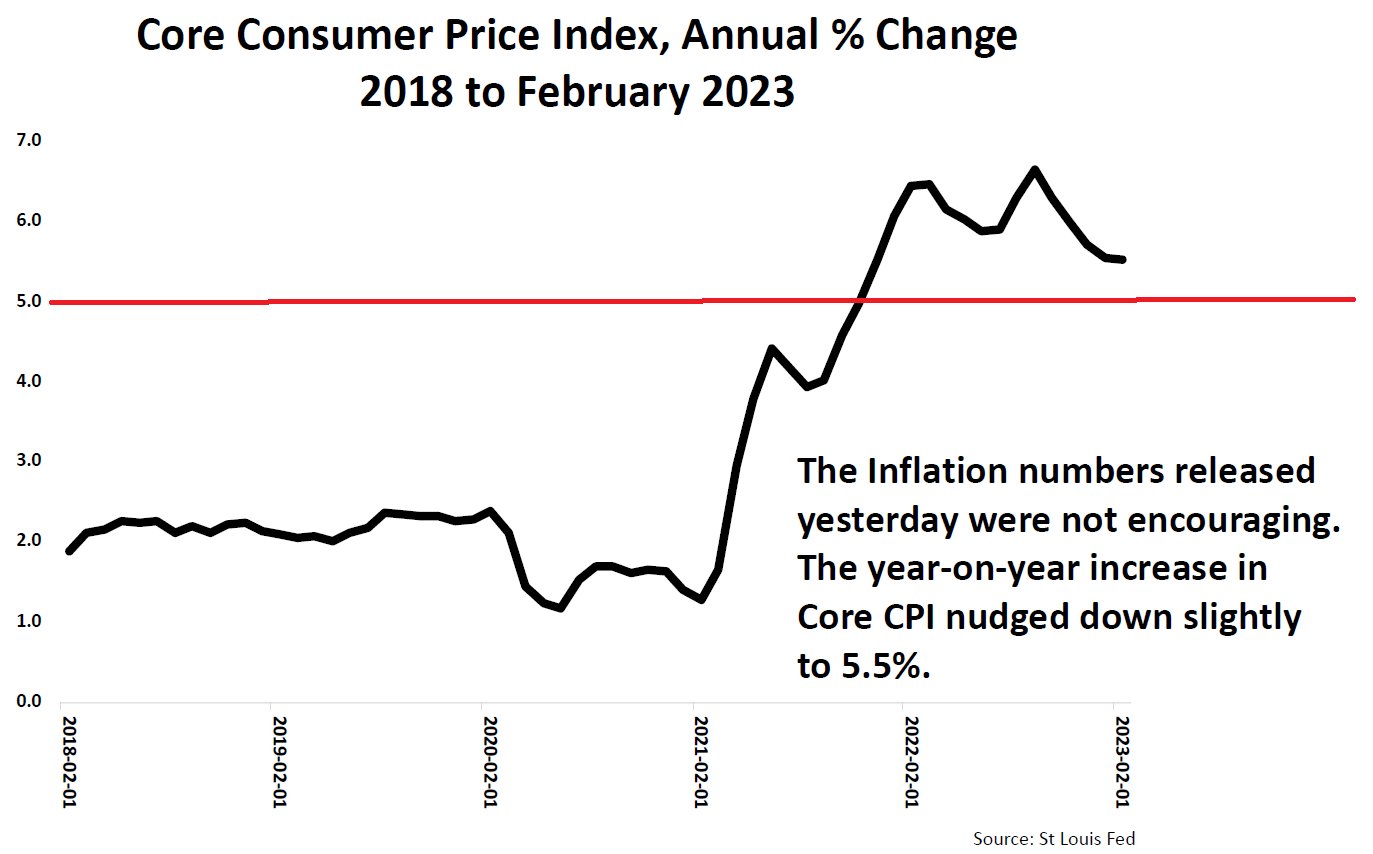

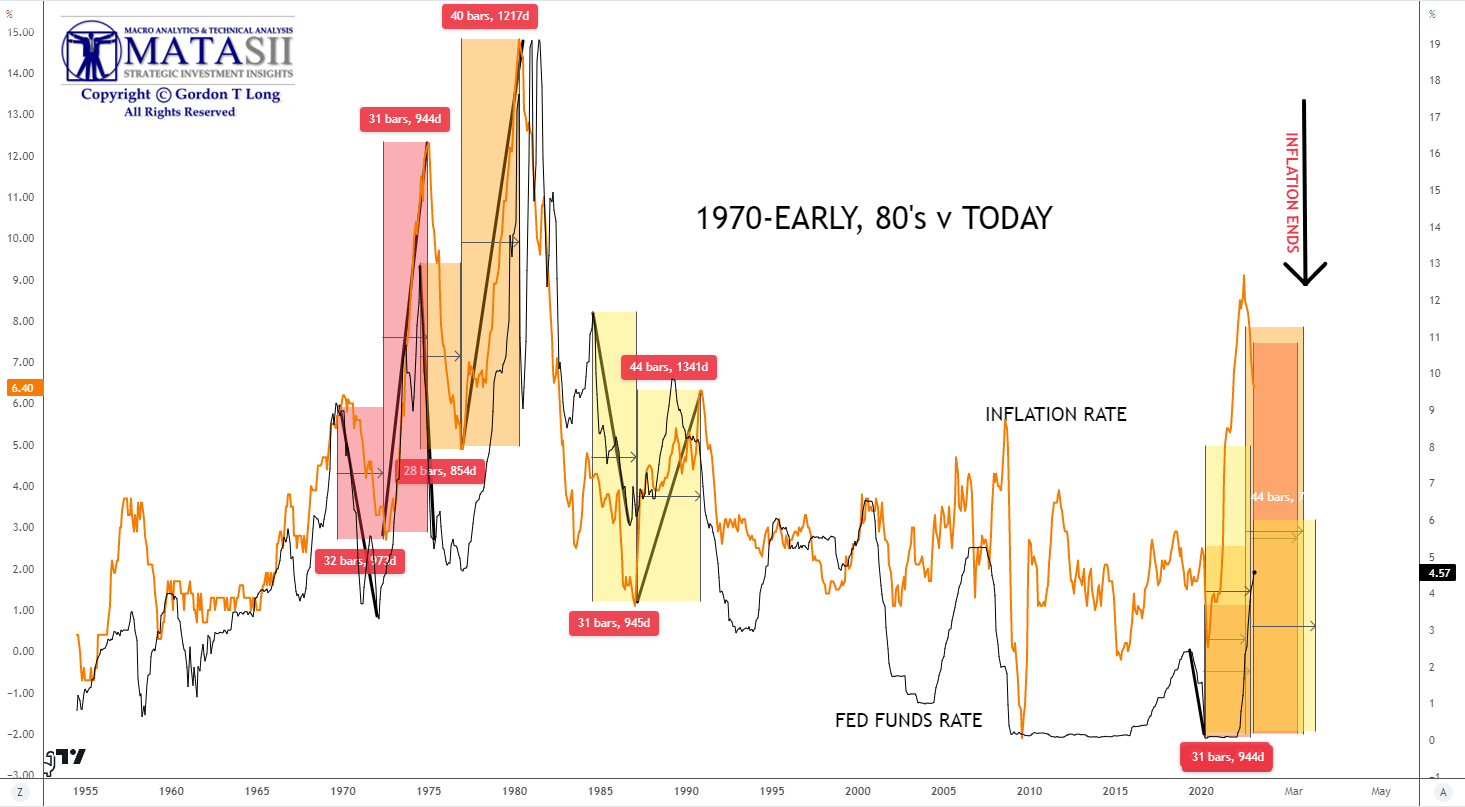

We are much too early for the Fed to stop fighting Inflation and not increasing rates to above the inflation rate. If we stop now we will only repeat the same mistakes of the 70’s!

We are much too early for the Fed to stop fighting Inflation and not increasing rates to above the inflation rate. If we stop now we will only repeat the same mistakes of the 70’s!

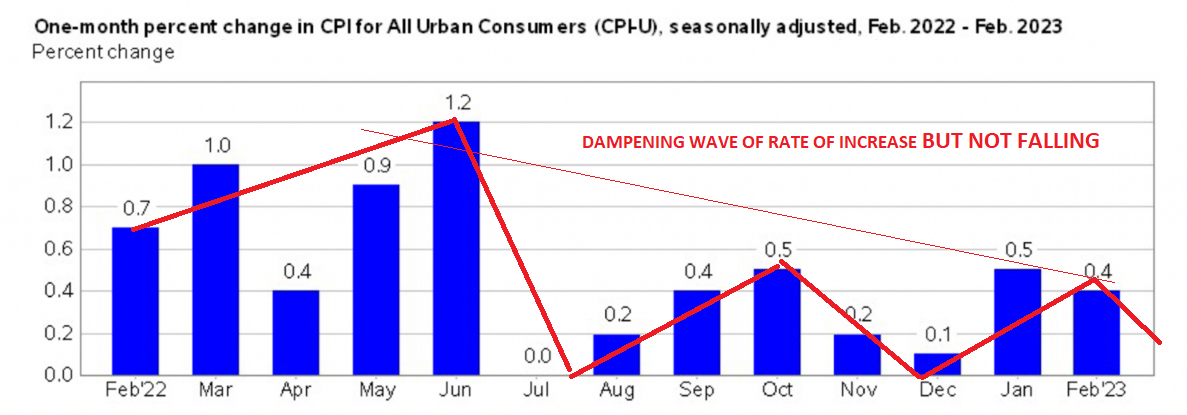

Remember: It is only the rate of increase that is falling NOT Inflation as felt by the critically important real disposable income of consumers in a 70% consumption dependent economy.

2023 US TREASURY v 2008 MORTGAGE CRISIS: This is Structural!

-

- Everyone has been ignoring the simple concept that the bonds they acquired at 1% (or less) lose money when interest rates go up (to like 4%) from unfunded government spending.

- Just as the banks in 2008 were sitting on billions of unrealized losses from the toxic mortgages on their books, the same banks are now sitting on ~ $600 billion of unrealized losses from the newest toxic asset

- The scope and scale of the use of US Treasury securities by banks and lending institutions world wide as a core “stabilizer” makes this a global structural and systemic problem.

- Systemic risk is global as USA sovereign risk reached a new record high.

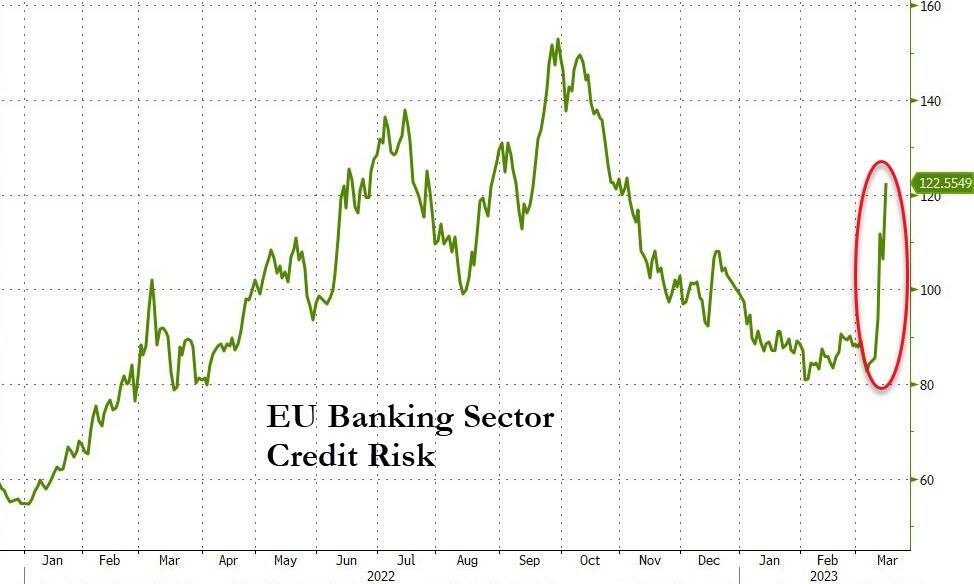

EU BANKING PYRAMID: Was Readily Combustible

-

- The spiking FRA-OIS says banks don’t trust the assets of other banks.

- EU Banks and Financial Institutions are under pressure and scrambling to protect their balance sheets from the likes of a Credit Suisse collapse.

- It works both ways! The crowd loved European banks as yields were moving higher. Looks like the inverse works as well.

BTLF: Effective Conservatorship of Banks

-

- The Federal Reserve’s emergency loan program may inject as much as $2 trillion of funds into the US banking system and ease the liquidity crunch.

- The Fed’s new BTFP facility is simply QE in another name and form.

- Expect assets to highly likely grow on the Fed balance sheet which will increase reserves, although technically they are not buying securities.

BUYING TIME: Fed Futilely Trying to Load the “Bazooka”

-

- The BTLF (like the purchase of Bear Sterns by JP Morgan in 2007) may have bought us another 6 months.

- The serious challenges still in front of the FOMC include:

-

-

- Get the Monthly Rate of Increase Inflation immediately falling below 4% before taking any actions that will weaken pressure on inflation reduction.

- Get the Annual Inflation Rate below the critical 5% before further long term damage is done in the form of inflation becoming more “sticky”.

-

CONCLUSION

THE REAL CRISIS: Crashing Disposable Income

-

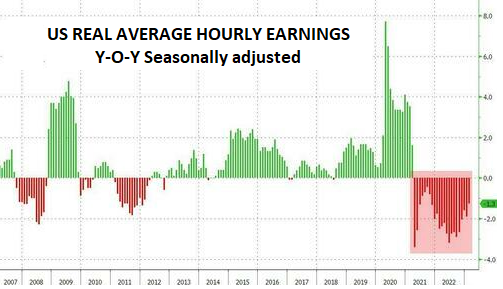

- Inflation is still compounding rising prices. Weakness is only in the rate of increases. It’s getting more critical everyday, as we see with 23 consecutive months of shrinking, negative real working wages.

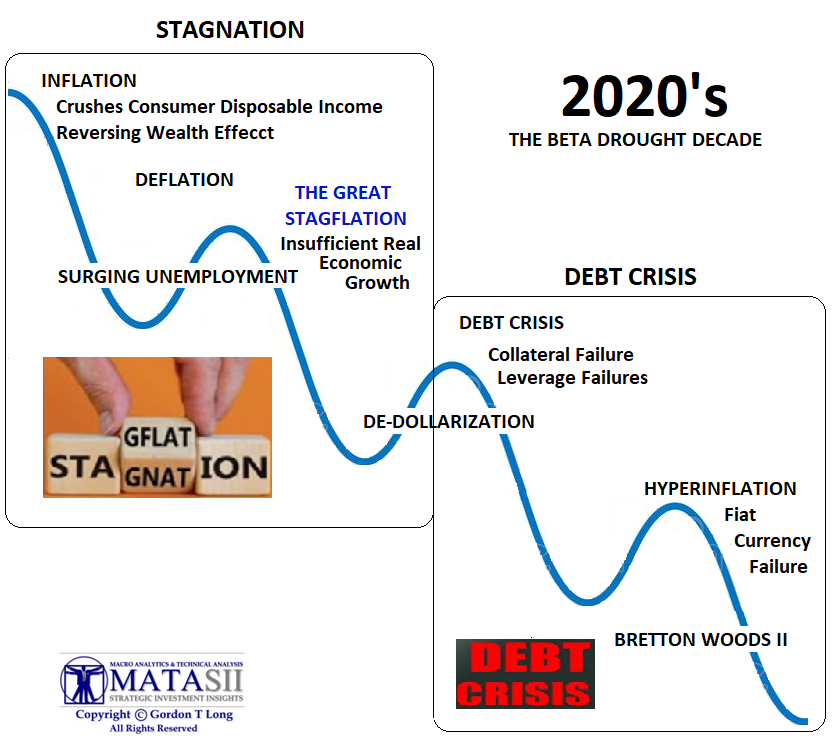

We still fully expect an overdue recessionary deflationary scare

to arrive in H2 2023.

=========

2023 US TREASURY v 2008 MORTGAGE CRISIS: This is Structural!

The problem is pretty easy to see if you actually looked! Everyone has been ignoring the simple concept that the bonds they acquired at 1% (or less) lose money when interest rates go up (to like 4%) from unfunded government spending.

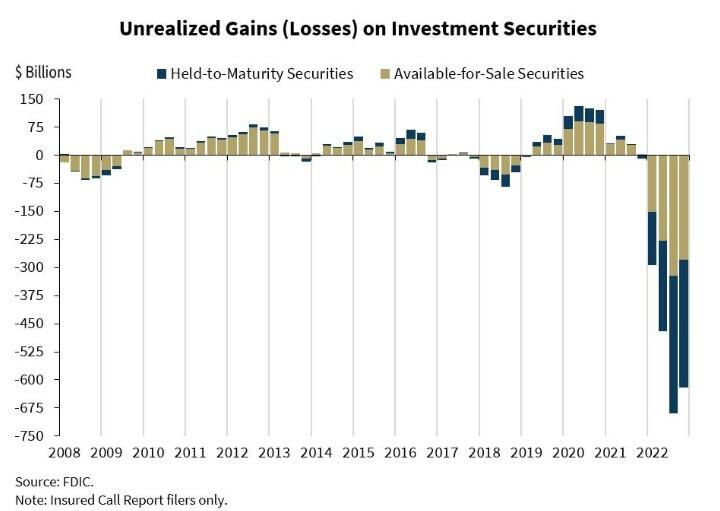

Just as the banks in 2008 were sitting on billions of unrealized losses from the toxic mortgages on their books, the same banks are now sitting on ~ $600 billion of unrealized losses (see chart below) from the newest toxic asset – U.S. Treasuries. Everyone knows it. It’s just math.

Everyone has simply been counting on Powell to soon reverse course, but with reported inflation still at 6%, he has been trapped. Suddenly the unrealized bank government bond losses began being realized as the likes of Silicon Valley Bank and Signature Bank had to sell assets to fund operations and unexpected redemptions. Then depositors realized that fact and the classic bank run ensued.

Poof!!! A sudden crisis.

Isn’t that what government bank regulators protect us against? There is that word government again!

|

ABOVE: The MOVE (Bond Volatility) has literally exploded. |

|

|

ABOVE: Only four times in the last 40 years have we seen movements in the bond market like we did this week. CHART BELOW: Unrealized Bank Bond Losses |

SOMETHING SERIOUSLY WORRYING IS BEING SIGNALLED

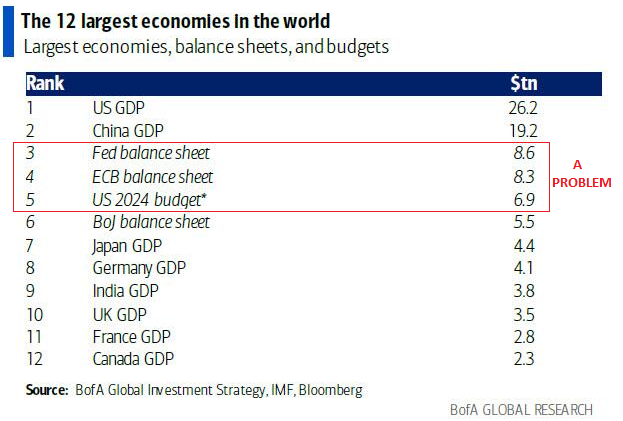

The reality is that spending can only be increased at a certain rate without inflation surging because the economy isn’t vibrant enough to handle it. When the existing US and global debt is at the levels it is has risen to (and expected to rise at an accelerated rate), the bond market effectively chokes via misaligned and precarious balance sheets.

CHART ABOVE: What we are witnessing are early emerging shocks of the future Global Debt Crisis we highlighted in this year’s thesis paper!

CHART ABOVE: The US Debt has been pushed over the edge with Biden’s release last Thursday of his Fiscal Budget.

THE PROBLEM IS NOW STRUCTURAL

This isn’t a bailout… it’s a time bomb…

CHART RIGHT: Systemic risk is global as USA sovereign risk reached a new record high.

CHART RIGHT: Systemic risk is global as USA sovereign risk reached a new record high.

READ THIS FOR A CLEAR VIEW: The Fed Just Hijacked American Democracy —

The scope and scale of the use of US Treasury securities by banks and lending institutions world wide as a core “stabilizer” makes this a global structural and systemic problem.

EU BANKING PYRAMID: Was Readily Combustible

I have written many times since the 2012 EU Banking Crisis about structural concerns regarding the EU Banking system. it has been rife for just such a shock as we are presently witnessing.

I have written many times since the 2012 EU Banking Crisis about structural concerns regarding the EU Banking system. it has been rife for just such a shock as we are presently witnessing.

CHART RIGHT: The spiking FRA-OIS says banks don’t rust the assets of other banks.

EU Banks and Financial Institutions are under pressure and scrambling to protect their balance sheets from the likes of a Credit Suisse collapse.

EU Banking Sector Credit has spiked and is likely to see new highs.

CHART BELOW: The EU Banking sector is now trading closer to the 200 day moving average than the 100 day moving, which we breached a few days ago. Don’t forget that this sector remains a massively crowded LONG position despite the recent crash. The focus is shifting from the narrative of higher rates being positive for banks to the risks that stem from further tightening of monetary policy.

-

- The Euro forward curve has shifted materially lower….leading to risk of disappointment over NII in the second half of 2023.

- With inflation on some metrics remaining high and pressure on central banks to continue tightening despite liquidity concerns, markets are likely to assume a higher probability of a hard landing and pressure on asset quality for the sector.

It works both ways! The crowd loved European banks as yields were moving higher. Looks like the inverse works as well.

BTLF: Effective Conservatorship of Banks

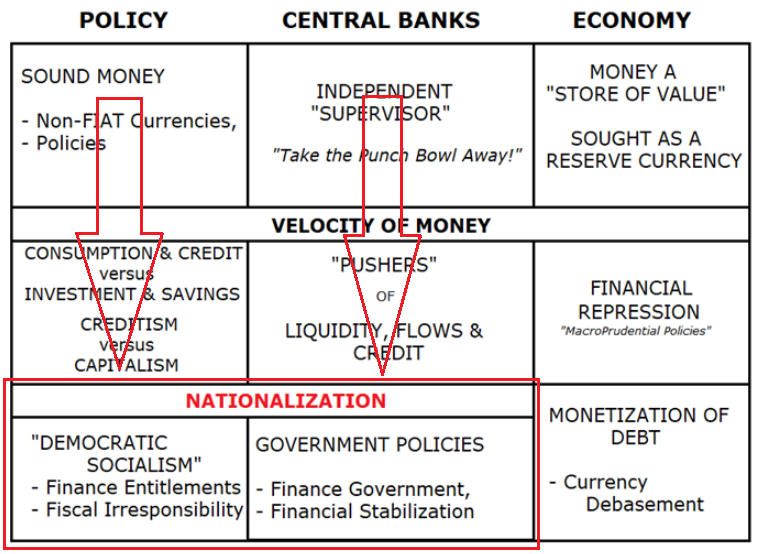

The bottom line is the US has effectively “nationalized” the banking industry by guarantees that all depositors will be “made whole” from potential bank failures. Since we don’t politically use the term “nationalization” in the US, it will likely be referred in the future as having been placed in “Conservatorship”, like we did in 2008 with Fannie Mae and Freddie Mac.

The bottom line is the US has effectively “nationalized” the banking industry by guarantees that all depositors will be “made whole” from potential bank failures. Since we don’t politically use the term “nationalization” in the US, it will likely be referred in the future as having been placed in “Conservatorship”, like we did in 2008 with Fannie Mae and Freddie Mac.

Specifically, the BTLF protects any depositor above the FDIC upper limit of $250,000 account, which is financed by banking fees. Though the Federal Reserve is “on the hook”, it has been “backstopped” by Janet Yellen at the US Treasury with $87B from the Stabilization Fund. This means we the tax payer are actually on the hook.

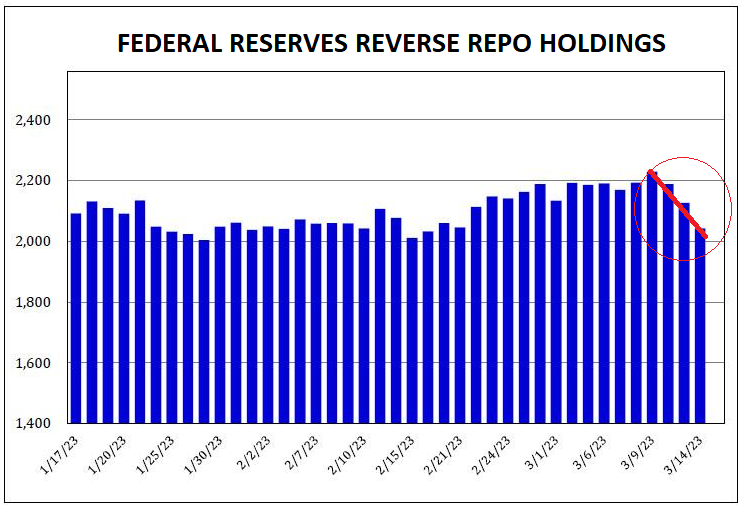

CHART ABOVE RIGHT: Banks have had less liquidity to securely park as Reverse Repos

Even the Federal Reserve’s Discount Window, which is ALWAYS avoided because of its “reputational” damage to banks needing it, has spiked.

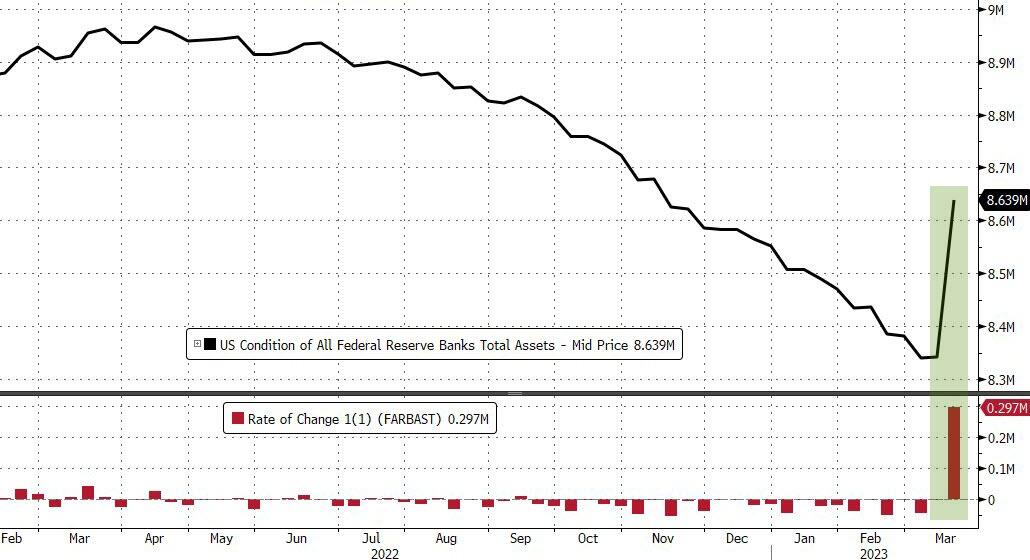

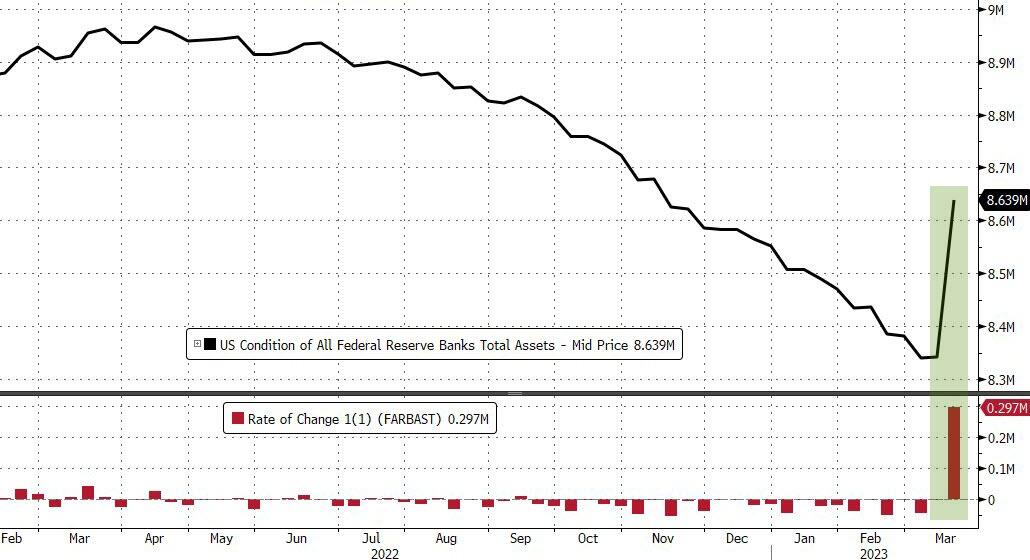

The Federal Reserve’s balance sheet has spiked (offsetting QT efforts) since the implementation of BTLF.

I forecasted this would occur in the 2020 UnderTheLens video “The Coming Era of Stagflation“. The chart below is taken from that video explanation of the prediction.

BUYING TIME: Fed Futilely Trying to Load the “Bazooka”

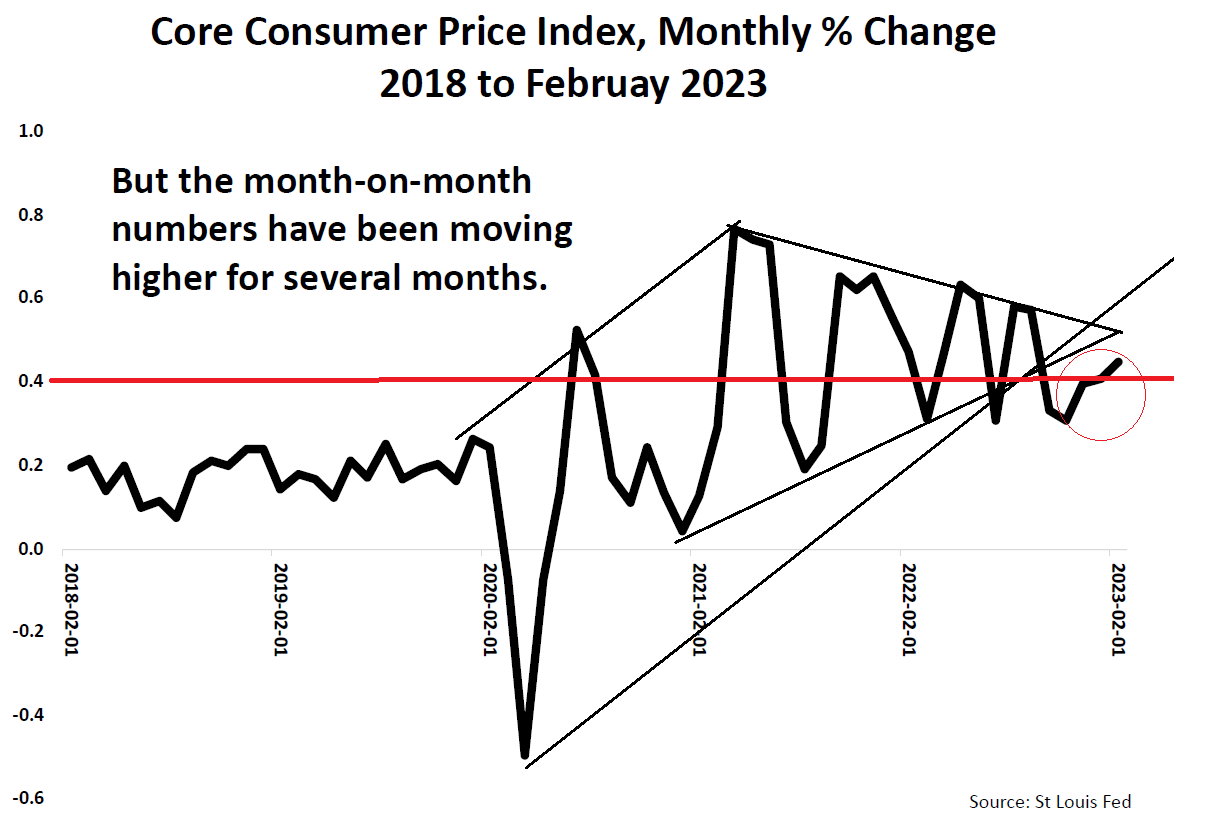

In the two charts below I have tried to illustrate the serious challenges still in front of the FOMC.

In the two charts below I have tried to illustrate the serious challenges still in front of the FOMC.

-

- Get the Monthly Rate of Increase Inflation immediately falling below 4% before taking any actions that will weaken pressure on inflation reduction.

- Get the Annual Inflation Rate below the critical 5% before further long term damage is done in the form of inflation becoming more “sticky”.

CHART RIGHT: Fed’s balance sheet exploding to the upside as bailouts/reserves make a come back. The Federal Reserve’s emergency loan program may inject as much as $2 trillion of funds into the US banking system and ease the liquidity crunch. The Fed’s new BTFP facility is simply QE in another name. Expect assets to highly likely grow on the Fed balance sheet, which will increase reserves, although technically they are not buying securities. Reserves will grow.

IF THE FED DOESN’T QUICKLY SUCCEED IN GETTING INFLATION BELOW THE RED THRESHOLD LEVELS (BELOW), WE COULD FACE CRIPPLING INFLATION PRESSURES

FOR THE REST OF THE DECADE!

Get the Monthly Rate of Increase Inflation immediately falling below 4%

Get the Annual Inflation Rate below the critical 5%

CONCLUSION

THE REAL CRISIS: Crashing Disposable Income

Inflation is still compounding rising prices. Weakness is only in the rate of increases. It’s getting more critical everyday as we see with 23 consecutive months of shrinking, negative real working wages (below).

Inflation is still compounding rising prices. Weakness is only in the rate of increases. It’s getting more critical everyday as we see with 23 consecutive months of shrinking, negative real working wages (below).

A banking crisis means banks will reduce lending dramatically. Consumers have been forced to live off their credit cards for the last two years, as their savings dried up and their wages bought less. Consumers are already pulling back and spending less. With credit drying up and spending going down, employers across the globe will start laying people off.

As unemployment rises, people will be forced into delinquencies on their enormous mortgage and auto loans. This will lead to further bank liquidity squeezes and increased loan lass reserves, just like 2008/2009.

A DEEP RECESSION IS NOW HIGHLY LIKELY IN THE CARDS!

THE US DOLLAR IS QUICKLY BECOMING THE US TREASURY’S REAL WORRY!

“Liquidity always disappears faster than a thief in the night!”

There is currently no major worry for the US Dollar in the immediate term. In fact it is likely to strengthen if the EU Banking sector continues to get sold. (see EU BANKING PYRAMID: Was Readily Combustible in this week’s Newsletter).

However, in preparation the time to study the problem is when everyone is preoccupied with some other problem – i.e. the current banking crisis.

ABOVE: In our last newsletter we shared the chart above of our analysis of the historic timing of duration lags from Fed Monetary policy shifts.

ABOVE: The Federal Bank balance sheet exploded higher this week as banks took full advantage of the new BFTP banking “backstop” facility

Remember, inflation is not going away and the Fed, because of the introduction of the new BTFP banking facility, will likely have to give up on its Quantitative Tightening (QT) program. Unofficially QT has realistically ended and additionally a new form of “Stealth QE” has emerged (See chart ABOVE ).

What does this mean? If the Federal Reserve policy going forward results in holding rates artificially lower in an attempt to:

-

- Push up bond prices and thereby increase the problematic bank asset values,

- Slow the new Federal Reserve balance sheet growth due directly to the BTLP facility.

Then the Federal Reserve potentially exposes the dollar to weakness. The Fed and US Treasury may actually want this, since a weaker dollar will attract foreign purchasers for the rapidly expanding US debt! There is a strong possibility this will also be good for US equities as they historically rise in US dollars when the dollar weakens.

Then the Federal Reserve potentially exposes the dollar to weakness. The Fed and US Treasury may actually want this, since a weaker dollar will attract foreign purchasers for the rapidly expanding US debt! There is a strong possibility this will also be good for US equities as they historically rise in US dollars when the dollar weakens.

This leads us back to Inflation which is therefore likely to persist at historically high levels. High US inflation will only eventually lead to a weaker US dollar, strong US denominated gold prices and reduced US currency adjusted returns.

The following charts should be carefully monitored.

|

|

|

|

|

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.