TIPPING POINTS

US BANKING CRISIS

THE ‘TELLS’ OF SVB & POWELL’S CONGRESSIONAL TESTIMONY

When the US’ 16th largest bank fails with $169B in uninsured deposits not covered by FDIC on a total asset base of $200B, markets panic! The collapse of the Silicon Valley Bank (SVB) is the second largest in US history and comes with a critically important caveat. Most of the depositors were not individuals, but rather venture capital start-ups in the technology rich “silicon valley” whose payrolls and ability to pay their bills went completely dark on Friday. Unless a financing bailout is arranged immediately, the firings will fix the BLS’ Unemployment numbers in one fell swoop! This is not about saving the SVB, but about the evaporated “life blood” fundings of the “early seed” depositors!

The surging TED and OIS-FRA spreads and plummeting bank stock prices tell us that everyone is scared of the potential Third Party and Unintended Consequences through cascading collateral damages. At this stage we can only ensure that our own bank savings are FDIC protected, which these start-ups were completely negligent in doing.

=========

WHAT YOU NEED TO KNOW

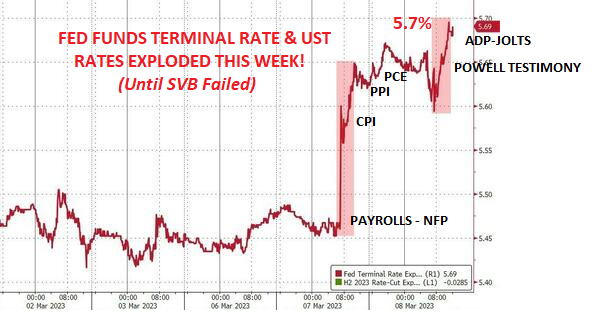

Though we are somewhat confident that the SVB depositors will be “made whole” for “Economic and National Competitiveness and Defense” reasons, it still is an important “Tell”. SVB failed because its assets were dominantly US Treasuries. When rates once again exploded violently higher as a result of Powell’s Wednesday’s Congressional Testimony, SVB’s VaR collapsed. By the time rates were dramatically driven down by Friday afternoon close the damage was done! SVB was financially just cutting it too close and got caught! They aren’t unique! The US Treasury volatility has many banks in a similar position globally!

Though we are somewhat confident that the SVB depositors will be “made whole” for “Economic and National Competitiveness and Defense” reasons, it still is an important “Tell”. SVB failed because its assets were dominantly US Treasuries. When rates once again exploded violently higher as a result of Powell’s Wednesday’s Congressional Testimony, SVB’s VaR collapsed. By the time rates were dramatically driven down by Friday afternoon close the damage was done! SVB was financially just cutting it too close and got caught! They aren’t unique! The US Treasury volatility has many banks in a similar position globally!

CREDIT SUISSE – THE FIRST GLOBAL BANK CURRENTLY UNDER “LIFE SUPPPORT”

-

- The announcement Thursday that a major global SVIB bank would postpone the release of its annual report at the request of the Securities and Exchange Commission is about as serious as it gets, short of a run-on-the bank or outright bankruptcy!

CHAIRMAN POWELL’S HUMPHREY HAWKINS TESTIMONY

-

- US Senators on both sides of the isle have shown overwhelming fear of potential Job losses if Fed rates are maintained or continue rising.

- The first, evidenced by the questioning Powell underwent during his Congressional testimony, is that politicians will be irate if the Fed torpedoes a recovery they have just bought with trillions of dollars in fiscal spending. The central bank is not immune from Congressional wrath.

- Powell was clearly left with the message that Jobs are politically more important than continued Inflation fighting.

- The Fed will capitulate on its Inflation fighting the moment the first of two events occur: i) A Financial Crisis erupts, or ii) Unemployment surges.

- Unfortunately this is precisely the political failure that deepened the Stagflation problems of the 1970’s.

- Congress has no stomach for a Recession nor spending curbs to fight Inflation.

UNKNOWN COUNTER LEVELS: DISINFLATION & JOBS

-

- Even seasoned professionals often forget how slow the transmission process is for monetary policy. The Fed Fund Rate changes can take from 24 -36 months, depending on the direction to take meaningful effect.

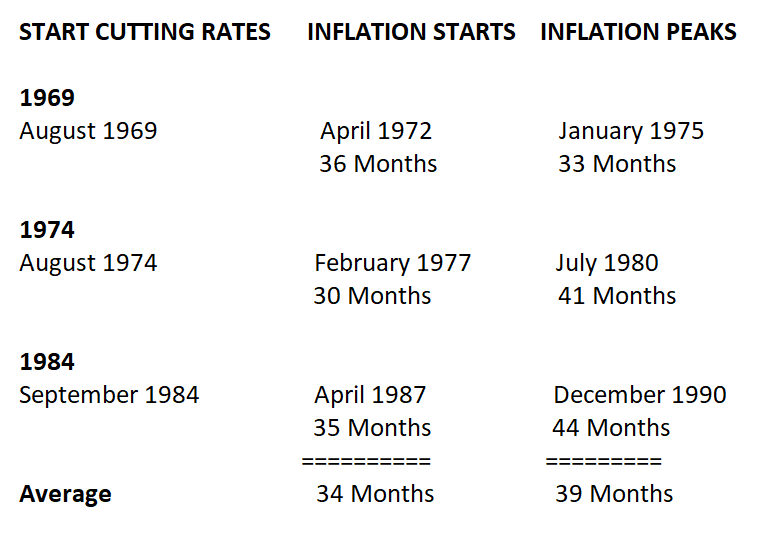

- From when the Fed starts CUTTING rates until inflation is actually felt in anyway can be expected to be approximately 34 months.

- From when Inflation begins to be felt until it actually peaks is approximately 39 months.

- When we overlay this, we see that after rates began being cut in March of 2020, inflation should have been expected to kick-in approximately 34 months later in January 2022. That is exactly when we were initially impacted with inflation.

- We should expect Inflation to peak 39 months later. That should be ~ April 2025. This doesn’t mean they go down until Rate hikes Kick-in.

- inflation has currently been trending down because pandemic-induced supply chain disruptions and war-induced commodity supply disruptions are now being sorted out,

- Rates were not taken up and delayed until January 2022 . There is minimally a delay of 24 months until this should be expected to be felt.

CONCLUSION

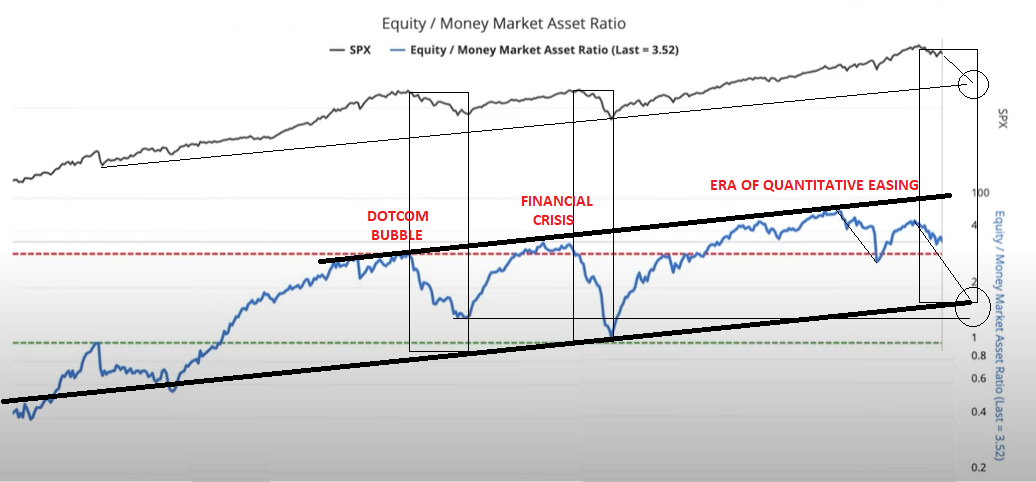

A “worried” Banking sector can be counted on to quickly reduce liquidity in its efforts to protect itself.

A “worried” Banking sector can be counted on to quickly reduce liquidity in its efforts to protect itself.- Pressures should be expected to soon be felt in the HY Corporate Bond Market and with what is termed “Zombie” corporations. These pressures will also soon dominate VC funded seed start-ups, Unicorns, Memes and other investment fads built on easy credit, availability liquidity and overly confident “naïve” investors.

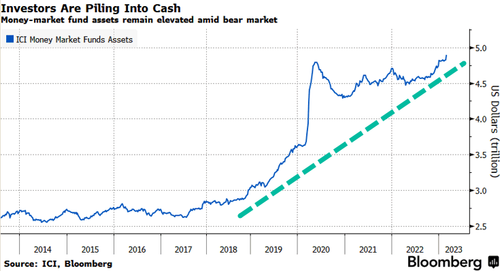

- “Cash is becoming King” with Institutional Safehaven Investing quickly fleeing to Money Market Funds.

We fully expect an overdue recessionary deflationary scare to arrive in H2 2023.

=========

CREDIT SUISSE – THE FIRST GLOBAL BANK CURRENTLY UNDER “LIFE SUPPPORT”

CREDIT SUISSE

In case you mistakenly believe this is the first major bank failure you are mistaken.

In case you mistakenly believe this is the first major bank failure you are mistaken.

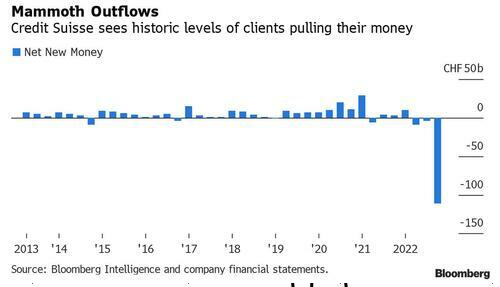

Everyone in the global finance community is acutely aware of the seriousness and magnitude of the collapse of Credit Suisse, which has so far been skillfully handled in an attempt to abort a global panic.

Credit Suisse stocks have been steadily falling, even when other European banks might have been rallying. On Thursday, the beleaguered Swiss investment bank’s shares slumped 6% in Zurich trading — closing in on the lowest level on record — following the announcement that it would postpone the release of its annual report at the request of the Securities and Exchange Commission.

SOMETHING WORRYING IS HAPPENING HERE!

THE VOLATILITY SHOCK TO BANK VALUE-AT-RISK (VaR) IS TOO MUCH FOR MANY BANKS TO HANDLE

It is forcing banks to pull in their horns to protect their liquidity positions!

CHAIRMAN POWELL’S HUMPHREY HAWKINS TESTIMONY

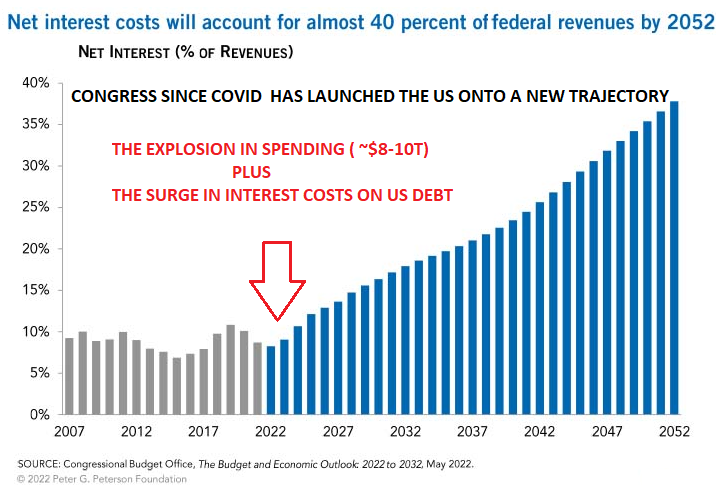

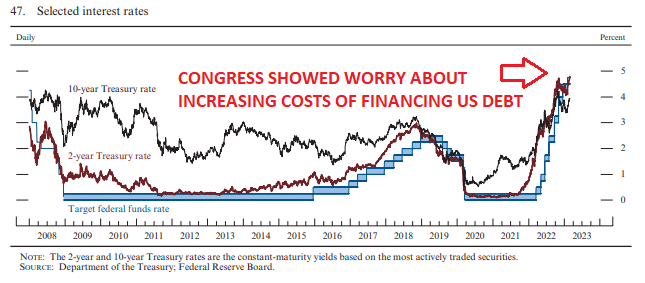

It was made clear, during this week’s Congressional Humphrey Hawkins Testimony involving key exchanges between Chairman Jerome Powell and two US Senators. Democratic Senator from Massachusetts, Elizabeth Warren, and Republic Senator from Louisiana, John Kennedy, that Congress on both sides of the isle have an overwhelming palpable fear of potential Job losses, if the Fed rates are maintained or continue rising, Both the rising costs of financing the exploding national debt and potential falling tax revenues from lost jobs, along with a slowing economy is a microscope no one in Washington wants.

It was made clear, during this week’s Congressional Humphrey Hawkins Testimony involving key exchanges between Chairman Jerome Powell and two US Senators. Democratic Senator from Massachusetts, Elizabeth Warren, and Republic Senator from Louisiana, John Kennedy, that Congress on both sides of the isle have an overwhelming palpable fear of potential Job losses, if the Fed rates are maintained or continue rising, Both the rising costs of financing the exploding national debt and potential falling tax revenues from lost jobs, along with a slowing economy is a microscope no one in Washington wants.

Interest costs represented about 8 percent of total federal outlays in 2022. By 2033, that share will minimally rise to 14 percent and will exceed programs such as defense and Medicaid. At that point, interest payments would be twice the amount the federal government spends on income security programs.

Powell was clearly left with the message that Jobs are politically more important than a continued Inflation fight. The first, evidenced by the questioning Powell underwent during his Congressional testimony, is that politicians will be irate if the Fed torpedoes a recovery they have just bought with trillions of dollars in fiscal spending. The central bank is not immune from Congressional wrath.

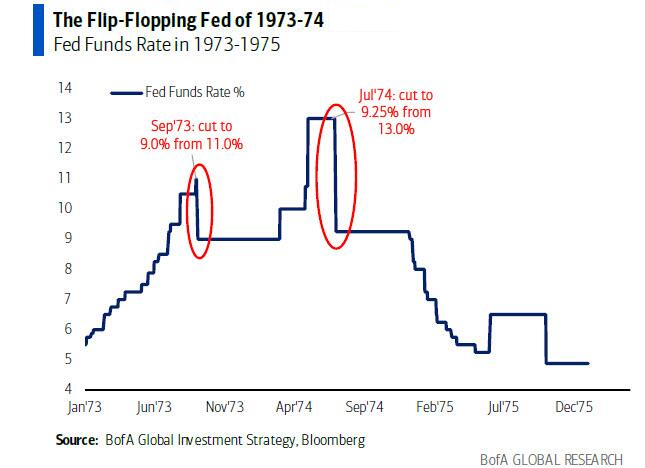

CHART RIGHT: “The Same Old, Same Old!”

CHART RIGHT: “The Same Old, Same Old!”

The message was clear. The public knows to blame congress for Job losses and a weak economy. However, the public is economically illiterate and therefore doesn’t know what causes inflation and therefore who to blame. One day they may discover that inflation is simply taxation in a different form!

There can be little doubt that the Fed will capitulate on its Inflation, fighting the moment the first of two events occur:

i) A Financial Crisis erupts, or

ii) Unemployment surges

Unfortunately this is precisely the political failure that deepened the Stagflation problems of the 1970’s.

Congress has no stomach for a Recession nor Spending Curbs to Fight Inflation.

— The Fed Will Follow! —

For those who have reviewed the latest LONGWave video, you will know it was directed toward our following observations:

- THREE KEY MANIPULTATION METHODS ARE BEING EMPLOYED BY THE FED, TREASURY AND GOVVERNMENT

-

-

- Lagging Data Being Manipulated

- Stealth Liquidity

- “Price Leads Narrative”

-

-

- PURPOSE: Distorts Ability of Market to Effectively Discount Recession Timing, and Valuation Pricing

-

- RESULT: Capitulation Occurs when False Beliefs Tigger a Price Reset

-

- TELL: Leading Indicators Say Lagging Indicators Will Arrive in the June timeframe

We believe the game of manipulation presently being played will soon expire. Surging layoffs will no doubt trigger the Fed actions. The problem for the Fed is understanding the rate of Disinflation to know how much of a problem will then still lie ahead!! Inflation is proving extremely sticky, especially when it comes to the always problematic wage spiral!

UNKNOWN COUNTER LEVELS: DISINFLATION & JOBS

The Fed’s problem with determining an accurate assessment of the rate of disinflation is extremely difficult. The reason for that is the lag in monetary policy.

Everyone is well aware that the Fed waited much too long to raise rates and though it has subsequently been historic in the rate of raising rates, it is still behind the curve. Rates are below the current rate of inflation which will not stop inflation.

But this is only one of the Fed’s problems with Disinflation. The other is actually the Lag in Inflation being FULLY FELT!

Let me explain.

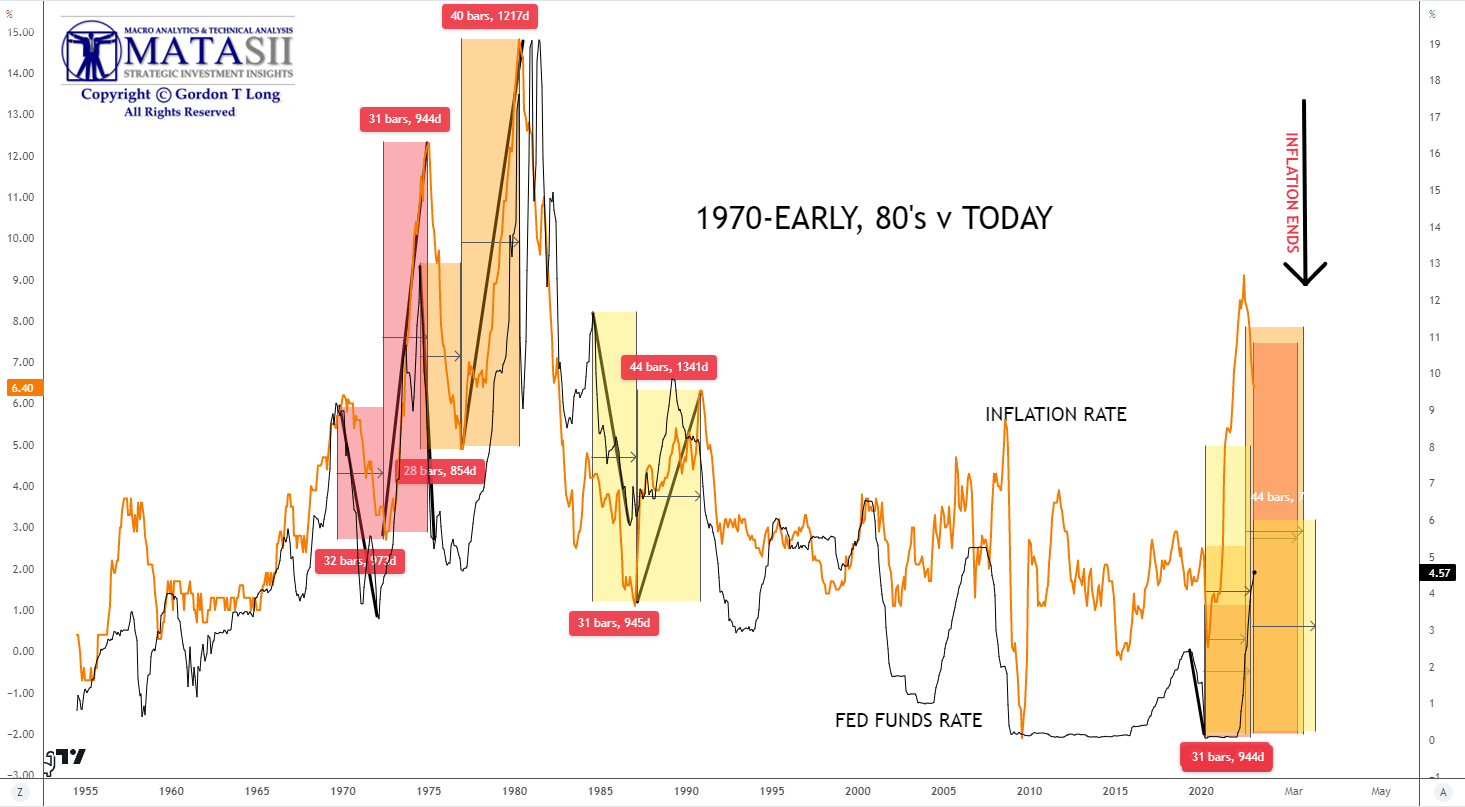

In the diagram below we look at Fed Rate CUTS versus the time for Inflation to Initially Kick-In; then we add the period it lasts before it actually tops out. We looked at 3 major examples in the 1970’s and early 1980’s when inflation was over 5% as is now. We then overlayed to our present position.

What we see is the following:

-

- From when the Fed starts CUTTING rates until inflation is actually felt in anyway can be expected to be approximately 34 months.

- From when Inflation begins to be felt until it actually peaks is approximately 39 months.

- When we overlay this, we see that after rates began being cut in March of 2020, inflation should have been expected to kick-in approximately 34 months later in January 2022. That is exactly when we were initially impacted with inflation.

- We should expect Inflation to peak 39 months later. That should be ~ April 2025. This doesn’t mean they go down until Rate hikes Kick-in.

- inflation has currently been trending down because pandemic-induced supply chain disruptions and war-induced commodity supply disruptions are now being sorted out.

- Rates were not taken up and delayed until January 2022. There is minimally a delay of 24 moths until this should be expected to be felt.

INFLATION SHOULD NOT BE EXPECTED TO SUBSIDE SIGNIFICANTLY

UNTIL ONLY AS EARLY AS 2024!

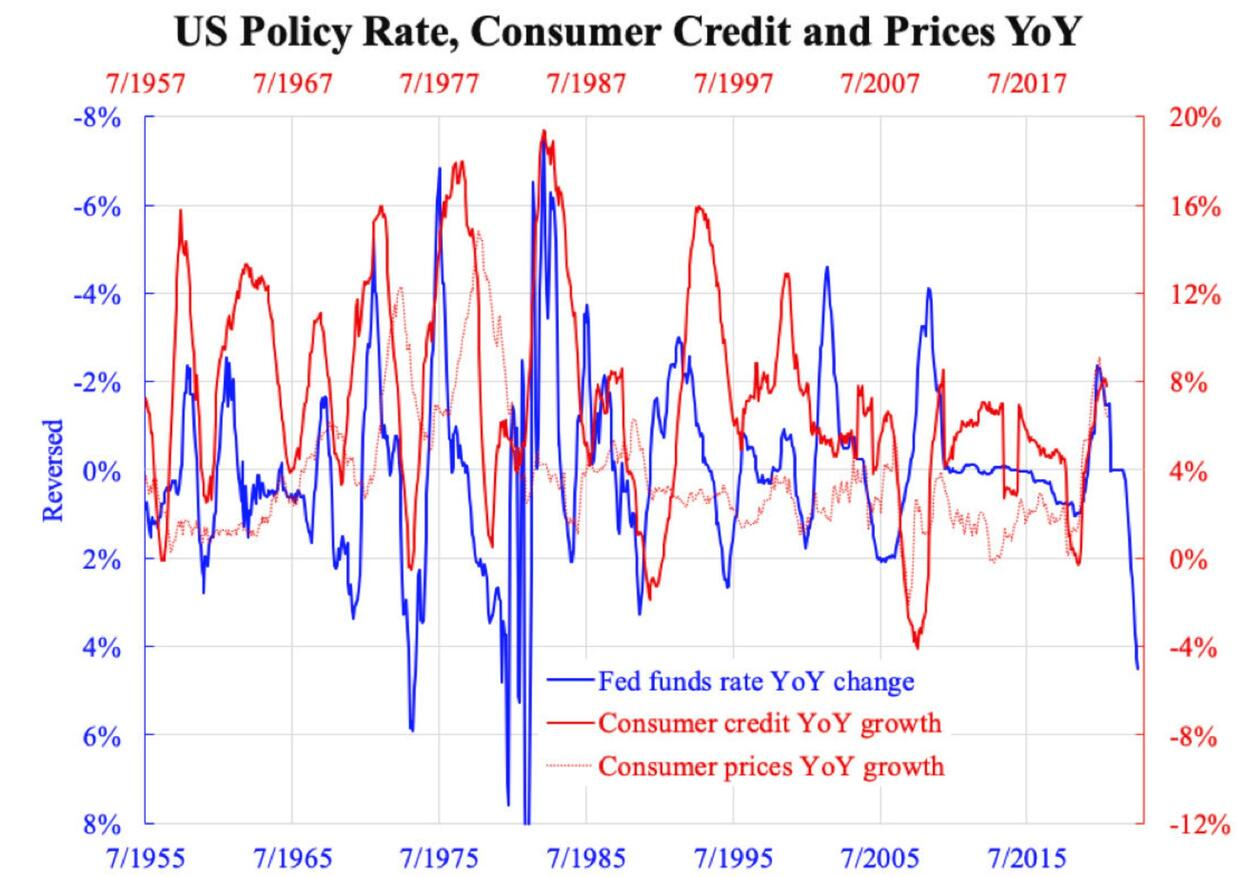

In principle, interest rate hike targets mostly credit, which, as the logic goes, drives inflation. Using the entire historical time series of Federal funds rate and consumer credit from the Federal Reserve, the accompanying chart shows that the year-over-year change of fund rates leads year-over-year percentage change of consumer credit by two years (compare the horizontal time axes). Theoretically, the price of lending (or cost of borrowing) instantly affects lending (or borrowing). But it affects only the new loans while all other outstanding ones are unaffected.

In principle, interest rate hike targets mostly credit, which, as the logic goes, drives inflation. Using the entire historical time series of Federal funds rate and consumer credit from the Federal Reserve, the accompanying chart shows that the year-over-year change of fund rates leads year-over-year percentage change of consumer credit by two years (compare the horizontal time axes). Theoretically, the price of lending (or cost of borrowing) instantly affects lending (or borrowing). But it affects only the new loans while all other outstanding ones are unaffected.

Since the tenor of lending is usually longer than that of deposits (the intrinsic nature of banks to earn interest margin), it is easier to see broad money (M2, which mainly comprises deposits) slow down first before credit.

Why the time lag is two years depends heavily on the effective tenor of lending, which is mainly empirical. It can vary, but two years seem to apply nowadays.

Because of this, central banks targeting inflation need to act at least two years before inflation arises, and this is why most of them project inflation to 2-3 years ahead.

However, whether they know what to do is one thing, but whether they can do it is another. This round of central banks (not confined to the Fed) acted not ahead but at least one year after inflation had accelerated.

Although they have been catching up quickly in the last few months, they tend to stop before inflation is certified dead. This is one of the significant risks.

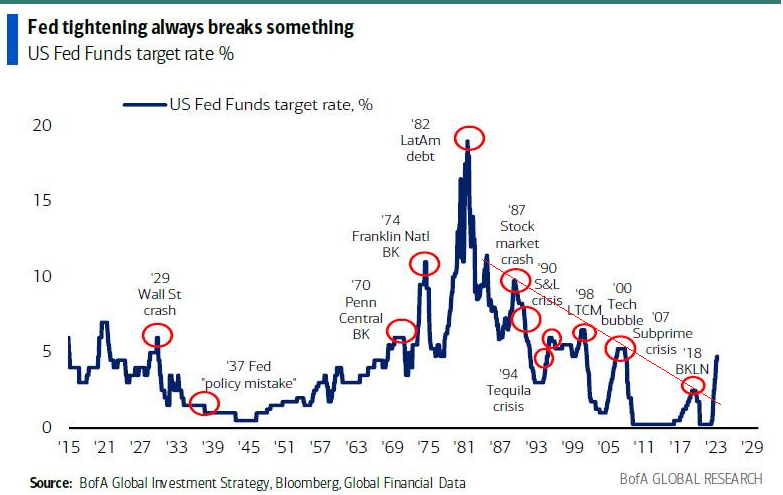

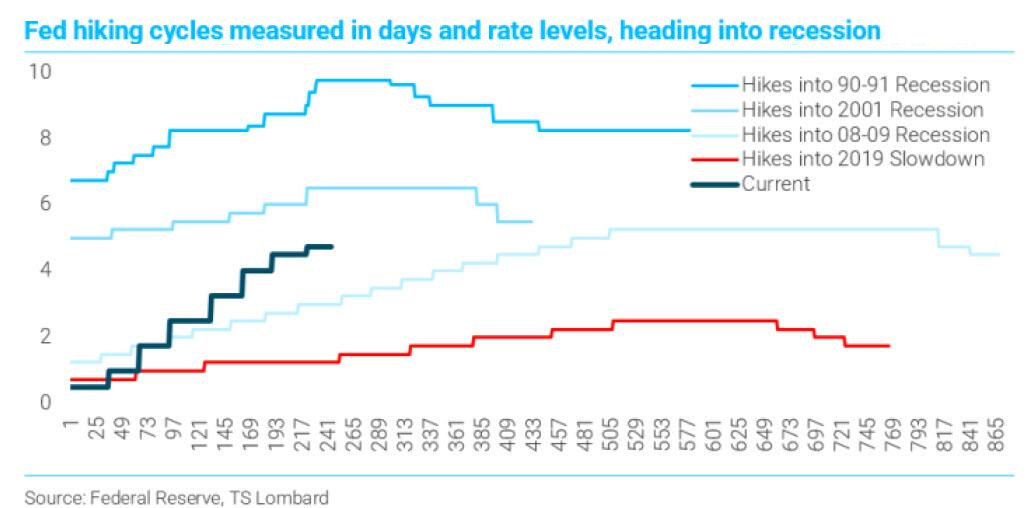

According to TS Lombard (as recently reported by ZH):

The Fed is no closer to understanding where the peak rate resides than they were a few months back,

“because they have no idea where disinflation will settle without a recession. February employment data, released Friday AM, could, however, flip the narrative yet again.”

The problem according to Lombard is that the Fed has been following the playbook of hiking cycles post-1982:

“get to a high real level and hold until the economy/ inflation/ unemployment bends” –

i.e., start a recession or “break something.”

Looking at historical hiking cycles, the average number of business days at which the Fed held steady at the peak is 168, the longest being 303 days prior to the 08-09 recession, at which point the global financial crisis started.

There is one place where all the previous hiking cycles differed: real rates at these peaks ran the gamut, but all were far above 0, where the real rate currently resides. In other words, Lombard observes:

There is one place where all the previous hiking cycles differed: real rates at these peaks ran the gamut, but all were far above 0, where the real rate currently resides. In other words, Lombard observes:

“this cycle’s hikes began to slow before the real funds rate was even at zero, even though the Fed acknowledges that 50BP real is neutral. This underscores the problem with the old playbook.”

Also unlike the past, this time the Fed is chasing a high but falling inflation rate. Here, the Lombard notes:

“what nominal rate consequently delivers the “right” real rate is near impossible to know when inflation is dropping to no one knows where. The focus therefore shifts to whether demand for labor weakens. There is also the question of whether the neutral rate has risen”.

And while the Fed still thinks 50bps real is still neutral, it may very well not be. Consider that a modified Taylor rule (50bp real is neutral, 2% inflation target, 4.5% NAIRU) solves to a 7.7% funds rate, some 3% higher than where we are now. Of course, at that rate the market will implode; so one can short-circuit this as follows: raise the inflation target to 3% and drop NAIRU to 4% and a 6.7% target funds rate is the answer… which is Lombard’s

Fed Funds target if no mid-year recession arrives.

Given all the variables and economic indicators which can only be known in retrospect, the Fed will keep hiking until unemployment breaks above 4.5%.

CONCLUSION

CONCLUSION

- The temptation is for the Fed to be more ambiguous, keep a soft landing on the menu and pray for an immaculate disinflation. Powell is managing to what ever comes first: i) A Market Crash requiring Fed Intervention, or ii) A spiking Unemployment Rate

- It is likely that Powell will hike rates until the unemployment rate spikes.

- This will be followed by Rapid Cuts and a crushing Inflation Cycle.

- The Fed will need to be wary until it sees enough slack build up in the labor market. If it turns too fast, markets will celebrate and the job will be left unfinished. But if it waits until there is sufficient slack, lay-offs could develop a momentum of their own.

- A Recession Is actually now required as the best solution to curbing Inflation quickly before it becomes truly sticky (a wage price spiral) to support rising costs of living and plummeting real disposable income.

- A “worried” Banking sector can be counted on to quickly reduce liquidity in its efforts to protect itself.

- Pressures should be expected to soon be felt in the HY Corporate Bond Market and with what is termed “Zombie” corporations. These pressures will also soon dominate VC funded seed start-ups, Unicorns, Memes and other investment fads built on easy credit, availability liquidity and overly confident “naïve” investors.

- “Cash is becoming King” with Institutional Safehaven Investing quickly fleeing to Money Market Funds.

WHEN BANKS WEAKEN, LIQUIDITY QUICKLY BECOMES SCARCE

“Liquidity always disappears faster than a thief in the night!”

The problem at hand is more than just the Silicon Valley Bank (SVB). As the saying goes – “there is never just one cockroach!”

The problem at hand is more than just the Silicon Valley Bank (SVB). As the saying goes – “there is never just one cockroach!”

It is actually the banking sector coming to grips with rising rates, tightening credit, the worrying real estate sector from residential housing to commercial office space (devastating impact of remote work) and the fall-out losses from protracted Covid-19 forbearances.

Now suddenly further surging rates are hurting their equity ratio assets and VaR PLUS their once profitable loan assets!

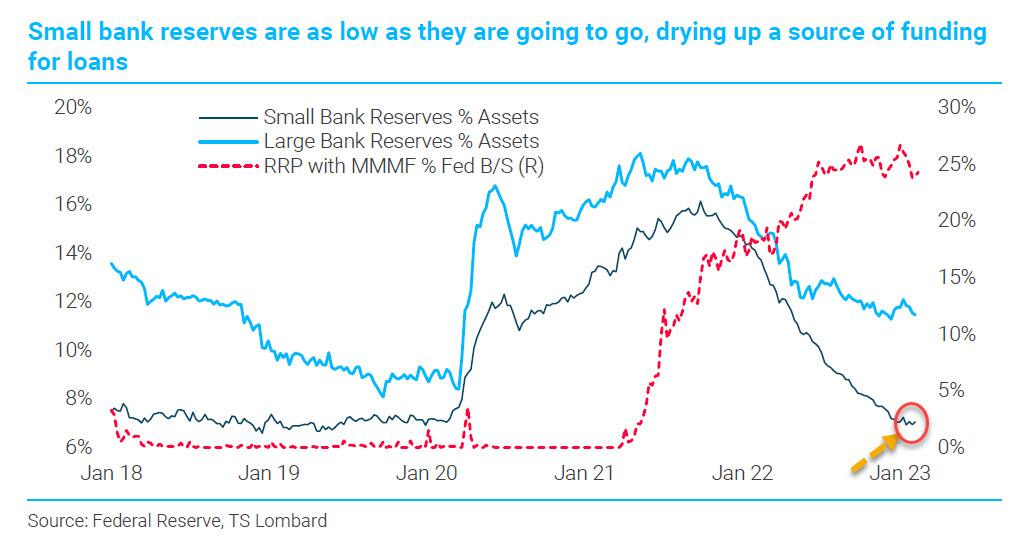

While large banks are still very well capitalized, small banks – the core constituents of the KRE index (below) – are in big trouble, because as the chart to the upper right from TS Lombard shows, their reserves (as a % of total assets) have collapsed as a source of funding for loans and are back to levels when the Fed needed to do QE to reload their reserves!

Banks – and especially small banks – are now sitting with reserves pretty much at their lowest comfort level. There is not much of a cash-to-asset cushion left for small banks as a whole, so a funding crisis can easily get rolling if large depositors decide too many loans in commercial real estate and other areas are about to go bad. Many are now calling it the BIG SHORT 3.0.

The Fed will make funds available to keep these banks afloat, but that alone will get some push-back from Congress, because of the increased concentration of bank deposits in an increasingly smaller number of banks. Once the small banks go down, the big banks won’t be far behind.

Ahead of any banking problem rooted in bad loans turning into a funding problem, banks are going to pull back on lending at an even faster pace.

Though many are targeting the banks, there is something we learned from the Fed during the Covid Crisis that you need to pay particular attention to. (bottom: below the bank charts)

Investors are taking a shot gun approach, dumping the regional and small banks en masse, with the KRE ETF plunging to the lowest level in two years.

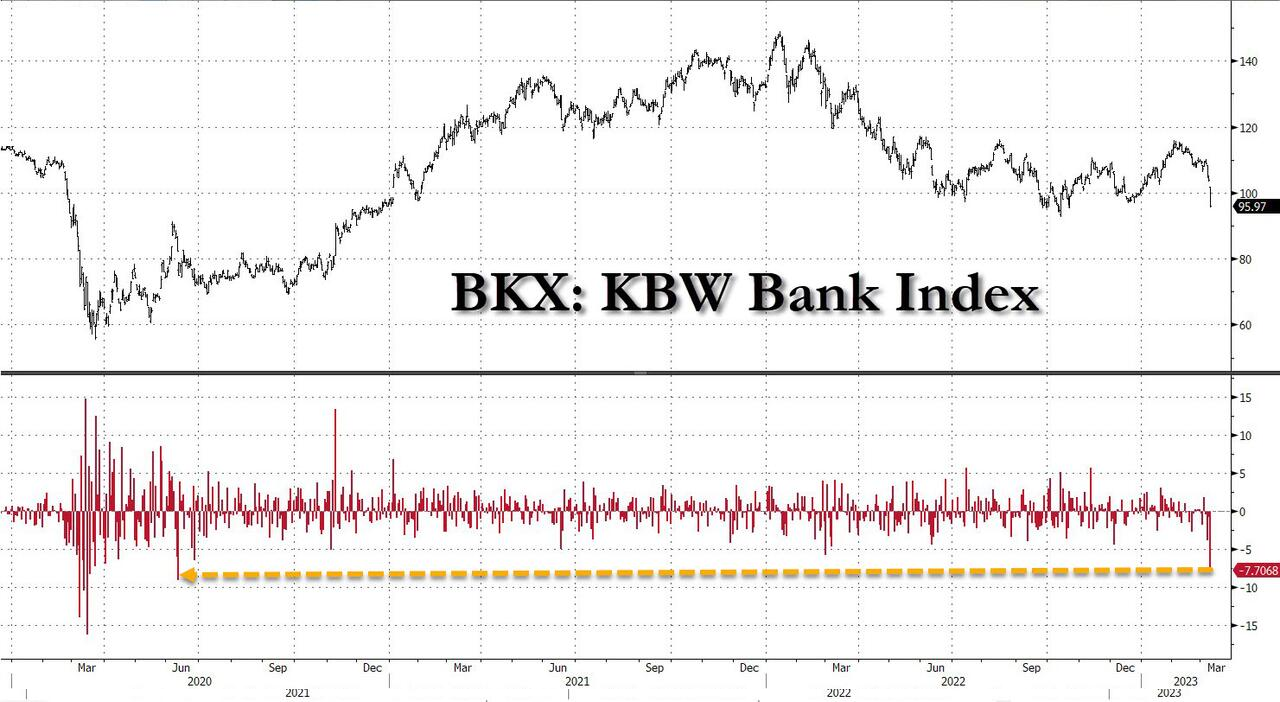

The broader bank index suffering its worst day since June 2020.

CHART RIGHT: The KBW Regional Fed just plunged over 7% back to pre-COVID collapse levels.

CHART RIGHT: JP Morgan punished with Staley/Epstein/Dimon headlines.

CHART RIGHT: Signature Bank punished by SVB driven crypto anxiety.

When the US’ 16th largest bank fails with $169B in uninsured deposits not covered by FDIC on a total asset base of $200B, markets panic! The collapse of the Silicon Valley Bank (SVB) is the second largest in US history and comes with a critically important caveat. Most of the depositors were not individuals but rather venture capital start-ups in the technology rich “Silicon Valley” whose payrolls and ability to pay their bills went completely dark on Friday. Unless a financing bailout is arranged immediately, the firings will fix the BLS’ Unemployment numbers in one fell swoop! This is not about saving the SVB, but about the evaporated “life blood” fundings of the “early seed” depositors!

The surging TED and OIS-FRA spreads and plummeting bank stock prices tell us that everyone is scared of the potential Third Party and Unintended Consequences through cascading collateral damages. At this stage we can only ensure that our own bank savings are FDIC protected, which these start-ups were completely negligent in doing.

CHART BELOW:

Pressures should be expected to soon be felt in the HY Corporate Bond Market and with what is termed “Zombie” corporations. These pressures will also soon dominate VC funded seed start-ups, Unicorns, Memes and other investment fads built on easy credit, availability liquidity and overly confident “naïve” investors.

The Federal Reserves initial Covid-19 focus was to IMMEDIATELY protect

the HY and “CCC” IG market before it collapsed!

While everyone is looking at banks, keep an eye on “JNK”.

For those who have been trading long enough, every couple of years a new “big short” opportunity presents itself, which makes a handful of investors extremely rich right before the Fed floods the system with liquidity and drowns all the bears for the next several years.

YOUR DESK TOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.