MACRO

US FISCAL POLICY

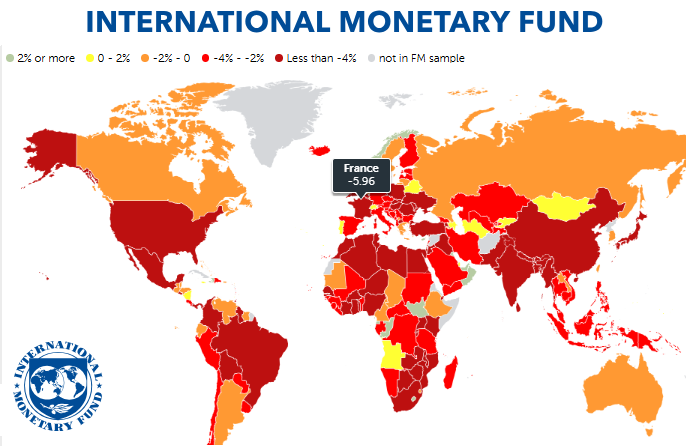

BLOATED GOVERNMENTS ARE A MAJOR 21st CENTURY PROBLEM

OBSERVATIONS: FINALLY, A REAL SUPPLY SIDE PUBLIC PLAN!

Markets and economists are beginning to recognize that a serious rationalization of spending is the only way to prevent a debt crisis and reduce inflation in the United States. In the latest estimates published by the Treasury, the accumulated deficit between 2024 and 2034 would reach $14 trillion. Considering the path of uncontrolled public debt and rising fiscal irresponsibility reached over the past four years, many feared a debt crisis looming. In a period of peace and recovery, a 6.4% budget deficit indicated the lowest economic growth, adjusted for debt increases since the 1930s. (Read Research: BLOATED GOVERNMENTS ARE A MAJOR PROBLEM.)

Market participants now appear relieved and are discounting a declining deficit as well as a stronger currency.

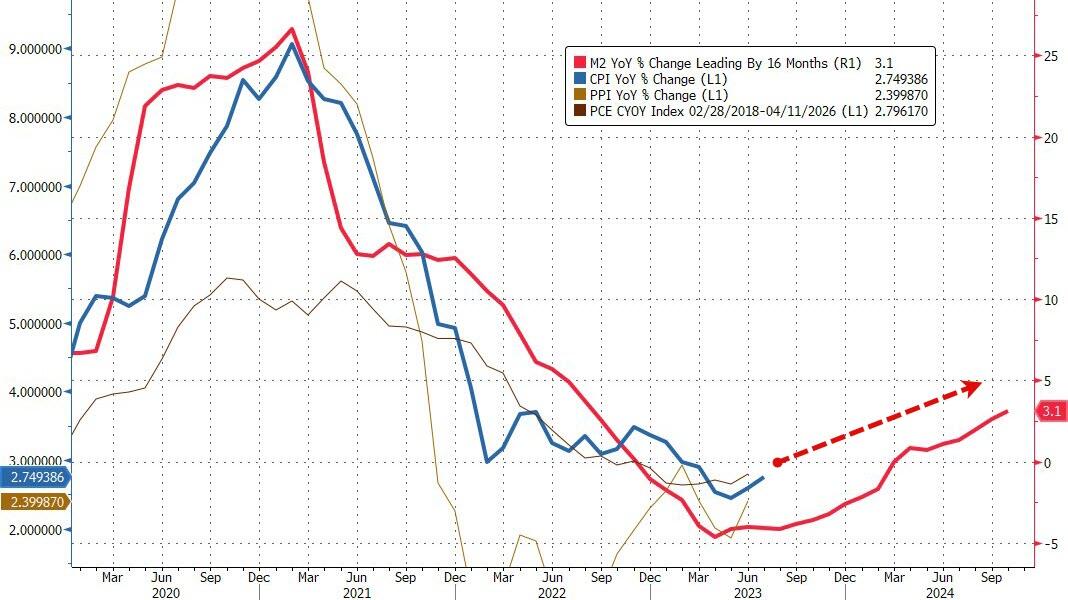

INFLATION IS ALWAYS A MONETARY PHENOMENON

Governments create inflation by issuing constantly depreciating currencies, eroding purchasing power through massive spending, and subsequently eroding productivity and the real value of wages and savings. Therefore, strengthening the currency, restoring confidence in public finances and reducing inflation are all part of the same policy: curbing government deficit spending.

The addition of Ron Paul to the Department of Government Efficiency, under the leadership of Elon Musk and Vivek Ramaswamy, is encouraging. Ron Paul knows the inefficiencies and excesses of government better than most politicians. All three of them have a clear objective: cut spending wherever it is possible. When economists say it is impossible to reduce government expenditures, they usually use aggregated items. However, a large part of non-interest discretionary spending goes to more than 1,350 subsidy programs. With a budget nearly $2 trillion larger than in 2019, there is significant room for reduction.

Optimism among market participants is obvious. The S&P 500 has reached an all-time high, and this time, interestingly, it’s not due to expectations of increased currency printing and deficit spending, but rather the opposite. Previously, markets viewed a stronger US dollar as a negative factor, but this time it has proven to be the opposite. The dollar index is up 4.6% this year and the S&P 500 has soared 27%. Since the U.S. election result, the dollar index has increased by 1.5%, while the S&P 500 has experienced a surge of over 2.5%.

Inflation expectations for November should not surprise anyone who looks at the still uncontrolled deficit. According to Bloomberg Economics, core inflation should remain high in November, at 0.3% month-on-month and 3.3% year-on-year. We expect a 0.2% rise in headline inflation, bringing the year-over-year rate up to 2.7% from 2.6%.

The expected level of inflation is intolerable in a country that enjoys global technology leadership and record energy independence, two disinflationary factors. Therefore, inflation is not only stubborn but unjustified.

Some economists warn against a strong dollar because they want a weak currency to disguise unsustainable fiscal imbalances. However, there is no strong economy with a weak currency.

A depreciated currency is not a tool of economic growth, but a policy supported by cronyism and bureaucrats aimed at subsidizing their inefficiencies at the expense of citizens’ real wages and deposit savings.

A REAL SUPPLY SIDE PLAN

For the first time in years, we may see a real supply-side plan. This administration deserves some trust, as the alternative would have led the United States into an economic catastrophe.

The new administration must understand that the only way to maintain and strengthen the U.S. dollar’s reserve status is to curb deficit spending and reduce debt while accelerating productive economic growth and private investment. Argentina’s Milei has demonstrated that eliminating deficit spending can significantly reduce inflation.

The United States needs to implement drastic measures to eliminate the bloated expenditure path of the past four years and restore confidence in the solvency of the public sector.

WHAT YOU NEED TO KNOW!

THE MOST EXPENSIVE VEHICLE TO OPERATE

THE MOST EXPENSIVE VEHICLE TO OPERATE

THE LAST 4 YEARS: +40%

- CPI: Over the Biden Administration Food is up over 22% based on Government Statistics and their market basic. For anyone actually shopping you know that ignoring substitution but factoring in shrinkflation and what we actually leave the grocery store with is up well over 40%.

CURRENT SITUATION: Still High and Rising Again!

- CPI: On a three-month annualized basis Food Costs are up nearly 4% in last Wednesday’s lastest CPI release.

- PPI: Food costs rose at their fastest since Nov 2022. A quarter of the November rise in prices for final demand goods is attributable to a 54.6-percent jump in the index for chicken eggs. Prices for fresh and dry vegetables, fresh fruits and melons, processed poultry, non-electronic cigarettes, and residential electric power also increased.

- FOOD INDEX: also increased over the month, rising 0.4 percent as the food at home index increased 0.5 percent and the food away from home index rose 0.3 percent.

- UN’S FAO: Averaged 127.5 points in November 2024, up 0.5 percent from the October level and reaching its highest value since April 2023. Annual Rate now 5.5%.

RESEARCH

BLOATED GOVERNMENTS ARE A MAJOR 21st CENTURY PROBLEM

BLOATED GOVERNMENTS ARE A MAJOR 21st CENTURY PROBLEM

-

- THE CENTRAL ISSUE

- FOURTH ARM OF GOVERNMENT

- Whether you call it the Administrative State, The Regulatory State or Deep State, the issue is the same. It is unmanaged.

- TOO BIG TO CONTROL

- The Chevron Deference has allowed unaccountable regulatory authority.

- It has uncontrollably metastasized between the Legislative, Executive and Judicial branches of government.

- FOURTH ARM OF GOVERNMENT

- INCREASINGLY TOO BIG TO FUND

- The missing powers of Creative Destruction, lack of accountability and stable public policy foundations within government inevitably fosters “Fiefdoms”, Budget Creep and avoidance of Program Obsolescence.

- Without the pressures of Bankruptcy, the profit motive nor competitive pressures bureaucracies are inevitable.

- Goals tied to the needs of the electorate (“We the People”) must be consistently inculcated towards:

- THE CENTRAL ISSUE

i) Rising Standard of Livings, ii) Public Security and iii) Real Economic Growth.

-

- GOVERNMENTS NEED TO BE CONTINUOUSLY “RIGHT-SIZED”

- Corporate America learned in the post Dotcom Bubble as China entered the WTO that “Right Sizing”, “Downsizing” and “Offshoring” were central for sustainable viability. Governments are now at that same point of departure.

- The driving force for that departure is the Taxation-to-Spending Ratio, (where inflation is properly considered a hidden tax), and the Deficit-to-GDP ratio.

- Government administrative operations need to be geographically distributed to maintain the tie with the electorate versus the “revolving doors” of government, contract workers and the lobbying complex.

- GOVERNMENTS NEED TO BE CONTINUOUSLY “RIGHT-SIZED”

THE SOLUTION TO THE CRIPPLING OF AMERICAN SMALL BUSINESS

-

- SITUATIONAL ANALYSIS

- Small businesses with employees 1-49 are particularly struggling in 2024 (down by 118,000), while large businesses are booming.

- Employment in businesses with 20-49 employees is down 8 of 11 months in 2024, shedding a total of 99,000 jobs.

- Year-over-year employment in small businesses is down from 1.8 million in January to a mere 22,000 in November.

- Why are small businesses failing in 2024? Across the board, surveys find that small businesses are facing similar challenges this year:

- Inflation

- Uncertainty around the economy and elections

- Higher interest rates and

- Finding qualified people.

- HURDLES TO SURVIVAL

- ECONOMIC ENVIRONMENT – A Particularly Tough Environment

- REGULATIONS – Compliance, Costs & Competitive Disadvantage

- RISK / REWARD – Taxation and Liabilities (Litigation)

- LABOR – Gen Z Expectations & Attitude (College), Illegal Immigration

- START-UP SURVIVAL – Cost of Living

- FINANCING – For Existing Businesses Is A Problem

- PRE-ELECTION CONCLUSIONS

- Big Business + Government were labelled in the late 1930’s as “Fascism” by Italian leader Benito Mussolini.

- BIG Business (Corporatocracy) versus Small Business (Entrepreneurial & Self Reliance).

- Big Business needs have increasingly been met by the government through Lobbying / Influence and Regulatory Arbitrage at the expense of Small Business.

- Small Business has been steadily exposed to industrialization of franchising by corporations in hollowing out what was formerly the exclusive enclave of “Ma & Pa” business sectors, (i.e. Hardware stores, Convenience stores, Restaurants, Fast Foods, Donut Shops et al).

- Small Business has increasingly been subjected to profit squeeze through Government overreach, crippling regulations and compliance requirements.

- A SUDDEN SURGE IN SMALL BUSINESS CONFIDENCE!

- SITUATIONAL ANALYSIS

The Surge?

-

-

- The net percent of owners expecting the economy to improve rose 41 points from October to a net 36%, the highest since June 2020. This component had the greatest impact on the overall increase in the Optimism Index.

- The net percent of small business owners believing it is a good time to expand their business rose eight points to a net 14%. This is the highest reading since June 2021.

-

Why?

-

-

- This is how the NFIB series for asking executives whether this is a “good time to expand” has moved over the last 10 years. (Chart Right) In a nutshell, if Trump is in power or about to return to it, then it’s time to expand; otherwise, it isn’t.

- Small business owners matter greatly. They may or may not be right to have such confidence that a Trump administration will improve the environment for them. And it’s possible that they’re simply loyally telling pollsters that things will be better now. But animal spirits like this, in a crucial sector of the economy, should be a great tailwind for Trump.

- If companies think it’s safe to invest and do so, that’s the administration’s battle won, no matter what policies they eventually enact.

-

DEVELOPMENTS TO WATCH

THE LAST VESTIGES OF BINDENOMICS

THE LAST VESTIGES OF BINDENOMICS

-

- The budget deficit in October and November – the first two months of fiscal 2025 – are now officially the worst start a year for the US Treasury on record.

- For December, expect a number north of $150 billion in interest alone!

CLEARLY THE BIDEN ADMINISTRATION ROLLED SPENDING INTO THE NEW FISCAL YEAR, WHICH WOULDN’T BE REPORTED UNTIL AFTER THE ELECTION. (Chart Right)

CHINA CONSIDERING DEVALUATION OF YUAN

-

- Reuters reported on Wednesday that China is considering allowing the yuan to weaken in 2025 to brace for higher trade tariffs in a second Donald Trump presidency, citing people familiar with the matter.

- If Beijing decides to actively push for an even softer currency ahead of tariffs from a Trump presidency, it may trigger more capital outflows and subsequent depreciation of the yuan.

- An aggressive response from the US might include higher tariffs, as well as leading to a tightening in domestic monetary conditions as departing capital destroys credit – a lose-lose for China.

- The ultimate answer for China lies not in a monetary response and a weaker currency – which only worsens domestic imbalances – but more fiscal stimulus that supports the demand- and not the supply-side of the economy.

GLOBAL ECONOMIC REPORTING

CPI

CPI

-

- US Core CPI MM, SA (Nov) 0.3% vs. Exp. 0.3% (Prev. 0.3%); Unrounded 0.308% (prev. 0.280%)

- US Core CPI YY, NSA (Nov) 3.3% vs. Exp. 3.3% (Prev. 3.3%)

- US CPI MM, SA (Nov) 0.3% vs. Exp. 0.3% (Prev. 0.2%); Unrounded 0.313% (prev. 0.244%)

- US CPI YY, NSA (Nov) 2.7% vs. Exp. 2.7% (Prev. 2.6%)

PPI

-

- US PPI Final Demand MM (Nov) 0.4% vs. Exp. 0.2% (Prev. 0.2%, Rev. 0.3%); YY 3.0% vs. Exp. 2.6% (Prev. 2.4%, Rev. 2.6%)

- US PPI exFood/Energy MM (Nov) 0.2% vs. Exp. 0.2% (Prev. 0.3%); YY 3.4% vs. Exp. 3.2% (Prev. 3.1%)

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.