TIPPING POINT

INFLATION

COMMODITY DRIVEN INFLATION

OBSERVATIONS: YES -THERE ARE CONSEQUENCES!

If you don’t think the interest on the federal debt is a problem, try this quick exercise. Grab your pay stub for June and see how much you paid in federal income tax, then realize that over 75% of that was effectively your contribution to interest on the debt last month. No roads, schools, military or hospitals—just interest.

For the first time ever, the government spent $140 billion in a single month to service its gargantuan debt of nearly $35 trillion. By the end of this fiscal year, the Treasury will spend almost $1.2 trillion in interest alone. And the problem is getting worse FAST!

For June, not a single line item in the Treasury’s monthly statement was larger than the $140 billion interest expense. It was larger than either the Social Security Administration ($129 billion), Department of Health and Human Services ($90 billion), Department of Education ($87 billion) or Department of Defense ($63 billion).

Interest is now equal to more than three-quarters of all personal income taxes, and over 30% of all taxes and duties received by the Treasury in June. Not only is the nation drowning in debt, but now the interest payments are an anchor around its neck.

Federal finance can seem a bit ephemeral, so let’s put this in terms of family finances. Imagine a family has racked up more credit-card debt than it earns in an entire year. Those cards had low introductory interest rates, so even as their debt ballooned, the monthly interest payments seemed manageable. But then, rates rose—and so did the finance charges.

Because the family spends more than they earn each month, (hence the massive credit card debt), any additional expenses only exacerbate their financial nightmare. Higher interest is just another expense that must be financed, which means their outstanding balances will now grow that much faster.

Of course, higher balances mean higher finance charges, and the debt doom loop has begun. The family has no way out other than severe spending cuts in their budget or an ignominious bankruptcy.

This is where our federal government is today. It has spent so much more than it has taken in that it has racked up a $35 trillion debt. It’s not only many times larger than annual federal tax revenue, but over 20% larger than the nation’s entire economy.

COUNTERFEITING

One key difference, however, between the family budget and the federal budget is counterfeiting. For the family, this isn’t an option—unless they want to go to jail. For the federal government, creating money is the preferred way to conduct a backdoor default on its obligations.

Through the Federal Reserve, the government has been expanding the money supply and devaluing the PURCHASING POWER of the dollar, including the nearly $35 trillion that makes up the federal debt. This allows the government to repay that debt and pay the interest, using depreciated currency.

If you loaned the government $1 at the start of 2021 and got it back today, it would only be worth about 80 cents. Even if you received 5% interest each year, you’d still be getting less back from the Treasury than you originally lent out.

This is why the stratospheric rise in the interest on the debt should concern everyone. Not only is it displacing funding for things like roads and the military, but it will also mean much more inflation, unless we take a chainsaw to federal spending, à la Argentinian President Javier Milei.

That course correction had better come quick. The federal government is already running $2 trillion annual deficits, and driving up interest on the debt exponentially. The time bomb of federal finance has already started ticking down.

WHAT YOU NEED TO KNOW!

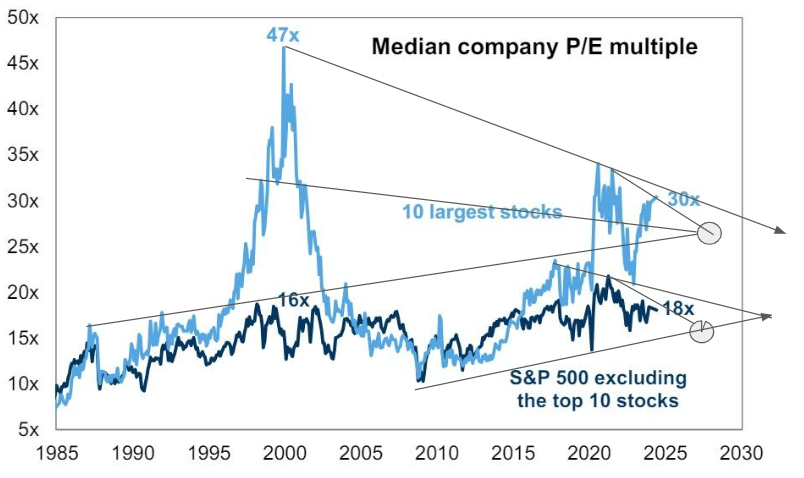

MAGNIFICENT 7 BEGINS PE CORRECTION

MAGNIFICENT 7 BEGINS PE CORRECTION

Tremendous market distortion created by Mag-7 breadth is beginning to be corrected in the form of lowering PE ratios for an anticipated deterioration in growth expectations.

The Magnificent 7 and specifically Nvidia have been weak since Q2 earning season began. However, this week’s reaction to the earnings of Tesla and Google is the first instance of this lowering of expectations showing itself.

RESEARCH

COMMODITY DRIVEN INFLATION?

-

- Commodities could increasingly become more expensive as global conflict mount and tariff driven trade wars impact currencies.

- Commodities have never been more poorly invested in by investors. A chronic lack of capital expenditure has left fewer commodity suppliers financially viable. Any increase in commodities and supply would take years to ramp up to meet even minimal increases in demand.

- This is the prescription for “Scarcity” if supply channels are interrupted through regional conflict – militarily, economically or politically.

- Most analysts expect commodities to only rise if the Dollar falls. But what about the dollar falling because Commodities Rise?

- The US consumes more than it produces, is a 70% consumption economy and must finance its consumption through International borrowing.

- If import prices rise even marginally, a “tapped out” US consumer will be forced to retrench.

- Falling demand with a chronically stagnate US economy will lead to a weakening US dollar. Since the twin deficits of Trade and Fiscal accounts are the primary cripplers of a currency, the US dollar would be expected to be impacted.

2024 Q2 EARNINGS SEASON

-

- When expectations are too high, then investors tend to over-react to any concerns. This is what we are seeing so far in this earning season. It has become a “sell” the news.

- Major players announced operating concerns of various degrees. Investors however are immediately reacting by reducing their exposure.

- We examine a few of the major players who have announced their Q2 earnings: Nestle (Food Brands), STMicroelectronics (Semiconductors), Tesla (Automotive EV), Alphabet (Search / Cloud), and Porsche (Automotive).

Q2 EARNINGS SEASON

-

- Investors are increasingly worried about the deviation of earnings expectations being so far above long term growth trends.

- NVIDIA, Amazon.com, Meta Platforms, and Alphabet are expected to report year-over-year earnings growth of 56.4% for the second quarter.

- Excluding these four companies, the blended (combines actual and estimated results) earnings growth rate for the remaining 496 companies in the S&P 500 would be 5.7% for Q2 2024.

- Overall, the blended earnings growth rate for the entire S&P 500 for Q2 2024 is 9.7%.

DEVELOPMENTS TO WATCH

PREPARING FOR GLOBAL CONFLICT

PREPARING FOR GLOBAL CONFLICT

-

- Last week the US intercepted Chinese and Russian military bombers over Alaskan air space. Flying within US Air Space is one thing, but witnessing joint military operational exercises is quite another matter.

- China and Russian were sending a very clear message. They waited to see how the US responded POLITICALLY.

- Rather than projecting strength, Washington simply pretended it did not happen.

CONSUMER FINANCIAL STRESS – Becoming Severe!

-

- Investors fear a US election sweep means inflationary higher tariffs, lower taxes, lower immigration, thus higher bond yields.

- Yet the electoral reality is that to voters “inflation” is what matters most. (How else to explain sub-40% Presidential approval rating with 4% unemployment rate)

- 70% of young voters in key battleground states express “cost of living/inflation” as the most important issue.

- 2024 is the first election in 30 years in which Baby Boomers won’t be majority voting bloc: 65 million Gen Z & Millennial votes will outnumber 50 million boomers. Surveys highlight these electorates want low inflation.

GLOBAL ECONOMIC REPORTING

US FLASH PMI

US FLASH PMI

-

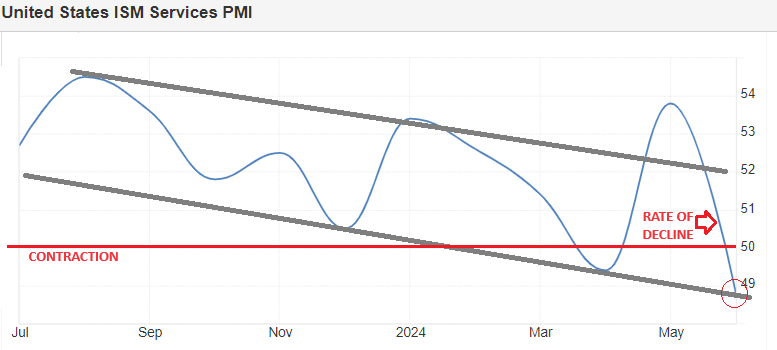

- The ISM Services PMI in the US tumbled to 48.8 in June 2024, the sharpest contraction since April 2020. Markets were expecting 52.5 after 53.8 in May.

- The Business Activity Index also fell, registering 49.6, the first contraction since May 2020.

- New orders (47.3 vs 54.1) and employment (46.1 vs 47.1) declined.

- The decrease in the composite index in June is a result of notably lower business activity, a contraction in new orders for the second time since May 2020 and continued contraction in employment.

- Survey respondents report that in general, business is flat or lower. Although inflation is easing, some commodities have significantly higher costs.

- Panelists indicate that: “slower supplier delivery performance is due primarily to transportation challenges, not increases in demand.” — Steve Miller, CPSM, CSCP, Chair of the Institute for Supply Management

DURABLE GOODS

-

- The headline figure plunged 6.6% in June (exp. +0.3%, prev. +0.1%), much deeper than the lower bound of the forecast range of -4.0%.

- Ex-defense tumbled -7% (prev. 0.0%)

- The headline saw the largest M/M decline since April 2020, and was weighed on by transportation orders which dived 20.5%.

US PERSONAL CONSUMPTION EXPENDITURE (PCE)

-

- Core PCE in June rose by 0.2% M/M, above the prior revised 0.13% and forecast of 0.1%. When unrounded, PCE rose by 0.18%, so only marginally above expectations.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.