GLOBAL LIQUIDITY

FEDERAL RESERVE

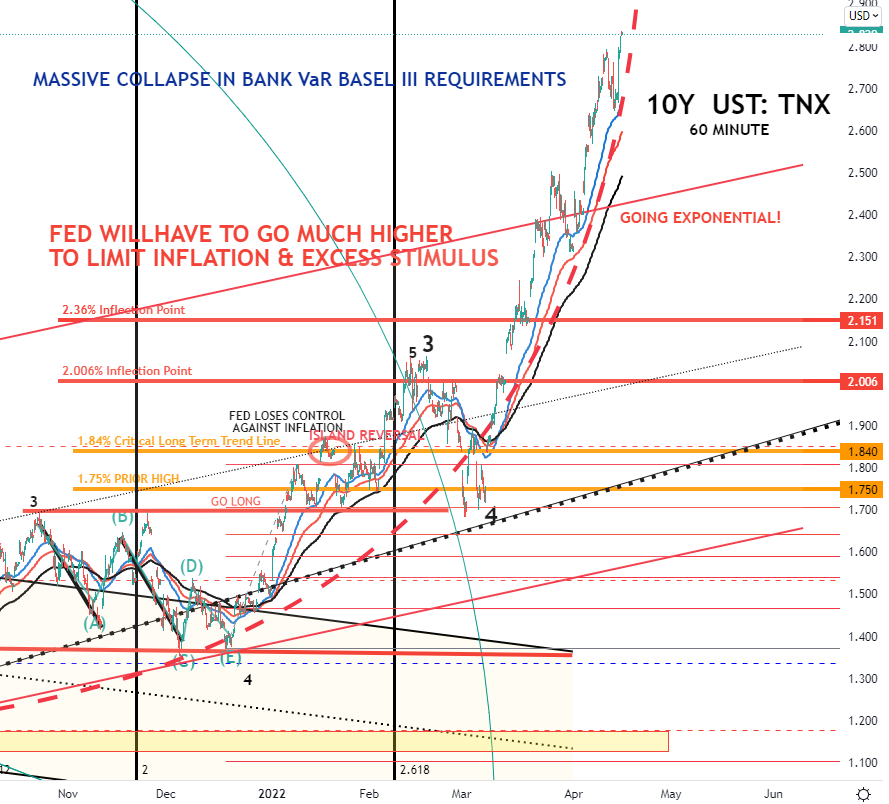

A RISING FED FUNDS RATE

The Federal Reserve has already begun raising rates. A number of Fed governors have suggested that a 50-basis point rate hike is likely to be announced at the next meeting. The Fed meets next on May 3rd and 4th. It is expected that a 50-basis point rate hike in May will occur with another 50-basis point rate hike at the Fed’s following meeting in June and then a 25-basis point rate hike at every FOMC meeting after that, until mid-2023. Then by June next year, the Federal Funds Rate will be 3.3%. This is highly likely to crash both the US Equity Market as well as the US Housing Market!

QUANTITATIVE TIGHTENING (QT)

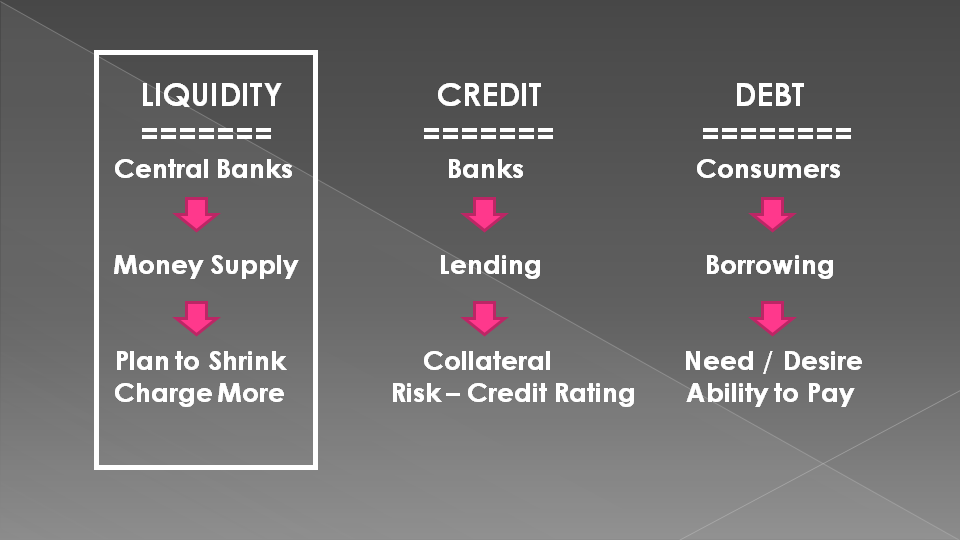

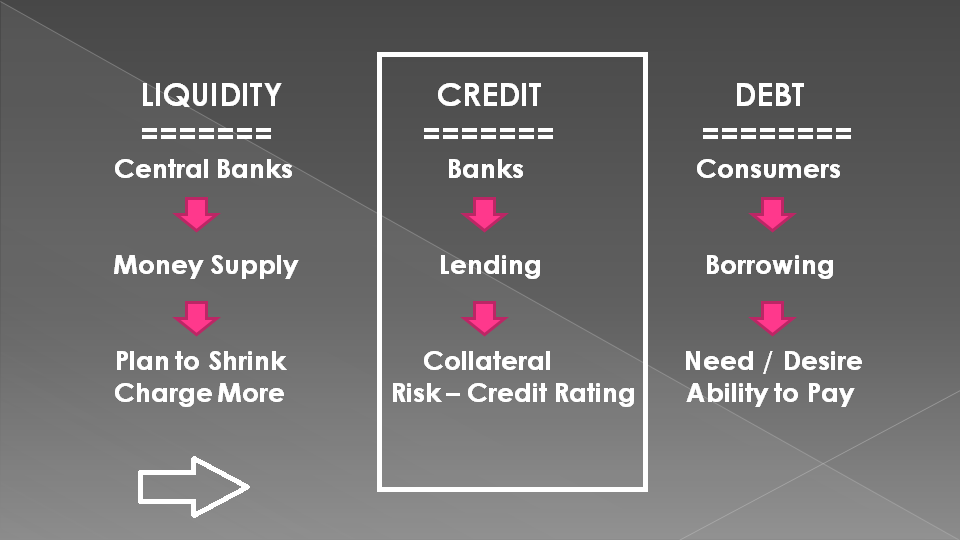

The Federal Reserve has additionally stated that its plans call for Quantitative Tightening which is the opposite of Quantitative Easing. With Quantitative Easing, the Fed creates Dollars and pumps them into the Financial Markets, which tends to push interest rates lower and asset prices higher. However, with Quantitative Tightening, the Fed removes Dollars from the Financial Markets and destroys them. That tends to push interest rates higher and asset prices lower.

The Minutes to the Fed’s March FOMC meeting (which were released on April 6th) suggested that the Fed is likely to launch Quantitative Tightening early next month (May).The Minutes also suggested the Fed planned to carry out QT at the

pace of $95 billion a month, although during the first couple of months it would phase in QT at a lower amount than $95 billion a month. It can be assumed that QT of $30 billion in May, $60 billion in June and then $95 billion a month every month after that, would mean that the Fed could destroy 1.25 trillion Dollars or 14% of all Dollars by the middle of 2023. That would reduce the size of the Fed’s Total Assets from $8.9 trillion now to around $7.7 trillion in June 2023.

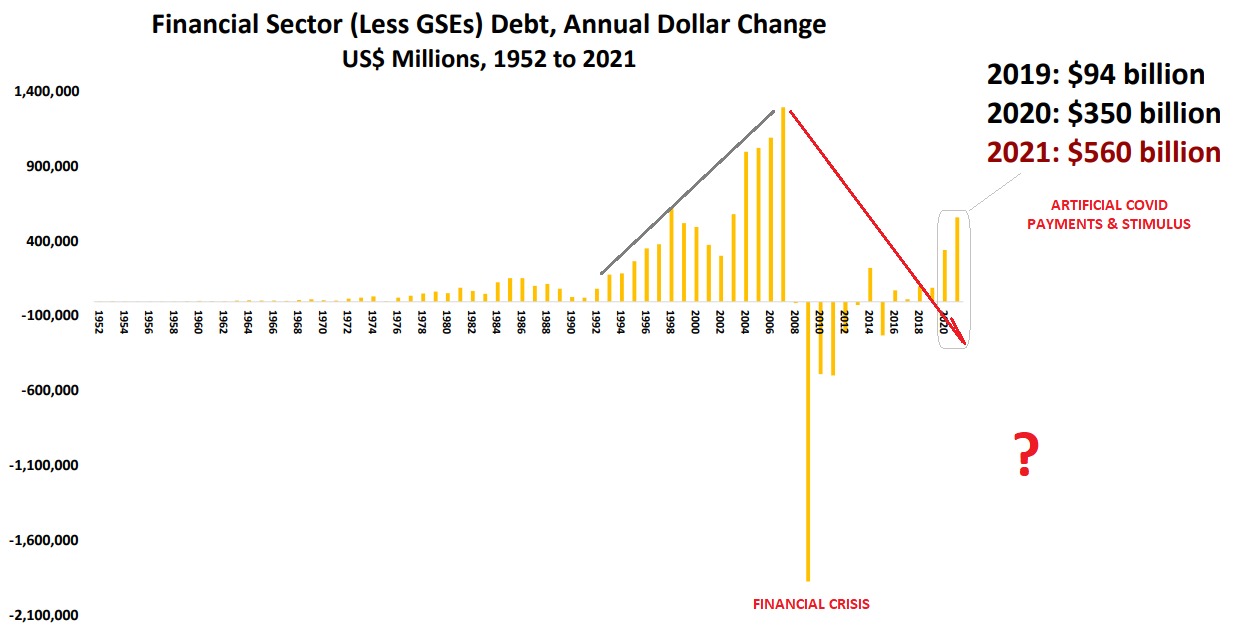

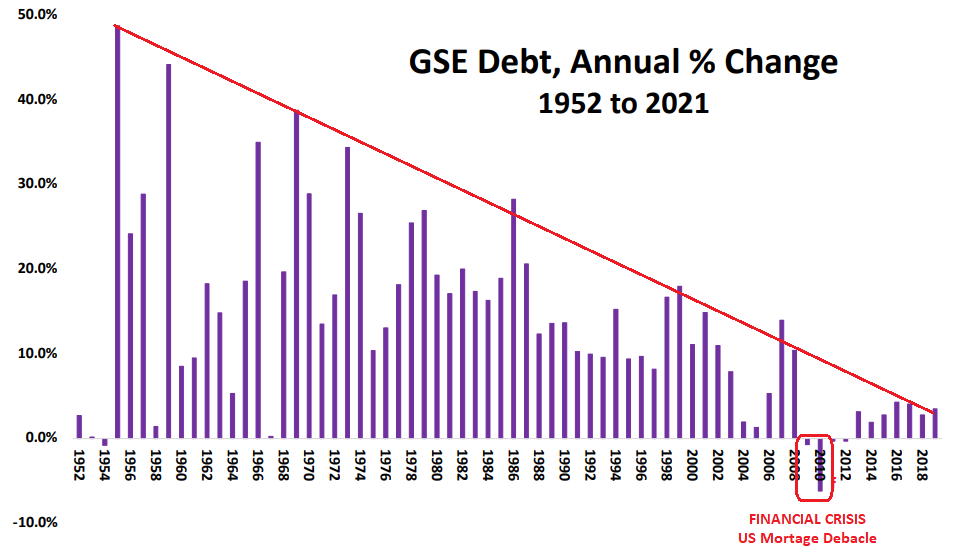

IS THE FED ABOUT TO TRIGGER ANOTHER HOUSING / MORTGAGE DEBACLE??

The 30-Year Fixed Mortgage Rate has moved up by 180 basis points so far this year and is already being felt in mortgage originations. This is going to get MUCH worse … SOON!