MACRO – US

MONETARY & FISCAL POLICY

ELECTION MEDIA AVOIDING

RESURGENCE OF INFLATION! MANDATE

OBSERVATIONS: WHO WINS ERIE PA. WINS PA. – WHO WINS PA. WINS THE ELECTION!

The Presidential Candidate that wins Pennsylvania is expected to win the election. Erie County PA has a record of always calling both the winner of PA, and the Nation. So what is going on in Erie County PA that we can learn from?

The non-partisan Epoch news recently wrote an article on Erie highlighting that “financial concerns—particularly inflation—are the most pressing issue. Inflation could be described as the No. 1 issue in the county right now. The modest income of many residents makes the hit harder than it might be in more affluent areas”.

If you are an undecided voter or independent, I encourage you to read the article. The hard conclusion for me is the reality of the situation in Erie, PA and the nation.

Millions of Pennsylvanians can’t afford to buy a house today, and failed public policy is to blame. Repeated missteps by elected officials have caused the American dream of homeownership to become more than twice as expensive in less than four years, which is why two-thirds of Americans now see that dream as permanently unobtainable.

The profligate spending in Washington over the last four years has become so extreme that by the end of the Biden-Harris administration, the Treasury will have borrowed about $8.5 trillion, plus run down its cash balance by about $1 trillion, too. That’s net overspending of about $9.5 trillion—a record for any presidential term and one-quarter of the total federal debt. As you will recall from your Econ-101: “Too much money chasing too few goods causes inflation.”

As inflation ran up to 40-year highs, the Fed belatedly raised interest rates, which meant potential homebuyers then faced the deadly one-two punch of high housing prices and high mortgage interest rates. To own a home, people must borrow more money at the same time the cost to borrow has soared.

It now takes over 36% of the median household income to afford a median-price home in the Pittsburgh area. That’s particularly shocking when you consider that the median home price in this area is 34% below the median price nationwide.

Conversely, in January 2021, it took only about 20% of the median household income to afford a median-price home in the Pittsburgh area. Since that time, however, home prices are up 26% and mortgage interest rates have more than doubled.

Even under normal circumstances, devoting more than one-third of your household’s income to monthly mortgage payments would stress the family budget. But these aren’t normal times. The costs of food, insurance, clothing and transportation have exploded over the last 3½ years, putting families into a record $1.1 trillion of credit card debt.

Americans broadly and Pennsylvanians specifically cannot afford today’s cost-of-living crisis with the punishingly high cost of homeownership and record-high rents.

A family of four in Pennsylvania now needs a stratospheric annual income of $230,000 to live comfortably.

The blame for this situation is rightly laid at the feet of the politicians (BOTH PARTIES) who caused it with their runaway deficit spending. Vice President Kamala Harris frankly deserves particular scorn in this regard because she provided the tie-breaking vote in the Senate on trillions of dollars in added government spending. That directly led to half the excess inflation that has occurred since 2020.

Unfortunately, politicians such as Ms. Harris and the politicians that voted for the spending (again from both parties) not only refuse to accept blame for their role in demolishing the American dream of homeownership, but they’re also creating scapegoats in their re-election campaigns.

They blame corporate greed for inflation, ignoring the fact that the Biden-Harris administration’s own figures prove that businesses themselves are paying higher prices and are merely passing those higher costs along to consumers.

It was government, not business, that spent trillions of dollars it didn’t have, created the highest inflation rate in 40 years and caused a homeownership affordability crisis with the lowest pending home sales ever recorded. Only

Keystone State residents deserve to know who made the American dream prohibitively expensive: Washington.

Whoever they vote for, you can only expect more of the same!!

WHAT YOU NEED TO KNOW!

GOVERNMENT DEPENDENCY = BIGGER GOVERNMENT = INCREASING SHIFT LEFT

GOVERNMENT DEPENDENCY = BIGGER GOVERNMENT = INCREASING SHIFT LEFT

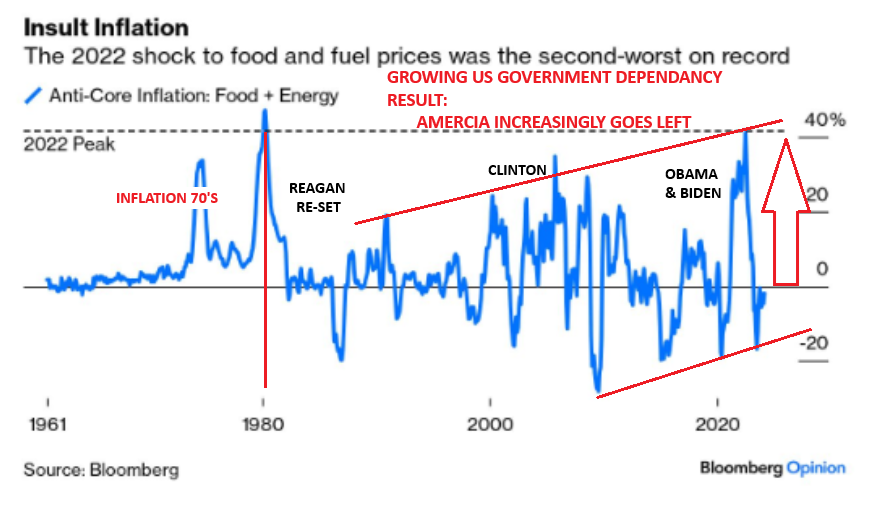

It took Federal Reserve Chairman Paul Volcker and President Ronald Reagan to end the inflation of the 1970’s – Volcker to deliver historic inflation breaking interest rates and the Supply Side policies of Ronald Reagan. Unfortunately, though the battle was won, the War was not! That is because we failed to learn from our mistakes!

Big government, deficit spending and savings, being primarily used for consumption (versus Investment), will only, over time grow the dependency on government – making it bigger and moving the electorate towards electing those that promise something for nothing! The chart shows this inevitable glacial shift of a “consuming more than you produce” economy.

RESEARCH

1- THE MEDIA’S ELECTION BLACKOUT OF RESURGENCE OF INFLATION

1- THE MEDIA’S ELECTION BLACKOUT OF RESURGENCE OF INFLATION

-

- We are witnessing a significant surge in Inflation Expectations and the pricing of Inflation Swaps!

- The underpinnings for this are clear. The market is saying Inflation has not been beaten and the Fed rate cuts are premature!! Mainstream media is not covering this during the election period for a number of reasons.

- One of those reasons may be as simple as they don’t understand that the nature of the Inflation problems has changed!

2- Q3 EARNINGS

-

- US Profit levels are unusually high! They have been for some time. However since 2008 they have exploded higher. We explore why and what they mean for current Q3 Earnings Season.

- The Major Reasons:

-

-

- Low Finance Rates & Cost of Capital (QE)

- Fewer Shares (Buybacks)

- Shrinking Stock Float/Pools being bought through ETFs employing Options

- Inflation (Higher Sales Prices)

-

-

- What it Means:

- The market and earnings are almost completely supported by the Magnificent 7 Earnings and their Earnings Expectations, which capitalize the most on the 4 major reasons for the sustained market rise.

- What it Means:

DEVELOPMENTS TO WATCH

YEN TOO WEAK TO CARRY – A Strengthening US$

YEN TOO WEAK TO CARRY – A Strengthening US$

-

- It’s a near-perfect illustration of the concept of money illusion. View wealth and income in nominal terms, not accounting for inflation, and Japanese assets are doing well. Account for the yen’s depreciation and it’s a different story.

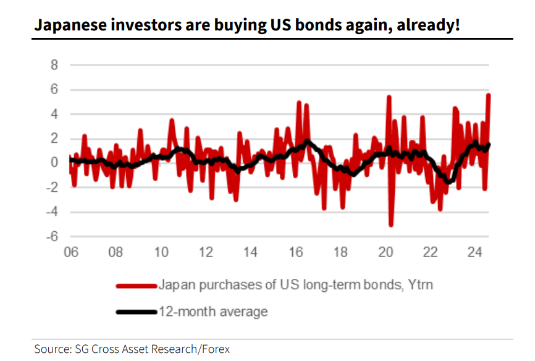

- Previous Fed cutting cycles have weighed on the dollar, but this cycle has caused only marginal pain, and investors are already regaining an appetite for US dollar assets.

- Foreign investors have increased their net holdings of US assets by a staggering $40 trillion since 2020, with the dollar still close to a multi-decade high in real terms.

- Japanese investors’ enthusiasm for the dollar takes US exceptionalism to new levels.

THE BRICS’ NEW “PAYMENT SYSTEM”

-

- Central banks have been net buyers of gold since 2010, but the tempo of gold buying has increased as the U.S. Rule of Law, under policymakers like Yellen, begins to crumble.

- To understand the BRICS Strategy you need to understand the difference between a Payment Currency and a Reserve Currency, which we explain.

- At the upcoming BRICS summit in Kazan on Oct 22-24th, Russia will announce significant progress in building out secure payments channels and will admit new members, which will drive the group closer to the critical mass needed to launch a currency union.

GLOBAL ECONOMIC REPORTING

RETAIL SALES

RETAIL SALES

-

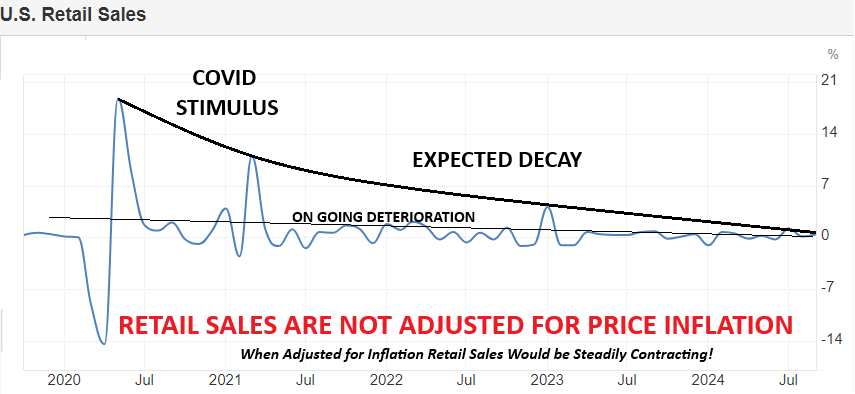

- Retail Sales rose by 0.4% in September, above the 0.3% forecast, accelerating from the prior 0.1%.

NY EMPIRE STATE MANUFACTURING INDEX

-

- The NY Fed Manufacturing Survey for October sharply dropped to -11.9, well below the expected 3.85 and forecast range, as well as September’s 11.5.

INDUSTRIAL PRODUCTION

-

- Industrial Production fell by 0.3% in September, more than the expected -0.2%, after rising in September by the downwardly revised 0.3%.

ECB RATE CUTS

-

- As expected, the ECB opted to cut the Deposit Rate by 25bps.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.