INFLATION IS NOT TRANSITORY! BOND & PRECIOUS METALS REACT AGGRESSIVELY TO CPI / PPI

After Tuesday's release of the dramatic PPI increase (8.6% Y-o-Y), then followed by Wednesday's historical high CPI (6.2% Y-o-Y) the bond and precious metals finally reacted. The reports put to rest any doubt that high Inflation rates were not Transitory as touted by the Fed and were going to be elevated at least for the Intermediate Term.

PPI

CPI

This was the highest print since June 1982 for the CPI with Core CPI spiking to its highest since August 1991

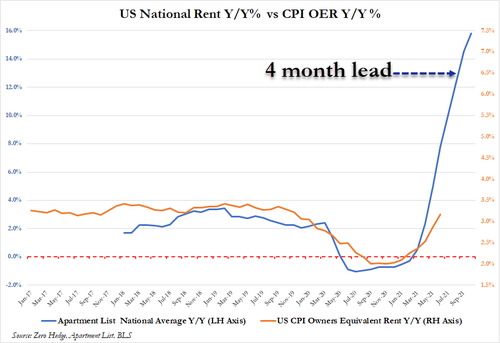

Owner Equivalent Rent (OER) comprises approximately 1/3 of the CPI measure. The surge in owners equivalent rent inflation is clearly anything but over...

BOND MARKET REACTION

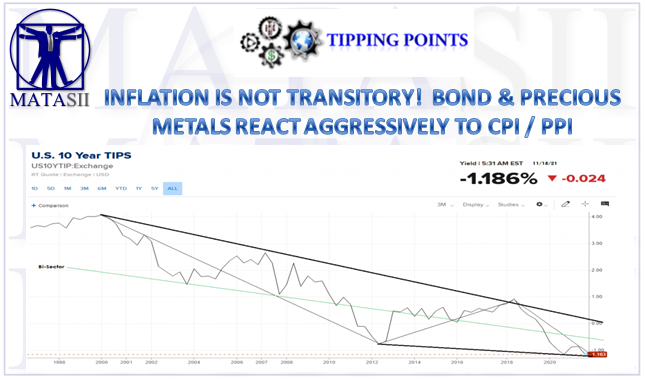

The Bond Market as measured by the 10Y Note reacted in two ways:

- It pushed 10Y Breakevens up from 2.50% at month beginning to a Friday close of 2.73% or +23 basis point.

- It pushed down Real Rates from -0.92% at month beginning to a Friday close of -1.16% (Monday pre-market of -1.186 below) -24 basis points

Though on the surface the net result was a minor move in the 10Y note, the change in underlying value composition was anything but!

1- Real Rates - Fell 24 bp

Money flowed into TIPS (Treasury Inflation Protected Securities) pushing price up and yield down. The change in the Intermediate perception by institutional investors was that:

- Inflation was likely to stay at these levels or worsen. Further decay in Inflation Breakevens would further lower yield and thereby make TIPS of more value,

- High Inflation would force the Fed to be more bullish which would strengthen the US dollar. This made TIPS particularly attractive to foreign investors accustomed to poor negative yields. A place to hold money where real rates continued to erode (lifting asset price value) along with a strong currency made TIPS particularly attractive to these investors & position traders in the Near to Intermediate Term.

An updated version of the above chart can be found at HERE

An updated version of the above chart can be found at HERE

2- Inflation Breakevens Rose +23 bp

US inflation Breakevens soared to record highs, jumping notably more last week than the rest of the world's break-evens.

This took the 10Y Breakevens to what we have been targeting as near term overhead resistance at 2.74% last achieved in 2004 (FRED chart below).

An updated version of the above chart can be found at HERE

3- 10Y Nominal TNX stayed flat, falling 1 bp.

An updated version of the above chart can be found at HERE

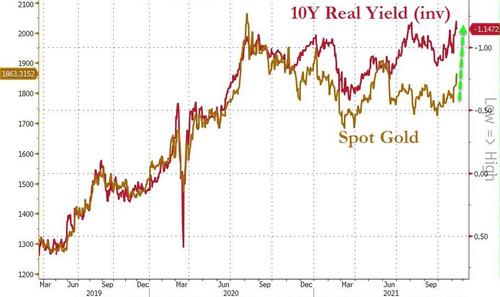

PRECIOUS METALS REACTION

With Real Yields crashing to new record (negative) lows, this provided support for Gold. Gold has not yet closed the gap with real rates which suggests a belief that real rates have fallen too far too fast!

Source: Bloomberg

CONCLUSION

- The current Inflation Scare will soon peak. Inflation will remain with us however markets react to the rate of change of drivers. Additionally, though inflation will be with us for awhile the market will begin to discounting slowing expectation rates out 6 to 8 months,

- Real Disposable Income is falling as wage gains are not matching inflation rates. Consumer spending is a result of post Covid Retail Lockdown demand, stimulus checks and rent and mortgage moratoriums. Growth in Credit Card debt is the first indication that retail spending is peaking. Demand will soon begin weakening.

- Richard Duncan's recent report is quite clear that Inflation can't be sustained with global monetary tightening and mounting deflationary pressures. He cites with 34 supporting slides, five reasons:

- Demand will weaken

- Money Supply Growth will slow to close to 0% by the second half of 2022,

- Global Supply Bottlenecks will begin to be resolved which will led to more production and falling pricing pressure and prices (which occurred after the 2008 Crisis),

- China's property bubble has begun to deflate which will mean china's economy will slow and add additional pressures to downward inflation pressures,

- Globalization is Deflationary. Free trade with low wage countries puts strong downward pressure on prices. So long as Globalization survives, inflationary pressures are unlikely to

last for long.

- Over the next year, stock prices and property prices may very well fall. But, if they do, it’s unlikely to be because Inflation and interest rates move sharply higher. It’s more likely to be because:

- The Fed is going to bring Quantitative Easing to an end through Tapering, thereby removing the monthly injections of Liquidity that have pushed asset prices so much higher since March 2020; and/or they may fall

- Because the economy and corporate earnings slow as the result of the sharp slowdown in credit growth next year; and/or

- Because asset prices are now very expensive, with the Wealth To Income Ratio at a much higher level than ever before.

MACRO ANALYTICS - 03-04-21 - Coming Deflationary Tsunami - w/ Charles Hugh Smith

VIDEO: 53 Minutes with 37 Supporting Slides