|

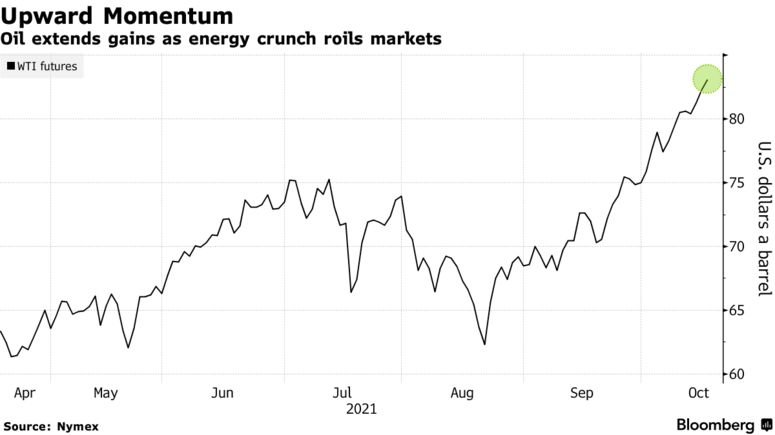

THE CURRENT GLOBAL ENERGY SHORTAGE

Exploding Energy prices at the pump, for home heating, and creation of electricity is urgently required to make the investment in Green Energy more attractive and fundable. Is the current energy shortage shock simply a “lucky” coincidence?

US SPENDING CONTRIBUTIONS ARE UNREALISTIC

On February 7 2020, AOC unleashed her Stunningly Absurd “New Green Deal”.

-

- Upgrade all existing buildings in the US

- 100% clean power

- Support family farms

- Remove greenhouse gasses form the atmosphere

- Eliminate unfair competition

- Affordable access to electricity

- Create high-quality union jobs that pay prevailing wages

- Guaranteeing a job with a family sustaining wage, adequate family and medical leave, paid vacations, and retirement security to all people of the United States

The current bill before congress also includes the following provisions within a $3.5T CR to fund the above ideas and additionally enforce and further finance it:

-

- $2.0T — Largest Tax Increase in American History,

- $7B — Green New Deal Climate Police

- $10B — Green New Deal Slush Fund for Colleges

- $2B — Green New Deal Job Training

- $27B — Green Bank

- $75M — Green Activists

- $50B — Death Taxes

- $80B — Small Business Taxes

- Taxes — Energy, Employers, Cigarettes

- IRS — Double Size (# of Agents)

- $6B — Charges on U.S. oil and gas operators on federal lands, which could effectively put mom and pop small business, and minority and Native-owned operations out of business, in addition to killing tens of thousands of jobs.

- Include new methane fees, inspection fees, severance fees, and bonding requirements, as well as additional requirements for operating on federal lands.

- Increases onshore oil and gas royalty rates on federal leases from 12.5% to 20%. The increase could be unsustainable because of the time it takes to go through a bureaucratic application and review process in light of the costs associated with capital investment and regulatory compliance costs. It takes years to complete required assessments and studies associated with lease approvals, and to invest capital and infrastructure to facilitate drilling, production and delivery.

- An additional $15 per-acre fee for expressions of interest in public lands with no guarantee that the companies applying for it would be included in eventual lease sales. The proposal might be likened to applicants paying several months’ rent up front with a rental application not knowing if they’d get approved, and not having the deposit refunded if the application is rejected. The rental market would collapse, as no one would apply for a house or apartment lease under such terms.Another proposal shortens the length of the lease from 10 to 5 years, making the lease nearly moot, since it often takes five years for a lease to be approved.

Since AOC proposed her plan we have seen the following initiatives already enacted:

-

- Halting of new leases on federal land,

- Halting of the Keystone Pipeline thereby eliminating of low-cost Canadian crude from being processed by mid-continent and Gulf Coast and U.S. refiners by prohibiting the Keystone pipeline from opening.

- Increased regulatory burdens,

- Halted the issuance of new oil and gas leases on federal lands, effectively stopping much production for existing operations.

- Regulatory burdens imposed on banks have effectively resulted in denying capital to some in the industry is stifling oil and gas production, Heywood Cooper, principal at Houston-based Argos Minerals, told Just The News. “The administration is committed to denying the energy industry access to capital, going down the same road as the Carter administration in the 1970s, which carried over into the ’80s,” he said.

SIDE NOTES

|