FOCUS

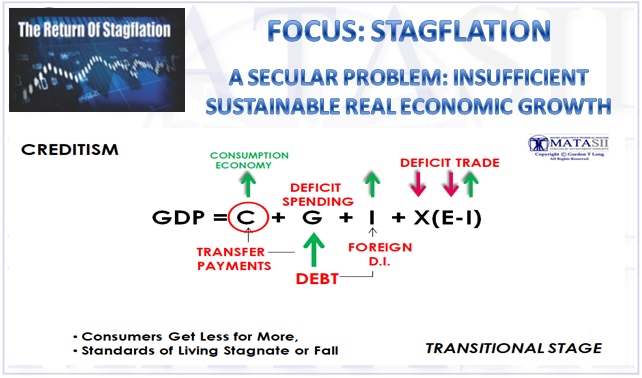

STAGFLATION

A SECULAR PROBLEM: INSUFFICIENT SUSTAINABLE REAL ECONOMIC GROWTH

2- PROBABILITIES SUGGEST THE EARLY 1930’S ECONOMIC PATTERN AHEAD

2- PROBABILITIES SUGGEST THE EARLY 1930’S ECONOMIC PATTERN AHEAD

Eugene Fama, Professor of Finance at the University of Chicago.

We expect the speed of channeling government policy stimuli into the economy, as well as pandemic relapse risk once lock-downs end, to significantly hamper economic recovery.

- According to calculations by Bloomberg Economics, it may take the global economy until the end of next year to fully recover from the pandemic. Its baseline scenario sees output shrinking 4.7% in 2020. In a more pessimistic view — assuming the pandemic runs longer, recession scars slow the recovery, and the ceiling on activity from residual social distancing is lower — global GDP contracts 6.7%.

- Even though many economies have already passed the trough, uncertainty about new waves of infection is keeping a lid on spending and investment. That means many parts of the world will see worse contractions this year than during the financial crisis. The International Monetary Fund has downgraded its outlook again and now foresees a drop in GDP of 4.9%.

- Emergency spending by governments is set to push the global debt ratio above 100% for the first time. The IMF forecasts the burden this year alone will jump by close to 19 percentage points, dwarfing the increase after the global financial crisis more than a decade ago.

- Purchasing managers’ indexes from Asia, Europe and the U.S. are among indicators that have recorded impressive gains that look just like the V-shaped recovery many once spoke about. But that short-term rebound doesn’t say much about the more important medium-term outlook. On top of that, measures of demand, employment and prices in the PMI offer reason for caution.

- U.S. consumer spending surged by a record in May but the annualized rate of household outlays remains well below pre-pandemic levels, indicating a long road to recovery from a deep recession.

- The misery spreading through the U.S. economy as a result of the pandemic may well have political consequences. An index combining unemployment and consumer prices has spiked to an extent that historically would suggest a loss for the incumbent party in the White House.

- In China, where the coronavirus first broke out, the economy continued its slow recovery in June, with a better performance in the services sector and among smaller companies tempered by the still-grim global outlook.

- Central banks have been key to rekindling growth momentum. Demand for Bank of Japan loans aimed at helping struggling companies have jumped fivefold to 8.3 trillion yen after the introduction of a second loan program.

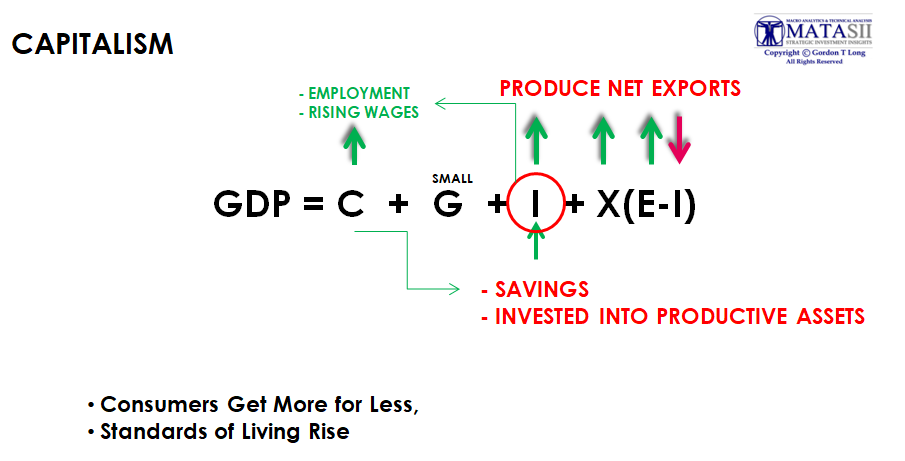

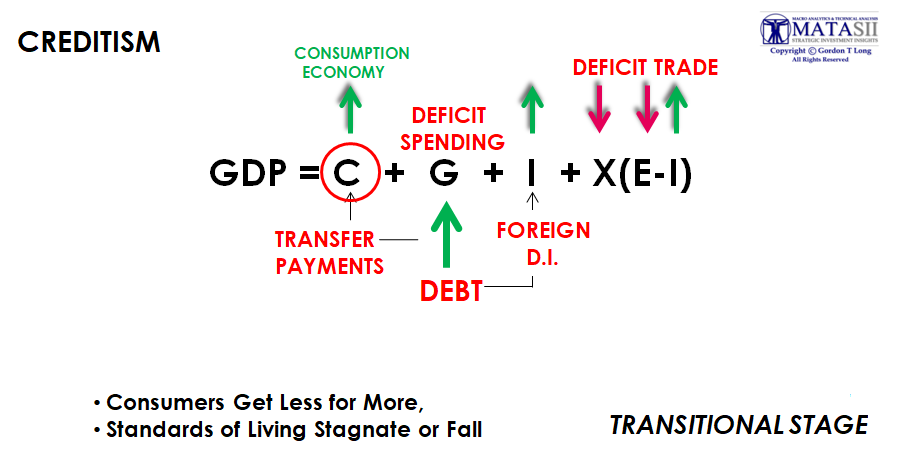

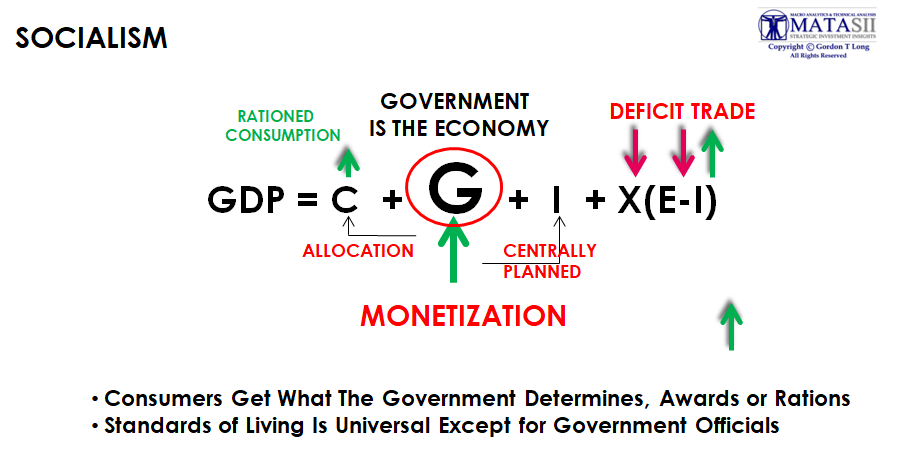

The GDP formula is hopelessly flawed for a Fiat Currency world. The formula creates the illusion through debt growth that the real economy is growing. It does this through increasing government debt adding to “G”, then through Transfer Payments it adds to “C”, then because it is partially financed by foreign investment it adds to “I”. The distortion is further compounded when the debt goes into non-productive assets and financial engineering.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.