MACRO

GLOBAL GEO-POLITICS

SHIFTING MULTI-POLAR PILLARS

In this month’s UnderTheLens video (right), we outlined six major Macro Themes for 2023. One of these themes was the mounting Geo-Political pressures associated with the fallout of the shift to a multi-polar world. A development we first wrote about in our 2018 Thesis paper “The New World Order”.

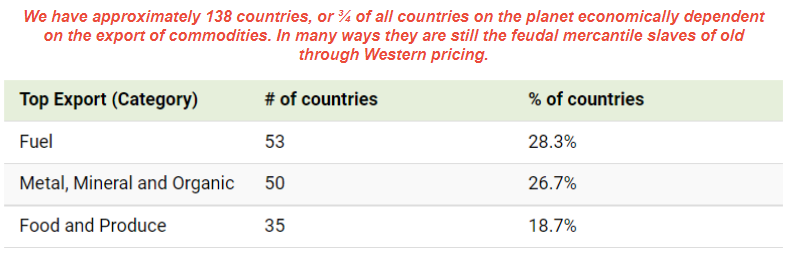

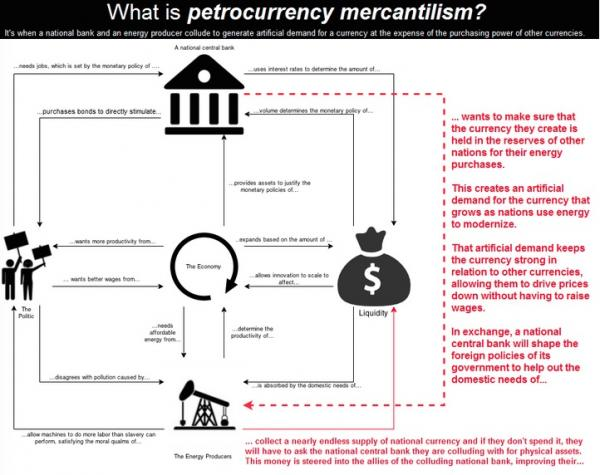

In 2023 we feel the area to pay particular attention to within this theme is the breakdown of the Petrodollar and an increasing alignment of commodity exporters. The 138 countries whose economies are almost solely dependent on their commodity exports will be led by the “BRICS” organization into strengthening trade and financial alliances, as part of a strategic push towards the creation of what we sense will initially likely take the form of a Commodity Cartel. A cartel similar to what OPEC has been for global Oil exporters.

=========

WHAT YOU NEED TO KNOW

- A REQUIRED PERSPECTIVE

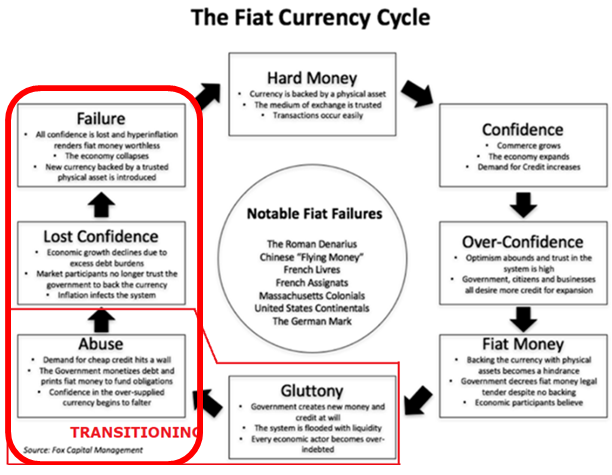

A lot is being written around how the Multi-Polar shift will impact: i) the US Dollar as the world’s FX Currency Reserves, ii) De-Dollarization, iii) a possible PetroYuan, iv) Gold-Backed BRICS currencies and v) a return to Sound Money. I have also written extensively on all these subjects. I want to be clear that though I see a slow dollar decline as inevitable, that does not mean it necessarily fails or disappears – only continues to weaken from its post WWII domination. This is actually healthy for the world. Additionally, it doesn’t mean that many of the current shifts in the Multi-Polar Pillars we often discuss will succeed. Quite the contrary! The plans and strategies of totalitarian states seldom stand the test of time. The pillars of freedom, de-centralization and transparency have proven to be the only sustainable path.

Sound Money is about more than the rejection of fiat currencies and the return to backing currencies with real tangible assets, whereby their scarce nature prudently controls government expansion, waste and spending. At its core Sound Money is about responsible Monetary, Fiscal and Public Policies that in concert deliver an economic environment where improving standards of living and productivity can flourish. This type of sound money policy delivers a nation state which produces more than it consumes.

The US has not produced more than it consumed for decades. It is not operating within a Sound Money System and therefore is not sustainable under its current policies. Consequentially temporary shifts in regional economic dominance should be expected. However, the longer term winner will be countries where the virtues of self reliance, independence, sacrifice and innovation are rewarded – not subjected to state control. This is what built America into the power it became. The question is whether these social bedrocks will continue to be cherished and valued in America?

The US Dollar as the Global Reserve Currency is not in jeopardy in the near future. There are however real concerns which we will discuss below. Please don’t construe that we believe they will succeed, but rather must be viewed as developments that must be factored into your investment thinking in 2023,

- WHAT KEEPS THE DOLLAR AFLOAT?

-

- RESERVE CURRENCY: There are presently no realistic alternatives to the dollar’s dominance as the global Reserve Currency. This is likely to be sustained for the foreseeable future. This FX global foundation is currently based on key pillars:

-

-

- The Dollar Floats Freely. The dollar is not pegged, floats freely and in fact is the only major currency that is pegged to other currencies. The Swiss Franc’s unofficially managed peg to the Euro is a marginal exception.

- Insufficient Alternative Global Bi-Lateral Trade Networks: Other Major Currencies such as the Yuan, EURO, Yen, Sterling do not have sufficiently broad enough networks of Bi-Lateral trade agreements in place to allow non-US$ currencies to be used to buy imported goods and services.

- Global Debt is Primarily Held in and Collateralized by US Dollars.

-

-

- CHINA’S GOAL: China wants the US Dollar to be the dominant global reserve currency (for the foreseeable future), because of:

-

-

- The crippling realities of the “Triffin Paradox”,

- Influence on Consumer Lending Rates through foreign buying / selling of US Treasury Bills, Notes and Bonds,

- Allowing the unofficial open pegging of the Yuan against the US dollar for competitive trade advantage.

-

-

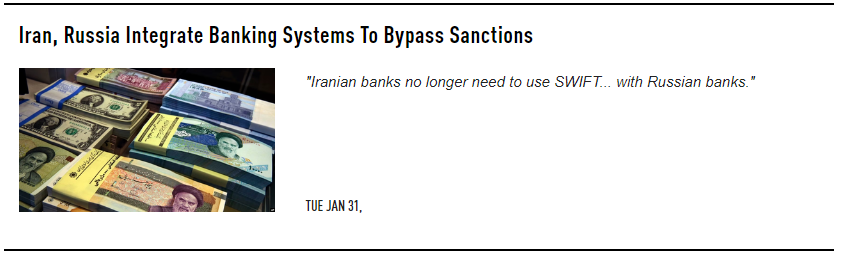

- BI-LATERAL TRADE: There are growing bilateral trade agreements that use other currencies as an alternative to the US dollar. Increasingly, not all trade needs to occur in US dollars. This is the only approach that can lead to the emergence of a real contender to the US$ as the primary FX Reserve Currency.

- ATTEMPTING A “COMMODITY CARTEL”?

-

- China and its BRICs partners are focused on building Bi-lateral Trade Agreements and therefore as a group a global trading network sufficiently large enough to make their currencies “usable” versus being forced to exchange it for US dollars.

- China sees the US’ Achilles Heel to be it debt and specifically how much of it is held by foreign powers. At 31.4T with 22.9% held by foreign powers (13.5% by China), the US has effectively surrendered its financial independence to the vagrancies of international debt financing flows.

- There are approximately 138 countries whose primary export is a commodity. All of which are relatively poor but have import consumer needs that China can fulfill, if their use of the Yuan has sufficient bi-lateral trade potential. China is attempting to fix that (amongst other strategic reasons) through the creation of a Commodity Cartel.

- BRICS, Shanghai Accord and Belt & Road Initiative are clearly mounting a coordinated attempt at putting together a mirror like OPEC Cartel for Commodities.

- A DESOLVING PETRODOLLAR

-

- Saudi Arabia’s recent pivot has potentially severely weakened but has not ended the Petrodollar (as of yet).

- Saudis no longer consider their alliance with the United States to be as important as it has been since the 1970s.

- A number of other dominoes would need to fall first, most especially the domino we call “Eurodollars”.

- We could potentially expect both higher domestic price inflation and higher interest rates than what Americans have become accustomed to over the past thirty years. In other words, as the dollar declines, the US regime will no longer be able to monetize debt and heap up immense new deficits without fear of high price inflation or falling Treasury prices.

- The end of the petrodollar is not a reason to panic right now, but it is the latest sign that the US regime’s power via the dollar is SLOWLY being reined in.

- THE SUSTAINABILITY OF DOLLAR’s “EXORBITANT PRIVILEGE”

-

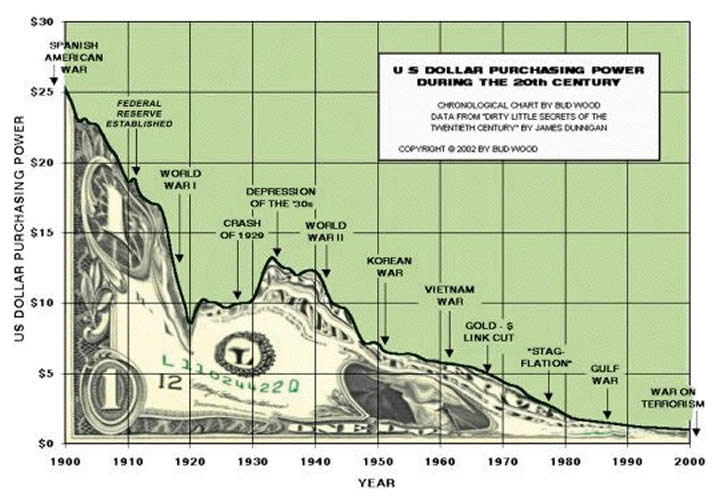

- PURCHASING POWER: Weakening Purchasing Power of Fiat Currencies

- As denominated in Gold and Silver over a longer time period,

- US exports inflation through the dollar.

- PURCHASING POWER: Weakening Purchasing Power of Fiat Currencies

- CONCLUSION

- No one uses China’s digital payment system abroad, simply because Beijing refuses to give up control of its capital account (and with it, inevitably, its trade account). Digital currency won’t change that.

- China’s trade surplus is bigger than ever, which makes China even more dependent, and not less dependent, on the willingness of China and the rest of the world to hold dollars.

- The RMB cannot really act as a major international currency.

- China requires above all someone to run deficits. As long as the US, and only the US, is willing and able to play this role (not for much longer, I hope), the dollar will dominate the world of international trade and capital.

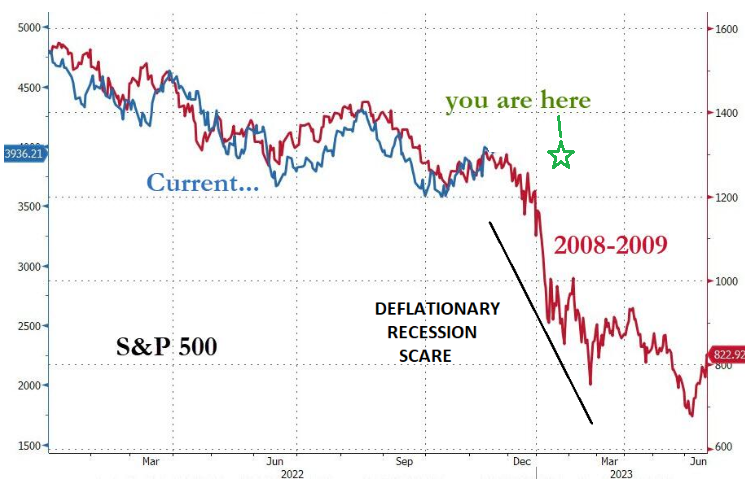

The fully expected and overdue recessionary deflationary scare is soon to arrive.

WHAT KEEPS THE US DOLLAR AFLOAT?

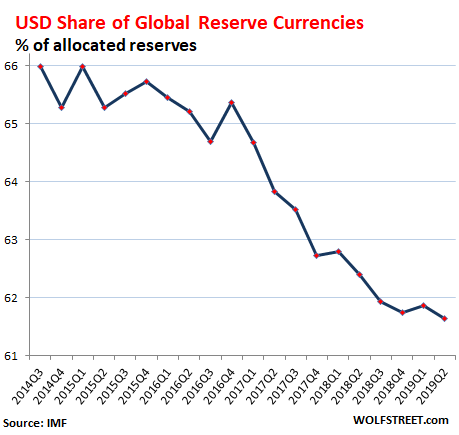

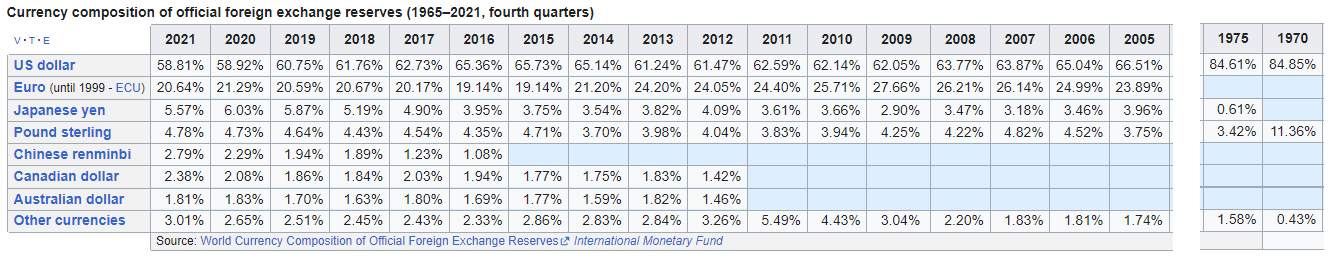

The US Dollar is slowly declining as a percentage of of total global currency reserve usage. The decline is clearly evident in the chart to the right and the table below. This decline is likely to be sustained especially as the US continues to weaponize the US$ through sanctions as a tool of foreign policy. However, it is critical to fully appreciate that US$ FX dominance will be with us for this decade and likely much longer.

For the US Dollar to be unseated it will require another nation (I.e. the Chinese Yuan) or region (I.e. the Euro) to have an extensive trade network that allows its currency to be readily liquid, exchangeable, have scale and be transparent in its monetary management. Today the US$ is the only such currency, though it is clearly abusing its “Exorbitant Privilege”.

RESERVE CURRENCY: There are presently no realistic alternative to the dollar’s dominance as the global Reserve Currency. This is likely to be sustained for the foreseeable future. This FX global foundation is currently based on key pillars:

- The Dollar Floats Freely. The dollar is not pegged, floats freely and in fact is the only major currency that is pegged to by other currencies. The Swiss Franc’s unofficially managed peg to the Euro is a marginal exception,

- Insufficient Alternative Global Bi-Lateral Trade Networks: Other Major Currencies such as the Yuan, EURO, Yen, and Sterling do not have sufficiently broad enough networks of Bi-Lateral trade agreements in place to allow non-US$ currencies to be used to buy imported goods and services.

- Global Debt is Primarily Held in and Collateralized by US Dollars.

China and the EU both want the US Dollar to continue to be the dominant global reserve currency (for the foreseeable future). There are a number of reasons for this which include:

-

- The crippling realities of the “Triffin Paradox”,

- Influence on Consumer Lending Rates through foreign buying / selling of US Treasury Bills, Notes and Bonds,

- In China’s case, it allows the unofficial open pegging of the Yuan against the US dollar for competitive trade advantage.

The present goal for China and the EU is to broaden its trading network through trade agreements which use their currencies. It is only through this approach can either ever become a true alternative to the US$ as the global reserve currency.

BELOW: Examples of two ZeroHedge.com clips in one day about elements of shifting bi-lateral agreements that are intended to reduce dependency and requirements for the use of the US Dollar.

ATTEMPTING A “COMMODITY CARTEL”?

China and its BRICs partners are focused on building Bi-lateral Trade Agreements and therefore as a group a global trading network, sufficiently large enough to make their currencies “usable” versus being forced to exchange it for US dollars.

China and its BRICs partners are focused on building Bi-lateral Trade Agreements and therefore as a group a global trading network, sufficiently large enough to make their currencies “usable” versus being forced to exchange it for US dollars.

China sees the US’ Achilles Heel to be US debt and specifically how much of it is held by foreign powers. At 31.4T with 22.9% held by foreign powers (13.5% by China), the US has effectively surrendered its financial independence to the vagrancies of international debt financing flows.

There are approximately 138 countries whose primary export is a commodity. All of which are relatively poor but have import consumer needs that China can fulfil if their use of the Yuan has sufficient bi-lateral trade potential. China is attempting to fix that (amongst other strategic reasons) through the creation of a Commodity Cartel.

BRICS, the Shanghai Accord and Belt & Road Initiative (BRI) are clearly mounting a coordinated attempt at constructing a mirror like OPEC Cartel for Commodities.

A DESOLVING PETRODOLLAR

Ryan McMaken via The Mises Institute

On January 17, the Saudi minister of finance, Mohammed Al-Jadaan, announced that the Saudi state is open to selling oil in currencies other than the dollar.

On January 17, the Saudi minister of finance, Mohammed Al-Jadaan, announced that the Saudi state is open to selling oil in currencies other than the dollar.

“There are no issues with discussing how we settle our trade arrangements, whether it is in the US dollar, whether it is the euro, whether it is the Saudi riyal,”

Al-Jadaan told Bloomberg TV

If the Saudi regime does indeed embrace substantial trade in currencies other than the dollar as part of its oil-export business, this would signal a shift away from the dollar as the dominant currency in global oil payments. Or measured another way, this would signal the end of the so-called petrodollar.

But how large of a shift is this? With the increasingly frequent Saudi comments about trading in nondollar currencies, we’ve also seen an increasing number of pundits announcing the “collapse” of the dollar or the imminent implosion of the dollar’s currently outsized global power.

Will a shift away from the dollar in the global oil trade really lead to a big relative decline in the dollar? Probably and eventually. But a number of other dominoes would need to fall first, most especially the domino we call “Eurodollars.”

On the other hand, it would be foolish to simply dismiss the potential end of the Saudi preference for the dollar with hand-waving. The end of the petrodollar would indeed weaken the dollar, even if this would not be a mortal blow in itself. Moreover, it is especially foolhardy to ignore the status of the petrodollar because that status also has geopolitical implications. Saudi comments on the dollar signal that the Saudis no longer consider its alliance with the United States to be as important as it has been since the 1970s. What’s not an immediate economic problem for the US regime or the dollar may nonetheless be an immediate geopolitical problem.

In context, probably the best way to look at the potential end of the petrodollar is to see it as one piece of the dollar-based portion of the global economy. Since the 1950s, the dollar has experienced an immense amount of support in terms of global trade and investment and in terms of dollar reserves held by foreigners. This has greatly propped up demand for US debt and for dollars, and this has had enormous disinflationary effects in the domestic US economy. That is, newly created dollars are soaked up by foreigners who both want and need dollars to pay off dollar-denominated debt and to pad bank reserves. But if global dollar dominance truly is in decline, we could potentially expect both higher domestic price inflation and higher interest rates than what Americans have become accustomed to over the past thirty years. In other words, as the dollar declines, the US regime will no longer be able to monetize debt and heap up immense new deficits without fear of high price inflation or falling Treasury prices. The end of the petrodollar is not a reason to panic right now, but it is the latest sign that the US regime’s power via the dollar is being reined in.

THE SUSTAINABILITY OF DOLLAR’s “EXORBITANT PRIVILEGE”

The term was coined in the 1960s by Valéry Giscard d’Estaing, then the French Minister of Finance. The term exorbitant privilege refers to the benefits the United States has due to the US dollar being the international reserve currency. For example, the US would not face a balance of payments crisis, because their imports are purchased in their own currency. Exorbitant privilege as a concept cannot refer to currencies that have a regional reserve currency role, only to global reserve currencies.

Academically, the exorbitant privilege literature analyzes two empiric puzzles, the position puzzle and the income puzzle. The position puzzle refers to the difference between the (negative) U.S. net international investment position (NIIP) and the accumulated U.S. current account deficits, the former being much smaller than the latter. The income puzzle is that despite a deeply negative NIIP, the U.S. income balance is positive, i.e. despite having much more liabilities than assets, earned income is higher than interest expenses.

CONCLUSION

I found the recent sequential twitter exchange, by Michael Pettis, one of the foremost China experts, quite informative and excellent identification of the central problem at play (h/t to my colleague Charles Hugh Smith):

I found the recent sequential twitter exchange, by Michael Pettis, one of the foremost China experts, quite informative and excellent identification of the central problem at play (h/t to my colleague Charles Hugh Smith):

- 1/15: Since the 1960s few arguments in international finance have been as exciting as “the coming demise of the dollar”, but these arguments seem always to flounder on the same set of mistakes. https://www.ft.com/content/3e05b491-d781-4865-b0f7-777bc95ebf71

- 2/15:That is why it is hard to find anyone who specializes in international financial flows, and who is fully familiar with the mechanisms and history of the global balance of payments, making this argument https://www.centralbanking.com/central-banks/monetary-policy/international/7954184/the-always-imminent-demise-of-the-global-dollar

- 3/15: Zoltan Pozsar argues, for example, that countries like China are running their biggest surpluses ever (true) but are recycling less and less of these surpluses into dollars (not true) and more into geopolitical investments such as funding the BRI and other developing countries.

- 4/15: In fact for all the over-excited talk of China’s debt-trap diplomacy, China’s developing countries lending peaked in 2015-16 when it learned, thanks in large part to Venezuela, just how risky this kind of lending can be, and has since then reduced flows substantially.

- 5/15: He also discusses the PBoC’s digital currency as a major indicator of this change, but here too he is very mistaken. Anyone who lives in China knows that for all practical purposes money was digitalized years ago. No one except the very elderly carries cash.

- 6/15: And yet no one uses China’s digital payment system abroad simply because Beijing refuses to give up control of its capital account (and with it, inevitably, its trade account). Digital currency won’t change that.

- 7/15: The irony is that while Pozsar correctly notes that China’s trade surplus is bigger than ever, he doesn’t realize that this makes China even more dependent, and not less dependent, on the willingness of China and the rest of the world to hold dollars.

- 8/15: The key to global currency “domination” is not how excited the political elite say they are about having their currency dominate. It is how willing they are to allow clear and transparent foreign ownership of domestic assets and, even more importantly, how…

- 9/15: …willing and able they are to give up control of their capital and trade accounts. Beijing has made it clear it wants none of those things, and while I think they are right to reject these, it also means that the RMB cannot really act as a major international currency.

- 10/15: So can we at least agree that China is reducing the dollar component of its reserves? Even that is questionable. China’s reserve accumulation since 2017 has occurred indirectly, through state-bank purchases of dollars. Without knowing the precise currency composition …

- 11/15: …of these assets, we have no idea whether or not the amount of dollars China is holding has increased or decreased, but simple B-o-P arithmetic tells us that China’s rising accumulation of foreign assets was mostly matched by rising foreign accumulation of US assets.

- 12/15: Poszar argues that the US is about to lose its “exorbitant privilege” to countries like China. He is wrong on two counts. First, the US does not benefit from the dollar’s global role. Wall Street, owners of movable capital and the foreign affairs establishment do benefit.

- 13/15: But their exorbitant privilege comes at an exorbitant burden for American farmers, workers and producers. The dollar’s global role is simply the obverse of its role of absorber of last resort of excess savings, mainly

- through soaring debt. https://foreignpolicy.com/2011/09/07/anexorbitant-burden/

- 14/15: Second, and related, is that this why conditions won’t change until Washington itself takes much-needed steps to reduce the global role of the dollar. Pozsar argues countries like China, Russia and Saudi Arabia want to lead the way to a world less dependent on the dollar. In fact those countries really want a world in which they can maintain the very high trade surpluses that boost domestic growth and especially benefit the exporting elites within their domestic economies. https://www.elgaronline.com/view/journals/roke/10/4/article-p499.xml

- 15/15: That means that what they require above all is someone to run the correspondent deficits. As long as the US, and only the US, is willing and able to play this role (not for much longer, I hope), the dollar will dominate the world of international trade and capital.

THE CURRENT MARKET RISE IS LIKE CHILDREN PLAYING WITH MATCHES!

THE CURRENT MARKET RISE IS LIKE CHILDREN PLAYING WITH MATCHES!

REMEMBER: THE WORST IS STILL IN FRONT OF US

EXPECT MARKETS SHORT TERM TO RISE ON CONTINUED LOOSENING FINANCIAL CONDTIONS

CONTINUED S&P 500 DOWNSIDE RESUMPTION WILL LIKELY RE-EMERGE IN Q2-Q3 2023.

FADE THE COUNTER RALLY – SELL THE RIPS.

HOLD LONG DATED TREASURIES.

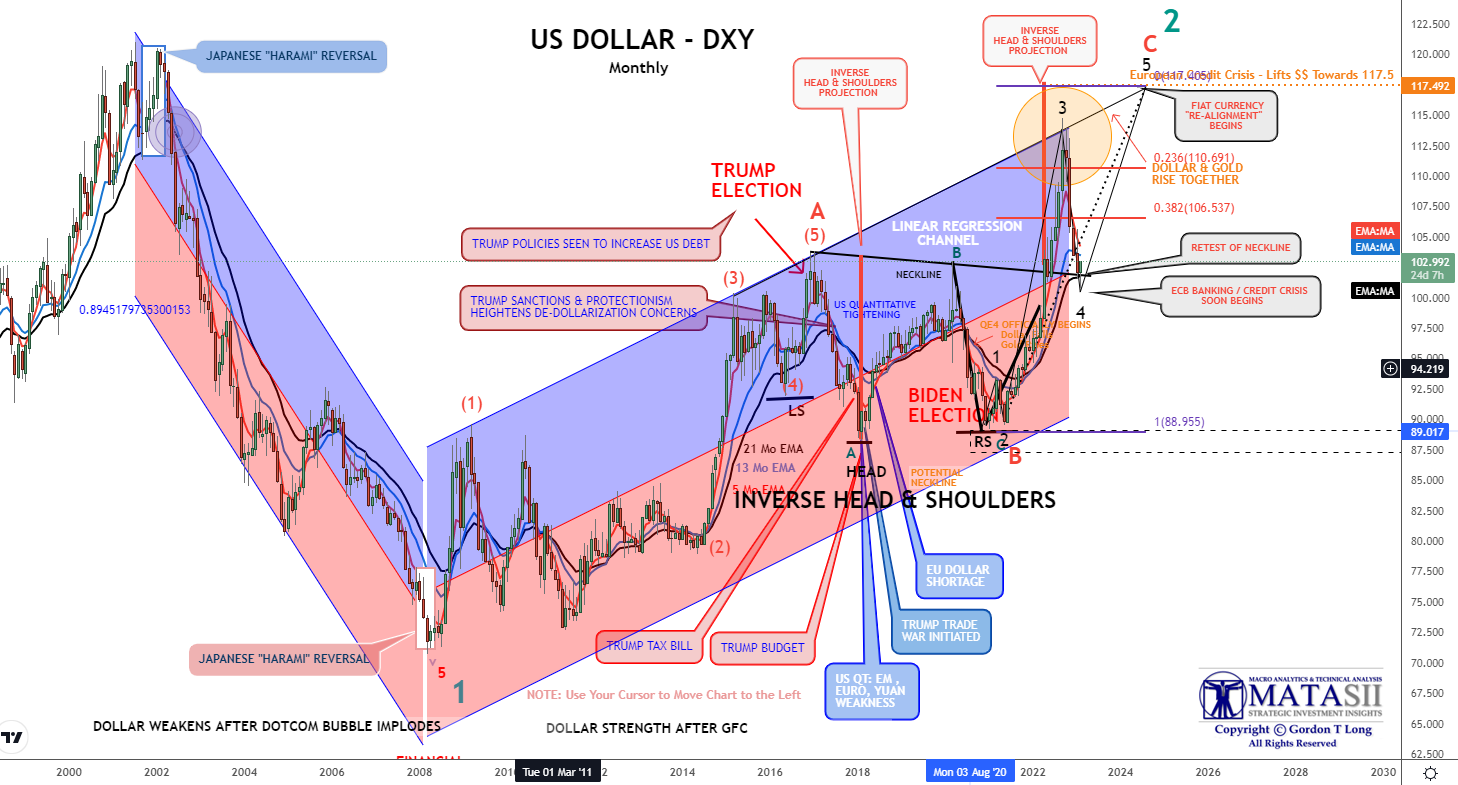

YOUR DESK TOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart: SUBSCRIBER LINK

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.