MACRO – CHINA

MONETARY & FISCAL POLICY

STAGFLATION’S LOOMING HOLD ON

THE FED’S DUAL MANDATE

OBSERVATIONS: WHAT WE HAVE FORGOTTEN ABOUT AMERICA

Adam Smith wrote the landmark book “Wealth of Nations” in 1776. This was incredibly serendipitous that his thinking came into focus during that same year the American nation was founded. Clearly, his thinking had a profound impact on our forefathers thoughts towards architecting the governance of this new Republic.

What he got right were two important pillars we need to remember during this election season:

- First, that wealth is created by individuals, operating in their own self-interest, and that this is achieved through the understanding that EMPATHY for others was required in order to earn the TRUST of others. Trust was required in order for others to voluntarily choose to engage, socially and in commerce.

- Secondly, based on his book the US founding fathers, chose to MINIMIZE THE ROLE OF GOVERNMENT and to rely on free enterprise to be the engine of the nascent nation.

Jeff Thomas (a “Brit”) has lived multi-nationally since childhood and questions governments as a general principle. Being an Austrian economist believing in personal liberty and limiting government, he recently penned the following salient reminders:

The Smithian principle is based upon voluntary exchange – a free market, from the bottom up, not the top down. In it, each creator of goods chooses to create, not that which he most wishes to create, but that which is most likely to be salable to others.

Similarly, he recognizes that he must produce it for a price that others are prepared to pay and in no greater amounts that they are prepared to buy. Increased demand may tend to raise the price being asked, but higher prices will inspire others to compete. Their production inevitably creates a balance between demand, availability and prices.

The free market, therefore, satisfies the provision of goods, the volume of goods available and the prices of goods. No one is forced to produce. No one is forced to buy. It’s an entirely self-sustaining and endlessly self-renewing process.

In a free-market system, there are no top-down controls by legislators or regulators. In a top-down system, attempts are made to dictate quotas and prices and apply taxation. All are counter-productive.

This “natural liberty,” as Mister Smith termed it, is invariably destroyed to a greater or lesser degree by outside forces, such as governments and trade unions. They seek to dictate prices and impose quotas, tariffs and taxation. Not only do these entities not have the ability to regulate every individual agreement between any two parties, they invariably fall prey to corruption – giving rise

to cronyism, monopolies and insider deals.

Government is … the destroyer of free enterprise.

All governments, in every era, wrestle with the question of, to what degree they should intervene in commerce in order to maximise the wealth of the country. Regardless as to whether they are sincere in their deliberations, the fatal flaw is that the answer – one that they cannot accept – is: none.

In modern times, free enterprise (i.e., capitalism) has been blamed for impoverishment, over-pricing, inadequate quality of goods and more. Yet a true free market corrects these problems. These problems, which are only too real, are the product of a century of governmental regulation of and interference in the free market. We may criticize the free market, yet we have never actually lived in a free-market system.

The successful government does not need to do good things for you; it only needs to cease doing bad things for you.

What Thomas is reminding us is that the exploding growth of the US of Regulatory State with its monstrous employee base and economic dependents / entanglements (Big Tech, Big Pharma, Big Ad, Military /Industrial/ Surveillance Complex & MSM ) has become a top down goliath (versus bottom up). This is everything our forefathers opposed and somehow we have forgotten?

As Benjamin Franklin warned: “We have created a Republic – if you can keep it!”

WHAT YOU NEED TO KNOW!

EXCESS LIQUIDITY IS BEING QUICKLY GRABBED (BY ZOMBIES?)!

EXCESS LIQUIDITY IS BEING QUICKLY GRABBED (BY ZOMBIES?)!

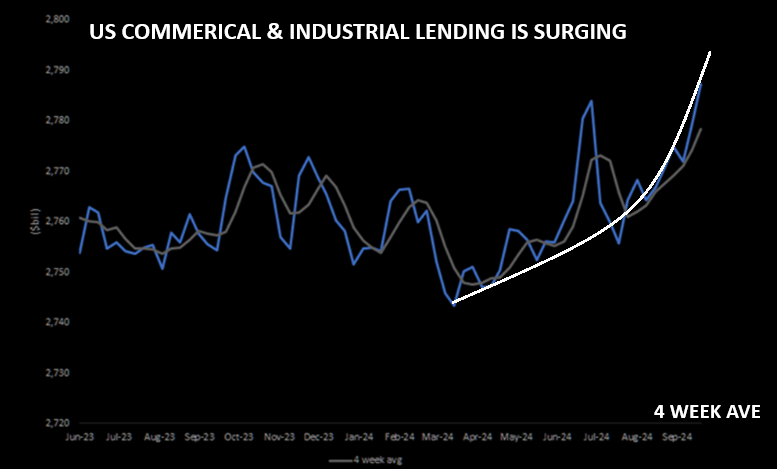

US commercial & industry (C&I) weekly lending data continue to grow on the leading edge, signaling higher investment + activity (+ve orders).

For the week ending 9/26, C&I lending grew another 29 bps w/w to $2.79T, which marks the highest level since Q1’23. Outstanding C&I loans are now tracking +73 bps yoy, the strongest growth mark since 2023.

HOWEVER, Consumer Revolving Credit (Credit Cards) has suddenly plunged with rates at 21.6%. (See Global Economic Insights.)

RESEARCH

1- STAGFLATION’S LOOMING HOLD ON THE FED’S DUAL MANDATE

1- STAGFLATION’S LOOMING HOLD ON THE FED’S DUAL MANDATE

-

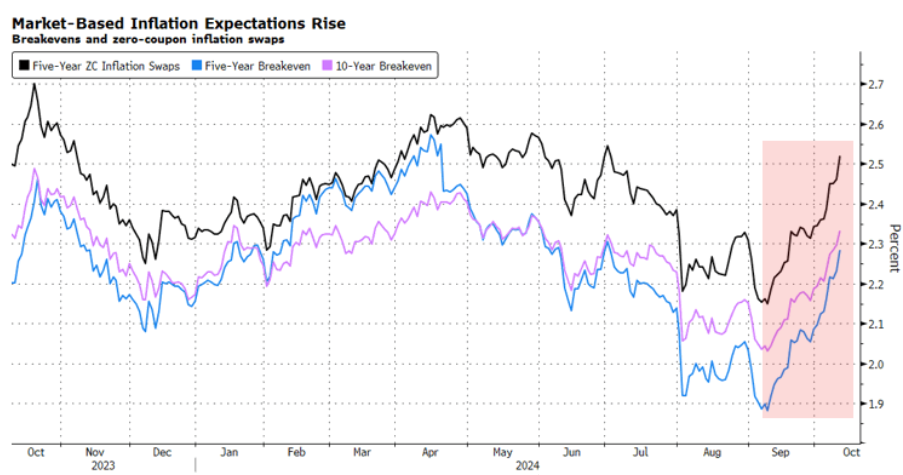

- Liquidity conditions in the US and globally are re-igniting inflation.

- Meanwhile slowing Global Economic conditions are increasingly weakening full employment.

- Stagflation is becoming a bigger problem than a Recession. A “No Landing”, Stagnation environment is currently the outlook.

- Weak GDP with elevated Inflation is harder for the Fed to fight than just two quarters of negative GDP (a recession).

2- CHINA: More “Half Measure” Stimulus Actions Taken

-

- First the Politburo (Fiscal), then PBOC (Monetary) and then Saturday the Ministry of Finance (Social & Housing).

- Yet still no Bazooka?

- China presently needs to focus on stimulating Consumer Consumption not “high value-add” Industrial Mercantilism.

DEVELOPMENTS TO WATCH

SUPPLY DEFICITS – Energy Transition Metals

SUPPLY DEFICITS – Energy Transition Metals

(Further Support of This Week’s Video)

-

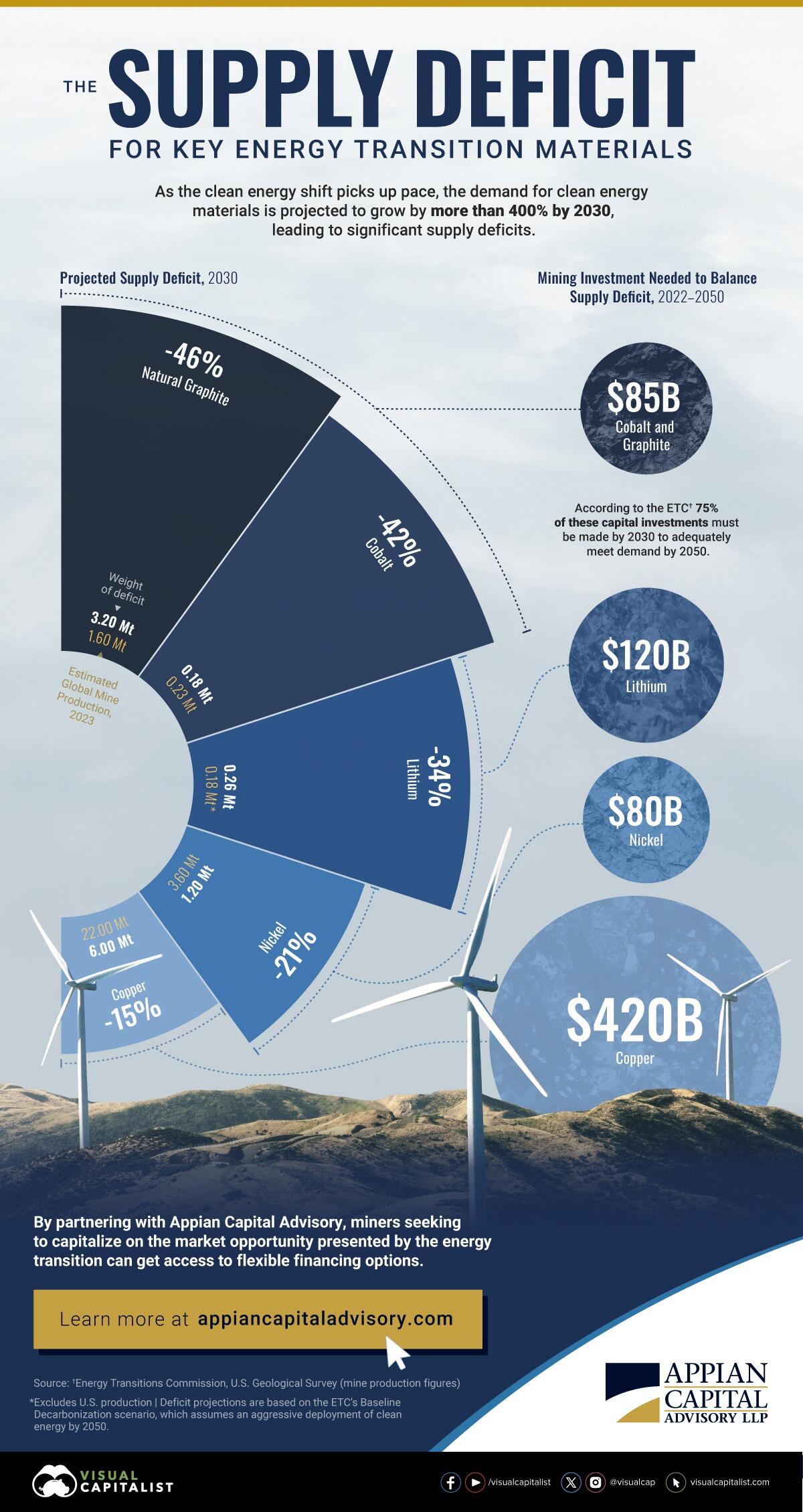

- The demand for clean energy metals will grow by more than 400% by 2030, according to the Energy Transitions Commission (ETC).

- Supply, however, is not on track to keep up with this surging demand.

- Building a clean energy future isn’t just about technology—it’s about materials. The transition to renewable energy will require a vast array of raw metals, such as:

-

- Natural Graphite and Cobalt: Critical for electric vehicles (EVs) and energy storage.

- Nickel: Critical for battery performance and an important component of wind turbines and green hydrogen technologies.

- Copper: Required for electrical wiring and expanding transmission infrastructure.

- Lithium: Central to batteries in EVs and energy storage.

-

- Together, the above energy transition materials require more than $700 billion of investment through 2050 to balance their supply deficits.

- 75% of these capital investments should be made by 2030 in order to meet demand by 2050, according to the ETC.

THE JP MORGAN FDIC BACKED DERIVATIVES CASINO

-

- The Office of the Comptroller of the Currency (OCC) released its Quarterly Report on Bank Trading and Derivatives Activities for the second quarter of this year. The shorthand for this report should be the “Casino Report.”

- The report showcases how much dangerous trading activity the brokerage firms on Wall Street have been able to muscle into their federally-insured banking units, where the deposits of millions of average Americans reside.

- Since the repeal of the Glass-Steagall Act in 1999 under the Bill Clinton administration, Wall Street trading firms have been allowed to combine with federally-insured banks – creating an endless series of crises and bailouts. No bank has been able to blur the lines between a trading casino and a federally-insured bank more aggressively than JPMorgan Chase.

- According to the FDIC, as of June 30 there were a total of 4,539 federally-insured commercial banks and savings associations in the U.S. All commercial banks and savings associations in the U.S., which held derivatives as of June 30, 2024, had trading revenues totaling $15.848 billion., Of that sum, JPMorgan Chase Bank NA represented $6.9 billion or 44 percent.

GLOBAL ECONOMIC REPORTING

CONSUMER PRICE INDEX (CPI)

CONSUMER PRICE INDEX (CPI)

-

- For the 52nd straight month, core consumer prices rose on a M-o-M basis in September (+0.3% MoM – hotter than the 0.2% expected) – the strongest since March. That left Core CPI YoY up 3.3%, hotter than the 3.2% expected.

- SUPERCORE CPI: Increased on a Y-o-Y basis to +4.6%.

- CORE SERVICES WITH FOOD: Costs surged in September:

- The index for meats, poultry, fish, and eggs rose 0.8% in September; the eggs index jumped 8.4%. The fruits and vegetables index increased 0.9% over the month, following a 0.2-percent decline in August.

- Five of the six major grocery store food group indexes increased.

PRODUCER PRICE INDEX (PPI)

-

- Energy prices weighed the PPI down (likely not to last) as Food + Services surged.

- The indexes for final demand Foods and for final demand goods less foods and energy increased 1.0 percent and 0.2 percent, respectively.

CONSUMER CREDIT – Hits ‘Brick Wall’!

-

- The Fed reported that in August, total consumer credit growth plunged by more than half to just $8.9 billion, below the $12 billion estimate.

- The average rate on all credit cards in the US just hit a new high of 21.76%, up from 21.51%.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.