HOW TO ACCELERATE THE STRANGLEHOLD ON THE GLOBAL OIL & GAS INDUSTRY

The following announcement by global insurer giant Allianz is as strategic (and as obviously coordinated) as Saudi Arabia’s decision three weeks ago to abandon the Petrodollar. Whether planned or a massive miscalculated blunder, together they potentially accelerate shifting global power to China & Russia by effectively crippling oil & gas supply in the non-aligned China-Russian alliances, as highlighted in this month’s

UnderTheLens video.

No producer can possibly operate without full property and casualty insurance on a multi-million dollar project!

Here is the announcement as reported by

ZeroHedge:

The Allianz Group, one of the world’s largest insurers and asset managers, published a

statement Friday detailing how it will no longer insure and invest in new oil and gas fields starting in 2023. This comes at the worst possible time for extremely tight oil markets as Russian production drops due to hard-hitting Western sanctions, igniting fuel shortages in Europe, the

US East Coast, and other parts of the world.

Allianz said it won’t offer new single-site and stand-alone property insurance and casualty insurance coverages (and renew existing contracts after July 1, 2023) and will halt new funding for exploration and development of new oil and new gas fields (upstream), construction of new midstream infrastructure related to oil, construction of new oil power plants, and projects in the Arctic.

The new guidelines come as the company is “accelerating the deployment of its climate strategy and has announced new ambitious commitments in both its core business and operations … limit the greenhouse gas emissions (GHG) deriving from Allianz’s sites and activities in over 70 markets to net-zero by 2030, instead of 2050 as originally planned.”

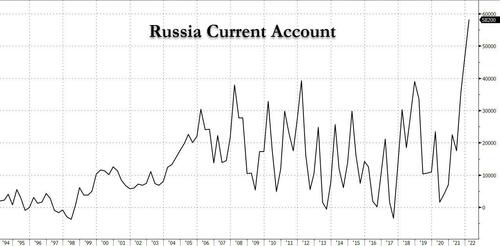

The timing of such an accelerated climate strategy will undoubtedly mean a reduction in capacity for new oil projects globally because it will be harder or perhaps more expensive for oil and gas companies to insure projects. This is a sure way to collapse supply even more, when the US is acting as a

barrel of last resort to a tight global energy market hungry for supplies as Russia’s production sinks.

Allianz said it was “committed to actively driving the transition towards renewable energy sources, supported by significant underwriting and investment capacity and appetite for renewable risks.”

The world is about to

experience a second energy shock, and Allianz’s move to abandon insuring and funding fossil fuel projects may lead to continued disorderly decarbonization of the economy. In other words, elevated energy prices are here to stay.

Here’s Allianz’s full press release.

DOWNLOAD